There have been a number of “big picture” questions about shipping stocks through the years: Should companies be “pure plays” or diversify across multiple segments? Which is the best segment to own? Do master limited partnerships (MLPs) have a future as shipping equities? Are related-party deals with sponsors fair to individual investors?

All of these questions came together in a single multi-billion-dollar shipping transaction announced Monday morning.

Capital Product Partners (NASDAQ: CPLP), an owner of seven liquified natural gas carriers and 15 container ships, will pay $3.13 billion to buy 11 LNG carrier newbuildings from its private sponsor, Capital Maritime, controlled by Greek shipping magnate, politician and football-team owner Evangelos Marinakis.

CPLP will convert from an MLP to a corporation, change its name to Capital New Energy Carriers effective Dec. 31 (new ticker: CNEC), sell off its fleet of 15 container ships and become an LNG shipping pure play.

It’s a “complete makeover,” said Stifel analyst Ben Nolan. CPLP’s common units closed up 7% Monday in more than triple average trading volume on the news.

Another change for LNG shipping stocks

The transformed entity will be a leading player in the U.S.-listed LNG shipping space, which has undergone a major reshuffle in recent years as the Ukraine-Russia war lifted LNG shipping rates to record highs.

In the minus column for LNG shipping investors, Teekay LNG, GasLog LNG and GasLog LNG Partners were taken private, as was floating regasification provider Hoegh LNG Partners, while the fleet of Golar LNG was sold. In the plus column, Flex LNG (NYSE: FLNG) listed in 2019 and CoolCo (NYSE: CLCO) — which purchased the Golar fleet — listed this March.

CPLP could see significant fleet growth beyond acquisitions announced Monday. It has the right of first refusal on any future LNG vessel sales by Capital Maritime, as well as on two ammonia carrier newbuildings and two CO2 carrier newbuildings ordered by Capital Maritime.

Following the “milestone transaction,” the company will grow into “one of the largest if not the largest LNG and energy transition gas company in the U.S. public markets,” said CEO Jerry Kalogiratos on a call with analysts.

Pure plays vs. diversified fleets

Capital Product Partners went public back in 2007 as an owner of product tankers, thus its name. But through its history, it used a diversified fleet model, also owning crude tankers, dry bulk carriers, container ships and LNG carriers, including many bought in related-party “drop down” transactions from Marinakis. It has been building up its LNG fleet since 2021.

The debate continues on whether it’s best to diversify or not.

The pro-diversification argument is that it allows a company to manage through shipping cycles, as opposed to being a commoditized captive of a single sector’s cycle. The counterargument is that diversified shipping stocks are not attractive to investors.

The more recent moves to diversify have been driven by the desire to offset exposure to the container shipping cycle and its exceptionally weak supply-demand fundamentals.

CPLP’s move into LNG two years ago coincided with a major diversification into dry bulk shipping by fellow container-ship lessor Costamare (NYSE: CMRE). This year, container-ship lessor Danaos (NYSE: DAC) followed Costamare’s lead with its own expansion into dry bulk.

The dry bulk strategy has yet to pay off for either Danaos or Costamare, because the dry bulk market has slumped at the same time as container shipping.

Diversification hasn’t worked for CPLP either — which is why it’s now changing course.

According to Kalogiratos, the company’s common units “have been trading at a large discount to NAV [net asset value]. Despite value-creating transactions … this picture has not changed materially,” so the company is “moving away from the diversified model.”

CPLP unloaded its tanker fleet via a merger with Diamond S in 2019; the fleet of Diamond S was then sold to International Seaways (NYSE: INSW) in 2021. CPLP sold its last dry bulk carrier this year, delivering it to the buyer last month.

