Even as businesses have shut down, traffic data from Inrix showed that, as of April 17, 87% of all truck vehicle miles were still being driven. (Photo: Jim Allen/FreightWaves)

The traffic data firm said trucks were still traveling 87% of their normal vehicle miles in mid-April

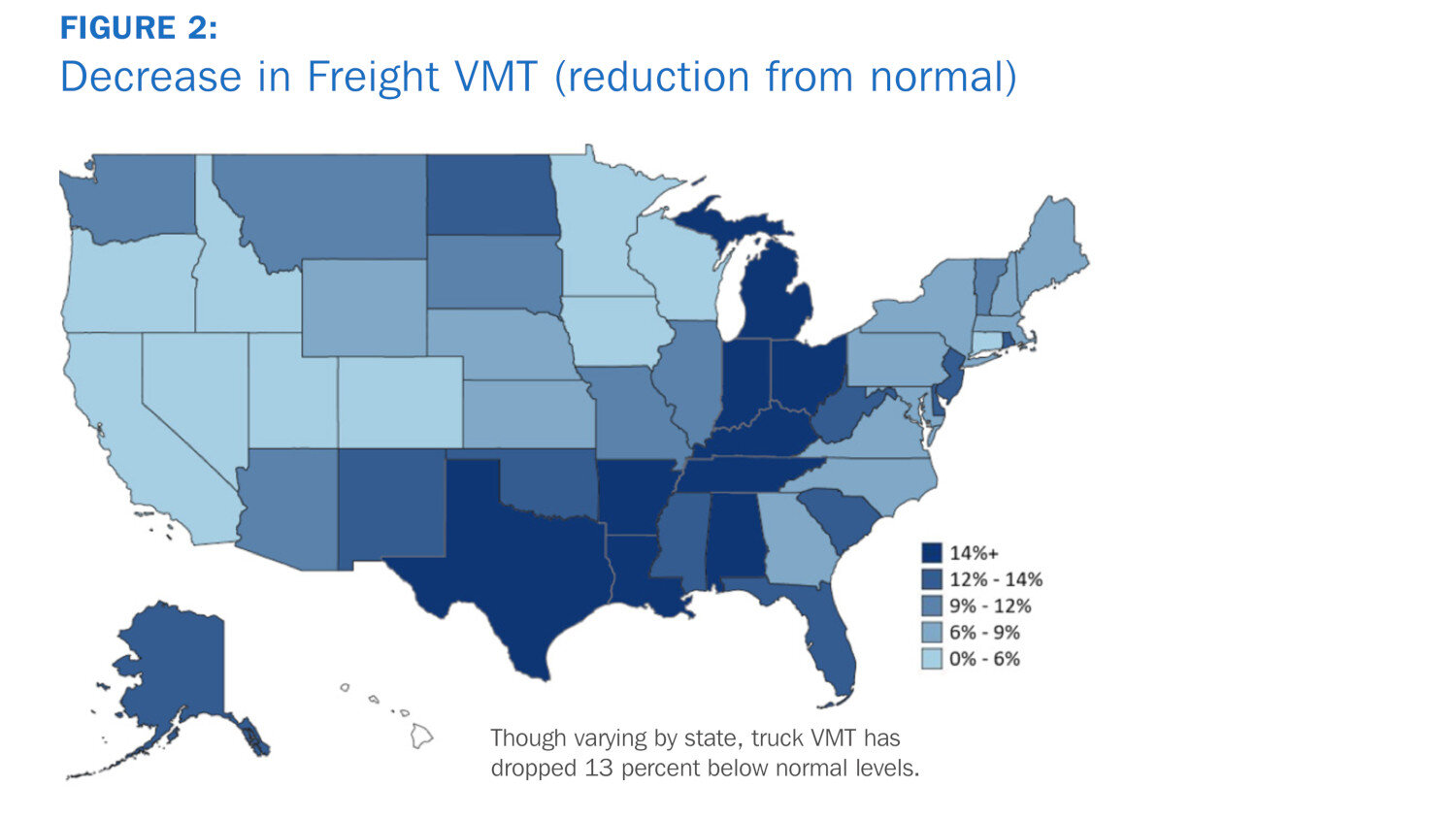

As stay-at-home orders grew around the country, more Americans did just that. Personal travel is down 46%. The decrease was far less for truck drivers, however. They logged 13% fewer vehicle miles traveled (VMT) from April 11-17 compared to a baseline before the orders were issued, according to traffic data firm Inrix.

