(UPDATED: Oct. 23, 11:30 P.M. ET)

Prospects for a fourth-quarter bounce in air cargo business as retailers stock up for the holidays are dim, the culmination of a gradual slowdown in shipment traffic and costs since Russia’s invasion of Ukraine in March.

And worsening macroeconomic conditions suggest the air logistics sector could face a darker 12 to 18 months after peaking a year ago. Forty-five percent of customers polled last week during a webinar hosted by logistics specialist Flexport said they intend to ship less by air in 2023.

The International Air Transport Association projected air cargo demand would grow 4% this year, after COVID supply chain disruptions sparked a 7.9% gain in 2021. Instead, volumes have sequentially fallen each month since the first quarter and were down another 8% in the first half of October from the prior two weeks. In September, volume as measured by the dimensional weight charged for shipments slipped below pre-pandemic levels for the first time, according to air freight data aggregator Xeneta. And year-to-date, demand is 2.4% and 0.3% less than last year and 2019, respectively.

Weaker demand and more capacity, mostly due to passenger airlines restarting more international service, have forced rates to retreat all year, easing pressure on shippers. Spot market rates in September were 9% below the 2021 benchmark and the gap has since widened. Although shipping costs are lower than a year ago for the first time, they remain twice as high as before the pandemic.

The weakness in air freight has several causes, according to analysts and logistics providers: Shrinking demand for manufactured goods; high inventories from U.S. and European retailers pre-ordering many products; a shift in consumer spending away from goods back to services; slower e-commerce growth; ocean freight that switched to air when ports were congested switching back to ocean on improved conditions and sharply lower rates; and an increase in available shipping space on aircraft.

Spooky economy

Broad economic conditions, especially inflation, are scaring away consumer demand for goods as Halloween approaches.

Falling consumption is reflected in global manufacturing output. The Purchasing Managers’ Index for manufacturing, a leading indicator for air freight, fell to a 27-month low of 49.8 in September and into contraction territory. China, a centerpiece of global supply chains, experienced shrinking output and sales in the summer as factories temporarily closed because of COVID precautions and power outages.

The global inflation rate is running about 8%. In the U.S., inflation in September rose 8.2% from a year ago, according to the Labor Department’s Consumer Price Index. Core inflation, excluding volatile energy and food, rose 0.6% — the biggest increase since August 1982. The biggest increases were in services rather than goods. The increase in core inflation was bigger than expected and the average of the past six months, showing price pressures are spreading into more areas of the economy.

U.S. wholesale prices rose faster than expected, 0.4%, in August.

Forecasts for global GDP, industrial production and real exports have all been revised downward for the remainder of the year and 2023. All large economies are slowing down at the same time.

The economic prognosis is much better in the U.S. than in Europe, but the import surge is now slowing. According to Descartes, September container imports fell 12.4% from August to September — a reversal of normal fortune. And the National Retail Federation’s Global Port Tracker estimates U.S. container import volumes in October will fall 9.4% y/y, with November traffic down almost 5% and December down 6%. It’s fair to say air cargo could follow a similar path.

“The growth in U.S. import volume has run out of steam, especially for cargo from Asia,” said analyst Ben Hackett in the NRF report.

In the eurozone the main constraint is Russia’s invasion of Ukraine and high gas prices. In China, the slowdown is due to COVID disruptions and troubles in the real estate sector. And rising interest rates, orchestrated by central banks to tame inflation, are also dragging down consumer spending and investment.

Economists downgraded productivity growth to 2.8% this year from 3% to 4%, and are pointing to 2% growth in 2023 and modest recovery in 2024. The International Monetary Fund has lowered its forecast for global GDP growth in 2023 to 2.7% from 3.2% projected this year. Merchandise GDP was downgraded to 1% growth from 3.4%, representing a significant deceleration in global trade.

The consensus estimate for industrial production is 3.2% growth, down from 4.5%, falling to 1.9% growth in 2023, according to IHS Markit. Meanwhile, exports are starting to slow and revised forecasts now estimate 2023 growth of about 2.9% compared to 5.2% this year.