Entire container ship fleet for sale

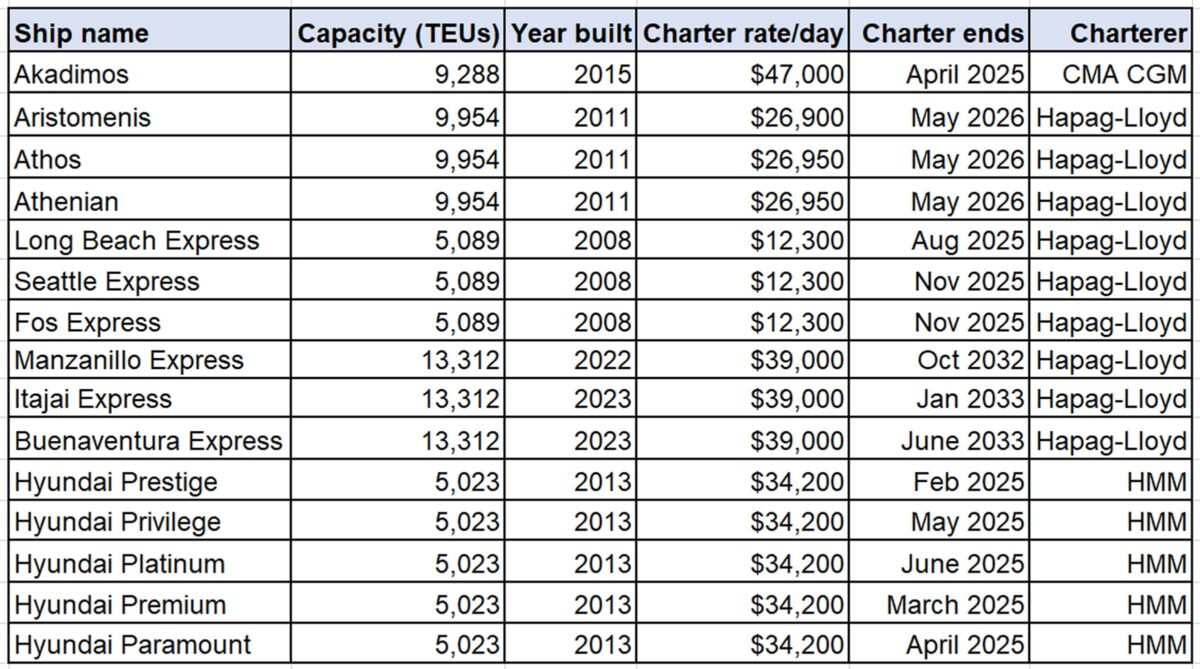

Its container shipping fleet consists of eight vessels with capacity of 5,000-5,100 twenty-foot equivalent units, four 9,000- to 10,000-TEU ships, and three 13,312-TEU ships.

Nine are on charter to Germany’s Hapag-Lloyd, five to Korea’s HMM and one to France’s CMA CGM. Nine of those charters expire in 2025, three in 2026, one in 2032 and two in 2033.

“One does not want to rush this,” said Kalogiratos, referring to the sale of the container shipping fleet. “There is no hurry. Hurried exits in shipping typically do not go well.”

He said the company is open to selling container ships off one by one or through a larger M&A deal that could involve a combination of cash and shares. “We are absolutely open as to how we do it and when we do it.”

That said, there is a sales timing factor that Kalogiratos neglected to mention on the call: An unprecedented wave of newbuildings will be delivered through 2025. The more newly delivered ships that liners put in service, the lower their interest in older, less fuel-efficient ships, a headwind to future lease rates and thus asset values and CPLP’s future fleet sale proceeds.

There’s no telling how bad the sale-and-purchase market for secondhand container ships could be a few years from now, when most of CPLP’s existing leases expire.

Long history of related-party deals

Another question for CPLP, given its weak share pricing and low trading volumes versus its peers despite the high profile of its Greek founder: Is CPLP’s diversified fleet the whole problem?

Could the company’s long history of related-party transactions with sponsor Marinakis have weighed down investor sentiment? And given that these related-party transactions will continue, could the NAV discount persist?

Critics of related-party deals done by Greek owners like CPLP have long argued that such transactions can benefit the sponsor too much, whether through inflated prices paid for assets or simply because common shareholders are at an informational disadvantage.

Commenting on Monday’s transaction, Nolan of Stifel said, “We view everything as a positive with the exception of the purchase price of the LNG carriers, which we estimate to be more than 10% above fair value.”

Nolan noted on the call that the purchase price “seems a little elevated relative to the market levels we’ve seen for newbuildings.”

Kalogiratos countered that “the valuation is quite fair” and was done through the board’s conflicts committee assuming charter revenues for the ships upon delivery, including rates on five of the newbuildings that have already secured charters, plus estimates for the remaining six given current long-term charter rates of around $100,000 per day.

Click for more articles by Greg Miller

Related articles:

- Shipping line Hapag-Lloyd suffers ‘big miss’ as Q3 profits slump

- Maersk cutting 10,000 jobs in face of ‘worsening market conditions’

- Shipping braces for impact as Panama Canal slashes capacity

- How Middle East war could impact global LNG, LPG shipping

- Container shipping’s Danaos buys into dry bulk amid rate slump

- Corporate governance in shipping: Who’s been naughty or nice?

- How LNG shipping kept Europe’s wartime energy supply secure

- Hello, goodbye: Shipping’s latest entries and exits on Wall Street

- Shipping on Wall Street: Is it better to be a pure play or jack-of-all-trades?

Johan Van den Driessche

Buying the LNG fleet is one thing, the conversion from the MLP structure another.

Quid with the GP ? Remember how Marinakis acted when INSW took the DSSI vessels !