Shipping liner executives predicted a continued drop in spot rates during their latest quarterly calls, while offering soothing assurances to investors that the fall would be gradual. Maersk CFO Patrick Jany said it would be a “progressive erosion,” not “a one-day drop.” Matson CEO Matt Cox emphasized rates were “adjusting slowly” in an “orderly marketplace” and not “falling off a cliff.”

The decline may indeed be fairly steady, as opposed to the sudden, violent swings seen in bulk commodity shipping. Yet spot container rates appear to be falling more rapidly than some liner executives expected.

Stifel analyst Ben Nolan recently met with executives of Matson (NYSE: MATX). “In our meetings, management indicated that … the downward softening has been much steeper and less orderly in the past two months,” Nolan wrote in a client note on Sunday.

Matson introduced its third trans-Pacific service — China-California Express (CCX) — in June 2021 to meet booming demand. During the Aug. 1 conference call, Cox said CCX would run through October. It didn’t.

“As a result [of softening demand] the company has completed the last sailing of the temporary CCX service ahead of the targeted October conclusion date,” said Nolan.

Steepest decline in Asia-West Coast market

“Spot rates continue to plummet,” said Clarksons Securities analyst Frode Mørkedal on Monday. “The Shanghai-U.S. West Coast corridor has seen the most significant adjustment.”

The Freightos Baltic Daily Index (FBX) China-West Coast assessment has fallen 76% over the past six months, to $3,799 per forty-foot equivalent unit as of Friday. The Drewry Shanghai-Los Angeles assessment is down 57% in the same period.

In the week reported Thursday, the Drewry rate for Shanghai-LA fell another 11% week on week. The prior week, it had dropped 14%.

“There is no clarity with respect to when or where market rates may bottom,” said Nolan.

More blank sailings predicted after Golden Week

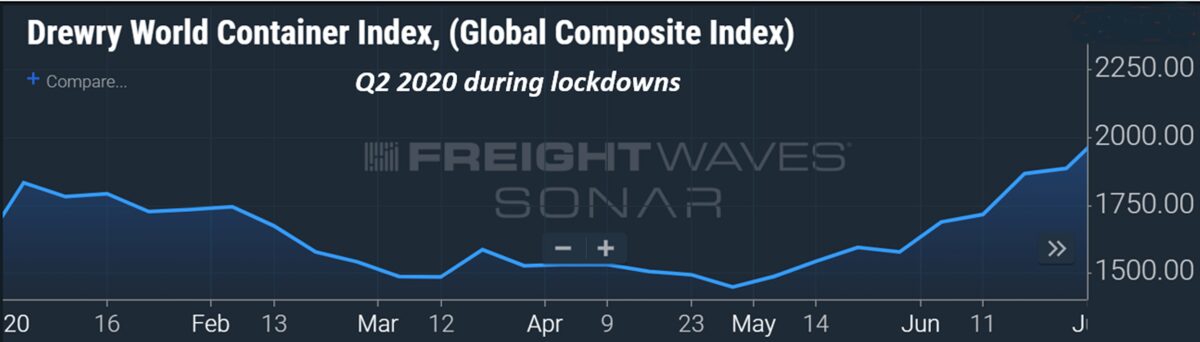

The initial COVID-19 lockdowns in Europe and the U.S. slashed import demand in the second quarter of 2020. Ocean carriers were able to “blank” (cancel) enough sailings to bring capacity down in line with demand. Carriers successfully stopped the spot-rate slide.

What happened in that earlier period is frequently cited as proof that carriers can blank sailings in the future if demand falls too low, putting a floor on rates. “We would expect ships to be removed from vessel services,” said Mørkedal.

Sources told Platts they’re looking to China’s Golden Week holiday (Oct. 1-7) as a potential turning point. Market participants are “bracing for a blank sailing program to be announced by carriers,” reported Platts. “Most sources expect the period immediately after Golden Week to be marked by a tonnage reshuffling as carriers look to balance capacity against the evolving marketplace.”