Most economists predict a high likelihood of recession in 2023, although the severity will vary by region.

Cathay Pacific’s cargo challenges

The economic conditions are reflected in the air cargo industry’s most recent performance figures for airlines, airports and freight forwarders.

Air cargo rates from Asia have significantly contracted since their record high in December. Carriers in the Asia-Pacific region have foreshadowed a flat peak season despite the easing of travel restrictions in Hong Kong and elsewhere that is enabling more passenger flights.

Reduced consumption in major importing nations led to a 14.3% drop in Vietnam’s exports from August to September, the latest government statistics show. Production of shoes, garments, phones and furniture is slowing, with state-controlled media reporting some laid-off workers have already started returning to their villages, according to an article by Nikkei Asia.

Hong Kong-based Cathay Pacific, a major combination carrier with a fleet of 20 Boeing 747 freighters, said September cargo tonnage fell 21% from last year’s extreme highs and nearly 40% compared to 2019. A distance-based formula for calculating revenue was 28.3% lower than a year ago and 38.6% below pre-pandemic levels. And load factors, a measure of capacity utilization, fell 13 points to 66.4%.

Cathay’s troubles this year are tied to extremely limited widebody passenger operations due to Hong Kong’s strict quarantine measures for arriving aircraft crews and travelers. The carrier signaled in recent weeks that it also expected a muted year-end shipping season, and that is now becoming a reality.

“We had reduced cargo flight capacity in expectation of this and operated fewer cargo-only passenger services on long-haul routes. However, the fall in demand compared with last year was greater than predicted, largely due to weaker consumer demand and reduced manufacturing activities in the Chinese Mainland,” said Chief Commercial Officer Ronald Lam in a statement accompanying the release of the September figures. “This prolonged the dip we typically see after the mid-autumn festival and also meant [China’s] pre-National Day holiday uptick was relatively mild. Overall last month, cargo flight capacity was approximately 61% of pre-pandemic levels.”

Cathay Pacific is resuming more passenger flights, with a goal of doubling the number of destinations by year’s end compared to the January schedule. The extra airlift will increase cargo capacity and allow Cathay to offer extended routings and more consistent service.

Lam said Chinese export demand is expected to firm up in the second half of October. “We remain positive that there will be solid demand over the traditional cargo peak period, and while it will not reach the levels achieved last year, we expect it to still be above historical averages.”

Q4 uncertainty

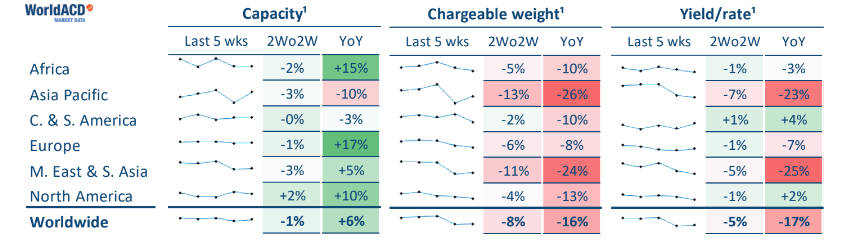

Data from market tracker WorldACD shows worldwide volumes sagged 6% in the two-week period ending Oct. 16. The amount of chargeable weight carried by airlines is down 16 y/y despite a 6% hike in capacity.

The most notable drop in volume, minus 26%, is out of Asia.

Cargo traffic at Brussels Airport decreased 5% in September from the prior year, although it remains 30% above the 2019 level. Belly cargo increased 9% due to the increase in passenger flights, while the freighter and integrated express segments declined 3% and 9%, respectively.

The amount of cargo moving through Frankfurt, Germany, last month decreased 14.1% year over year, according to airport operator Fraport.

Global capacity is still 7% below 2019 levels, but the average measure for how full planes are is down 2% on lower demand, according to Xeneta. Load factors for the Asia-Pacific region recently fell 10 points below 80% — the demarcation point for a seller’s market. Load factors fell the most on trans-Atlantic lanes where capacity is actually 1.7% higher than in 2019 thanks to airlines reintroducing scheduled services in response to the surge in travel demand between North America and Europe.

