The big surprise for shipping stocks has been the outperformance of certain container industry names despite the post-boom plunge in volumes and freight rates. Container-equipment lessor Textainer (NYSE: TGH) is a case in point.

Textainer’s stock just hit its highest price since the company went public in 2007. Its shares are doing even better than they did at the peak of the COVID-era boom.

Box leasing companies are in close contact with their customers — the shipping lines — and during a conference call Tuesday, Textainer CEO Olivier Ghesquiere relayed what he’s seeing in the liner business right now. It’s far from doom and gloom.

Ocean carrier volumes picking up

“There are initial signs of higher ship loadings as well as firming ocean freight rates on major shipping routes,” Ghesquiere said. “Cargo volumes have started to recover over the past few weeks. There is growing optimism that August will see further ocean rate hikes, especially on the trans-Pacific routes, where ship utilization has recently been much stronger.

“Our customers expect the inventory destocking cycle to come to an end soon, paving the way for the need to replenish inventory ahead of the winter holiday season. As such, our shipping line customers anticipate cargo volume to pick up in the second half of the year.”

Ghesquiere also commented on how his liner customers are handling a massive influx of newly built container vessels. “Those ships have already started arriving and it has given us a good indication of what shipping lines are doing with them.

“Essentially, they’re adding ships to their existing routes. Typically, where they were operating 10 or 11 ships on a route, they’re adding one or two more ships, they’re adding one or two more stops on the round trip, and they’re slowing down the ships to consume less fuel and reduce CO2 emissions.

“The big benefit for us is that if there are more ships in service and they’re sailing slower, it takes longer for containers to move around, which means that more containers are actually needed. It will require larger container [equipment] fleets to transport the same amount of cargo.”

New box manufacturing sharply reduced

Container equipment is built by a handful of groups in China. Over 90% of all containers are built in China, with over 80% built by one of three Chinese companies. Orders for new containers skyrocketed during the pandemic.

“We oversupplied the industry during the COVID supercycle, but for the past five quarters, production has been a lot more moderate,” said Ghesquiere, who expects ordering to remain low through at least the end of this year.

The price of new containers has fallen from the peak but has stabilized at “a fairly good level of $2,200 per CEU [cost-equivalent unit; the cost equivalent of a twenty-foot equivalent dry container].” At that price, it makes more sense for shipping lines to renew expiring leases than order new boxes, he said.

“Orders for new containers remain minimal, at only 650,000 CEUs so far this year, as the industry continues to absorb the elevated production volumes of the COVID supercycle. There is very little incentive for shipping lines to shift away from renewing maturing leases, so the demand [for leased containers] is still there.”

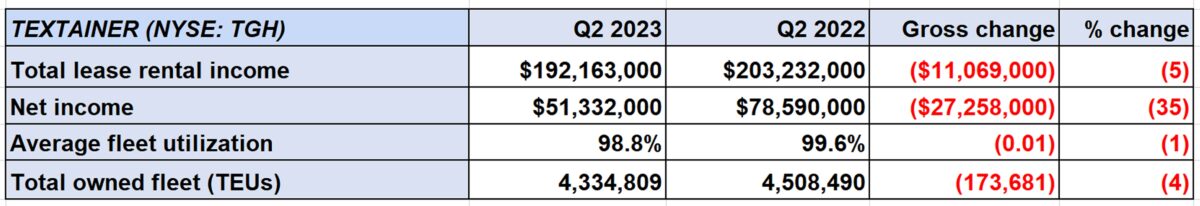

Textainer’s utilization rate for its containers was 98.8% in the second quarter of 2023, down just a sliver from 99.6% the year before. “We’re optimistic that our utilization rates will remain highly elevated until the end of the year and most likely into next year,” said Ghesquiere.

Textainer reported $51.3 million in net income for Q2 2023 compared to $78.6 million in Q2 2022. Adjusted earnings per share came in at $1.20, topping the consensus forecast for $1.18.

The company’s stock hit an all-time high $42.75 per share on Tuesday, closing at $42.73. The stock price is up 40% year to date.

Click for more articles by Greg Miller

Related articles:

- Shipping line ONE’s profits plunge but still top pre-COVID levels

- Container shipping giant CMA CGM still earning over billion a quarter

- Zim downsizing its container ship fleet as demand disappoints

- Trans-Pacific shipping rates rise as carriers make capacity cuts

- Q2 container line earnings could surprise to the upside

- Container stocks outperform despite market gloom

- US containerized imports still outpacing pre-COVID levels

- Container shipping trilemma: Weak rates, new ships, pricey charters

- Shipping faces fallout as China’s post-COVID rebound falls flat

- How three Chinese companies cornered global container production