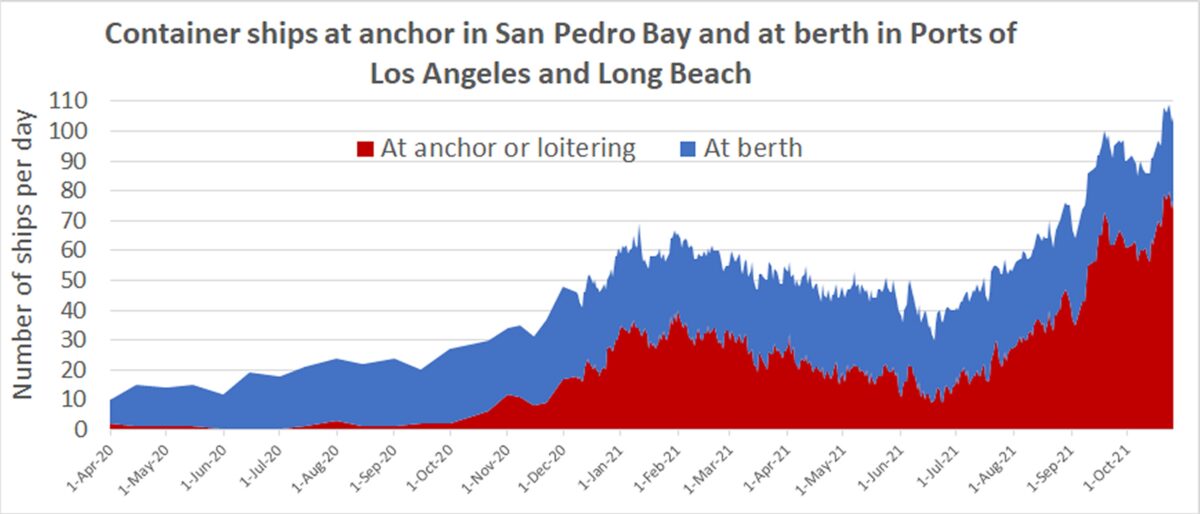

There was fleeting hope that Southern California port congestion had turned the corner. The number of container ships waiting offshore dipped to the low 60s and high 50s from a record high of 73 on Sept. 19, trans-Pacific spot rates plateaued, the Biden administration unveiled aspirations for 24/7 port ops, and electricity shortages curbed Chinese factory output.

The reality is that the port congestion crisis in Southern California is not getting any better.

The time ships are stuck waiting offshore continues to lengthen. There are simply too many vessels arriving with too much cargo for terminals, trucks, trains and warehouses to handle.

