America’s $875 billion trucking industry is struggling.

The number of authorized interstate trucking fleets in the U.S. declined by nearly 9,000 in the first quarter of 2023, according to federal data analyzed by Motive, a fleet management technology company. Several midsized fleets have already shuttered this year, including Florida’s Flagship Transport and North Carolina’s FreightWorks Transport. And major freight brokerages have laid off 1,000 employees in 2023 alone.

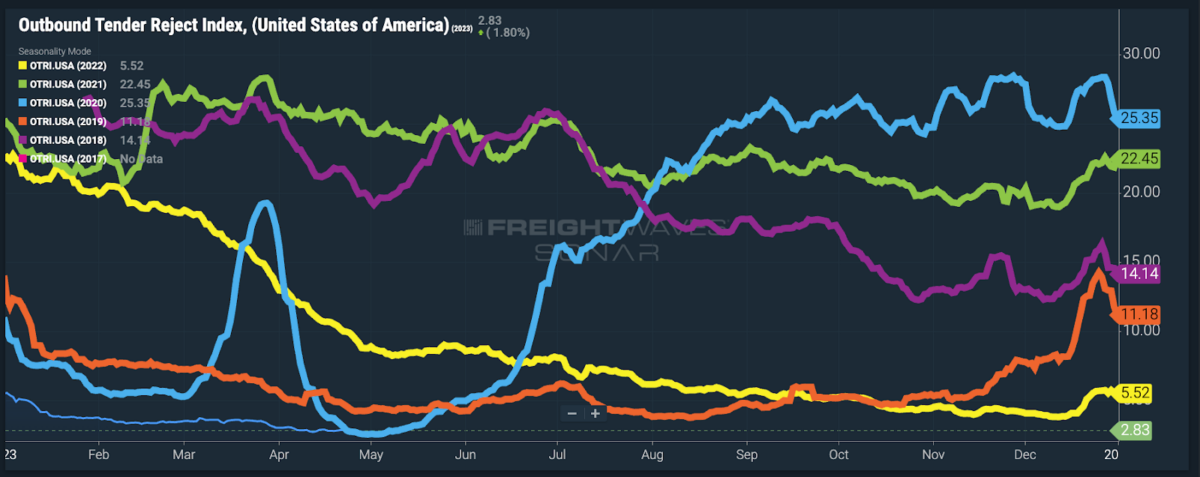

Per FreightWaves’ Outbound Tender Rejection Index, trucking fleets are rejecting about 2.8% of load requests. That makes “early 2023 the softest sustained truckload market since the tender data history began in early 2018,” as FreightWaves’ Zach Strickland wrote earlier this month.

Folks throughout freight — from CEOs to truck drivers to dispatchers — are raising red flags about a downturn that could go in the history books. J.B. Hunt President Shelley Simpson wrote in a LinkedIn post recently that the current conditions remind her of 2009, which was the longest and most brutal freight recession of the 21st century.

Steve Urbish, a freight dispatcher based in New Jersey, has seen the number of truck drivers in his network fall from 18 before the pandemic to three today. Many of the clients he lost were owner-operators who could no longer profitably operate their own businesses. They gave up their authorities, sold their trucks and largely found company driving jobs.

Truck driver Doug Kratz, who hauls a flatbed trailer, said he and his peers are struggling to find loads. Spring is usually hot for freight. And an unusually balmy winter in the Northeast meant that there wasn’t much demand for propane, which is usually a cash cow for Kratz.

Another truck driver, who asked to not have his name published, said he shut down his operating authority and sold his truck late last year. Now, for the first time in 16 years, he’s an employee of a trucking company — rather than the owner. “There’s a lack of freight to move,” he said. “People are cautious about spending money.”

Others are more optimistic, if not exactly chipper. Some believe we’ve hit, or will soon hit, a bottom in the freight market.

Analyst Avery Vise, who is vice president of trucking at FTR Transportation Intelligence, said there’s no more massive drop-offs of freight coming. Still, a healthy recovery isn’t inevitable.

“We’re not looking at any kind of cliff event — or at least no more than we’ve already had,” Vise said. “We also don’t see the kind of surge that you often get after you have something like that. We don’t really see a lot of upside pressure until you get at least to early or mid-2024.”

Trucking bloodbath for (almost) everyone

This downturn in trucking started early last year. The spot market, where fleets pick up loads that need to be moved in the next few days, was hit first. Spot tends to be more volatile than the contract side.

In March through May of 2022, spot rates saw their largest month-over-month decline on record, according to Uber Freight senior economist Mazen Danaf.