Spot rates still nowhere near past levels

Looking back to Q2 2020, the Drewry Global Composite Index fell to a low of $1,446 per FEU in late April. Blank sailings by carriers kept rates from falling even lower amid lockdowns.

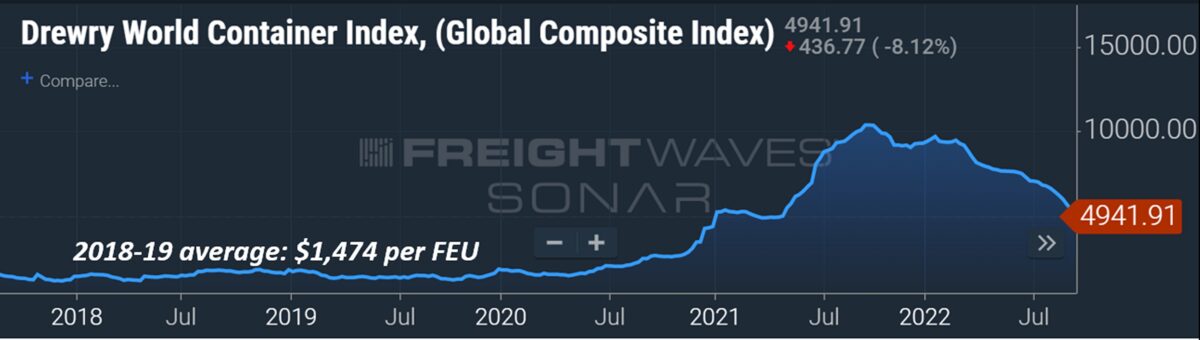

Prior to the pandemic, Drewry’s global index averaged $1,474 per FEU in 2018-2019. Several carriers lost money in those years.

As of last Thursday, Drewry’s global index was at $4,942 per FEU, still 3.4 times higher than the pre-COVID average and the COVID lockdown low — even after a 44% decline over the past half year, an average drop of $650 per FEU per month.

If this same pace of decline were to continue, the Drewry global index would not reach pre-COVID levels until mid-Q1 2023.

If the same pace of decline continued for the next three months, the index would still be double pre-COVID levels.

Contract rates support carrier profits

Furthermore, a decline in spot rates does not have the same effect on ocean carriers as it did pre-pandemic because of changes in the contract market.

Carriers have more of their volume on annual contracts. In 2019, Maersk said it had only 46% of its long-haul business on long-term contracts. It now has 71% secured for one or more years.

Contract rates are also dramatically higher than they used to be. While a portion of this year’s contract business will be renegotiated, or not honored, the remainder will allow carriers to offset spot-business declines.