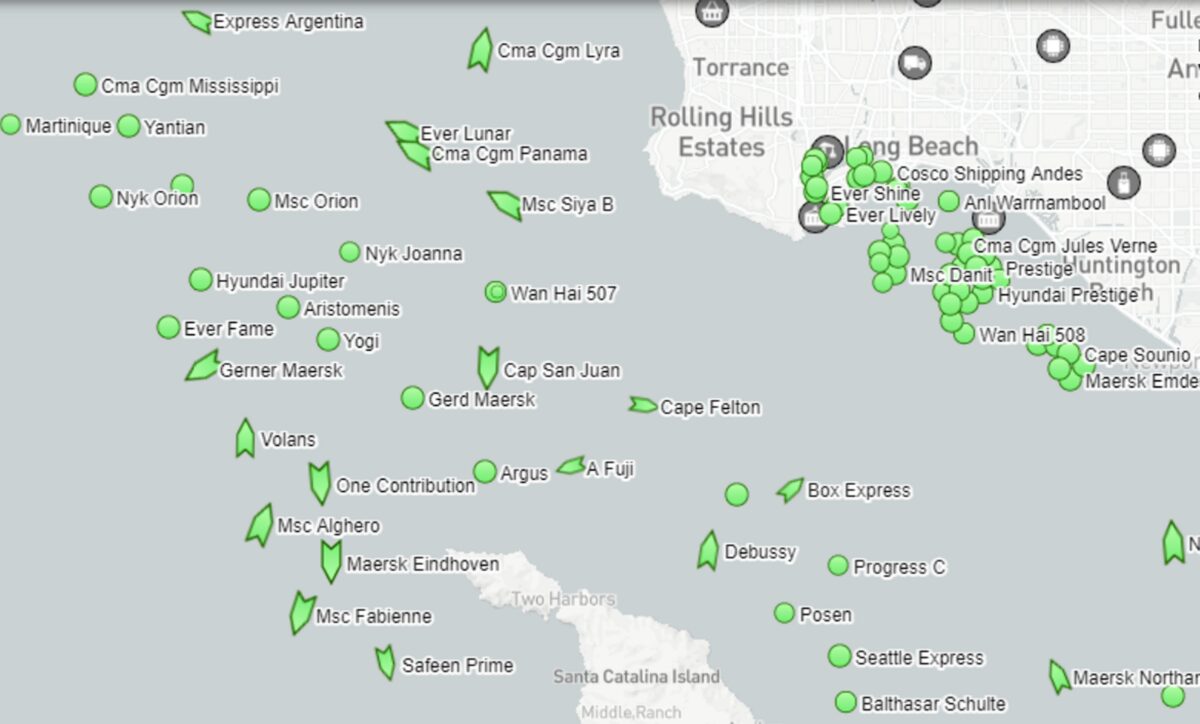

The number of ships at anchor or in holding patterns is once again at record levels. According to the Marine Exchange of Southern California, 80 container ships were waiting off Los Angeles and Long Beach on Sunday, yet another all-time high.

Massive value of cargo stuck offshore

Marine Exchange data shows that ships waiting offshore on Sunday — including the 80 container ships as well as six additional cargo vessels carrying containers — had aggregate capacity of 580,619 twenty-foot equivalent units. To put that in perspective, that is 24% more than the Port of Los Angeles imported during the entire month of September and 69% of the combined Los Angles/Long Beach port complex’s September imports.

Assuming ships are at capacity, how much cargo value is out there in the “floating warehouse”? What’s in each box, and its value, varies dramatically — it can be worth a few thousand dollars or several hundred thousand dollars. But Port of Los Angeles stats provide a good guide.

The total customs value of the Port of Los Angeles’ containerized imports in 2020 was $211.9 billion. Given that imports totaled 4,827,040 TEUs, this equates to an average of $43,899 per import TEU. (Several other sources also estimated average cargo value at around $40,000 per TEU.)

This suggests that the cargo currently waiting off the ports of Los Angeles and Long Beach on Thursday is worth around $25.5 billion, more than the annual revenues of McDonald’s or the GDP of Iceland.

Imports trapped on ships for over a month

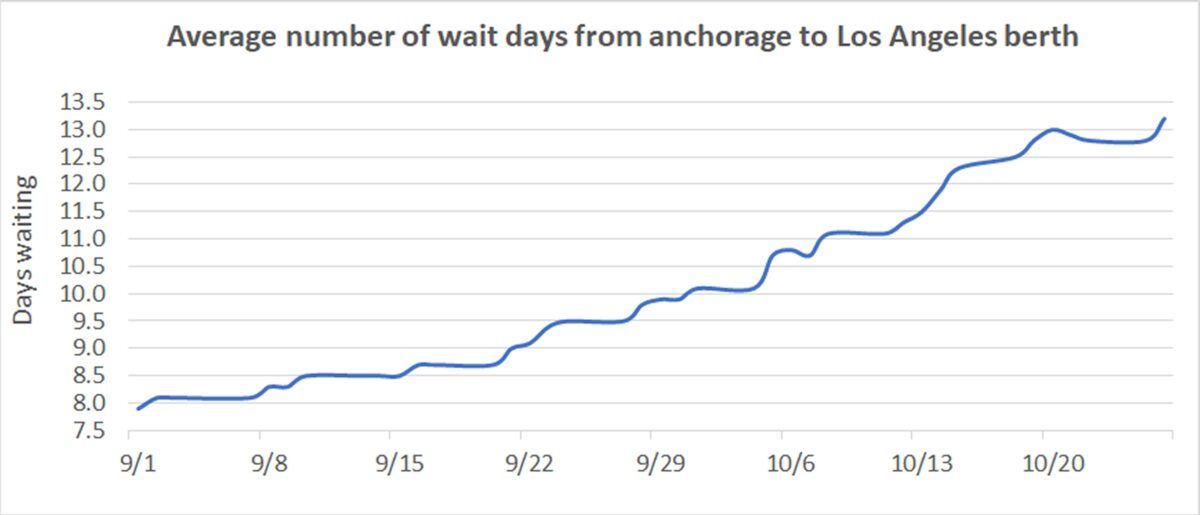

Data from the Signal platform shows that wait time from anchorage to a berth in Los Angeles rose to an all-time high 13.2 days on Tuesday, up 67% from the beginning of September.

