Hot Takes

The Golden State isn’t proving to hold up to its name with recent Assembly Bill 5. As the bill was written, independent contractors must operate under the “ABC Test.” Once a contractor satisfies all three requirements below, he or she can operate as an independent contractor in the state of California. The requirements are:

- The person is free from the control and direction of the hiring entity, both in contract and in fact.

- The person performs work that is outside the usual course of the hiring entity’s business.

- The person is customarily engaged in an independently established trade, occupation or business of the same nature as the work performed.

This poses a huge issue to trucking companies that employ some drivers as independent contractors. Currently the California Trucking Association (CTA) has filed injunctions to temporarily prevent this from applying to motor carriers.

The second prong is a majority of opponents’ sticking point. It calls out workers who are involved in the primary activity of a company.

Since most trucking and logistics companies move freight, it potentially removes their ability to use independent contractors unless hired as regular employees, which not all drivers want. It would be different if it was a back-end developer working at a trucking company. There isn’t any form of overlap there, unlike with drivers.

CTA has appealed to the U.S. Supreme Court to allow the exemption to apply to motor carriers, as it does to doctors, stock brokers, etc. Currently either of the cases needed to save owner-operators as independent contractors is not on the docket, but no official word has come that they won’t be heard.

Should this bill go into effect, owner-operators are looking at a possible critical change to their business models.

Proponents of the bill are saying that it’s time drivers be employees and receive the benefits and protections that typical employees have. Opponents of the bill are saying that it removes the freedoms, flexibility and growth they rely on to do business.

Other supporters in multiple states have also submitted amici filings (a “friend of the court”). That provides insight and expertise that have bearing on the case. Whether their submissions will be factored into the court’s decision to hear the case, we don’t know, we’ll just have to wait and see.

If motor carriers are potentially having to hire their owner-operators we could see changes in capacity and the spot market. If a driver has full autonomy, as an independent contractor, then they can set their own rates, schedules, and freedoms.

Should that same driver be hired but a motor carrier company they could be told what rates to use, when they work, and not have as many opportunities for growth some could potentially leave the market or the motor carrier would have to charge more in the spot market.

Quick Hits

New ride who dis? — Need new wheels? Maybe just keep fixing your current set. New trucks are taking an astonishing eight-plus months to be built versus the three-ish they were in the past. No problem, though, there is the used truck market. Surely you can get a deal.

If by a “deal” you mean roughly the same price for a new truck but three to five years of wear on it, then yes! It’s all yours.

Current used truck prices are at an all-time high. New truck production has slowed due to the lack of critical microchips and other components. Fleets are holding onto their equipment longer as they wait for new trucks to be made instead of trading in at the three- or five-year mark.

The high price of used trucks can be a deterrent to anyone looking to get into the market as a driver, which in turn means there isn’t much relief on capacity constraints. The high demand for new trucks and supply constraints will mean this market will be at record breaking levels for a while. Potentially as used truck prices lower we might start to see some capacity open up in the market.

Until the semiconductor and parts shortage is no longer a shortage, we can expect to see prices continue to hold at their current levels or increase. Don’t expect much relief on that until well into 2022.

Santa’s Bag — E-commerce warehouses are a vital part of the supply chain and as more and more retailers are beefing up warehouse space to compete with Amazon’s next-day shipping model, a unique set of problems has presented itself.

InVia is presenting an equally unique solution. Knowing that warehouse staffing will continue to be an issue for the foreseeable future, InVia has in turn started using AI to leverage existing labor. Automating what it can and having robots traveling around the warehouse and leaving people to pack the final product is more efficient than having people walking around the warehouse all day and then packing the order.

By switching workers’ tasks every couple of hours to accommodate the “bursts” in productivity, InVia has developed a system it can take to others and implement efficiencies everywhere. It is charging by picked unit instead of the cost of the robot. It’s proving to be a more effective way to get customers in the door and started with its services before just asking people to hand over a large amount of money for something that can totally help efficiency.

Market Check

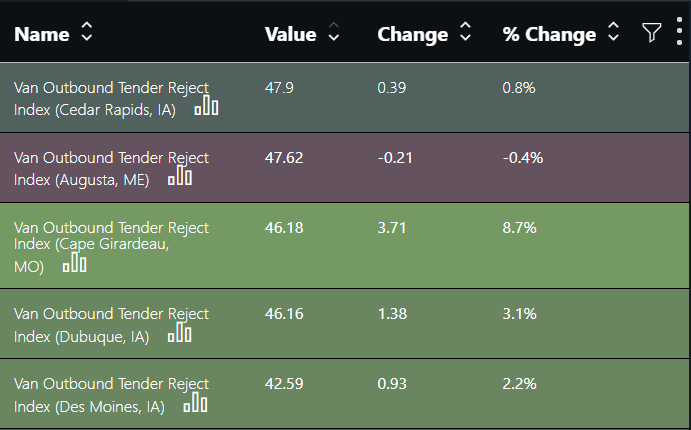

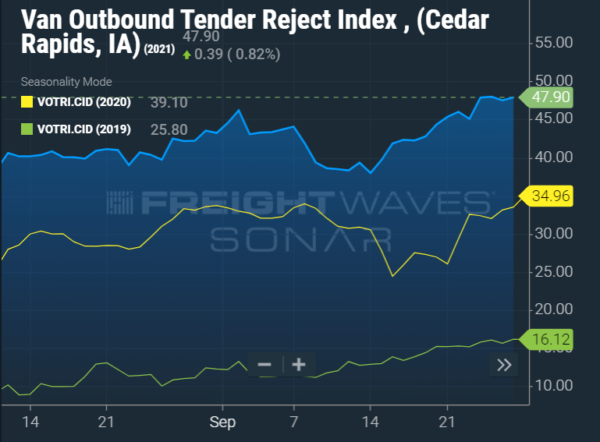

When brokering loads in the Hawkeye State, you better have just that, eyes like a hawk. Iowa currently has three of the five highest markets for outbound tender rejects. Corn and soybean harvest season does affect a little bit of capacity, but for the overall rejections in these markets to be so high, it raises a question as to what exactly is going on in Iowa?

Without knowing for sure if there is a corn convention happening, I would bake in some safety to any load coming out of Des Moines, Dubuque and Iowa City. The spot market will be higher than usual — and higher than previous years. In Cedar Rapids, rejections have followed a similar pattern as last year but the rate at which overall rejections are happening is so much higher.

Who’s with Who

Worldwide Flight Services has acquired Pinnacle Logistics. The goal of Worldwide Flight Services is to increase its cargo handling through e-commerce services, which allows it to increase the value proposition to customers. With Pinnacle’s expertise in express deliveries, it stands to be a lucrative opportunity. Read more here.

The More You Know

Used truck prices keep soaring to records

Fate of California AB5 riding on 2 cases seeking supreme court review

For warehouse operators e-commerce is the biggest problem in the world

Want this in your inbox? Subscribe here