This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Bulls in the US shop

Freight demand was muted during December’s final week, though what remained was above the levels of 2020 and 2022 alike. Unfortunately, this relative bright spot did not translate into market dynamics shifting — even temporarily — into carriers’ favor, as tender rejections and spot rates trended noticeably below 2022. As will be discussed below, spot rates did eventually see a boost at the start of the new year, albeit one that was unable to meet FreightWaves’ prior forecasts.

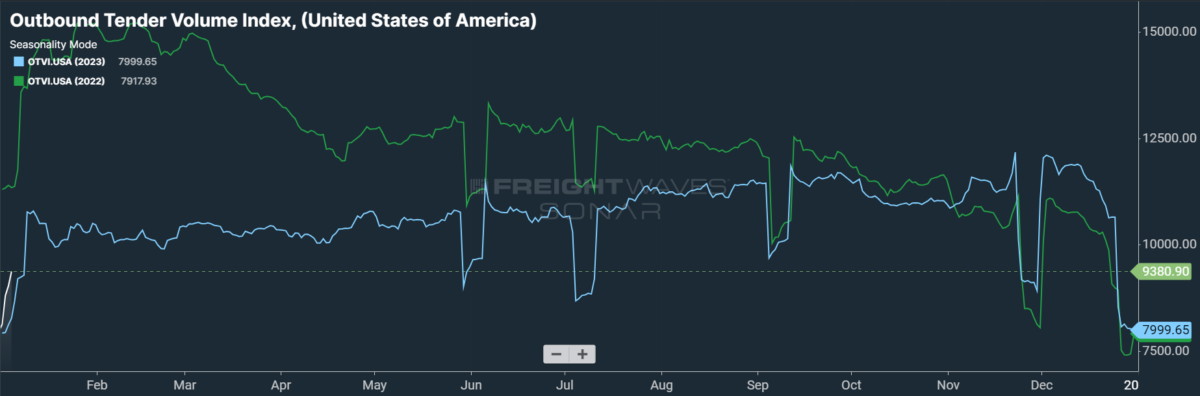

SONAR: OTVI.USA: 2024 (white), 2023 (blue) and 2022 (green)

To learn more about FreightWaves SONAR, click here.

The Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, is down 14.2% on a two-week basis as holiday noise devalues comps made against last week’s data. On a year-over-year (y/y) basis, OTVI is up 8%, though such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be inflated by an uptick in the Outbound Tender Reject Index (OTRI).

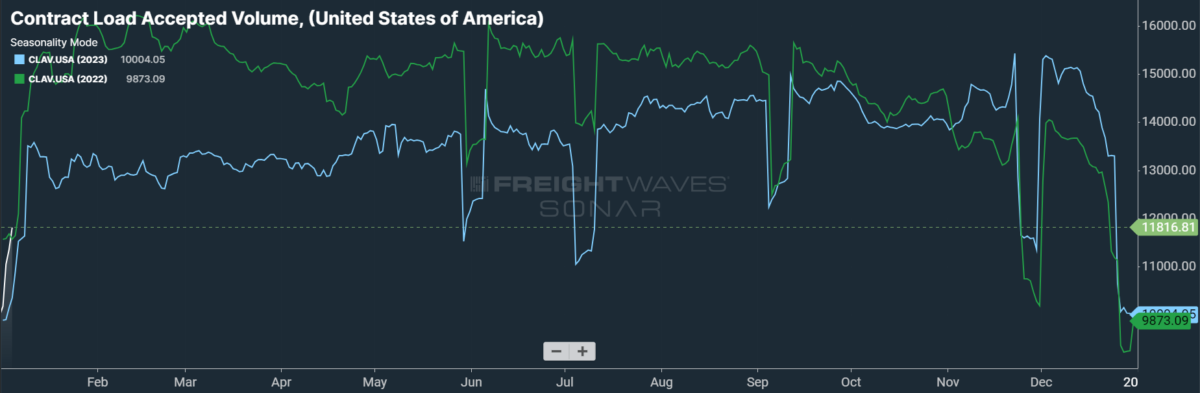

SONAR: CLAV.USA: 2024 (white), 2023 (blue) and 2022 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a dip of 18.2% on a two-week basis and a rise of 12% y/y. This narrowing y/y difference implies that actual freight flow is recovering from this cycle’s bottom.

