Container-shipping spot rates keep bouncing around at stratospheric heights — and show zero signs of sliding back to earth. On some trade lanes, they’re still ascending. Case in point: The formerly sleepy Europe-U.S. trans-Atlantic route just spiked.

With fallout from the Ever Given accident in the Suez Canal expected to cut container and vessel availability, the “when will this end?” chatter is starting to fixate less on the second half of 2021 and more on 2022.

This is the season — in a normal year — when rates moderate. While different freight indices offer different numbers, the trend lines are all the same: either up or steady at the peak. The weekly composite Drewry World Container Index, released Thursday, rose 1% this week, to $4,910 per forty-foot equivalent unit (FEU). It’s now up 221% year-on-year. The weekly Shanghai Containerized Freight Index, released Friday, rose another 2.6% week-on-week.

The Freightos Baltic Daily Index global composite (SONAR: FBXD.GLBL) stood at $4,260 per FEU on Thursday, hovering at or near the all-time high set in February. It is around quadruple normal levels for this time of year.

Trans-Atlantic surge

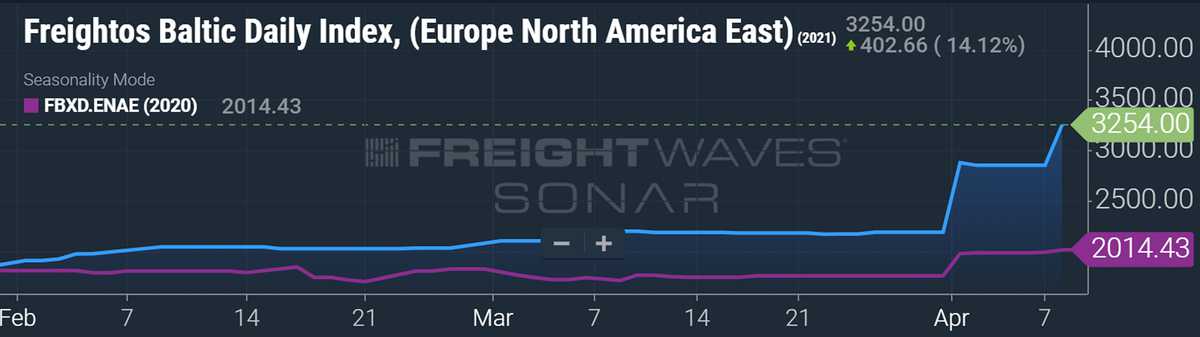

In the U.S. markets, the biggest rate move this month is in the westbound trans-Atlantic trade.

The Freightos assessment of this route (SONAR: FBXD.ENEA) shows rates surging by almost 50% between March 31 and Thursday, to $3,254 per FEU.

Judy Levine, head of research at Freightos, attributed the spike to “strong demand and scarce capacity.”

On April 1, Hapag-Lloyd announced a booking suspension on eight sailings leaving Northern Europe for the U.S. in the first half of this month due to “an overbooking situation.”

Levine also speculated that the recent disruption of services through the Suez Canal could be having ripple effects on the trans-Atlantic.

Asia-US rates peaking yet again

In the much larger Asia-U.S. trade, Freightos put the rate to the East Coast (SONAR: FBXD.CNAE) at $6,239 per day as of Thursday, a new all-time high topping the previous record set in early February.

The Asia-West Coast rate (SONAR: FBXD.CNAW) was at $5,052 per FEU, just below the new high hit on Wednesday.

In the Drewry weekly indices, the latest assessment from Shanghai to New York (SONAR: WCI.SHANYC) is even higher than Freightos’ — at $6,705 per FEU. Drewry assessed the Shanghai-to-Los Angeles spot rate (SONAR: WCI.SHALAX) at $4,202 per FEU.

Many U.S.-based cargo shippers also move considerable volumes on the Asia-Europe route. However painful Asia-U.S. rates are, the Drewry indices highlight how much more painful the situation is for Asia-Europe shipments.

The spot rate for Asia cargoes to North Europe is now up 396% year-on-year, with rates to the Mediterranean up 317%. In contrast, Drewry estimates that rates from Shanghai to New York and Los Angeles are up 133% and 153% year-on-year, respectively.

What’s next?

The current rate boom has defied the predictions. In mid-2020, multiple commentators thought demand would peak in August or September and fall off in the fourth quarter. It didn’t. Then came fears that winter COVID lockdowns would hamstring consumers. That didn’t happen either. Analysts also speculated last year that rates were due to a one-off restocking event after the initial lockdowns in Europe and the U.S. in spring 2020. But even now, stores are still restocking and inventories are still low.

U.K.-based consultancy Drewry said in a research note on Friday, “Using history as the only guide, the smart bet would be to think that the market will cool down quickly. But these are not normal times. We argue that carriers are set up nicely for at least another two very profitable years [2021 and 2022].”

According to Drewry, the two drivers of stratospheric rates — the COVID-propelled shift to goods consumption and supply chain disruptions — “are stubbornly refusing to go away. The timeline for a ‘return to normal’ keeps getting pushed back.” Drewry expects port congestion and equipment shortages to persist through 2021 and for carriers to lock in profits into 2022 via higher annual contract rates signed this year. “Things might not be so easy for carriers post-2022,” said the consultancy.

For shippers who’d once hoped for rate relief in Q4 2020, a forecast for market conditions getting tougher for carriers — and thus better for cargo owners — in 2023 is a frightening prospect. If there’s any solace for shippers, it’s that forecasts during the COVID era have been persistently wrong. Click for more articles by Greg Miller

Related articles:

US ports, shippers face major fallout from Suez Canal chaos

Demand boom on collision course with ocean transport ceiling

Could America’s historic import crunch get even worse?

Ocean carriers hold all the cards in contract talks with shippers

Deutsche Bank on import bonanza: ‘You ain’t seen nothing yet’

I heard something

I heard a CB Radio story that Amazon is paying $3.00 a mile loaded and empty . If you’re an owner operator. Like a rental truck with a piece of paper taped to the door with your authority numbers or something