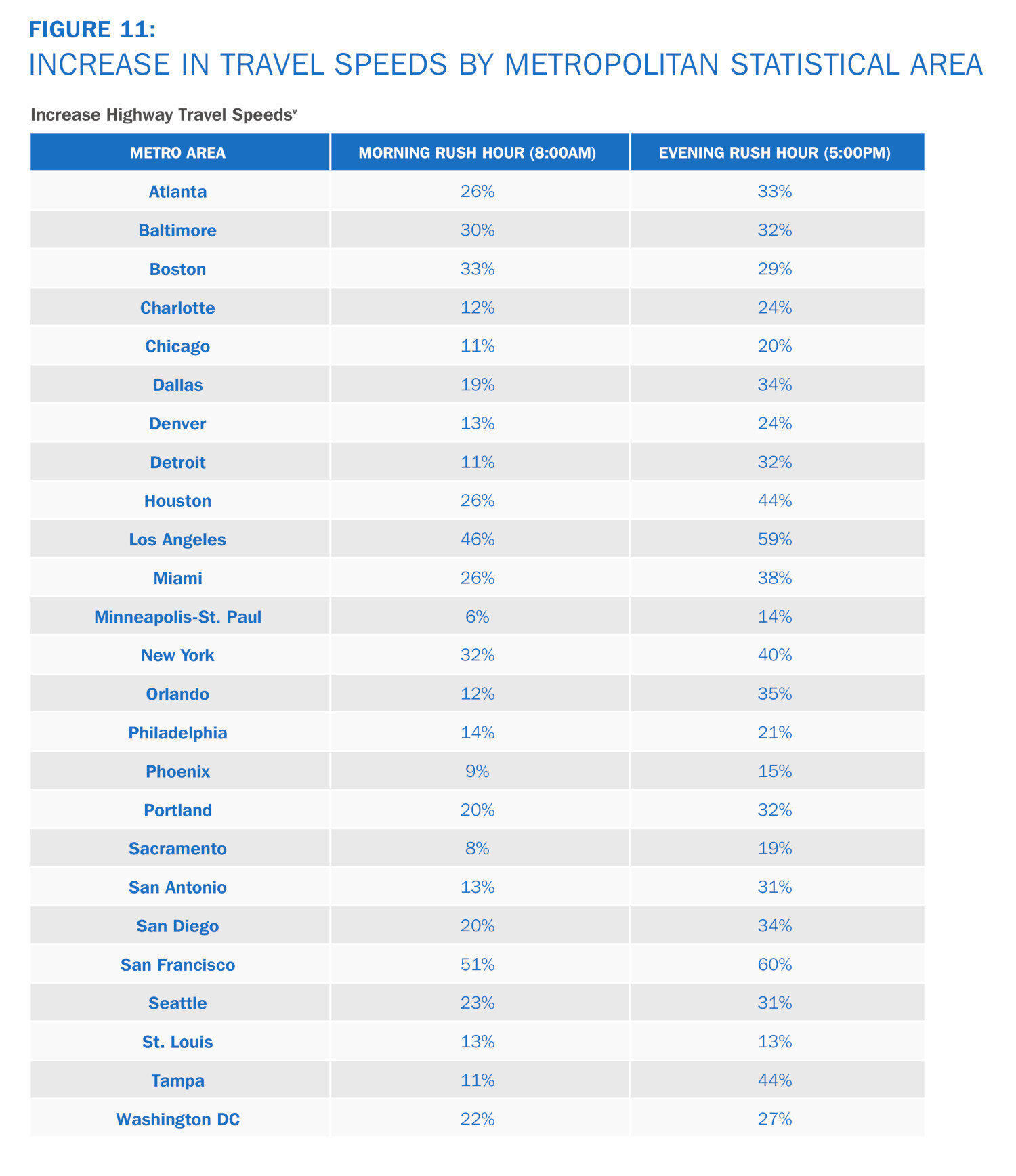

The findings are part of a comprehensive study of VMT by both personal vehicles and commercial vehicles. It also found that in 25 metro areas studied, vehicle speeds in each one increased during both morning and evening rush hours, ranging from a 6% increase in vehicle speeds for morning rush hour in Minneapolis-St. Paul, to a high of 60% faster during San Francisco’s evening rush.

