The stock of TravelCenters of America is up about 135% in the past 52 weeks, and the company’s third-quarter earnings released late Monday show why.

The earnings also suggest that by at least one measurement, the pace of freight movement on the roads may have stopped climbing last quarter.

TA’s total revenue (NASDAQ: TA) figures are not a good indicator of how the company is doing financially, given that it is heavily influenced by the cost of fuel. The company’s fuel revenue was up almost 80% compared to the third quarter a year ago, not surprising given that the average retail diesel price, according to the Department of Energy, was about 90 cents more in the third quarter of this year than in Q3 2020.

But the company made more on its fuel sales, with the fuel gross margin rising to $106 million from $80 million a year ago. Nonfuel revenues also were up, rising 7.8%.

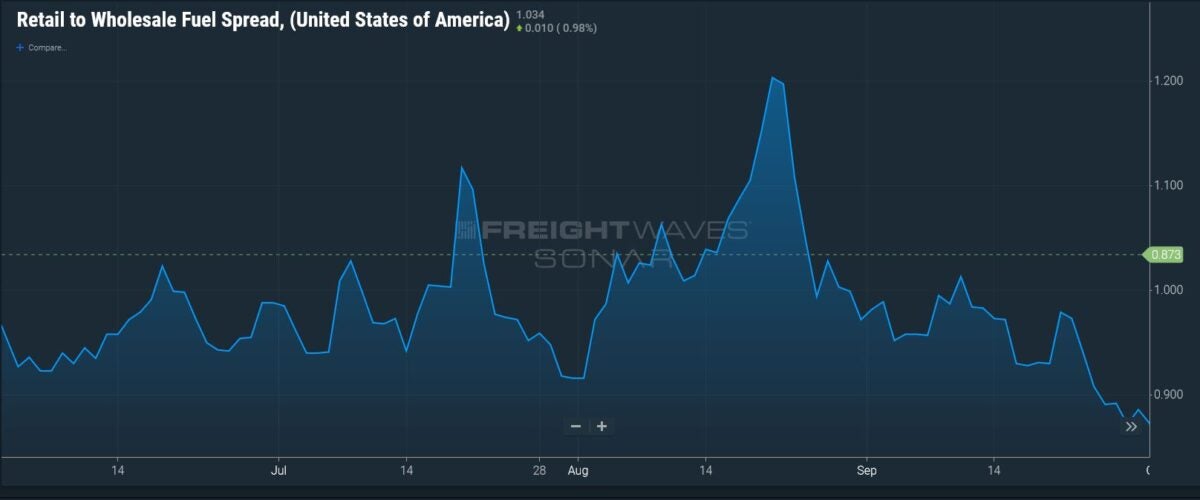

However, the market swings were beneficial to TA, as its fuel gross margin was 18.1 cents a gallon, compared to 14.4 cents a gallon in the third quarter of last year. This was accomplished even as the margin between diesel wholesale and retail prices, as seen in the FUELS.USA data series in SONAR, showed a weakening number as the quarter wore on.

While TA does not break out the difference in margins between gasoline and diesel sales, its sales in the quarter were about 7.1 gallons of diesel for every 1 gallon of gasoline sold.

Diesel sales at TA rose only slightly for the quarter sequentially, suggesting a possible plateau in demand nationally; it is likely that TA’s sales would be reflective of broader trends.

In the third quarter, diesel sales were 513.8 million gallons. In the second quarter, they were less than 1 million gallons below that, coming in at 512.9 million. In the third quarter of last year, diesel sales came in at 485.4 million gallons.

The slight rise in third-quarter diesel sales at TA was stronger than what federal government data suggested was going on for the broader diesel and distillate market.

The weekly Energy Information Administration report does not break out diesel demand specifically but does have a category for distillate product supplied, which is demand for distillates like diesel but without jet fuel included. Diesel demand is the biggest part of the number. (Diesel demand is broken out in a monthly EIA report that is viewed as more accurate, but there is a two-month lag on that report).

The weekly data showed a decline of about 1.1% in distillate product supplied from the second to the third quarter, suggesting that TA’s diesel sales may have grown at a slightly faster rate than the overall demand in the market, which may have been mostly stagnant in the quarter.

TA has been reorganizing for more than a year, and equity markets have been applauding those changes with hefty gains in the price of TA stock. For the quarter, net income of $22.2 million was up $13.5 million from a year ago. Non-GAAP EBITDA was up $14.1 million, or 27.7%, to $65.2 million.

The non-GAAP EPS of $1.52 was 35 cents better than consensus, according to SeekingAlpha. Revenue fell short by just $10 million.

TA said its overall operating margin had risen to 2.1% from 1.4% a year ago. TA’s balance sheet also was stronger, with cash and cash equivalents rising to $621.1 million from $483.1 million at the close of 2020.

In the prepared statement released in conjunction with the earnings, TA CEO Jonathan Pertchik cited the company’s “transformation plan” as being responsible for the strong earnings. “TA’s strong operating results for the third quarter continue to demonstrate our successful execution on the transformation plan that we began implementing last year,” he said in the statement.

More articles by John Kingston

Echo going to debt market; highly speculative ratings issued

Used truck prices high but Ryder’s inventory low

ATA’s Spear gets specific on vaccine mandate: Trucking should have an exemption