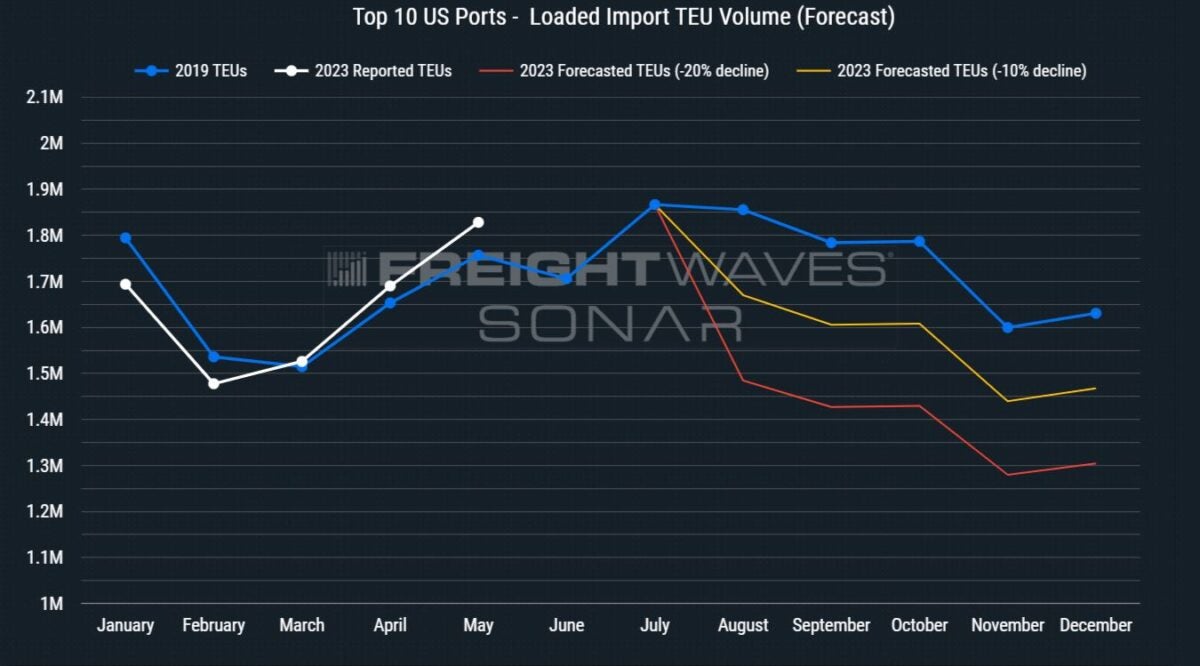

For the past few months, we have been warning that U.S. containerized import volumes were not only likely to experience a weak peak season but were also positioned to reach a “new” bottom in the back half of this year (forecasting a 10%-20% decline below second-half, 2019 levels). Fast forward to today, and the projected weak peak season has not only arrived but appears to already be peaking. It may be all downhill from here.

SONAR’s Container Atlas, which provides real-time, high-frequency ocean container data, currently shows our proprietary Ocean TEU Volume Index (in the chart above) registering a new year-to-date high for U.S.-bound container volumes departing from all origin ports globally. While this high may (at first glance) appear as an upward trend demand or second-half rebound in demand, upon further examination, this index seems to actually be signaling that the “peak” of peak season has likely arrived. While the first half of this year saw a full-on reversion of U.S. import volumes to pre-pandemic levels, it is important to note that during the past two years the true peak of peak season for U.S.-bound containers (departing from abroad) was reached in July (one to two months earlier than in years past). Now, this year’s peak season appears to be following this same trend when looking at the next seven days (white shaded area in the chart above) of departing container volumes. If these volumes depart over the next week as expected, they are likely to mark the peak of peak season and begin rolling over into a steady downtrend for U.S-bound container volumes below second-half, 2019 levels.

