The West Coast port markets that drove much of the freight volumes in the back half of 2020 heated up again this week, and that led to the Outbound Tender Volume Index (OTVI) rising 2.7% this week to 14,051. (Photo: JIm Allen/FreightWaves)

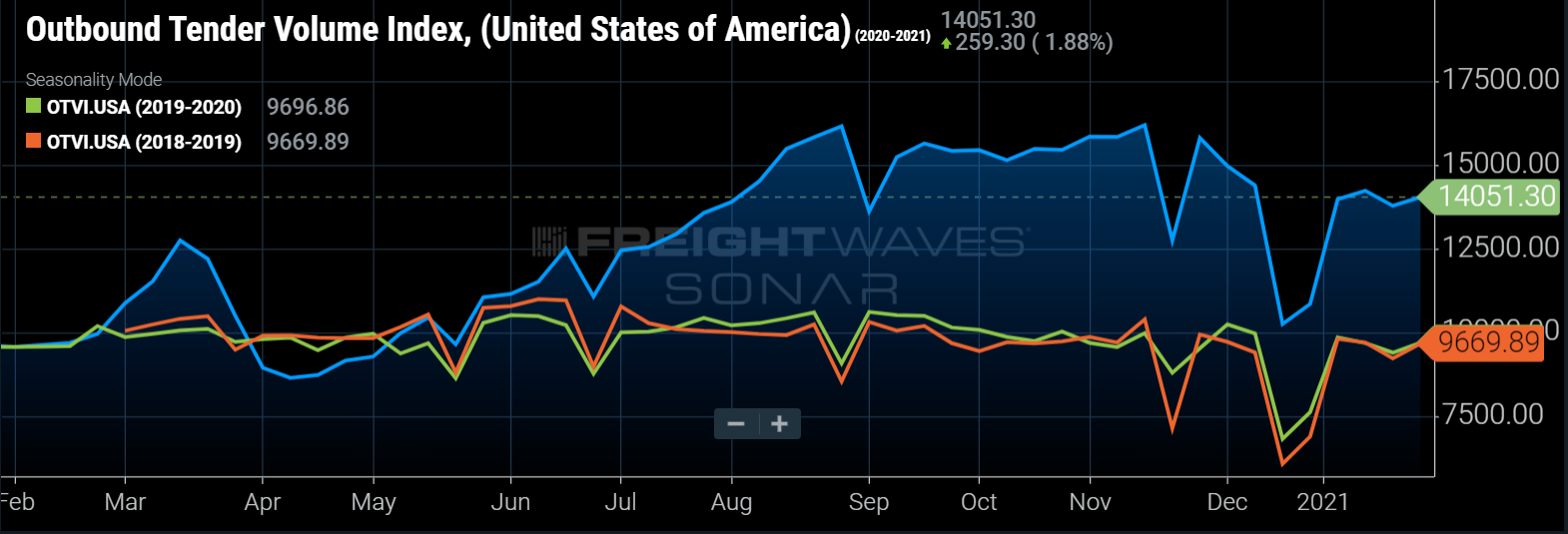

The Outbound Tender Volume Index (OTVI) rose 2.7% this week to 14,051. It makes sense to adjust for the level of rejected tenders accounted for in OTVI to get a clearer look at year-over-year (y/y) comparisons. On a rejection-adjusted basis, volumes are up 21% y/y, a slight deceleration from last week’s 23% growth rate.

The West Coast port markets that drove much of the freight volumes in the back half of 2020 heated up again this week, and that led to the Outbound Tender Volume Index (OTVI) rising 2.7% this week to 14,051.

The Outbound Tender Volume Index (OTVI) rose 2.7% this week to 14,051. It makes sense to adjust for the level of rejected tenders accounted for in OTVI to get a clearer look at year-over-year (y/y) comparisons. On a rejection-adjusted basis, volumes are up 21% y/y, a slight deceleration from last week’s 23% growth rate.

The West Coast port markets that drove much of the freight volumes in the back half of 2020 heated up again this week. Los Angeles and Ontario, California, are two of the largest markets in the country and each saw volumes rise more than 7.5% over the past week. The rapid transition to e-commerce and stimulus-driven consumer demand has kept the Port of LA/Long Beach complex running at full capacity for months now. The same goes for Georgia Ports. Georgia Ports Authority (GPA) Executive Director Griff Lynch hasn’t seen a lull nor does he expect to. Shippers have front-run Lunar New Year, but sailings are not being canceled in normal fashion.

Port markets on both coasts saw volumes pick up significantly this week. Savannah, Georgia, Elizabeth, New Jersey, and the West Coast ports all picked up (and New Orleans, too).

The most recent Bank of America credit card spending data included positive and interesting data on stimulus recipients’ marginal propensity to consume (MPC). The MPC is an economic concept that captures the amount of spending that comes from a source of income — in this case, stimulus checks. What the researchers found was the MPC of the second round of stimulus was much higher than the first — meaning recipients are spending the second round at a faster rate than the first in April. Even then, only 15% of stimulus received so far has been spent, still leaving open the possibility of pent-up demand in coming weeks.

