It’s the time of year when retailers typically make their final push to ship goods from abroad in time for holiday shopping and freight rates are highest, but so far signs of peak season in air cargo are difficult to find. Instead, rates continue to slide as global economic clouds dampen demand and airlift supply rises with the recovery of passenger travel.

Air freight spot rates tumbled 9% year over year in September to below the 2021 level for the first time this year, Xeneta, an ocean and air freight rate benchmarking and data analytics firm, reported Wednesday.

The cost to ship by air lowered another 2.8% in the past week and is now 21.6% less than a year ago, according to the Baltic Air Index. A year ago rates were up about 80% on a yearly basis.

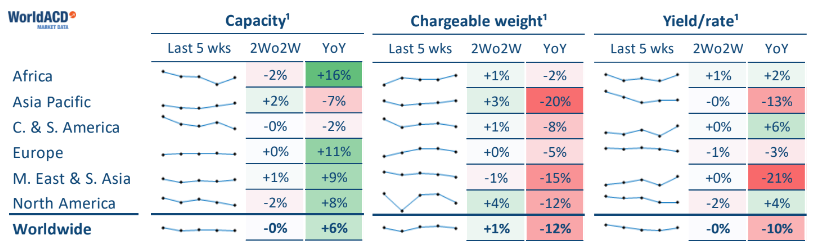

Analysis by WorldACD, another provider of air freight data, also shows tonnage and prices slipping marginally again in the second half of September. More notable, however, is that volume is down 12% from last year despite a 6% increase in capacity. Its data also reflects a 10% decline in spot rates to an average of $3.46 per kilogram.

And the International Air Transport Association (IATA) on Thursday provided lagging data for August that reinforced earlier evidence, including front-line reports from logistics companies, of muted demand. IATA said cargo throughput on airlines fell 8.3% year over year, an improvement from the 9.7% contraction in July. Xeneta previously reported that August volumes contracted 5% year over year and 4% compared to pre-pandemic levels.

Drilling down to specific trade lanes demonstrates how the market has stalled. Slowing demand for goods out of China has caused trans-Pacific air cargo rates to drop 32% since September to $5.12/kg – half the level of a year ago – while China-to-Europe rates fell 19% to $4.13/kg, 43% lower than last year, according to Freightos. Trans-Atlantic rates are more stable, but 25% lower than a year ago as passenger capacity on the lane has increased.

Results for the first week of October are likely to be even weaker as cargo airlines cut back activity in China to coincide with the Golden Week national holiday when factories are closed. In a normal year that would be followed by a burst of catch-up flights, but the past has proven a poor barometer for logistics predictions this decade.

Few expected the market to stay at the pandemic-fueled record of 2021, but demand is now trending toward the level in 2019 — a weak year for air cargo.

And yet, despite economic weakness, air cargo rates are still more than twice what they were in 2019. According to the Baltic Air Index, the cost to ship by air in September from Hong Kong and Shanghai to North America sank 19% and 42% on a yearly basis, but were still up 175% and 92%, respectively, compared to pre-pandemic levels.

Downturn dynamics

Several factors are weighing on air cargo transport.

The industry never experienced an expected spurt in exports from China after regional COVID lockdowns were lifted last summer. Power rationing and ongoing quarantine restrictions continue to limit factory output and the Chinese economy is growing much slower than it has in decades. The Baltic Air Index for outbound lanes from Shanghai, for example, dropped 5% last week and is below the 2021 level by 35.7%.

Meanwhile, high inventories, inflation and consumers shifting more spending to services has curtailed demand for international ocean and air shipping. Production in Germany and other European countries has slowed due to energy challenges associated with the war in Ukraine. New export orders — a leading indicator of air cargo activity — are declining in major economies, except the U.S.

Many large shippers preordered early in the year to avoid supply chain disruptions and are being more cautious with new orders because they don’t want to repeat an overstock situation as consumer buying habits shift. Even the robust e-commerce market has cooled as reflected by FedEx (NYSE: FDX) recently announcing a large earnings miss partly due to a slowdown in Express business in Asia, a report that Amazon Air has decreased the pace of its fleet growth and French logistics provider Geodis saying e-commerce volumes have been lower than expected.

