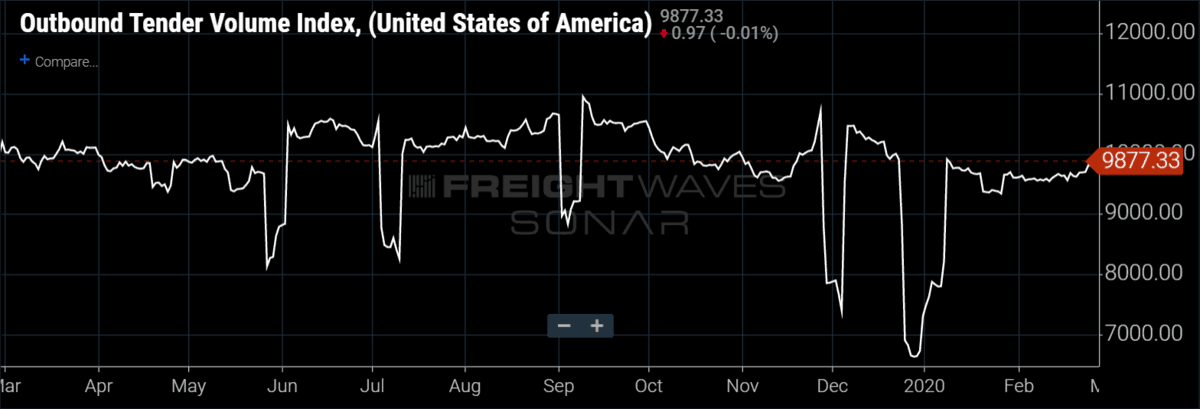

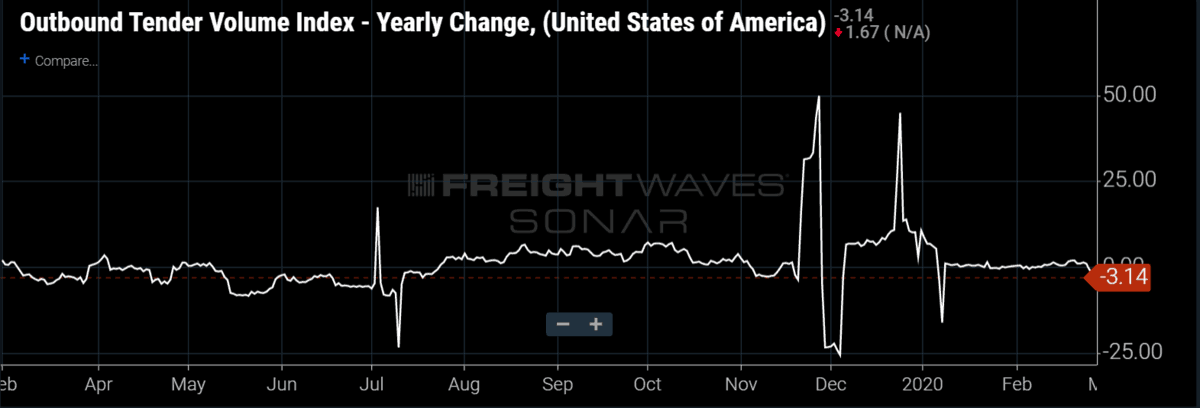

The national outbound tender volume index rose just over 2.5% over the past week. It may not seem like much, but this is the largest weekly gain thus far in 2020. For the past seven weeks, we have seen flattish volumes. OTVI now sits at 9,877.33, well below the March 2018 starting point of 10,000. On a year-over-year basis, OTVI is actually running down 3% (compared to recent weeks at flat) due to a temporary bump and tough comparison from February 2019 that we expect to pass.

If OTVI is to mimic the past two years, it should exhibit another low-single-digit gain over the next week. In each of the past two years, March volumes have been considerably stronger than the first two months of the year. Although the coronavirus certainly threatens this trend, it is still likely to continue.

Reefer volumes bounced up 7% off the bottom on Feb. 7. While reefer volumes have trended down over the past few weeks, ROTVI still stands 6% over 2019.

Less wintry weather across the Midwest and Northeast has eliminated the demand for reefer trailers for some products. The effects of the coronavirus on global trade flows blur our outlook for volumes for the remainder of the first quarter. Until we have more visibility from people outside Beijing, it is difficult to properly determine what the impact will be on U.S. truckload volumes in the short term.

Twelve of the 15 markets FreightWaves tracks were positive on a week-over-week basis. Markets with the largest gains in OTVI.USA were Elizabeth, New Jersey (10.3%), Ontario, California (6.4%), and Indianapolis (6.3%). On the downside, this week saw declines in Laredo, Texas (-13.3%), Seattle (-2.7%) and Chicago (-1.6%).

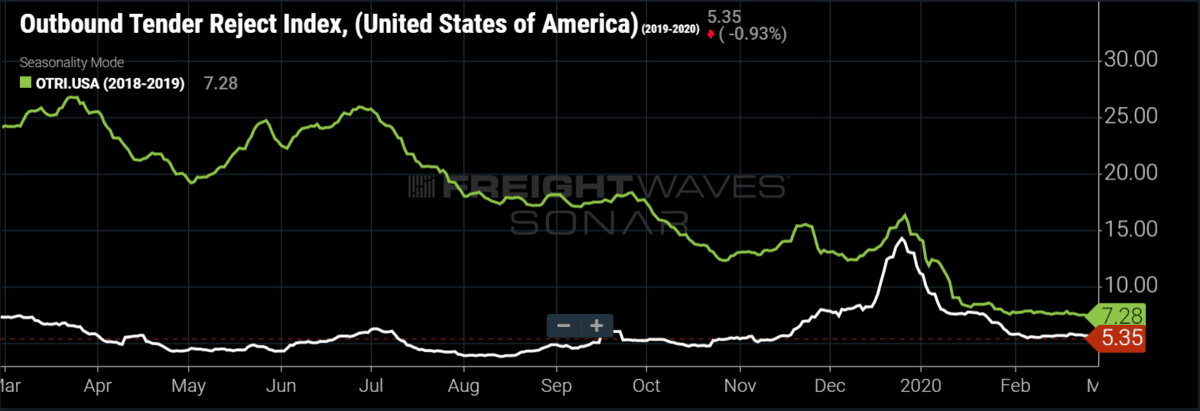

Tender rejections slide this week

Tender rejections fell more than 6% this week, primarily pulled downward by slipping reefer rejections. National outbound tender rejections now sit below the 2019 average at 5.35%. This week marks a reversal of upward momentum over the past two weeks. After peaking at 14.25% on Christmas Day, the Outbound Tender Reject Index (OTRI) has tumbled more or less straight down and stabilized in the 5% range. Capacity is still extremely loose, and it will most likely stay this way for the next few weeks. The coronavirus has not yet impacted American truckload capacity, but it is likely to do so in the near future.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast here.