There are almost no container ships in the world left for liners to charter. Secondhand purchase prices are through the roof. It takes two years or more to get a newly built ship. How can liners find more capacity?

There is a way — without adding ships — for liners to move more cargo and take even greater advantage of today’s stratospheric rates: speed up.

That’s exactly what they’re doing, according to new data from VesselsValue and MarineTraffic. Container ships are moving faster despite the fact that fuel consumption, and thus marine bunker fuel costs, rise exponentially with speed. Carbon emissions also surge, a politically sensitive side effect.

Carriers are stepping on the gas despite spending the last decade focused on the opposite strategy, “slow steaming,” and despite container ships built in recent years being specifically designed for slower speeds.

Just one of many examples of container ships recently sailing westbound at 20 knots or more: Automatic Identification System (AIS) vessel-position system data from MarineTraffic shows that the 4,253-twenty-foot equivalent unit (TEU) Seaspan Melbourne hit nearly 24 knots this month in the eastern Pacific on the backhaul from Los Angeles to China.

“Under normal circumstances, carriers would never do this, because bunker consumption is such a major cost factor,” said Simon Sundboell, CEO of shipping data provider eeSea. “But if you’re talking about rates of $12,000 [per forty-foot equivalent unit], you will do it.

“This is such a weird world we’re in,” he told American Shipper. “Because of freight rates, so many things are now possible.”

The caveat is that higher speeds may allow carriers to claw back some of the capacity they lost to port congestion, but there are limitations to how far this can go, so it won’t be a game-changer for cargo shippers.

How much has speed has increased?

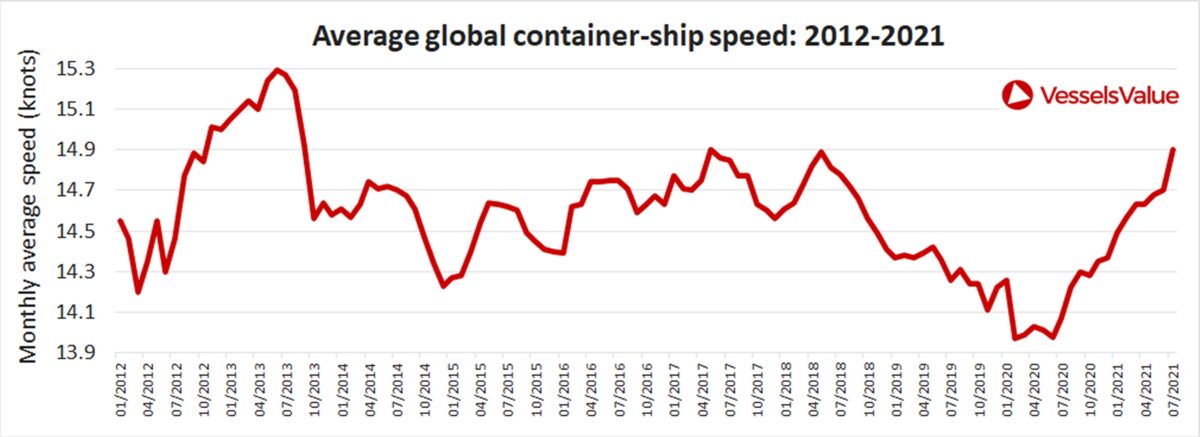

According to U.K.-based data provider VesselsValue, the global average speed of container ships has risen to 14.9 knots this month, matching highs in 2017-18 and verging on the highest monthly average since 2012. Speed is up 6% year on year.

The global average is brought down by smaller ships in regional trades. For larger ships in the mainline east-west trades — mainly post-Panamaxes (defined by VesselsValue as ships with capacity of up to 10,074 TEUs), New Panamaxes (up to 16,500 TEUs) and ultra-large container vessels (up to 25,000 TEUs) — the global average speed this month is 16.5-16.6 knots, 11% above the average for all ships.

