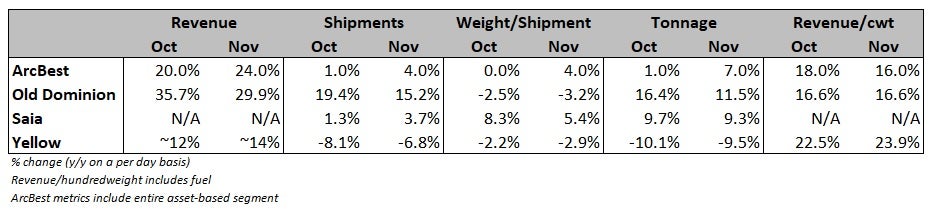

Less-than-truckload carrier Yellow Corp announced negative tonnage trends for the first two months of the fourth quarter, but that’s largely by design. Tons per day fell by approximately 10% year-over-year in October and November, the company said in a Thursday press release issued after the market closed.

Compared to peers, some of which experienced double-digit gains, that’s quite a falloff. However, the disruption to Yellow’s (NASDAQ: YELL) volumes is expected to be short-lived.

Like many LTL carriers, Yellow is taking advantage of a tight market to replace lower-margined freight throughout the network. And that’s just part of a much larger restructuring.

The company has undertaken an overhaul aimed at consolidating its four LTL carriers and logistics company under the same banner and on the same technology platform. The consolidation is expected to eliminate the redundancies it experienced running four independently operated carriers. Potential revenue and cost synergies will also be aided by a $700 million pandemic-relief loan, which has allowed it to replace aging equipment and improve the fleet’s cost profile.

A hot freight market and early wins from the transformation led the company to its first profit (excluding real estate gains) and best operating ratio since 2018 during the third quarter.

Even with the hatchet-like approach to the freight book in the current period, Yellow still recorded low-double-digit revenue increases as the yield strategy appears to be working. Revenue per hundredweight was up 23% year-over-year in October and 24% higher in November. Those were the largest percentage gains reported by the group.

“The operating metrics for November and December are in line with our expectations as we continue to execute our yield strategy,” said CEO Darren Hawkins. “We are working with our customers to ensure the right freight is flowing through the network and that the price reflects the value that Yellow brings to the market.”

The carrier also announced the exit of its single-employer pension plans. It entered into an agreement to transfer its qualified nonunion plans to an insurance company. No changes to benefits will be seen by the 8,500 plan participants. However, Yellow will record a noncash loss of $50 million to $60 million, or 98 cents to $1.18 per share, in the fourth quarter, associated with the accelerated loss on its obligations.

Q4 shaping up to be another big quarter for carriers

Old Dominion Freight Line (NASDAQ: ODFL) said a strong economic backdrop and recent investments allowed it to “win market share” again in the fourth quarter. During the first two months of the period, it recorded revenue increases that were 30% higher year-over-year as tonnage growth (+16% in October, +12% in November) outpaced peers. Old Dominion also reported a mid-teen-percentage yield increase over the same period.

ArcBest (NASDAQ: ARCB) recorded revenue growth of 24% year-over-year in November, which followed a 20% increase in October. Yields were up by a mid- to high-teen percentage. The company used similar trends in the third quarter, a modest tonnage increase alongside a 17% hike in yield, to post record quarterly results and a mid-80% operating ratio in its asset-based segment, which includes LTL results.

Like other carriers, ArcBest is investing in terminals and equipment, as well as hiring staff, to drive earnings higher. The efforts are expected to produce a mid-single-digit percentage increase in shipment capacity by the end of 2022. The company sees additional capacity and higher yields as the primary catalysts for future earnings growth.

Asset-light provider Forward Air (NASDAQ: FWRD) has been very aggressive upgrading its freight mix. The company is onboarding heavier freight in the medical and industrial tech industries to max out shipment weights and yields. The thought is fewer, heavier shipments will free up incremental terminal space throughout the network. Its revenue per shipment in the first two months of the fourth quarter was more than 50% higher year-over-year.

General rate increases (GRIs) will aid future results as well.

ArcBest implemented a 6.9% GRI in mid-November for general tariff codes that are not subject to a contract. Industrywide, GRIs have been established earlier and at higher rates than in the past as truck capacity remains constrained and demand has yet to crack.

Yellow issued a 5.9% GRI on Nov. 1.

Saia’s (NASDAQ: SAIA) tonnage was up nearly 10% year-over-year in October and November. The carrier didn’t provide revenue or yield metrics but assuming it captured yield increases similar to competitors, it likely recorded mid-20% revenue increases in the period.

“We operate the second largest LTL network in North America with more than 300 strategically placed terminals and we have capacity to take on freight that aligns well with our network and is priced appropriately,” Hawkins continued. He said the company’s transformation “enhances the value proposition to our customers and positions us for long-term tonnage growth.”

Click for more FreightWaves articles by Todd Maiden.

- Forward Air’s freight swap pushing shipment yields up

- Transportation, warehouse capacity lacking, costs soar in November

- Knight-Swift builds out LTL network with $150M acquisition of MME

Cathy Swigert

●▬▬▬▬ ✹ 𝐒𝐭𝐚𝐲 𝐀𝐭 𝐇𝐨𝐦𝐞&𝐖𝐨𝐫𝐤 𝐀𝐭 𝐇𝐨𝐦𝐞 ✹ ▬▬▬▬●

I started earning $85/hour in my free time by completing tasks with my laptop that i got from this company I stumbled upon online…Check it out, and start earning yourself . I can say my life is improved completely! Take a gander at it what I do…..

Here is I started.……GOOD LUCK…>> http://Www.NETCASH1.Com

Latasha Baade

[ JOIN US] I get paid more than 💵$90 to 💵$320 per hour for working online. I heard about this job 3 months ago and after joining this I have earned easily 💵$10k from this without having online working skills . Simply give it a shot on the accompanying site…

Here is I started.…………>> http://Www.NETCASH1.Com