No matter how “open” the Chinese government has said Shanghai is, the flow of trade is telling otherwise. The reality is quite simple: Shanghai’s supply chain is sick.

The diagnosis is based on the volume of trade being moved and produced. Trade takes people working throughout the entire supply chain. That is not happening.

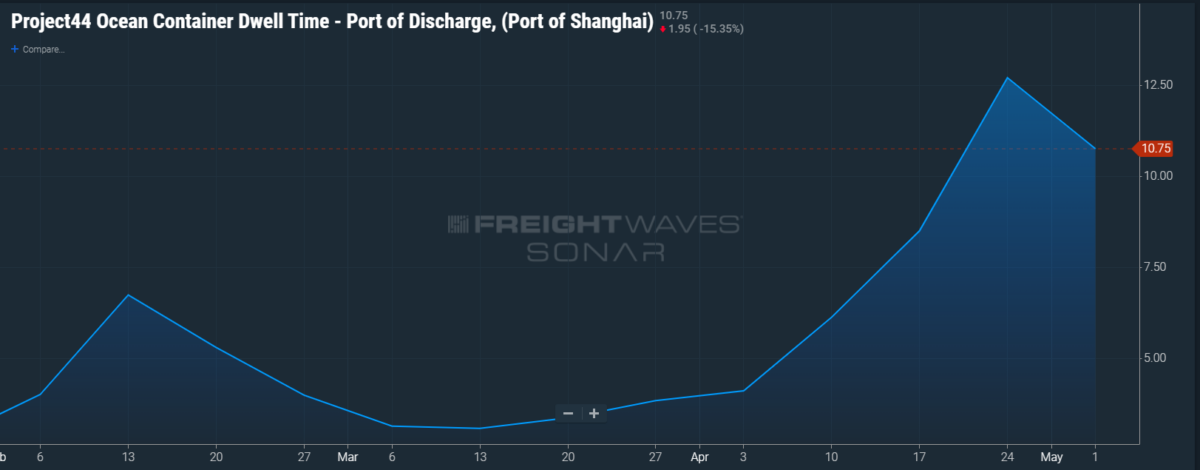

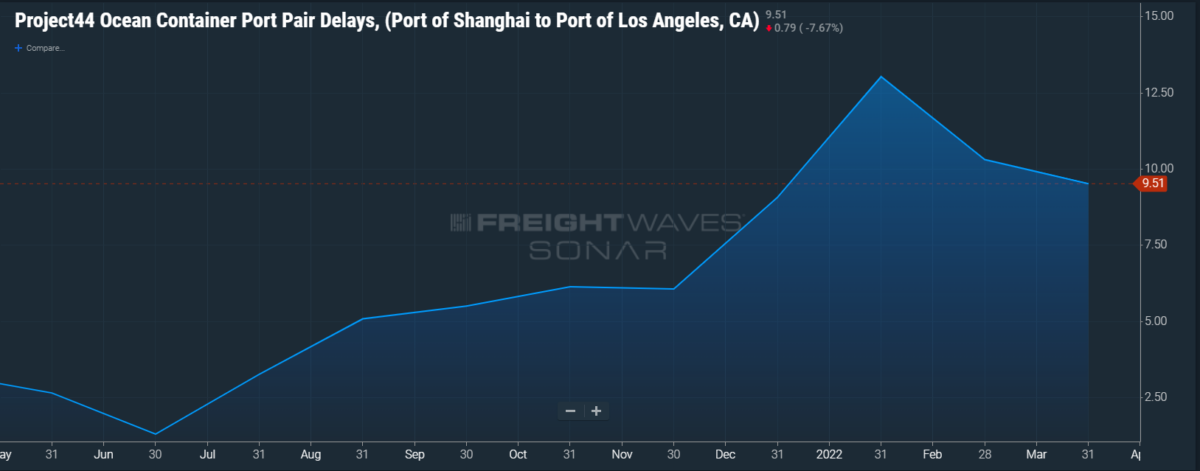

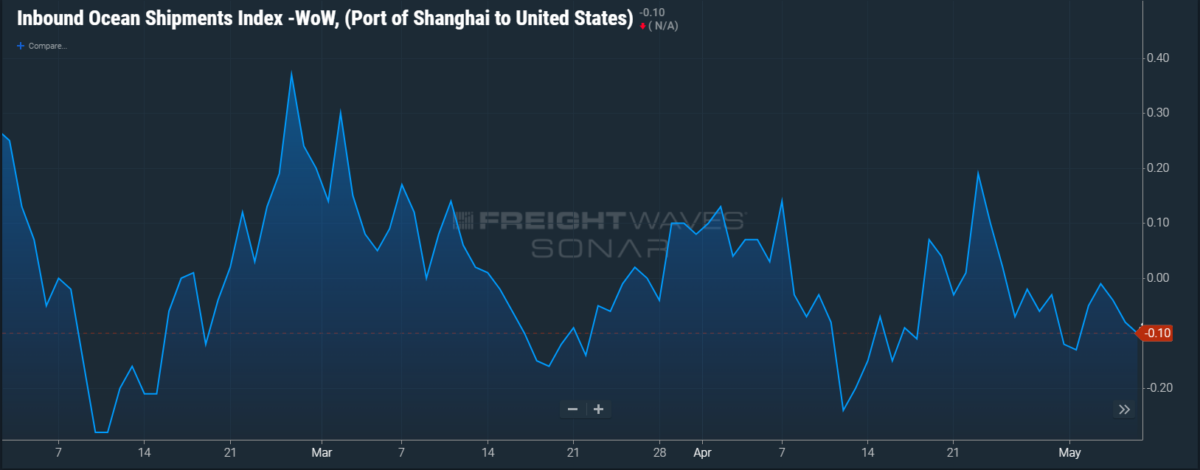

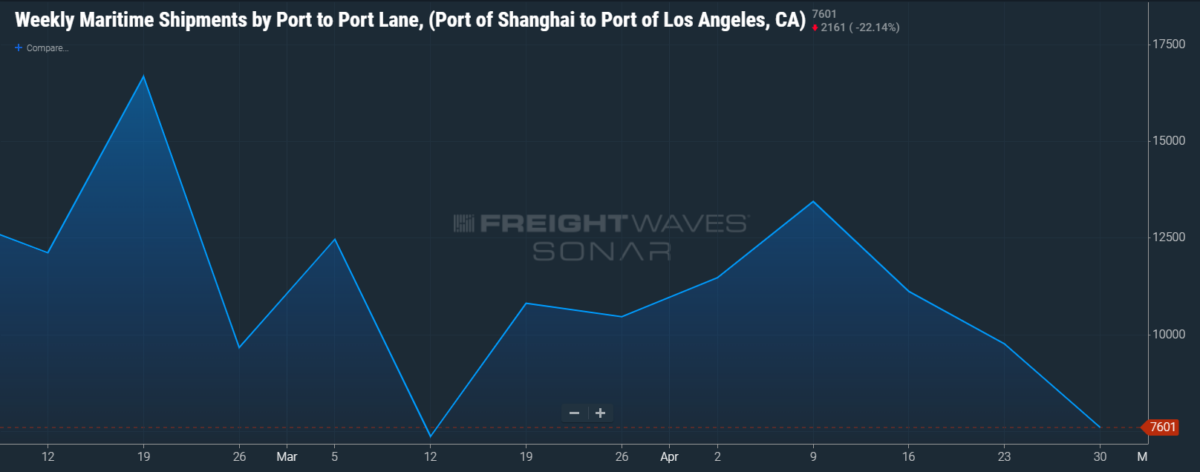

Below are FreightWaves SONAR charts that take a real-time temperature check on the Shanghai trade route.

The first shows container dwell time at the Port of Shanghai. Sure, it’s great you can get your product in a container, but you will have to wait more than 10 days for it to get loaded on a vessel. A container at rest is not making money.