The calls are coming in for 2024, with most of them bullish on both the freight market and the broader economy. Prologis boldly forecast a reversal of the freight recession that will see “double-digit growth in port and truck traffic.” Container ports in Southern California are likely to be the first to benefit from this expected reversal, as import volumes are predicted to outpace pre-pandemic levels. With transit limited along the Panama Canal, which is suffering from water shortages, and the Suez Canal, rattled by recent attacks on container ships in the Red Sea, Southern California is one of the few destinations that are relatively problem-free.

That said, U.S. ocean imports will almost certainly languish during China’s annual celebration of Lunar New Year, which will commence on Feb. 10. But the influence of Chinese customs and laws on domestic freight demand is set to weaken as the Inflation Reduction Act tempts manufacturers with billions of dollars in tax credits to reshore operations stateside. While the growing trend of reshoring and nearshoring manufacturing plants will take years to transform the domestic freight landscape, the early stages of the movement are already having a positive effect on cross-border trade with Mexico.

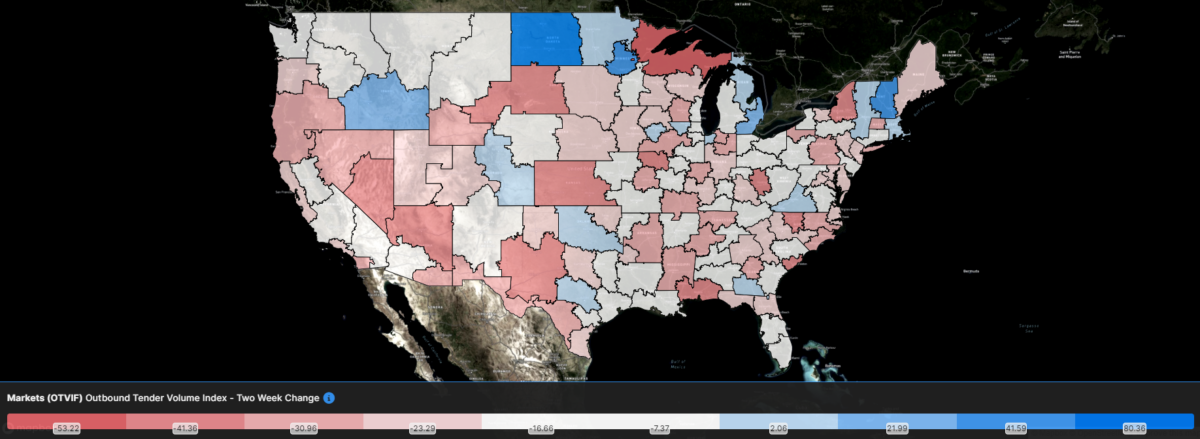

SONAR: Outbound Tender Volume Index – Two Week Change (OTVIF).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, only 18 reported increases in tender volumes on a two-week basis, with the strongest performances mostly confined to small or seasonally active markets.

Living in interesting times

With OPEC+ showing a growing number of fractures among its member states, U.S. oil production has become the most significant determinant of global crude prices. Despite already defying expectations in 2023 and finding itself as the highest-volume oil producer in history, the stage is set for the U.S. to ramp up its output in the coming year. In a quarterly survey of top U.S. oil executives, large and small firms alike said that increasing production was their No. 1 priority in 2024 — albeit in different ways, as larger firms mainly target asset acquisition while smaller ones angle to make their operations more attractive to potential investors.

