Tanker freight rates remain solidly spectacular, tanker stocks decidedly less so.

Spot rates for very large crude carriers (VLCCs; tankers that carry 2 million barrels of crude oil) are still above $160,000 per day, yet share prices of VLCC owners DHT (NYSE: DHT), Euronav (NYSE: EURN) and Frontline (NYSE: FRO) were down sharply in heavy trading on Wednesday.

The reason? Crude oil prices jumped after the Energy Information Administration reported a stronger-than-expected U.S. gasoline draw and a lower-than-expected crude inventory build.

Tanker investors (or trading algorithms) are following a simple equation: falling oil prices equal more floating storage, more ship demand and higher rates, ergo “buy tanker stocks.” Conversely, rising oil price equals “sell.”

Webber Research & Advisory has just published a new research report that predicts a change ahead in this tanker-investment calculus.

“We believe the long-tanker trade is gradually transitioning from a shorter-term OPEC hedge to a longer-term COVID-19 global-relapse hedge,” asserted Michael Webber, founder of Webber Research & Advisory, in the new report.

Webber, the former head shipping analyst of Wells Fargo, has won the Institutional Investor award for best shipping coverage for the past five consecutive years.

Near term

In the near term, the simultaneous COVID-19 demand shock and OPEC supply shock have “reinforced the notion of systemic, structural and economically driven floating storage,” he wrote, noting that tanker names his company covers “are poised to throw off record cash flow in the second and third quarters – and potentially longer.”

Yet tanker stocks are still down year-to-date. Webber sees two reasons for this.

First, these equities are “a show me story after a decade in the wilderness.” In other words, investors have lost money on tanker stocks since the 2009 global financial crisis; with a track record like that, larger investors need to see sustainable strength, not just a rate pop.

Second, tanker stocks are being weighed by “the notion that, from a capital-flow perspective, an eventual storage unwind should siphon capital away from tanker hedges and toward price-levered energy exposure.” If investors can clearly visualize a scenario in which tanker fundamentals crumble and tanker stocks fall, they may be concerned about getting out of their positions in time, even if they’re sold on short-term upside.

Longer term

How can tanker stocks move past these sentiment headwinds? According to Webber, the answer relates to how fast the world recovers from the coronavirus. The more gradual the recovery, the better for tanker stocks.

“We believe tanker dynamics for the remainder of 2020 and 2021 will be defined by the depth and duration of the floating-storage dynamics – which we believe will be increasingly driven by the shape and pace of a global economic reopening,” said Webber.

“Tanker rates and equities will have a strong negative correlation to the success of any semi-synchronized economic opening. [Being] long tankers equals [being] long an extended and asymmetrical global reopening,” he said.

To the extent economic woes drag on into 2021, there could be fewer tanker-stock buyers looking to make a quick buck over the next few quarters and more who either believe the coronavirus recovery will be lengthy or need protection against that scenario.

Even for those betting on a V-shaped recovery, tanker stocks could serve as a hedge to offset potential losses if that bet goes wrong.

Tanker stocks would rise when “consensus demand curves gradually reflect the notion of a shallower and/or prolonged demand recovery – particularly if or when we see a significant global retrenchment in terms of COVID-19 quarantines,” said Webber.

“In short, we think tanker equities can break through their fourth-quarter 2019 ceilings once the market has demonstrated evidence that fourth-quarter 2020 and first-half 2021 won’t simply be dominated by sharp and sustained crude draws.”

Webber’s group does not believe in the quick-rebound scenario. “We don’t expect that process to be smooth, as the market’s expectations of a convenient ‘V’ or ‘Nike swoosh’-shaped recovery gradually give way toward something less predictable and less linear,” said Webber.