“We … found that trucking was hit harder in different regions of the United States, likely a result of manufacturing slowdowns due to COVID,” the company said in a blog posting announcing the findings. “For example, while trucking in the ‘North Central’ region is on-par with the country as a whole, states within the region are seeing large variations. Trucking in Michigan is down approximately 37% from normal, while Minnesota and Wisconsin are down just 4%.”

The decrease in freight vehicle miles traveled by state. (Photo: Inrix)

Inrix noted that the Southern Gulf region — defined as an area that includes Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Tennessee and Texas — saw the biggest regional drop of 17%, with Kentucky and Texas experiencing 20% drops in vehicle miles traveled.

“Despite these key oil and manufacturing states contending with a volatile market and COVID-19 responses, the fact that freight is moving at 83% of normal is remarkable and reveals the resiliency of these economies in some of the hardest hit areas of the country,” the company said.

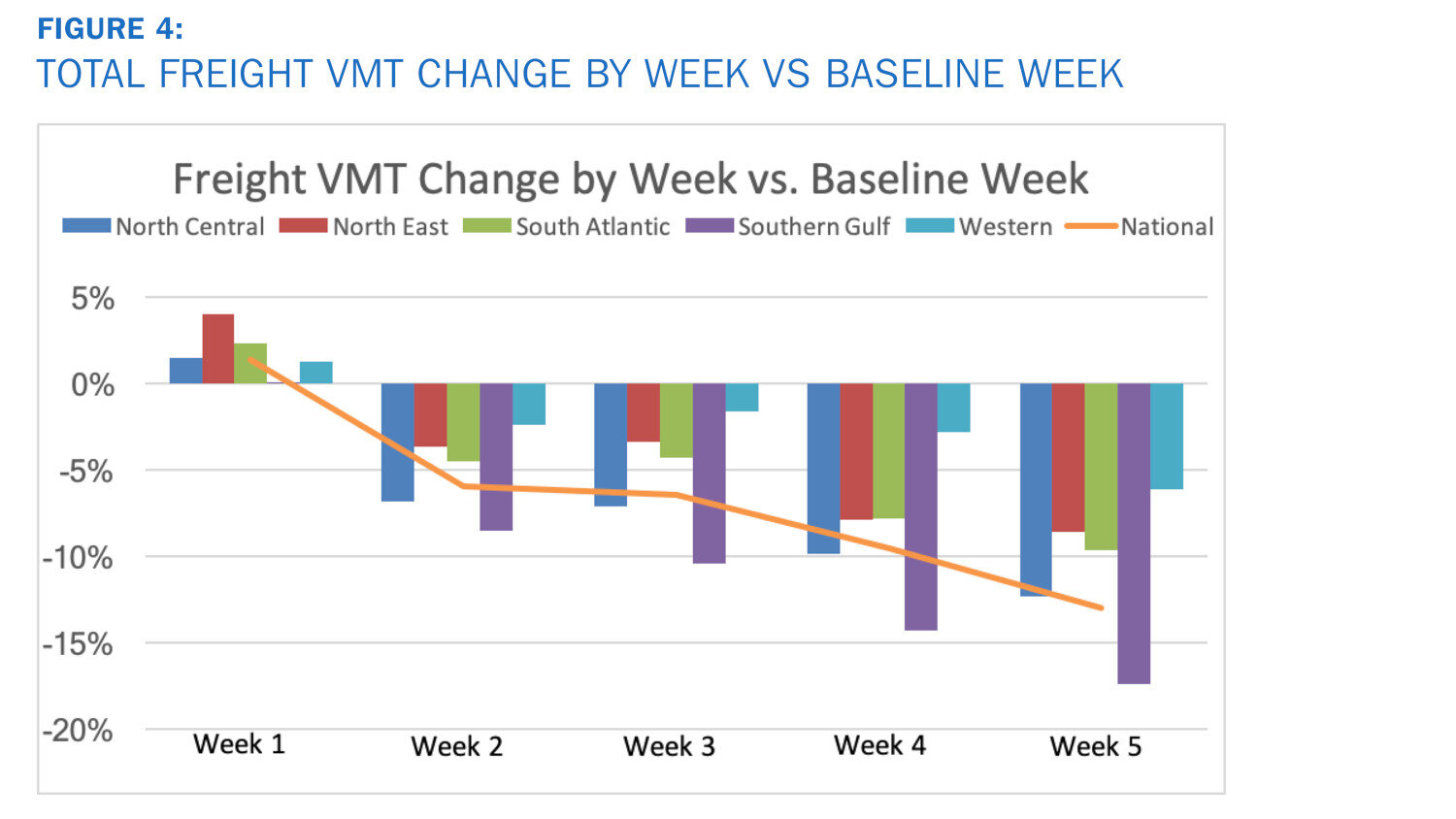

The study lasted five weeks, from March 14 to April 17, with results broken down by week. For instance, in week one (March 14-20), freight-related VMT was off just 1%. That increased to 6% by week two and remained there in the third week. It wasn’t until the week of April 4-10 that freight VMT started falling again, dropping 3% from the week before and 10% below normal levels.