Truck driver Kratz called load boards, the platform where truck drivers find spot market jobs, “a disaster.” “If you have to rely solely on spot freight, there’s no way to survive,” he said.

The contract market was somewhat insulated from this catastrophe in 2022. That meant larger carriers, which tend to dominate the contract side, were protected too. Today, that’s no longer the case.

“[W]e’re in a challenging freight environment where there is deflationary price pressure for an industry that continues to face inflationary cost pressures,” J.B. Hunt’s Simpson said on an April 17 call to investors. “Simply stated, we’re in a freight recession.”

Last year, I wrote an article with the subhead: A bloodbath for thee, but not for me. The trucking slowdown appeared to be mostly harming the tens of thousands of small carriers that entered the industry during 2020 and 2021, rather than large stalwart players.

The trucking bloodbath has now assuredly reached many of those megacarriers. Here are some highlights from first-quarter earnings:

- J.B. Hunt lost $5.4 million in the first quarter of 2023, compared to a $24.2 million windfall in the first quarter of last year. It moved 25.5% fewer loads.

- Knight-Swift’s truckload sector recorded an 8% decline in revenue, 6.4% more deadhead miles and 9% less revenue per tractor, excluding fuel.

- PAM Transportation’s adjusted operating income fell by 46.7% year over year (y/y) in the first quarter. Its operating ratio hit a stress-inducing 99.3%, which means its operating expenses pretty much equaled its total revenue.

- The operating income at Landstar System fell by 37.8%.

- Covenant actually did OK, with a small uptick in revenue per tractor and per mile compared to last year.

- Old Dominion Freight Line said its April tonnage is down 15% y/y. However, in the first quarter, it managed to keep revenue per shipment up by 5.9%.

- Saia’s first-quarter income dropped by 4.2% y/y and shipments per workday decreased 7.1%.

- OK, you get the point. It’s not great.

Ludicrously capacious capacity

Despite the downturn, some of these major fleets have slapped on a lot more capacity in their truckload sectors. This is a bit spooky!

- Marten, an increase of 17.1% tractors.

- J.B. Hunt, 33.1% more.

- PAM Transportation, 18.3% more.

- Knight-Swift and Schenider kept it classy with a tractor uptick of around 1%.

Large fleets were largely unable to grow during 2021 and 2022. That was partially because everyone wanted to make crazy money on the spot market, but it was also because big players couldn’t secure new trucking equipment. Supply chain issues were causing more supply chain issues; there wasn’t enough manufacturing capacity to produce trucks that fleets needed.

Now these fleets are quickly expanding — and hiring too. Since April 2020, we’ve seen an increase of nearly 181,000 trucking payrolls.

It’s a sign that trucking is shifting from the spot market, which became unusually large in 2020 to 2022, back to contract. Truck driver Joe Bielucki hauls steel coils for a manufacturing plant in New England. He said he’s not seeing “doom and gloom,” thanks largely to his preference for contract freight over spot jobs.

Still, as first-quarter earnings showed, carriers that favor the contract market are still reporting decreased revenue — even as the market begins to favor them.

The ‘Great Purge’ continues, and it’s bad news for small-time truckers in particular

A shift from spot to contract freight is a return to the pre-pandemic trucking ecosystem. It’s a correction — and it should help steady the market.

“As small and medium-size business capacity leaves, we’ll hopefully see rates stabilize and eventually rebound as capacity starts to match demand a little bit more,” Hamish Woodrow, head of strategic analytics at Motive, said.

However, that normalization has already been painful for small fleets that favor spot freight.

“[T]here are essentially no loads falling from the contract to the spot market, something that characterized the 2020 to early ’22 era,” Strickland wrote in April. “Many carriers became accustomed to this volume of transactional business and built their networks around something that has completely evaporated in a relatively short period of time.”

As for Vise, he believes that spot rates are nearing the bottom and contract rates will hit the bottom by the fourth quarter. The recovery from this will be slow and steady, he said.

That likely means a continuation of the “Great Purge” of the smaller trucking companies that have flooded the market. Kratz, the flatbed truck driver, said he’s not expecting the market to pick up this year.

“I am fortunate that my truck and trailer are both paid for,” Kratz said. “I’ve worked hard over the years to put good reserves away for times like this. I hate to see it, it won’t be good for many, but I can ride this out if I need to.”

Are you a trucking industry professional? What’s been your experience of the freight recession? Email me at rpremack@freightwaves.com. Subscribe to the next edition of MODES here.