Since the Ocean TEU Volume Index is measuring container volumes on their date of departure from all origin ports around the world, to better understand the next few weeks of demand we can look further upstream to the Ocean Bookings Index (in the chart above). This index measures container volumes on the date that they are booked and confirmed (allocated a departure date) with ocean carriers; therefore, it provides additional visibility into what future demand will look like by measuring U.S. containerized import volumes up to an additional two to three weeks (on average) in advance of their estimated departure date. As we can see, the Bookings Index is clearly signaling that there is already less U.S. containerized import volume being booked, which further adds to the likelihood that this downward trend in new volumes is set to continue for the next one to two weeks. But, more importantly, it adds credibility to the likelihood that the peak of peak season is already here.

As the Ocean TEU Volume Index and Booking Index are both displaying clear warning signs that volumes are likely peaking and triggering the start of a descent toward a new bottom in future loaded import TEU volumes for 2023, the Ocean TEU Rejection Index (in the chart above) is also likely to be peaking for container volumes heading to U.S. ports. Rejections peaking simultaneously alongside a peak in container volumes also serves as an explanation as to why rates on major U.S. import lanes received at least a small portion of the proposed general rate increases (GRIs) at the beginning of this month. But, the most important takeaway for how current market conditions will impact spot rates is the fact that rejection percentage for U.S. containerized import volumes did not exceed the level they reached in mid-April when trans-Pacific Eastbound rates saw their largest single GRI of 2023 implemented. This importance nuance highlights the clear (and seemingly increasing) weakness in the ability of ocean carriers to meaningfully increase spot rates in the face of deteriorating container demand, and thus, further increases the likelihood that spot rates will break through their year-to-date lows (reached in early April — prior to the large April 15 GRI) and find a new bottom (which we warned of again last week).

Another import signal from SONAR’s Container Atlas can be found in measuring how far in advance beneficial cargo owners (BCOs) are making their bookings prior to their intended vessel’s departure date. In the chart above, we can see a clear downward trend in this measurement, which can be a key indicator into how BCOs are perceiving tightness in capacity within the greater ocean container market. This lack of urgency from BCOs is a supplementary signal (alongside the aforementioned indices) that they (BCOs) see no need to book their volumes further out in advance of their intended dates of departure to better offset any volatility caused by potential increases in demand. In other words, current lead times from BCOs are in line with expectations based on current market conditions and seem to also indicate that they are likely well aware (at least) that this year will be a weaker peak season for volumes.

As for the supply side of the container market, it remains projected to increase slightly during the second half of 2023 (following a similar upward trend as seen in the chart above over the past few months). These projections highlight an obvious disparity, and steadily increasing imbalance, between supply and demand. This growing imbalance will likely persist in the months ahead as new capacity comes online and U.S. containerized import volumes embark on a steady decline in search of a new bottom in the back half of 2023. Under these circumstances, it is reasonable to expect that ocean carriers will go to even greater lengths to try to increase the frequency and use of blanked/canceled sailings, or possibly even introduce new strategies for cutting/controlling capacity to help offset the increasing imbalance between supply and demand. This will likely include (but not be limited to) carriers choosing to retire or scrap older vessels in their fleets or idling them until demand does experience a clear rebound at some point down the road.

To learn more about FreightWaves SONAR, click here.

As we have continuously warned through Q2 of 2023, demand peaking just as we enter the first few weeks of the second half of 2023, coupled with too much vessel capacity on the water, has the potential to trigger a more intense price war among ocean carriers as they strive to gain market share during the remainder of this downcycle. Consequently, it may lead to heightened tensions within the three ocean carrier alliances, resulting in significant disruptions in their current structures and potential full-on reorganization within the ocean container market. This possible disruption of the current alliance structures could further erode any stabilizing influence they may have had on spot rates, further reducing their ability to maintain GRIs effectively. This would create a rate environment where a new bottom for spot rates in 2023 would be almost inevitable across U.S. import lanes.

Peter C.Ely

I bet everyone glad the ILWU slowdowns are over with.