Energy prices should be all but invulnerable to an upward shock this winter (a huge relief for incumbents in an election year), and so consumers will find themselves with slightly heavier wallets going forward. Not only does this outcome bear positively on the near-term health of the broader economy, but it also invites the possibility for goods demand that is stronger than expected.

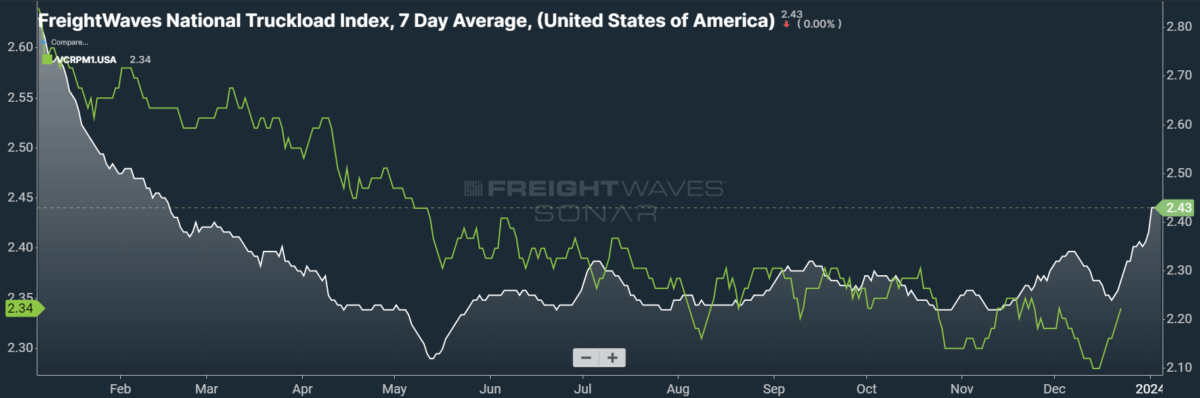

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — rose 7 cents per mile to $2.43. That this rally came practically at the beginning of the new year is somewhat unusual, as the NTI typically peaks closer to Christmas. Falling diesel prices partially offset the holiday surge in linehaul rates, with the linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — rising 8 cents per mile week over week (w/w) to $1.81.

Contract rates, which are reported on a two-week delay, found their yearly low in mid-December at a reading of $2.28 per mile. While contract rates have been rising since, their upward momentum is likely to dissipate entirely at the start of 2024. The current bid season will be shippers’ final chance to exercise the full extent of their pricing power, as the industry’s recovery should be at an appreciable stage by Q4 2024. For the time being, contract rates — which exclude fuel surcharges and other accessorials like the NTIL — are up 6 cents per mile w/w at $2.34.

To learn more about FreightWaves SONAR, click here.

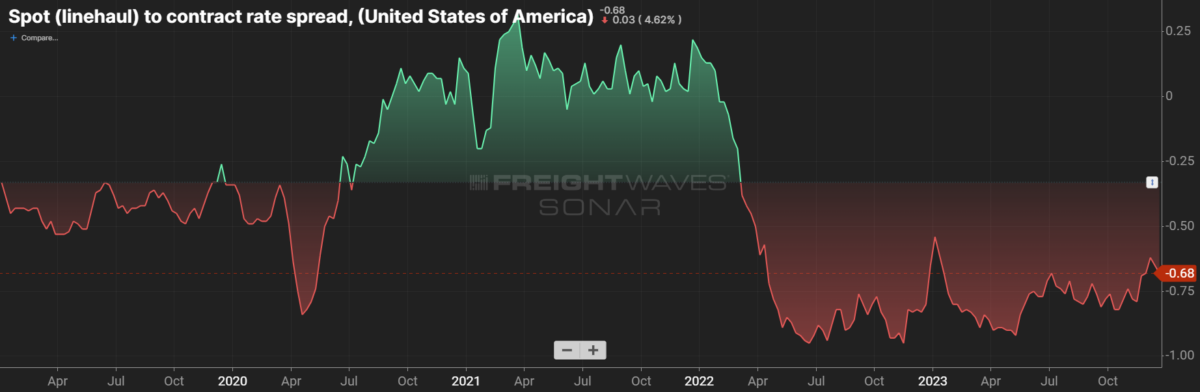

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs seemingly weekly, while contract rates slowly crept higher throughout 2021.