This is great news for freight volumes. While the vaccine rollout has picked up speed and America vaccinated 1.6 million people in a single day this week, the vast majority of the population remains unvaccinated and still unable to enjoy a normal range of activities (including spending on services). With services still unavailable, it is safe to say the bulk of the stimulus is being spent on both durable and nondurable goods, further fueling the freight markets.

Last week, industrial production data for December was released and surprised to the upside. With consumers continuing to spend (up 5.2% y/y this week), a nascent industrial recovery, a red-hot housing market and retailers with weeks (and possibly months) of inventory replenishment ahead, the near-term future for freight demand appears solid.

On a positive note, nine of the 15 major freight markets that we monitor as a broad, representative benchmark were positive on a week-over-week basis. This ratio strengthened back to the stronger levels it has become accustomed to in recent months as the freight market rallies. The markets with the largest gains this week in OTVI.USA were Newark, New Jersey, (15.45%), Memphis, Tennessee (10.32%), and Savannah (8.45%). The markets with the largest drops this week in OTVI.USA were Fresno, California (-12.38%), Houston (-4.35%) and Chicago (-3.13%)

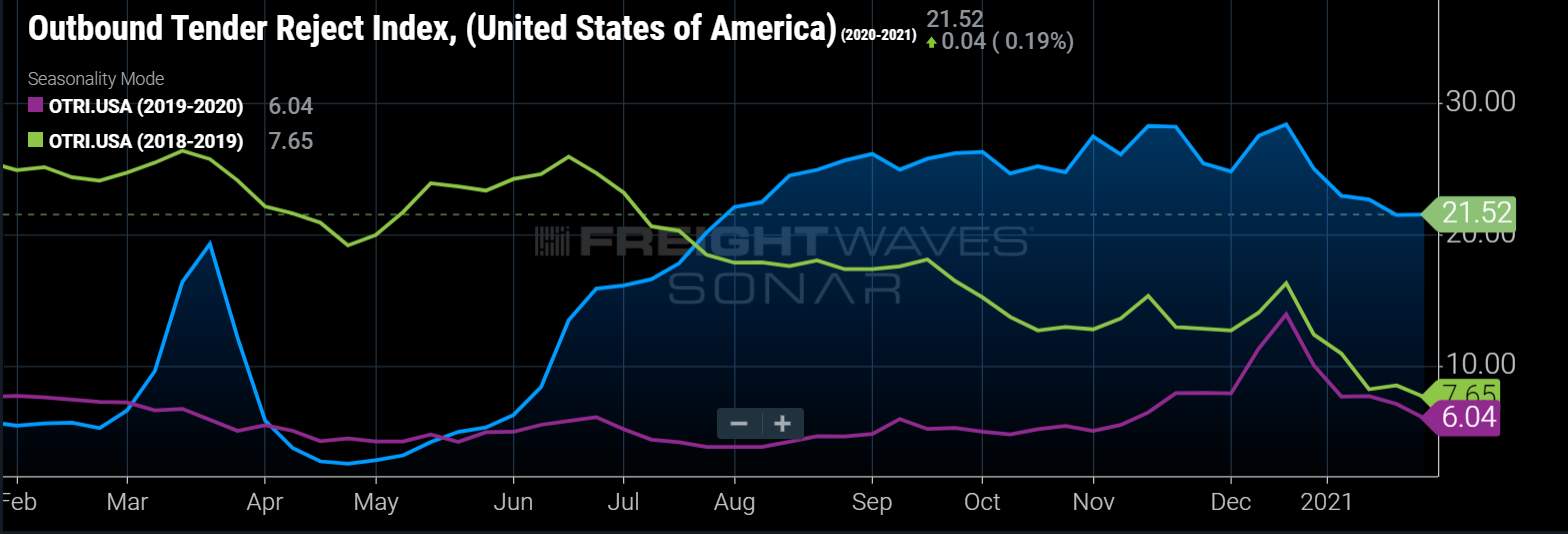

Tender rejections slipping but still elevated

The Outbound Tender Reject Index (OTRI) has seemingly found a floor, moving less than 2 percentage points over the past three weeks. OTRI descended from the all-time high on Christmas Day near 28% to 21.52% currently, and the rate of decline has decelerated meaningfully over the past two weeks.

The decline was not due to an influx of capacity rushing in, nor a steep decline in demand. Instead, it may have been a matter of price. The falling rejection rates have likely been driven by improving routing guides with new, much higher contract prices. We may see further declines in OTRI over the coming weeks due to this factor, but if demand remains high (which we believe is more than likely), OTRI will remain high relative to historical averages until bottlenecks at driver training schools can be resolved.

The freight market is still incredibly tight, and capacity is not easy to source versus historical standards. The tight market is being rewarded with higher contract rates, which may continue to put downward pressure on both tender rejections and spot rates in the coming weeks.

This doesn’t mean we should expect tender rejection rates to fall back near historical averages. Freight volumes remain up over 20% y/y and have not shown any signs of slowing anytime soon. The off-the-charts, record new equipment orders will surely impact capacity at some point. However, it will likely take several months for this equipment to be delivered, and even then, if the bottlenecks at driver training schools are not resolved, the impact could be muted.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.