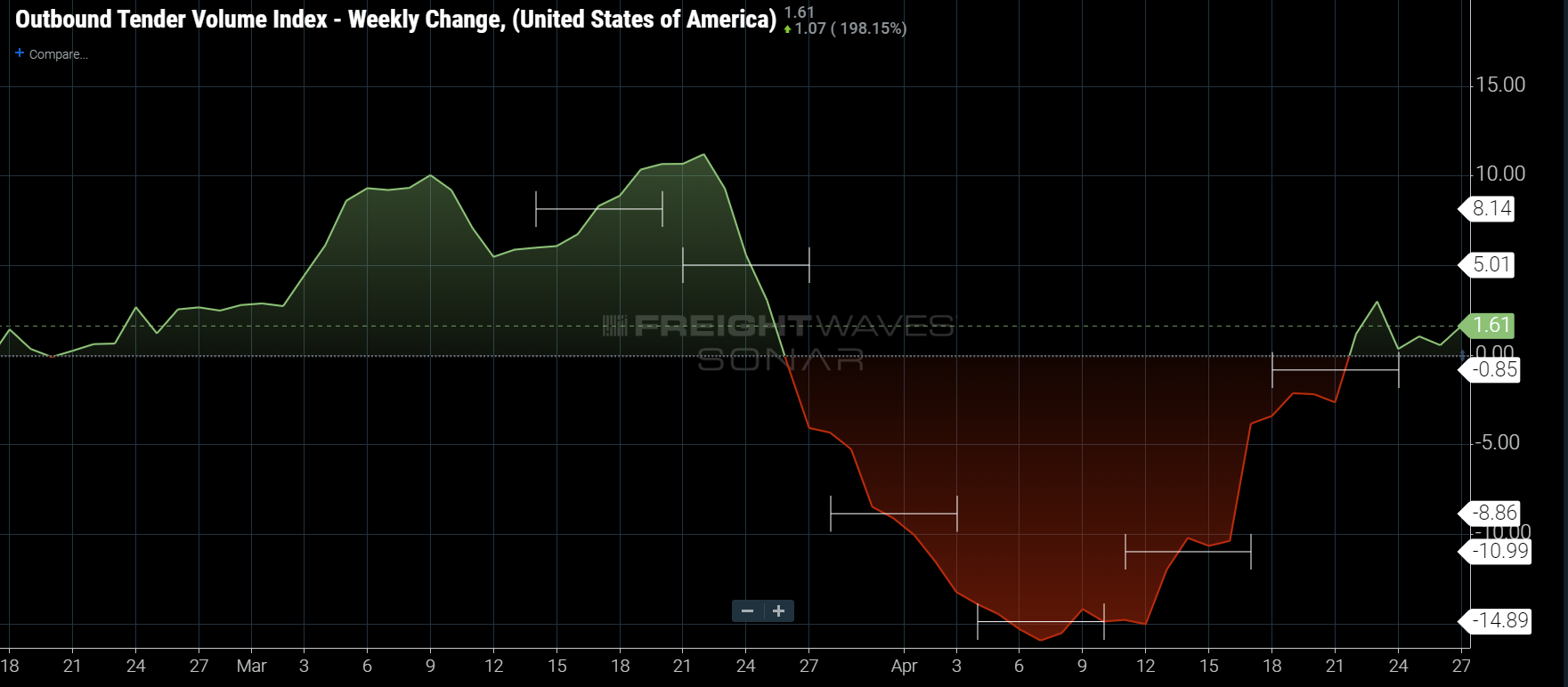

Zach Stickland, market analyst for FreightWaves, noted that SONAR data tracking volume predicted the VMT data Inrix found. This was in part because SONAR’s Outbound Tender Volume Index (SONAR: OTVI.USA) tracks volumes based on electronic tenders, which are accepted before a load actually moves. In this case, as OTVI began dropping on March 22-23, the Inrix data lagged by about half a week.

FreightWaves’ SONAR Outbound Tender Volume Index showing weekly change in tender volumes compared to Inrix vehicle miles traveled data per week (displayed by short lines on graph). (SONAR: OTVI.USA)

