How will the “personas” of dispatchers, maintenance technicians and roadside assistance change as autonomous trucks arrive? Torc Robotics is working with major fleets to find out.

Torc differs from its major competitors in preparing to launch fully integrated autonomous Freightliner Cascadias into commerce.

The independent subsidiary of Daimler Truck moves deliberately. Aurora Innovation and Kodiak Robotics target late 2024 for their first commercial routes with driverless trucks. Torc is looking at 2027.

“I have a lot of respect for the other folks in the industry,” Andrew Culhane, Torc chief strategy officer, told me in an interview this week at Torc’s testing center in Albuquerque, New Mexico. “Most of us have been in self-driving together for 15-plus years. Everybody has a different definition of what commercialization really means to them.”

Culhane is an original “Torc’r,” a nickname accorded employees of the company then-graduate student Michael Fleming co-founded at Virginia Tech University in 2005. Fleming stepped down as CEO after 17 years in August 2022 but remains on the Torc board.

The Blacksburg, Virginia-based company became part of Daimler in 2019 when the truck maker acquired a majority stake for an undisclosed amount. The transition from a technology and product emphasis to creating a business began when Daimler installed Peter Vaughan Schmidt as CEO.

‘What is it actually going to take?’

“We go pick up a trailer. We move it from A to B. Sure, we’ve done something, but that’s not true commercialization,” Culhane said. “Over the last 12 months, it’s less of a conversation about the truck itself. Now [it’s] OK, ‘What is it actually going to take to run these assets?’

“There’s plenty of people who can move freight for you,” Culhane said. “It’s a question of ‘Can we enable the fleet to run autonomous trucks?’”

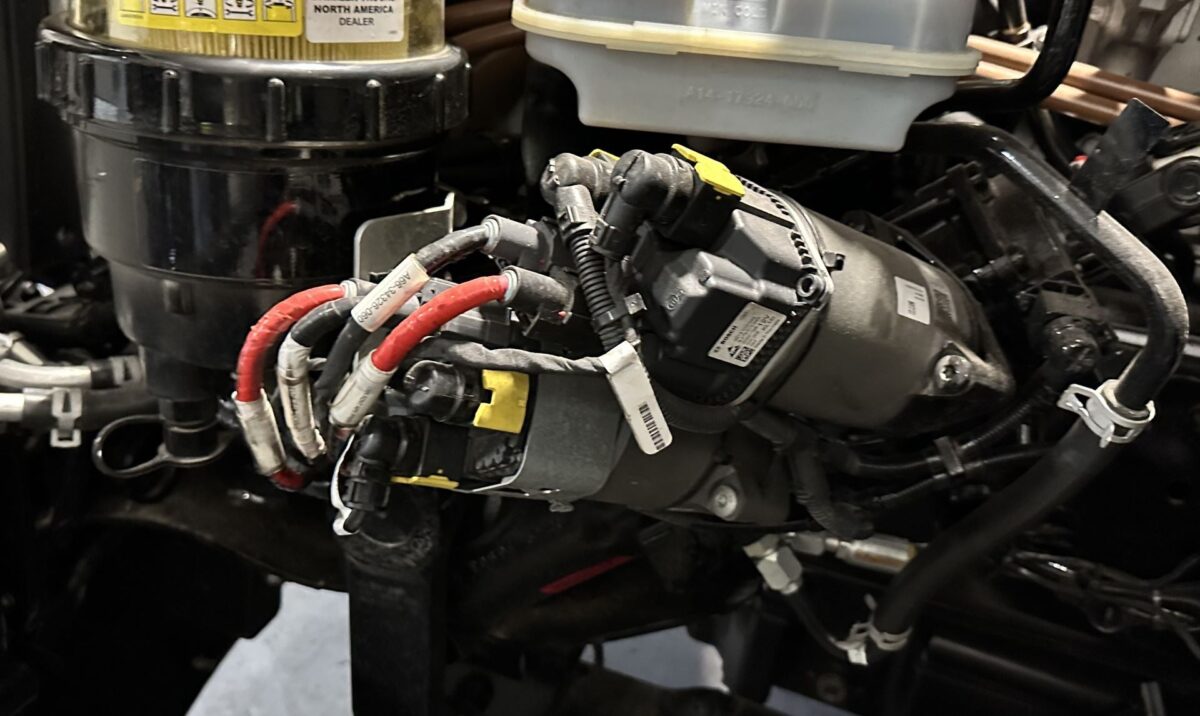

The arrival from Portland, Oregon, of the first fully redundant Cascadia chassis at Torc’s testing center in a former car dealership in Albuquerque addresses part of the question. Seamless duplication of braking, steering, low-voltage power and other key components stand in where a human might take over in case of a failure.

‘10 different big chunks of things’

Culhane focuses on the “10 different big chunks of things” that have to be ironed out before Torc can scale a commercially profitable business.

