Third-party logistics company Hub Group sees market conditions supporting inventory imbalances to persist through much of 2022, executives said during Hub Group’s third-quarter 2021 earnings call late Thursday.

“Strong demand continues as inventory-to-sales ratios are at near all-time lows while intense restocking of the shelves persist,” Hub Group (NASDAQ: HUBG) CEO Dave Yeager told investors. “On the second-quarter call [in July], we related that we believe that this strong demand and tight capacity market may extend through the second quarter of 2022. Nothing has really changed since that last report, and we believe that this imbalance will continue through most of the first half of 2022, and very likely throughout most of the year.”

Also likely continuing through 2022 is congestion at the West Coast ports because of a lack of warehouse capacity, Dave Yeager said.

“I would suggest to you that the West Coast port situation is not going to be resolved quickly or easily, that we’re going to continue to see congestion at least through the end of the year and, I would suggest to you, beyond,” he said. “So there just is not enough warehouse capacity. The 24/7 is really not going to work. I mean, you still need skilled labor to be able to load and unload those vessels.”

He continued, “So you are seeing some diversion to some of the East Coast ports, and people are trying the Port of Portland and other ports on the West. But the congestion is there for a while. And … there is no light switch to turn it off and on.”

That tightness in international box capacity because of the West Coast port congestion has resulted in higher levels of transloading into domestic containers, and that trend looks poised to continue, according to COO Phil Yeager.

“That’s going to continue to be a driver of more growth for domestic intermodal off the West Coast, and there’s going to continue to be a high level of demand for imports there,” Phil Yeager said. “But even as we look at other locations we see that there’s a lot of growth opportunity for us. If you look at the Port of Savannah, that’s been a big growth opportunity for us this year, and I think that will continue as well.”

As network fluidity improves and as demand for service will likely persist through much of 2022, Hub Group expects a strong bid season in 2022 for intermodal contracts. Executives said shippers should “lock in capacity.”

“As we look ahead with intermodal pricing, we’re feeling very good about the early stages,” Phil Yeager said.

Hub Group hit a number of records in the third quarter amid “strong demand and favorable market conditions,” Dave Yeager said in a release.

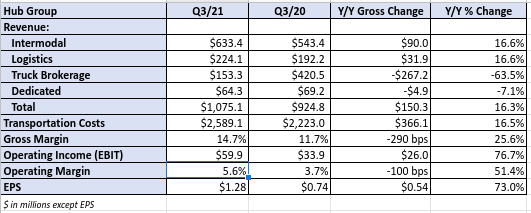

Third-quarter 2021 net profits were a record $43 million, or $1.28 per diluted share, compared with $25 million, or 74 cents per diluted share, in the third quarter of 2020.

Record quarterly revenue rose 16% to $1.1 billion from $925 million a year ago, while operating income was $60 million, or 5.6% of revenue, compared with $34 million, 3.7% of revenue year-over-year.

Gross margin was a record $158 million, which represented 14.7% of revenue, compared with $108 million in the third quarter of 2020. The third-quarter 2020 figure represented 11.7% of revenue.

Costs and expenses rose to $98 million from $74 million a year ago on higher variable compensation expenses, operating costs for Hub Group’s final-mile acquisition, expenses related to legal settlements and costs related to the acquisition of Choptank Transport.

Third-quarter capital expenditures were $58 million. Hub Group also recently acquired Choptank for approximately $130 million in cash.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.