A couple of truckload carriers said the bottom of the cycle has likely occurred but acknowledged that any material positive inflection in fundamentals won’t happen until sometime in 2024. That likely means a “muted peak season” again this year.

“I think there will be some signs of seasonal activity across September, October, November,” Schneider National (NYSE: SNDR) CFO Steve Bruffett said at a Morgan Stanley (NYSE: MS) investor conference Tuesday in Dana Point, California.

“I think that sets us up for a more constructive start to 2024. I wouldn’t call it robust but I would call it a more balanced and more in equilibrium type of setup than what’s been in place entering any of the last … four years.”

He said after months of a very flat freight environment marked by customers rightsizing inventories, there is some merchandise restocking occurring currently. Bruffett noted demand improvement during the back-to-school shopping season and said Halloween-related goods are doing a little better than expected. Neither category, however, is expected to make much of an impact on the carrier’s results.

Schneider lowered 2023 earnings guidance when it reported second-quarter results in early August. It expects the third quarter to be the low point of the cycle from an earnings perspective as the full impact of contractual bid season is represented across its entire customer book.

Management from Werner Enterprises (NASDAQ: WERN) echoed a similar outlook at the event. Derek Leathers, the company’s chairman and CEO, said the “overcapacity marketplace coupled with overstocked inventories” has passed.

Werner’s biggest customers, which include discount stores that specialize in household essentials, are in a good position with their stock levels, Leathers noted. He expects restocking to occur during peak season but said customers are likely to be a bit more conservative this year to avoid the demand miscalculations that resulted in stuffed warehouses last year.

Along those lines, Werner’s biggest customer, Dollar General (NYSE: DG), recently said it would implement promotional markdowns to rightsize inventories. The actions are expected to equate to a $95 million hit to operating income in the back half of the year.

“We’re fairly optimistic as we look forward but we’re certainly still in a day-to-day fight,” Leathers said.

Werner is expecting to see some type of peak this year but it has a tough comparison to a year ago, which benefited from a decent amount of project freight.

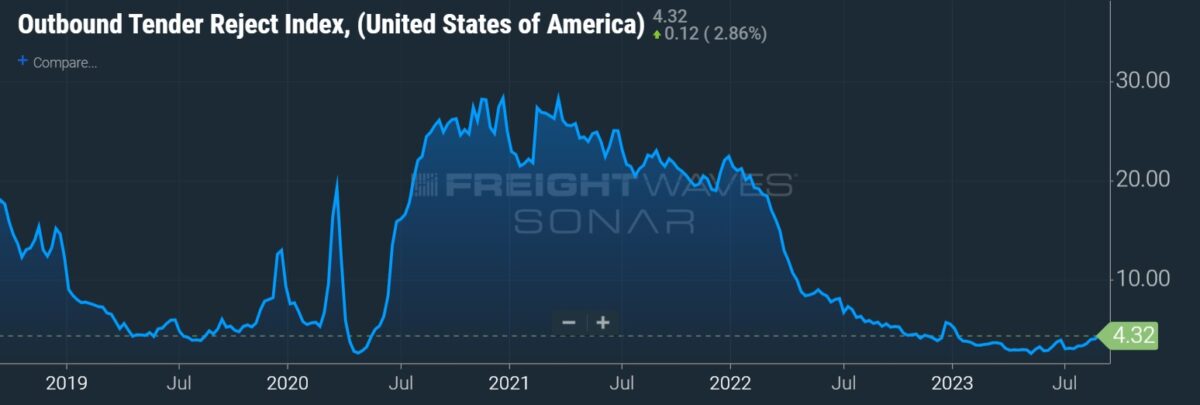

“We’re only now starting to really find some sense of balance in the market,” Leathers said. While truckload capacity has been leaving in dribs and drabs for a year now, the exit rate is increasing. “I think you’re going to start to see that wash increase from here.”

The change is noticeable with smaller carriers predominantly hauling spot-market freight.

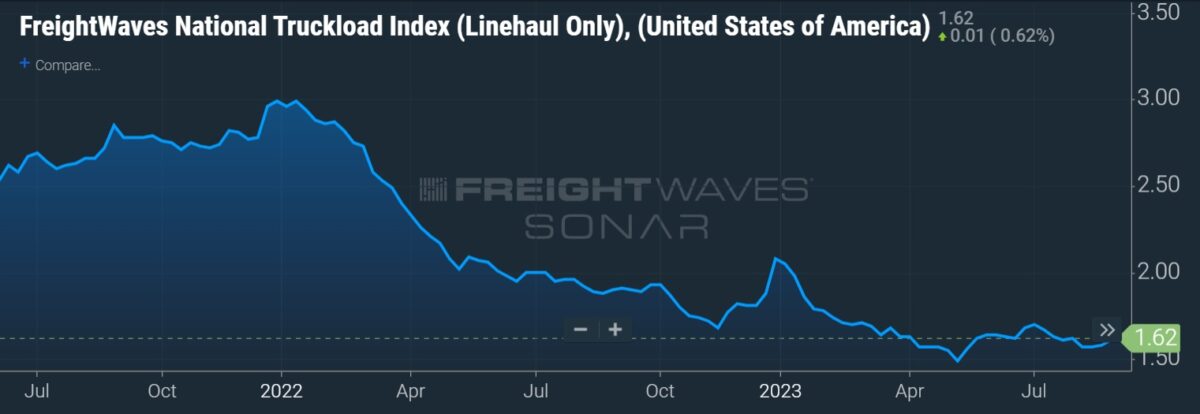

Spot rates have been in decline for more than a year, only recently bouncing off a low established in May. The consensus throughout the industry is that smaller fleets have burned through the cash positions they built during the freight boom. The group now faces the highest interest rates in two decades and widespread cost inflation, including diesel prices that are up 20% since early July.

Bruffett is seeing capacity exit as well. He noted an increase in the availability of qualified drivers and said Schneider’s leasing business has seen an uptick in returned equipment. The company’s brokerage unit has also seen a decline in the number of carriers renewing their authorities.

It’s still too early to forecast what might happen on contract rate renewals next year, but a decline is unlikely, Jim Filter, Schneider’s group president of transportation and logistics, said.

“I don’t think there’s a level below where we’re at right now from a contract rate and our customers — I believe they understand that.”

More FreightWaves articles by Todd Maiden

- Forward Air sees muted August after controversial deal announced

- Old Dominion sees August impact from Yellow’s shutdown

- Forward Air says ‘earned trust’ a must after Omni acquisition

Jose

Eso les dicen que digan a esa clase de expertos, pero la realidad es que es otra cada vez esta peor la situación.

Jose Fernandez

What we need is for these brokers to stop being cheap as well as companies.Theres been several O/O throw in the towel because of this.We should at least get $1.65 and above to make it well in this business..Fuel is back up and they are paying to cheap for us to compensate and make a little profit..We got bills and maintenance repairs and life overall to deal with..Again these brokers are ripping us off,just look at the freight screen,rates are ridiculous !