“How do we move customers from left to right to where they can say, ‘Yeah, I can own that asset, I can run it, I can maintain it, I know how to dispatch it. It plugs into my TMS [transportation management system]. If you don’t answer all of those questions, it’s not commercial-ready. It’s the next great demo or it’s a neat pilot.”

The traditional jobs surrounding freight operations will change. What new skills must a dispatcher acquire? What would roadside assistance look like? Who would supervise driverless trucks to keep them running as intended?

Helping customers take advantage of autonomy

“I think we’ve hit that tipping point of, ‘OK, the serious players are going to get there.’ Now they want to know how they’re going to take advantage of it.”

Torc is in the enviable position of having access to Daimler’s market-leading Freightliner customer base. Two of those customers, Schneider and C.R. England, run 1,000-mile safety driver-monitored test runs from Phoenix to Oklahoma City.

Big fleets that Daimler dominates are just part of Torc’s business plan.

“When we talk about scale, there’s scale with them,” Culhane said. “But the industry is much bigger than them.”

Three years of questions

It will take the next three years for Torc to influence and adopt the policies, procedures and standard operating efficiencies for autonomous trucks. How do you couple and decouple an autonomous truck? How do you inspect them?

“Putting those pieces together is where we think our part of the equation is,” Culhane said. “And then partners can step in and fill in more.”

Torc’s model is strictly hub-to-hub autonomy. But rather than build out its own transfer points, the company wants to leverage customer facilities. Schneider and C.R. England both have facilities at either end of the Phoenix-to-Oklahoma City test route.

More carriers will stand up facilities when Torc starts moving freight 430 miles without drivers from the U.S.-Mexico border city of Laredo, Texas, to Dallas in 2027.

“We don’t want to think of this as the Atlanta airport-size thing that everybody has to run through,” Culhane said. “We want to distribute that out. Take Dallas-Fort Worth. To truly access that market without owning 500 acres of real estate, you would need 10 locations around Dallas just to make the drayage legs work.”

Electric truck cola wars

Daimler Truck North America delivered 20 Freightliner Class 8 eCascadia day cab tractors to Reyes Coca-Cola Bottling, a West Coast and Midwest bottler and distributor of Coca-Cola brands.

The beverage industry is a burgeoning market for battery-electric vehicles. The Tesla Semi hauls Pepsico products in California. The Volvo VNR Electric moves Coke products in Canada. And BYD and Nikola teamed up on beer runs for Anheuser-Busch before a Super Bowl in Los Angeles in February 2022.

The eCascadias rely on 20 Detroit eFill commercial charging stations installed at its Downey, California, facility. Reyes is also using Detroit Charger Management System, software that lets the company see where its electric trucks are and manage them to reduce operational costs.

Food distribution giant Sysco Corp. signed a letter of intent in May 2022 to purchase up to 800 eCascadia tractors through 2026.

Range e-trailer puts up big mpg savings numbers in testing

Electric-powered trailer startup Range Energy reports that preliminary third-party real-world testing results showed its technology enables up to 36.9% fuel efficiency gains — 3.25 mpg — for semi trucks.

The testing occurred on a 25.5-mile urban/highway loop with a top speed of 60 mph and a gross vehicle weight of approximately 59,000 pounds. Stop-and-go and steady speed scenarios accounted for variables such as wind, climate, load, duty cycle and driving behavior.

“Achieving 36.9 percent efficiency improvements proves to the trucking industry how important and overlooked trailers are to enhancing efficiency and lowering emissions for our industry,” said Ali Javidan, Range Energy CEO and founder.

“Range is the first electrification platform to actually prove this level of efficiency benefit, and we anticipate these numbers will only improve as we begin testing with production-quality parts versus prototype components,” Javidan said.

Briefly noted …

Networked charging solutions provider ChargePoint replaced its CEO and CFO in a top-of-the-house shakeup.

European trucking OEM Iveco and autonomous trucking developer Plus will launch a driver-supervised pilot in Germany in the first half of 2024 with the continent’s largest retail chain and DSV, a leading transport and logistics provider.

California Truck Centers will sell and service the Class 4-5 zero-emissions Rizon cabover trucks — engineered by Daimler Truck — at six of its eight California locations.

Orange EV has produced its 1,000th pure-electric terminal truck. It has amassed more than 11.8 million miles and 4 million hours of operation over eight years.

4 Gen Logistics is launching construction for the first phase of a plan to install 60 350-kilowatt chargers at its Port of Long Beach, California, facility.

The Eaton Cummins Automated Transmission Technologies joint venture is making its Endurant XD automated manual transmission available in select Kenworth truck models in Mexico and Latin America.

That’s it for this week. Thanks for reading. We value your feedback. Please write aadler@freightwaves.com with comments and story suggestions. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on Truck Tech at 3 p.m. Wednesdays on the FreightWaves YouTube channel.