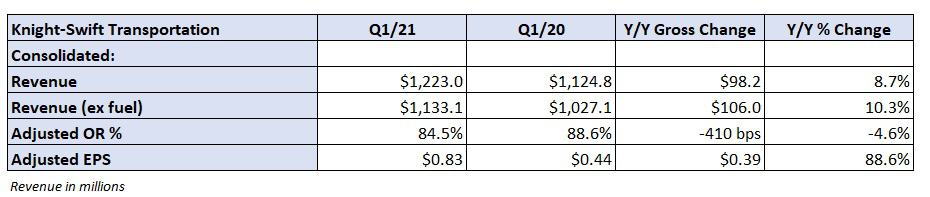

The nation’s largest truckload carrier, Knight-Swift Transportation (NYSE: KNX), posted a better-than-expected first quarter Wednesday. The Phoenix-based company reported adjusted earnings per share of 83 cents, 13 cents ahead of consensus and 39 cents better than the year-ago quarter.

The quarter benefited from a reversal of almost $23 million in other income when compared to the prior year. “The year-over-year improvement was primarily driven by gains recognized within our portfolio of investments in the first quarter of 2021,” the press release stated.

The result also benefited from a $7.5 million increase in gains on equipment sales and a lower tax rate (-130 basis points) compared to the 2020 first quarter.

Knight-Swift raised its full-year adjusted EPS guidance to a range of $3.45 to $3.60, roughly 7% higher than the original guidance at the midpoint of the range. The new guide sits well ahead of the current consensus expectation, which is $3.40, but reflects the outperformance in nonoperating income in the quarter.

The company’s guidance assumes a mid-teen percentage increase in over-the-road contract rates as “over-the-road truckload demand is at unprecedented levels and expected to continue into 2022.”

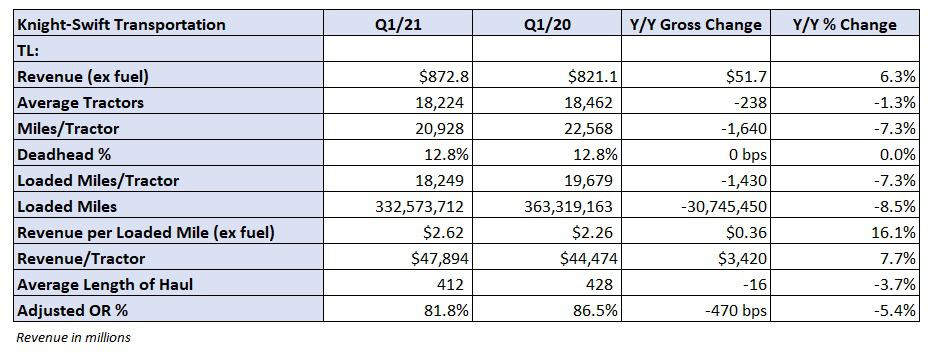

Knight-Swift’s trucking segment reported a 6% year-over-year increase in revenue, excluding fuel surcharges, at $873 million. Loaded miles per tractor declined 7% in part due to severe winter storms during the quarter, which was offset by a 16% increase in revenue per loaded mile (ex-fuel) to $2.62.

The division’s cost structure was fairly stable in the period. Salaries, wages and benefits as a percentage of revenue declined 120 bps year-over-year, which was largely offset by a 110 bp increase in purchased transportation.

“Our Trucking segment overcame inclement weather conditions and driver sourcing challenges during the quarter and improved average revenue per tractor by 7.7%, which resulted in a 470 basis point improvement in the adjusted operating ratio to 81.8% in the first quarter of 2021 from 86.5% in the first quarter of 2020,” the release continued.

The Swift fleet operated at a 78.5% adjusted OR with Knight operating at a 79% level.

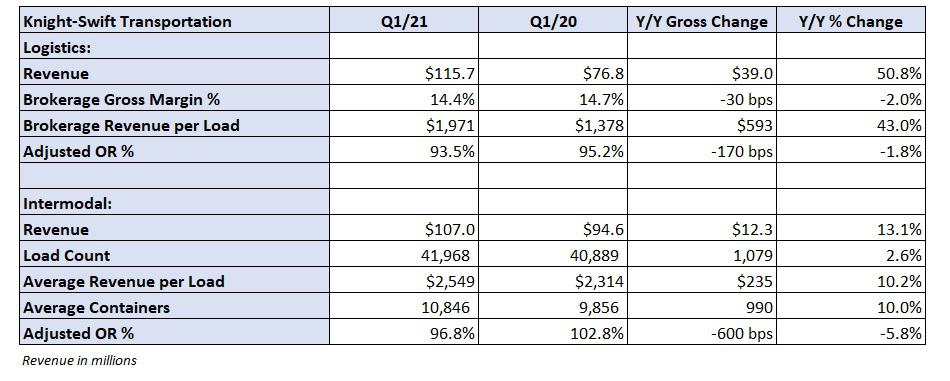

Brokerage revenue increased 51% year-over-year to $116 million as revenue per load surged 43% and loads increased just north of 5%. Gross margin in the division dipped 30 bps to 14.4%. The company’s power-only offering accounted for 25% of total brokerage volumes with its digital brokerage platform, Select, accounting for 20% of volumes.

Intermodal revenue increased 13% year-over-year with revenue per load, up 10%, driving the bulk of the increase. The division returned to a profit, posting a 96.8% adjusted OR.

“Despite weather and service disruptions during the first quarter of 2021, our intermodal segment achieved year-over-year improvements in operating results, and we anticipate ongoing improvement in the coming quarters,” the report read.

The company reiterated net capital expenditures of $450 million to $500 million in 2021, 22% higher than the 2020 investment at the midpoint. The bulk of the spend is slated for tractor and trailer replacement and improvements to its terminal network. Knight-Swift’s average tractor age increased to 2.3 years in the quarter from 2 years a year ago.

Knight-Swift ended the quarter with $853 million of available liquidity and net debt of $632 million, down $126 million from the end of 2020. The company generated $306 million in cash from operations, $262 million in free cash flow.

The company recently raised the dividend by 25% to 10 cents per share and repurchased $54 million of its stock in the quarter.

Shares of KNX are down more than 4% in early trading compared to the S&P 500, which is up 0.5%. The quality of the earnings beat and guidance raise, largely due to increases in nonoperating income, is likely the reason for the underperformance.