But the average wait time doesn’t tell the full story. Ships have been sitting in San Pedro Bay for more than twice that long.

Most of the vessels that still have no terminal berth assignments despite extended wait times are small ships operated by Chinese players such as BAL Container Line that entered the trans-Pacific market for the first time this year. Some of the ships stuck in the queue have been chartered at exorbitant rates, raising the question of whether charterers accounted for such lengthy delays.

American Shipper was contacted by a U.S. manufacturer who has over 100 containers of goods trapped aboard the Chinese-owned Zhong Gu Jiang Su. The ship has been waiting offshore for over six weeks, since Sept. 13, and has yet to obtain a berth assignment, according to the Marine Exchange master queuing list.

The U.S. manufacturer, who booked through a freight forwarder, spoke on condition of anonymity. “This is really impacting our production,” he said, noting that the trapped goods are “a major component” in his company’s manufacturing process.

“We can’t get any type of help or get any type of escalation from anyone,” he said. He was told that the ship operator “hadn’t negotiated with the terminals for a berth” before arrival, which led to the extended delay.

Among the Chinese-linked ships with no berth assignment stuck in the queue, the Martinique has been waiting the longest, since Sept. 9. Loadstar reported that it is on charter to Transfar, which is owned by a Chinese logistics provider that is in turn partially owned by Chinese e-commerce giant Alibaba.

The BAL Peace has been waiting without a berth assignment since Sept. 25. The S Santiago also arrived on Sept. 25. It finally had a berth assignment listed just under a month later, on Sunday.

According to Alphaliner, BAL is chartering the S Santiago for around $125,000 a day. An industry source told American Shipper the rate was $135,000 per day. So far, that ship has been waiting — paying rent and not loading any more revenue-generating cargo — for 31 days straight.

Click for more articles by Greg Miller

Related articles:

- China port congestion falls sharply, trans-Pacific shipping rates retreat

- Los Angeles port boss lays out congestion-fighting plan

- Ship at anchor off California ports may have caused major oil spill

- Power crisis deepens in Asia and Europe: What it means to shipping

- How supply chain chaos and sky-high costs could last until 2023

- Just how many containers of cargo are stuck off California’s coast?

- Record shattered: 73 container ships stuck waiting off California

jw

WHAT I WANT TO KNOW IS, ARE THE CONTENTS OF THE CONTAINERS ALREADY PAID FOR, AND HOW THOROUGH ARE THE INSPECTIONS OF EACH CONTAINER ? I WOULD NEVER PAY FOR ANY GOODS UNTIL I CAN INSPECT THEM IN MY WAREHOUSE FOR DAMAGE AND QUANTITY ! SO 25 BILLION DOLLARS ARE NOT PAID TO CHINA NOW ?

F2F

Why is it that nobody mentions the DANG VAX MANDATES as central to the problem?! We all know that truckers are either refusing to work or being denied the ability to work because of the EVIL MANDATES, but no report ever seems to mention THAT crucial factor. They all talk about “inflation” and ship backups, blah-blah-blah.

SUSPEND THE ROTTEN MANDATES, ACROSS OUR COUNTRY, AND LET US BECOME AMERICA AGAIN!!! :-\

Lori Wheeler

Obviously you are swayed by your political beliefs. The mandates have little if anything to do with what is happening right now. There was a driver shortage before the pandemic and now, The SSLs and the Port are making it even more difficult for a trucker to make any money by holding up the drivers at the Port and locking up their equipment by not accepting empties. At the Ports, the inmates are running the prison and the SSL’s are not moving the empties out to make room and alleviate the congestion because there’s no money in repositioning empties. It’s a very complex problem and for you to say it’s all about the mandates is really shortsighted and wrong.