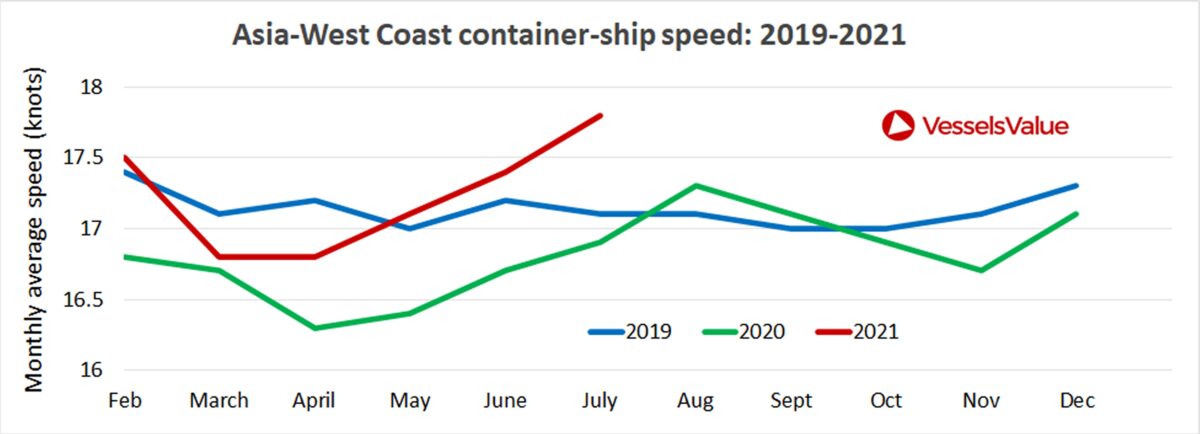

Speed in the trans-Pacific is higher still. Sundboell said that the current average capacity of a ship in trans-Pacific service is close to 10,000 TEUs (the equivalent of a post-Panamax). According to VesselsValue, the average speed of container ships (of all sizes) in Asia-West Coast service this month is 17.8 knots — 1.3 knots higher than the global post-Panamax average. Asia-West Coast speeds have jumped 6% in just the past three months.

Sporadic speeds of 20 knots or higher are not only common on the trans-Pacific backhaul run, as in the case of the Seaspan Melbourne, but also on the fronthaul Asia-U.S., according to MarineTraffic tracking data.

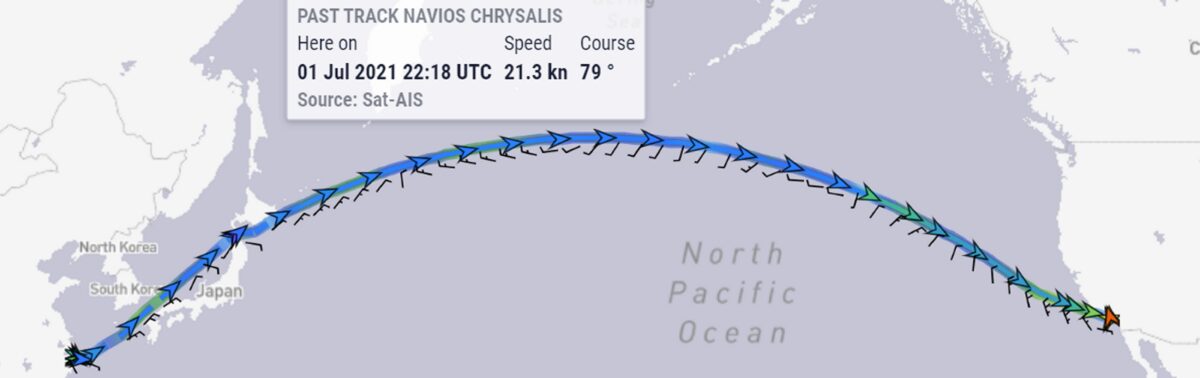

A recent example: The 4,250-TEU Navios Chrysalis, operated by ZIM (NYSE: ZIM), is currently at anchor off Los Angeles. At one point on its way over from Asia, it topped 21 knots.

Navios Chrysalis’ average speed over the past three months was 18 knots, according to MarineTraffic. That’s 15% faster than the global average for this vessel type (Panamax) over the same period, based on VesselsValue data.

Limits to speed benefits

“Back when carriers went to slow steaming and super slow steaming, it was mostly driven by high bunker prices,” Alan Murphy, CEO of analytics and consulting company Sea-Intelligence, told American Shipper.

“Slow steaming drove lower fuel costs but it had the added effect of soaking up capacity. Back in my days [at a liner company], ships would spend nine weeks going from Asia to Northern Europe. Then, with slow steaming, it could take up to 12 weeks.

