American coal production grew exponentially from 1870 to its peak in 2008 at 1.17 billion tons, but has fallen since then. 2016 was an especially bad year as rock-bottom natural gas prices prompted a wave of coal-to-gas power plant conversions, but 2017 was a recovery year for coal production and railroad coal volumes. The EIA projects that American coal consumption and net exports will stay relatively flat through 2050.

Of all the class 1 railroads, BNSF, a wholly owned Berkshire Hathaway subsidiary, hauls the most coal as a proportion of its overall traffic. According to research reports by Susquehanna, 17.9% of BNSF’s total loads are coal compared to 13.4% for Union Pacific, 12.3% for CSX, 12.1% for Norfolk Southern, 11% for Canadian Pacific, 5.8% for Kansas City Southern, and 4.7% for Canadian National.

In 2017, BNSF grew its coal revenues by 14% over 2016 and grew its coal volumes by 6% over 2016. BNSF’s coal revenues for 2017 totaled $3.84B, representing 18.9% of its $20.4B in total freight revenues.

BNSF’s leadership among railroads in hauling coal stems from its dominant position in the Powder River Basin in Montana and Wyoming, which contains one of the largest coal deposits in the world. PRB coal is classified as ‘sub-bituminous’ and very low sulphur compared to Appalachian coal, but it’s buried fairly deep underground, and extracting it wasn’t economically viable until power plant emissions became a major area of public concern. Almost no coal came out of the region in 1970, but by 1988, Wyoming produced more coal than any other state and in 2017, it produced more than three times as much coal as the next biggest-producing state, West Virginia.

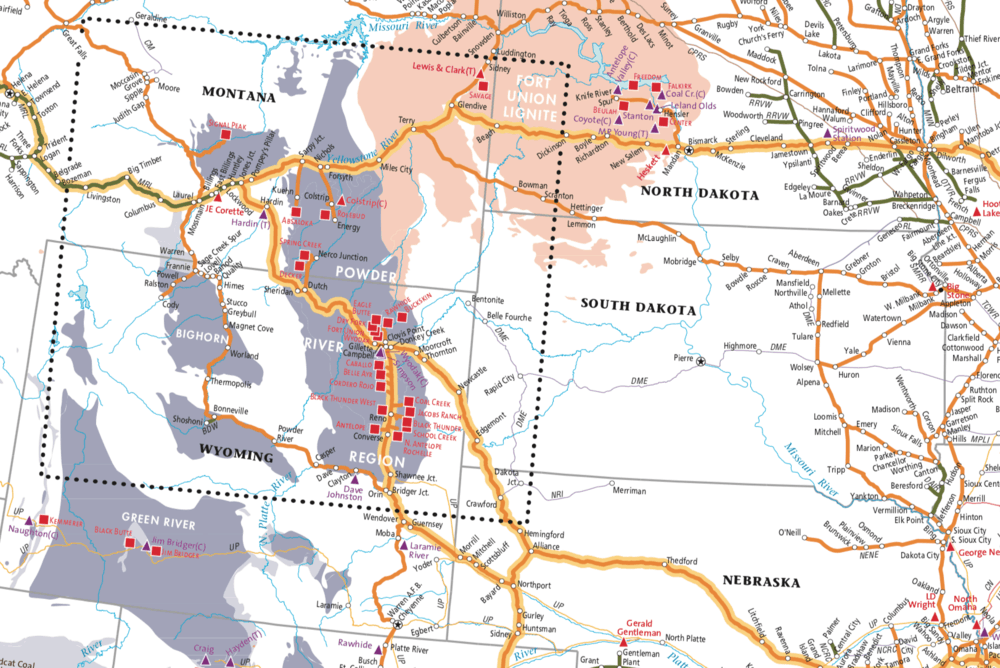

Currently the Powder River Basin alone accounts for about 40% of the United States’ coal production. Check out the map below to see BNSF’s roads through the PRB (BNSF railways are represented by thick yellow-orange lines):

The Powder River Basin grew its 2017 production by 7.2% over 2016, and BNSF captured most of that—Union Pacific is the only other railroad with any access to this coal-producing region, but it only touches a piece of the lowermost extremity of the PRB in southern Wyoming. Plans to build terminals on the PNW coast to expedite coal exports to Asia have been downsized; most PRB coal hauled by BNSF moves east to coal-fired power plants. A wave of new coal plants were constructed in the Mountain West and the Midwest in the 21st century; other regions, like the Pacific coast and the Northeast, have or are eliminating coal fired power plants.

The EIA thinks coal consumption in the United States will be fairly flat for decades to come, but other forecasters think that coal will decline steadily over the next few decades as electricity demand stagnates and renewable energy sources replace retiring coal plants. To determine how BNSF’s relatively heavy exposure to coal affects the performance of the railroad, both of those scenarios have to be considered. Then the question becomes: in case of a steady decline in coal consumption and production, will BNSF be hit the hardest, or is the railroad in position to be the ‘last coal carrier’ standing, with a network covering the largest source of clean-ish coal and the most recently constructed coal plants?

The late Hunter Harrison was bearish on coal, explaining in the summer of 2017 that CSX would buy no new locomotives to haul coal trains out of Appalachia. “Fossil fuels are dead,” Mr Harrison said on CSX’s Q2 2017 earnings call. “That’s a long-term view. It’s not going to happen overnight. It’s not going to be in two or three years. But it’s going away, in my view.”

Warren Buffett, who controls BNSF through Berkshire Hathaway, also expressed skepticism about the long-term future of coal. At Berkshire Hathaway’s 2017 shareholders meeting in Omaha, Buffett said, “If you are tied to coal, you’ve got problems. Coal is going to go down over time. I don’t think there’s any question about that coal is going to go down as a percentage of revenue significantly.” Yet Berkshire Hathaway also owns MidAmerican Energy, an Iowa-based utility company that has 11 coal-fired power plants, many of them supplied by BNSF.

Buffett’s stated pessimism about the future of coal is belied by his decision to acquire BNSF and Berkshire Hathaway Energy’s reliance on coal (PacifiCorp, one of its companies, generates 62% of its power from coal). It seems that although Buffett recognizes that fossil fuels, including coal, are in long-term secular decline, at the same time he’s putting Berkshire Hathaway in a position to transport and burn huge amounts of coal for the foreseeable future. This suggests to us that BNSF’s coal business is relatively resilient, mostly because its network connects the most productive coal mines to the newest, most efficient coal plants.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.