Trans-Atlantic westbound rates of about $3.10 per kilogram are at a two-year low, half what they were at the start of the year, due to the high capacity, softer demand and the strong dollar.

Airfreight prices are remain 28.3% lower than a year ago, according to the latest data from the TAC Index. Despite the end of the weeklong Golden Week holiday in China, when shipping volumes and rates normally bounce back from the production lull, outbound prices from Shanghai and Hong Kong were flat in mid-October, the TAC-based Baltic Air Freight Index showed. Compared to 2021, average rates from those cities are down a third. Shipping from Vietnam to the U.S. is about 58% less than a year ago.

The biggest price gain, 20.2%, was out of London Heathrow airport, although rates are still down 24.5% y/y. Also gaining were routes from the U.S. to China, up 17.8%, and Frankfurt to Shanghai, plus 10.5%.

Shorter contracts

As passenger carriers fly more and more lanes around the world, cargo capacity could reach 2019 levels by the end of next year, according to industry officials. In fact, next year’s schedules indicate airlines will be operating at 20% above 2019 levels in the trans-Atlantic market. But any assumptions about capacity recovery should be balanced by the possibility that inflation and high fares, or a return of COVID restrictions in Asia, could cause a travel pullback.

Freight forwarders are passing lower rates onto shippers, as demonstrated by recent negotiated rates outbound from Hong Kong to the U.S. for 500-kilogram, non-express shipments falling below $8 per kilogram at the end of September for the first time in 12 months, Xeneta data shows.

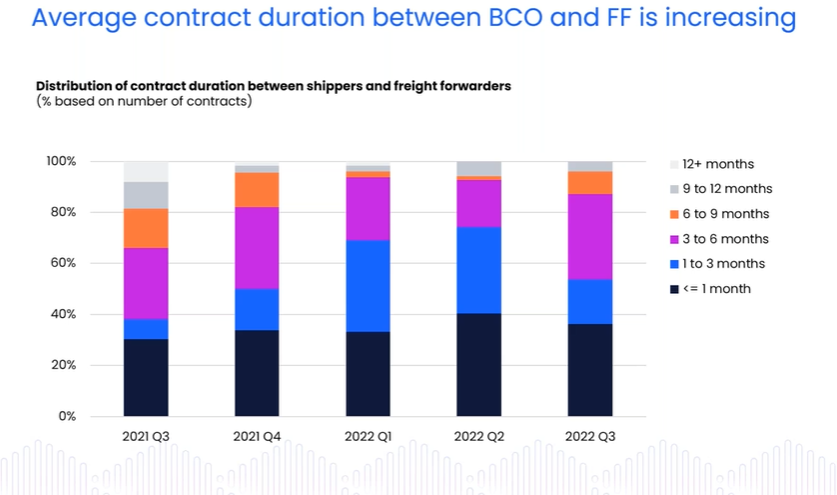

During the third quarter, the share of contracts between shippers and forwarders lasting three to six months increased 15% from the prior quarter and now represents a third of the market, with another third of shippers making transactions in the spot market, according to Xeneta. Short-term contracts between one and three months were less favored, possibly due to softening rates on rerouted flights around Russian airspace and lower jet fuel costs.

More than 80% of contracts have a duration of less than six months, which means there is very little visibility in the market.

“People do not have the confidence at the moment to enter into longer-term agreements,” said Niall van de Wouw, Xeneta’s chief airfreight officer, on a company webinar.

The TAC Index reiterated Wednesday in a bulletin to journalists that prices being paid on longer-term contracts are holding up average rates reflected in the Baltic Air Freight Index while spot prices continue to fall.

More cargo owners are expected to decline longer contracts in a falling market, while others remain attracted to them for predictable access to capacity and easier budgeting, said Xeneta analyst Wenwen Zhang.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Air cargo peak season evaporates on lower demand, higher capacity

Leasing companies secure slots to convert aircraft for cargo