Once the container is out on the water, it has to wait yet again once it arrives at its destination port. The Port of Los Angeles receives the most containers from Shanghai, which is why only Los Angeles is shown on the SONAR chart below. Notice another nine-plus days of waiting. More time is being lost.

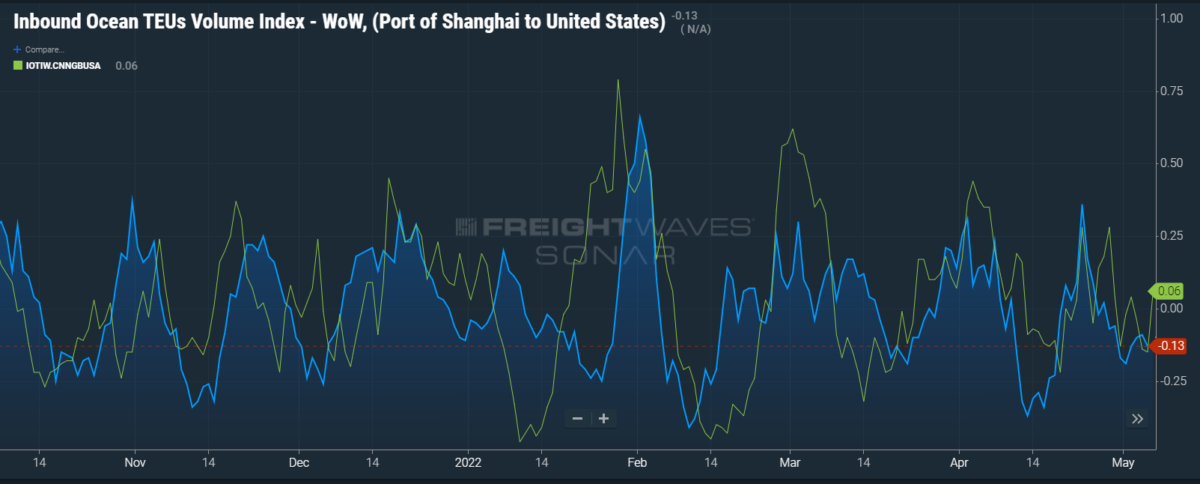

So what does this all mean? It points to a massive drop in exports from Shanghai to all U.S. ports.

The weekly shipments from the Port of Shanghai to the Port of LA resemble a ski slope. There’s nothing healthy here.

Now, while some trade has been diverted to Ningbo, China, it’s not a cure. We know congestion will follow in Ningbo as a result of the elbow in the trade plumbing.

China’s zero-COVID policy is a prescription for more inflation and supply chain illness. The prognosis will not change until the remedy being hailed as a cure is no longer prescribed.

For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.