Airfreight rates out of China are beginning to creep up again and there are signs the cost to ship goods to North America and Europe could quickly escalate again as shippers flock to air transport while the supply of aircraft falls.

A confluence of factors associated with a resurgent coronavirus, ocean freight dynamics, Hong Kong health safety rules and operational issues at all-cargo operators is causing the Chinese airfreight market to tighten, according to market researchers and logistics specialists.

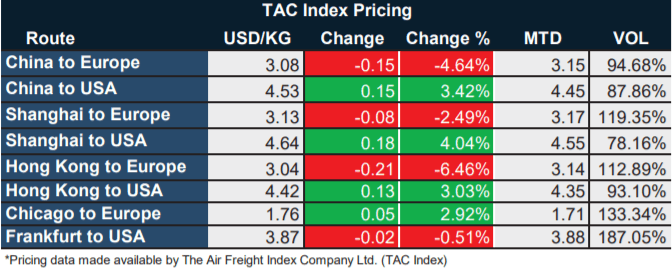

Export rates from China to the U.S. ticked up 3.4% to $4.53 per kilo, with the price from Shanghai up 4% to $4.64/kilo, according to tracking by The Air Freight Index Co. Outbound rates from Hong Kong to the U.S. increased 3% to $4.42/kilo. And rates from Taiwan are running $2 to $3 per kilo higher than from mainland China because of very tight capacity, San Francisco-based Flexport said in a customer memo.

The increases stood out from several other markets, where the price of shipping by air decreased the previous week. In Europe, supply and demand continued to come closer to balance, especially for westbound traffic from Asia.

Outbound rates from China had fallen more than 70% from their mid-May peak, but industry veterans know not to take anything for granted in international trade. The market is very fluid right now for several reasons.

(FreightWaves SONAR chart)

Face masks redux

Demand for personal protective equipment and lab supplies to combat the coronavirus is surging again. Shipment volume tapered off in June when healthcare distributors and retailers built buffer stocks to the point they could opt for slower, cheaper ocean transport to maintain inventories. Suggestions that the airfreight market had normalized, because some international passenger flights had resumed and there were fewer emergency air shipments, proved premature. The COVID-19 virus outbreak is catching fire across the southern and western U.S. and reports indicate hospitals are again facing shortages of protective gear. And more face masks and disinfectant are needed everywhere now – not just for caregivers – as businesses try to safely reopen and face-mask mandates proliferate.

Ocean rates on the trans-Pacific spot market are at record levels as U.S. companies aggressively restock inventories while container lines carefully manage capacity with blank sailings, pushing some shippers back to air transport.

Hong Kong retreat

Meanwhile, United Airlines, American Airlines and Air Canada pulled out of Hong Kong when authorities there imposed strict health screening measures on arriving pilots and flight attendants, reducing freight capacity. Crews object to the invasive tests and airlines worry entire crews could be quarantined for 14 days if one person tests positive, which could disrupt flights. United this week began offering passenger flights to Chicago and Los Angeles with technical stops in Tokyo and Guam to change crews, spokesman Frank Benenati said. Passengers remain on board during the layover flights, which will be extended through the end of July.

United (NASDAQ: UAL) also suspended cargo-only flights, in which passenger planes are repurposed as freighters, to Hong Kong, he added.

American Airlines (NASDAQ: AAL) suspended charter and scheduled “mini-freighter” flights between Dallas-Fort Worth and Hong Kong, and Los Angeles and Hong Kong, when screening requirements changed, Maulin Vakil, managing director of cargo customer care and performance analysis said in a statement provided through a spokesperson.

Air Canada (TO: AC) cargo-only flights between Toronto and Hong Kong have continued without interruption, spokesperson Johanne Cadorette, said.

The Hong Kong Airport Authority on Friday reported that cargo throughput decreased 7.7% to 357,000 tons in June versus 2019 primarily due to the decline in transshipments from reduced belly capacity on passenger flights, the result of strict entry restrictions for non-Hong Kong residents.

Another reason capacity out of Asia is down for the first time since late April, and versus last year, is that many passenger freighters have exited the trans-Pacific market as those very-long routes become uneconomical given the drop in yields and increase in fuel prices, according to airlines and logistics companies.

Compounding the supply problem is that several Chinese carriers have sidelined some pure freighters for scheduled and deferred maintenance, which sometimes can take two months to complete, said Neel Jones Shah, executive vice president and global head of airfreight at technology-focused freight forwarder Flexport. “Expect this capacity to return by the end of August in time for the anticipated peak season,” he said.

Market observers say airline yields are likely to increase later this summer as demand increases.

In addition to COVID-related medical supplies and rising cross-border e-commerce shipments, several big high-tech product launches are coming in the fall that “will absorb a great deal of capacity” and contribute to higher rates, Jones Shah said.

Apple’s iPhone 12 is expected to launch in September, although coronavirus-production delays could push it back a month or more. And Sony is likely to release the new Playstation 5 console in the fourth quarter. Tech companies typically charter waves of pure freighters to rush hot new products to market, especially during the holiday shopping season.

In related news, the Australian government has expanded the types of products it will support under its rescue program for airfreight shippers. The International Freight Assistance Mechanism, which recently was extended until year’s end, will no longer be restricted to perishable exports. Instead, any shipments that are high value, time sensitive, reliant on airfreight or deemed in the national interest, such as imports of equipment for critical infrastructure, will be eligible for the government-organized flights.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Air cargo market: Rationality returns, but for how long?

“Ghost” freighters provide marginal boost to shippers