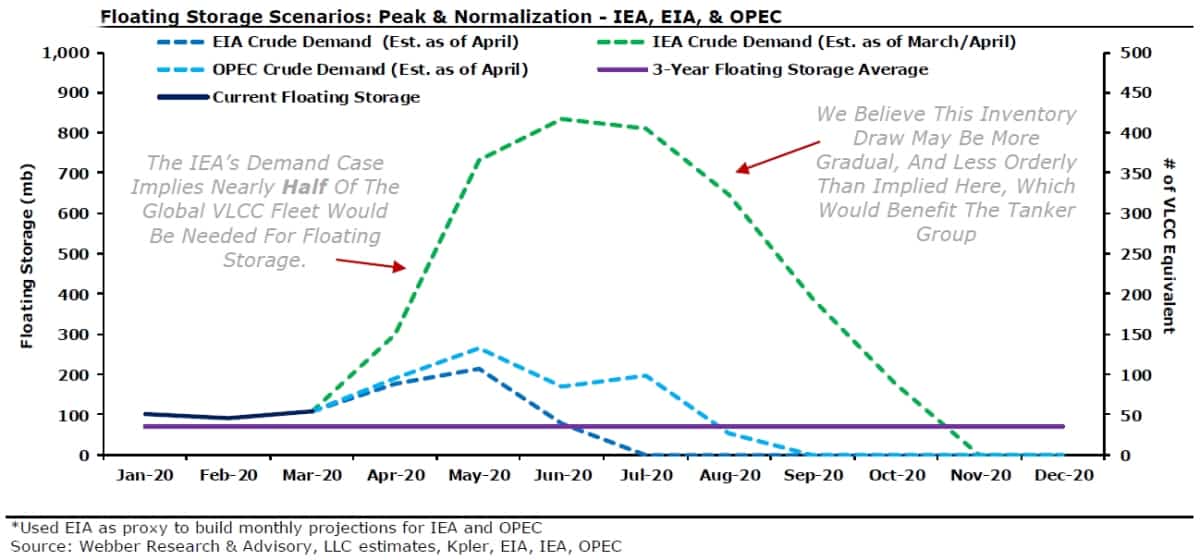

The International Energy Agency (IEA) has published one of the highest-volume and longest-lasting outlooks for floating storage among the various energy organizations. Webber Research & Advisory believes the actual curve may be even further out than the IEA estimates, to the benefit of tanker stocks.

Rate strength through 2022?

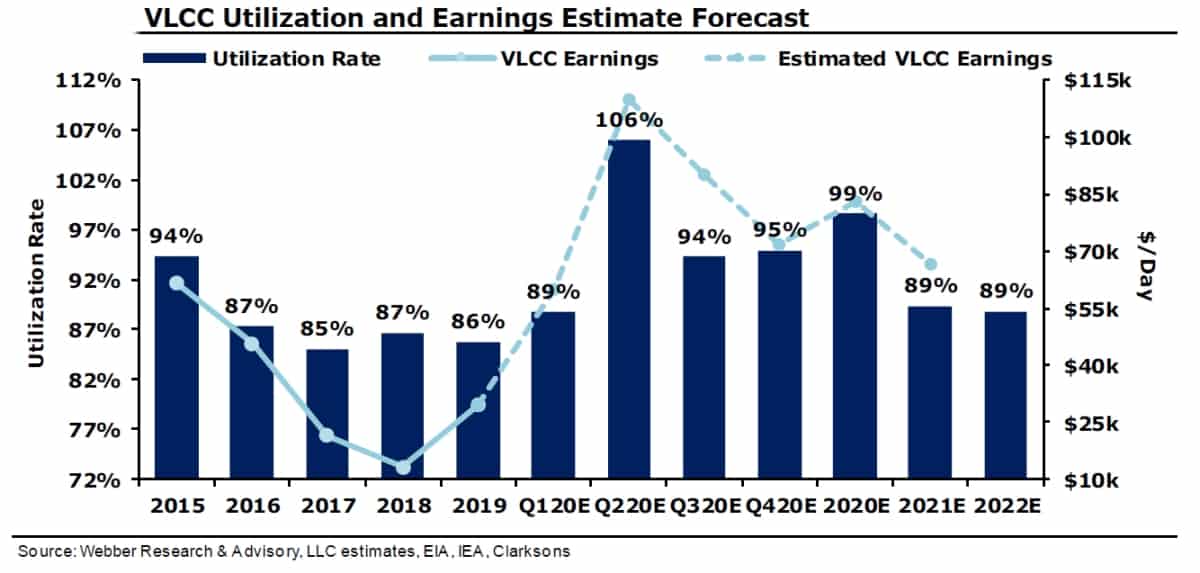

The new rate outlook from Webber Research & Advisory is bullish. It estimates that full-year 2020 VLCC rates will average around $85,000 per day and rates in 2021 will average around $65,000 per day.

To put that in context, VesselsValue estimates a break-even rate for most VLCCs in the vicinity of $30,000 per day.

The analyst group also estimates that VLCC utilization rates will stay strong in 2022, at 89%, the same level as the year before, implying a strong rate environment through 2022.

FreightWaves asked Webber about the potential for a global relapse to negatively impact the spot rates of those tankers that are not tied up with floating storage and congestion.

What if COVID-19 reflares and petroleum inventories are not drawn down quickly, to the benefit of floating storage, but at the same time, voyage demand is pulled down by lower production, pushing down spot rates? Does the Webber group’s outlook imply that if there is an economic relapse (or no recovery and a continued slide), oil producers will not be able to cut output fast enough to keep pace with falling consumer demand?

Webber responded, “What we’re saying is that it will likely oscillate in both directions, and the net draw could be extended well beyond the consensus timeframe – potentially into 2021 – which would extend the viability of a tanker equity trade, presuming a relatively shallow drawdown slope.

“More directly to your question, we’re not saying production cuts will lose the race against demand declines. We’re saying it may take them [production cuts] a lot longer to win. To use an NBA analogy, [production beats demand] cuts in seven games, not four.” Click for more FreightWaves/American Shipper articles by Greg Miller

ed eichman

An important question is not addressed here : will the ships used for FS be the ones to make the voyage or will the cargo be transferred back to land storage or to other newer ships for the voyage, ,based on the assumption that FS tends to make use of older ships less desirable for the long trip.

A deeper, long term question is that with about 1/4 of the world fleet at the 15 year or greater age and with newbuilds at about 1/3 of normal, what is creating the hesitation to order new ships. Investment capital was burned last cycle and is not coming back, but is the uncertainty surrounding the IMO 2030 CO2 reduction initiative may be making owners nervous even when they have the cash for a new order. Ordering a ship today means at 2030 your 100 million plus asset might need some very expensive refitments to satisfy the IMO mandates.