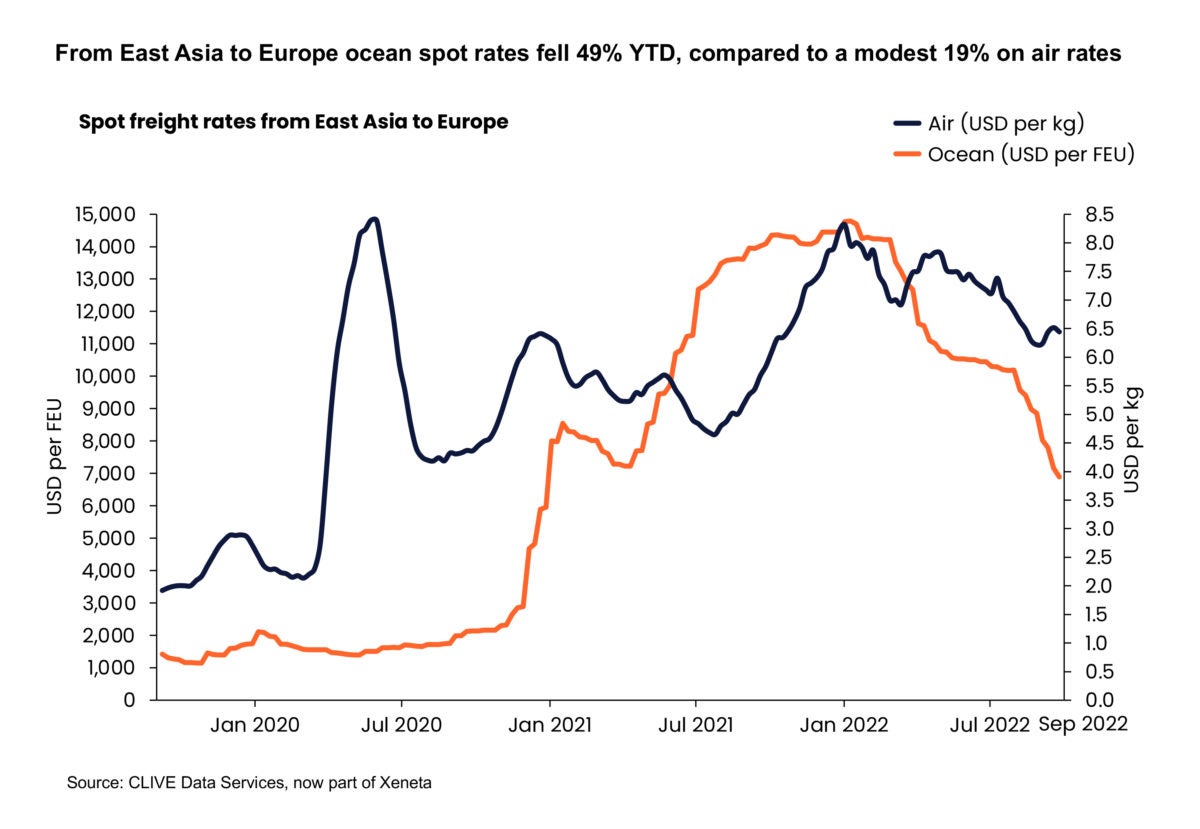

At the same time, more shipments are migrating back to ocean shipping, where spot rates have fallen much further than in air and ocean freight conditions have improved.

According to Xeneta, September cargo demand based on shipment profiles, fell 5% from last year and was down 2% from the same month in 2019. The shipping downturn timed with a 5% recovery in cargo capacity, which is now only 7% below pre-pandemic levels as international airlines continue to restore service. The combination of weaker demand and rising supply dropped the aircraft fill rate, or load factor, by 7 points to 59%. That is 2 points lower than recorded in 2019.

Before the COVID crisis, the lower decks on passenger aircraft accounted for half the world’s air cargo supply. During the past two years, 70% of capacity was provided by all-cargo aircraft.

“Given more inventory in the system, more fluidity in the supply chain, less residual boost from fiscal and stimulus policy, and uncertainty over the direction of the global economy, we do not believe there will be much of a peak,” said Bruce Chan, director and senior analyst for global logistics at investment bank Stifel, in his monthly blog for the Baltic Exchange. “Sentiment is certainly shaky but for now it’s more fear than reality and that may help to keep a lid on capacity.”

Chan said FedEx Express’ quarterly operating loss had more to do with operational inefficiencies than market conditions.