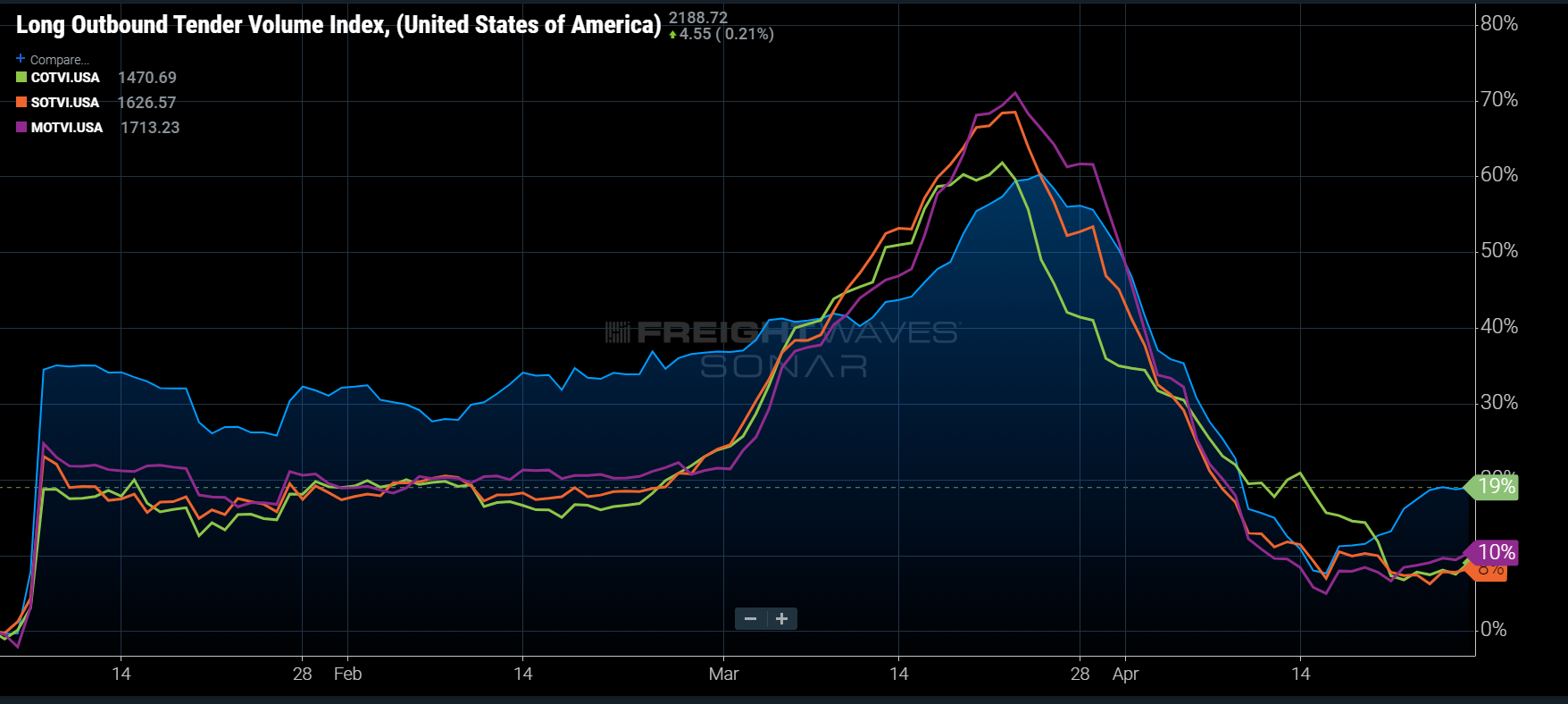

Conversely, Strickland said that during early March, short-haul freight volumes (under 450 miles) increased at a faster pace than loads moving over 800 miles. That dynamic has begun to swing again as replenishments of groceries and other goods begin to flow again.

According to Inrix, as of April 17, the 12-state Western U.S. region saw a 6% decline in VMT, with all states seeing a drop in long-haul trucking except Utah, which was flat. California, among the first states to put a stay-at-home order in place, was down just 4%. New Mexico was the largest decliner at 13%.

Each state in the Southern Gulf, which saw a 17% drop overall, saw double-digit declines. As mentioned, Kentucky and Texas dropped 20%, but Arkansas was down 18% and Tennessee was off 16%.

FreightWaves’ SONAR Long Outbound Tender Volume Index shows increasing growth in short-haul freight, comparing city (green), short (orange), midhaul (purple) and long (blue mountain) volumes. (SONAR: LOTVI.USA)

“The reduction in freight movement may be partially due to hard goods manufacturing, as it represents a large portion of the Gross Domestic Product in these states,” Inrix said. “It is also important to recognize this area is also home to major freight corridors, like I-70, I-80 and I-90, and shutdown impacts in other states will weigh heavily on freight VMT throughout the [Southern Gulf] region.”

Michigan took a big hit in the North Central region, down 37% in the latest week, although Inrix noted that 28% of that decrease took place in the second week of the survey as auto plants shut down. Indiana and Ohio have also logged large decreases of 16% and 14%, but they too have stabilized. Inrix noted that VMT in Nebraska, down 6%, has started increasing again.

The South Atlantic region has fared better than other areas, with only West Virginia hitting the national average of 13%. All other states are ahead of the curve, led by Delaware and Maryland, each down just 6%.

Total freight vehicle miles traveled week change versus the baseline week. (Photo: Inrix)