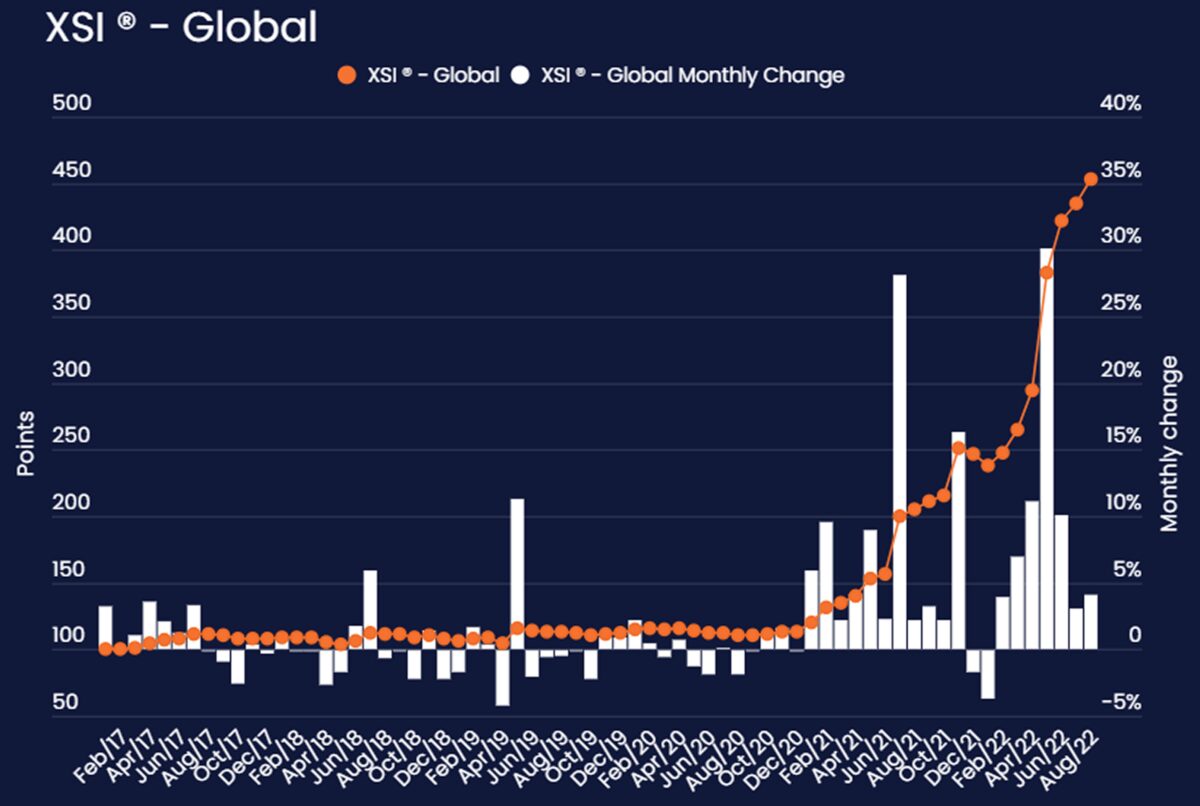

Ocean carrier Zim (NYSE: ZIM) said its contract rates this year were double 2021’s. Hikes of 50% or more were reported by carriers in 2021 versus 2020. Xeneta publishes an index that tracks long-term freight rates. Its global index hit 453 points in August, about 4.5 times pre-COVID levels. The index is up 121% year on year.

Thus, not only do spot rates still have a long way to fall before they’re back where they started — even at the steeper-than-expected pace of decline — they’re also overshadowed by contract rates when it comes to near-term carrier profits and shipper costs.

Click for more articles by Greg Miller

Related articles:

- Red flag: Shipping lines suddenly a lot less interested in renting ships

- Imports to Los Angeles, America’s largest port, plunged 17% in August

- US imports keep chugging along, still up double digits vs. pre-COVID

- Trans-Pacific rates still sinking. Trans-Atlantic rates still peaking

- Container line Zim hit by exposure to falling spot rates

- No precipitous plunge in container shipping rates, just ‘orderly’ decline

- Container shipping spot rates still falling: What will be the new normal?

- Asia-US container shipping rates are flashing two bearish signal

Stephen Webster

we need to have minimum freight and a maximum of twice the minimum. same for drivers wages and people who work on boats the docks and pilots . Five years ago the company’s that owned boats pleading for rates to cover costs

the highest price was because of unfair practices by a number of shipping customers.

Raven57

I still do not understand why we have all these giant shipment containers that are still not going out to the places they belong how much longer is this going to take what are they have like 100 drivers? why has Americans forgotten how to be the most powerful nation in the world.?? we have literally in America outlawed made illegal, intelligence. we now have no adults left that are smart and strong everybody is corrupted from facebook, google, twitter, youtube, instagram, tick tock where everybody complains about other people’s freedoms to say what they want to say they deliberately sit on their computer all day long tantalizing and attacking everyone for every statement that they want to make and I think social media should be stamped antisocial media and I think the government should close it down it does nothing but bring trouble and unrolling this and prejudice and bigotry and we can’t tell truth from dishonesty anymore. no one wants to hear anybody else’s opinion if it don’t agree with theirs these media Giants so to speak, have gotten Rich while Americans have gotten stupider.

Lm

Bc you dint shut down ur own successes.