A high-rate disconnect

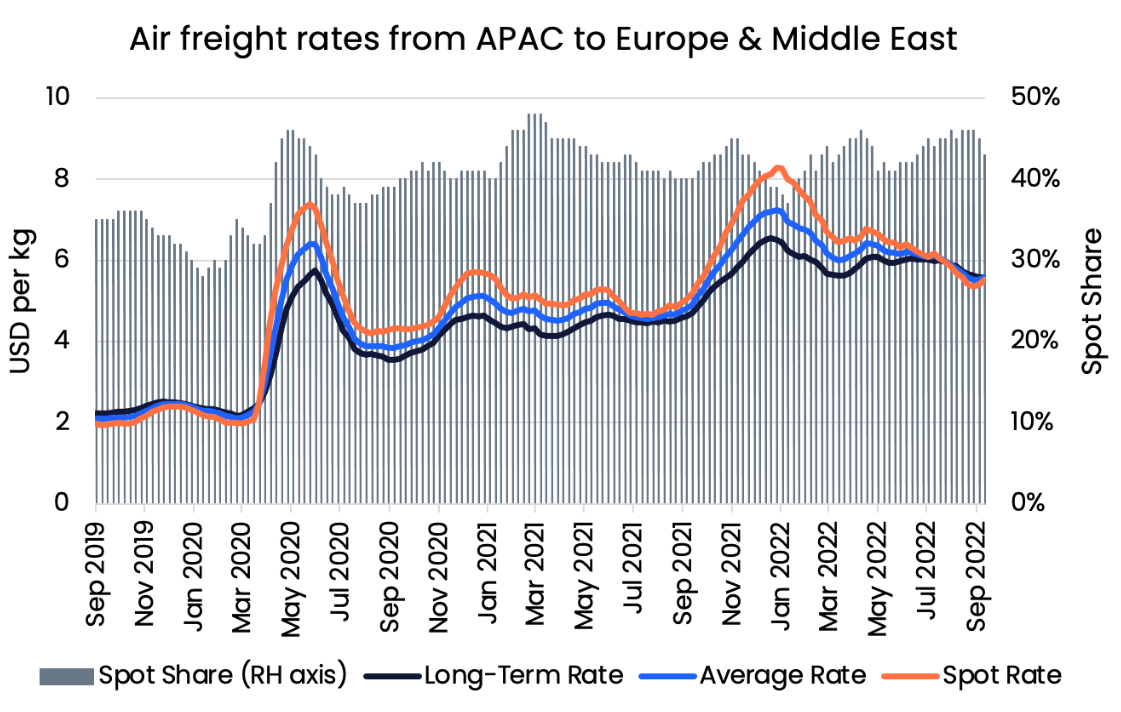

The little bit of pent-up demand that did occur because of lockdowns in China explains why spot rates from there are higher than for outbound Asia-Pacific to Europe, where prices for immediate purchases by freight forwarders have actually dropped below long-term rates for the first time in two years, according to Xeneta.

Contract rates are actually holding up pricing to some degree on various lanes, John Peyton Burnett, managing director of TAC Index, which tracks airfreight rates and administers the Baltic Exchange’s air index, said on The Loadstar’s latest podcast.

Other factors propping up airfreight prices above 2019 include the introduction of high fuel surcharges by airlines, the lingering shortage in passenger belly capacity, and ground handling delays at airports, and ongoing supply chain disruptions, such as congestion at U.S. East Coast ports and strikes by maritime workers in Europe.

Because of continuous market disruption and general uncertainty since the beginning of the pandemic, carriers have allocated more space to the spot market compared to the long-term market. By mid-September 2022, the share of cargo weight sold in the spot market was 43%, up 8 points from three years ago, according to Xeneta.

But TAC’s Peyton Burnett told FreightWaves that several airlines this year chose not to offer contracts guaranteeing space allocations to customers because they hoped to take advantage of a strong peak season and rising rates. The tactic backfired because the peak season hasn’t materialized.

“Airlines are taking the hit for weak demand. Less so the forwarders,” he said in an email.

Rate and volume data differs by provider because of how they are managed. Xeneta’s airfreight unit, Clive Data, collects regional and global data from airlines, while TAC Index focuses on specific heavy corridors and gets transaction data from large freight forwarders, according to logistics professionals and representatives for the two companies. That means, for example, if forwarders are dropping prices faster than airlines to maintain market share that could be reflected in TAC’s charts.

Despite recurring supply chain disruptions in China this year, a shift to alternative routes such as Vietnam and India to the U.S. did not materialize. The latest intelligence from TAC shows rates fell 7.2% week over week from Vietnam to the U.S. and has plunged more than 52% since the same period last year. India-to-U.S. routes fell 4% and are down 36.5% year over year.

Air export volumes in the Asia-Pacific region are down 20% from last year’s elevated highs, while North American outbound tonnage is down 12% on a yearly basis, WorldACD reported.

Capacity as of late September is up 12% and 11%, respectively, in North America and Europe, it said. Cargo operators, however, may rethink their capacity deployment strategies with all the economic uncertainty, Chan noted.

Certain routes are still capacity constrained, especially in Asia, where COVID restrictions have only recently been relaxed in many countries, and between Asia and Europe because of the extra flying time required due to the closure of Russian airspace following the invasion of Ukraine.

One trade lane that is holding up well amid all the market cross currents is the trans-Atlantic, Baltic Exchange data shows. Frankfurt, Germany, to North America prices are up 32 cents per kilogram since the end of August, mirroring rate strength for ocean shipping. A likely explanation is the strong dollar, which has equalized with the euro and made it cheaper for U.S. buyers to import goods from Europe.

According to IATA, Europe was again the weakest performing region in August. However, cargo traffic between Europe and North America showed a 13.1% year-over-year growth, due to both the recovery of the North American market and the logistics support from the U.S. to Ukraine.

Chan cautioned against reading too much into the mixed economic signals.

“There is also a possibility for a rapid upswing and late season spike if inventories bleed down sufficiently and consumer demand remains more resilient than consensus currently suggests. . . . The ‘elevated inventory’ story is not perfectly representative of the entire market. And current efforts by retailers to clear stock via discounting may pave the way for late-peak replenishment, in turn producing a corresponding spike in pricing later in the season,” he wrote.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Rachelesroches

Everyone can make money now a days very easily…dd…..I am a full time college student and just w0rking for 3 to 4 hrs a day. Everybody must try this home online job now by just use… This Following Website.—–>>> 𝐨𝐧𝐥𝐢𝐧𝐞𝐜𝐚𝐬𝐡𝟗𝟐.𝐛𝐥𝐨𝐠𝐬𝐩𝐨𝐭.𝐜𝐨𝐦