“Freight VMT in the South Atlantic region has declined 10% since the COVID-19 related shutdowns,” Inrix said. “Though the decrease is lower than the nation as a whole, freight travel in West Virginia, Florida and South Carolina has fallen by double digits, with the Carolinas both down about 9%.”

The Northeast has also fared better, Inrix said, with overall freight VMT down just 9% for the region. Between weeks four and five, the region saw freight VMT drop only 1%, likely due to earlier shutdowns in the nine-state region.

New Jersey, at 13%, was the worst performer, while Connecticut fared best with just a 3% drop overall.

Speeds on the nation’s highways have increased, Inrix said, resulting in improved efficiency for the nation’s trucking fleets.

“[As] passenger travel has dropped 46% nationwide freight movers have been able to shed some of the costs of congestion, improving the movement of goods and services,” it said.

For instance, the Brooklyn Queens Expressway (BQE) in New York has seen a 68% improvement in travel times during evening rush hour, adding an estimated 6.5 hours per day for a trucking company operating on that route.

A similar story is playing out on the I-405 in Los Angeles through Sepulveda Pass. That route has seen a 73% decrease in evening rush hour travel times. Travel time on Interstate 290 in Chicago is down 62%; Interstate 90 is down 65%; and Interstate 285 in Atlanta is improved by 52%.

“While the COVID-19 crisis continues to sweep the country, and the world, one rare bright spot is the vitality of the logistics network,” Inrix said. “Throughout the country, long-haul trucks continue to make their trips at nearly the same amount preceding the crisis, but don’t have to contend with the congestion around urban areas that typically stifle productivity. Despite an unprecedented 46% drop in personal VMT, freight movement has fallen a modest 13%, highlighting how vital commercial freight is to the country’s efforts to recover from the pandemic.”

Average change in vehicle speeds for morning and evening rush hours in 25 metropolitan areas. (Photo: Inrix)