“A criticism that has been levied at carriers now is that if they sped up, it would release additional supply.

“On a high level, that’s true. And carriers have been speeding up. But the problem is that we don’t really have a global shortage of ships, we have a shortage because capacity is being soaked up by congestion, primarily at U.S. ports. If you speed up just to wait at a port, how much of a difference does that really make?

“The other problem is that some vessels can do 23-25 knots, but not all of them, especially if they’re heavily loaded. And many of the newer ships are not built for those kinds of speeds,” Murphy added.

Another limitation involves the nature of container shipping, which is a scheduled service. In contrast, dry bulk and tanker shipping are so-called “tramp” trades, which have no schedules. If tramp tankers or bulkers speed up by 5%, it creates 5% of new effective capacity. Not so for container ships.

Sundboell explained that in normal market conditions, “if you would usually go 13 knots and you speed up and you save one or two days [crossing the Pacific], that doesn’t give you any additional capacity in a weekly service. You’d need to save seven days.”

Why ships are speeding up

But these are not normal times. The advantage in the current market is that schedules are already so far behind that faster speeds can help carriers chip away at congestion-induced capacity losses over time.

Ships speeding up on the headhaul run may be trying to make their windows at West Coast ports after loading delays in Asia. Or, more likely, they may already be far behind schedule and seeking to shave off some time in the anchorage queue.

Ships are spending around five to eight days at anchorage before getting their berth at California ports. After they turn around, the need for speed on the backhaul is obvious: to counterbalance time lost in California. Over a period of months, this should theoretically lead to more sailings per year versus maintaining normal speed amid the congestion. With spot rates at historic highs, squeezing out even a few more sailings per year is highly lucrative.

According to Sundboell, “Right now we’re in a scenario where instead of having 52 departures in a year, easily five to 10 of those are falling through the cracks due to these stupid delays we’re seeing right now.” If a carrier can increase annual departures on a weekly service from 42 to 45, for example, those three additional sailings would equate to a large amount of revenue.

Underscoring the current appeal of carrying more cargo, container ships are now being chartered for short periods for one or two round trips at astronomical rates in excess of $100,000 per day. Using higher speeds, an operator might obtain the equivalent amount of capacity as through such a charter.

The cost is higher emissions, a negative for ESG reporting, and much higher bunker costs. But fuel costs can be passed along to shippers via higher bunker surcharges and, in general, higher costs would be more than offset by freight revenue at current rate levels.

“It’s the opposite of slow-steaming calculations,” explained Sundboell. “These kinds of [cost-benefit analyses] are extremely complicated because there are so many assumptions. But when a chartered ship can cost $100,000 a day, you can be sure that carriers are looking at exactly this calculation and making a detailed analysis.

“They’re not doing it for the blue eyes of the BCOs [beneficial cargo owners]. They’re doing it because there’s money in it.”

Click for more articles by Greg Miller

Related articles:

- Los Angeles port braces for Yantian catch-up, peak season combo

- More container ships score ‘astronomical’ $100,000/day rates

- Ship values are soaring amid secondhand sales ‘frenzy’

- Mounting evidence that container crunch will persist into 2022

- California’s massive container-ship traffic jam is still really jammed

- Inside container shipping’s COVID-era money-printing machine

Lori Halderson

The whole shipping industry is racketeering. Your own backyard and state is where all your resources would come from. Very little would be turned into commerce from other states. Gardening has been destroyed. The guilty at the Savannah Country Club have to paint the golf course green because they refuse to drop mineral rain for centuries while they pretend they are rich. Shame on you.

Thomas A. Hutchins

The total problem is not the shipping trade but also the railroad bridge traffic. Double stack container trains mainly are west to east then on to a ship to Europe. Here lies the problem. There on only so many double stack well rail cars. So traffic sits and waits for empty well cars to reload.

Railroads have tried to use tofu cars to move containers however instead of 4 per well car only 2 can fit on a tofu car.

Solution 1 is build more well cars. Solution 2 is to take some of the larger open top hopper cars and modify them to except 40 foot containers. The down turn in the coal industry has left many sidelined

Used Tesla

Used Teslas http://www.teslas.forsale