Over the course of 2023, this spread averaged 10 cents lower than in 2022, indicating that contract rates had yet to come into balance with the market’s fundamentals of carriers’ supply and shippers’ demand. These lopsided fundamentals were more appropriately reflected in spot rates, which are highly reactive to shifting market conditions. As linehaul spot rates remain 68 cents below contract rates, there is plenty of room for contract rates to decline — or for spot rates to rise — in the first half of 2024.

To learn more about FreightWaves TRAC, click here.

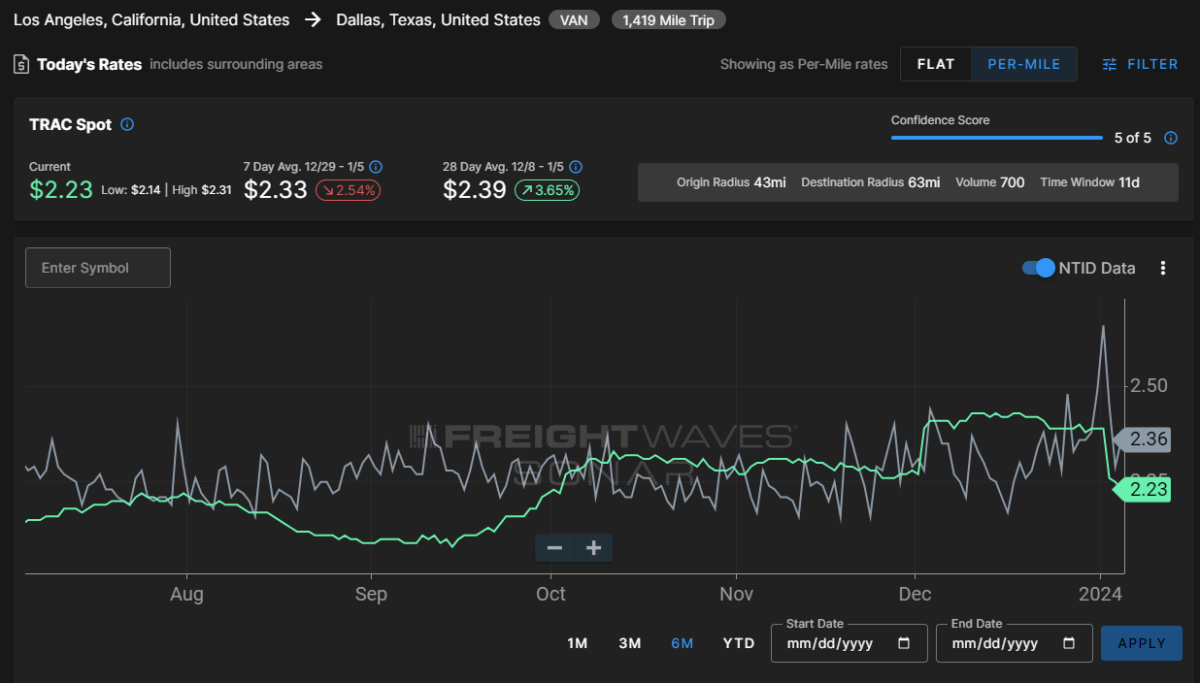

The FreightWaves Trusted Rate Assessment Consortium (TRAC) spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, quickly lost its holiday gains. Over the past week, the TRAC rate fell 17 cents per mile w/w to $2.23 — albeit falling from 2023’s high. The daily NTI (NTID), which has risen to $2.36, is again outpacing rates along this lane.

To learn more about FreightWaves TRAC, click here.

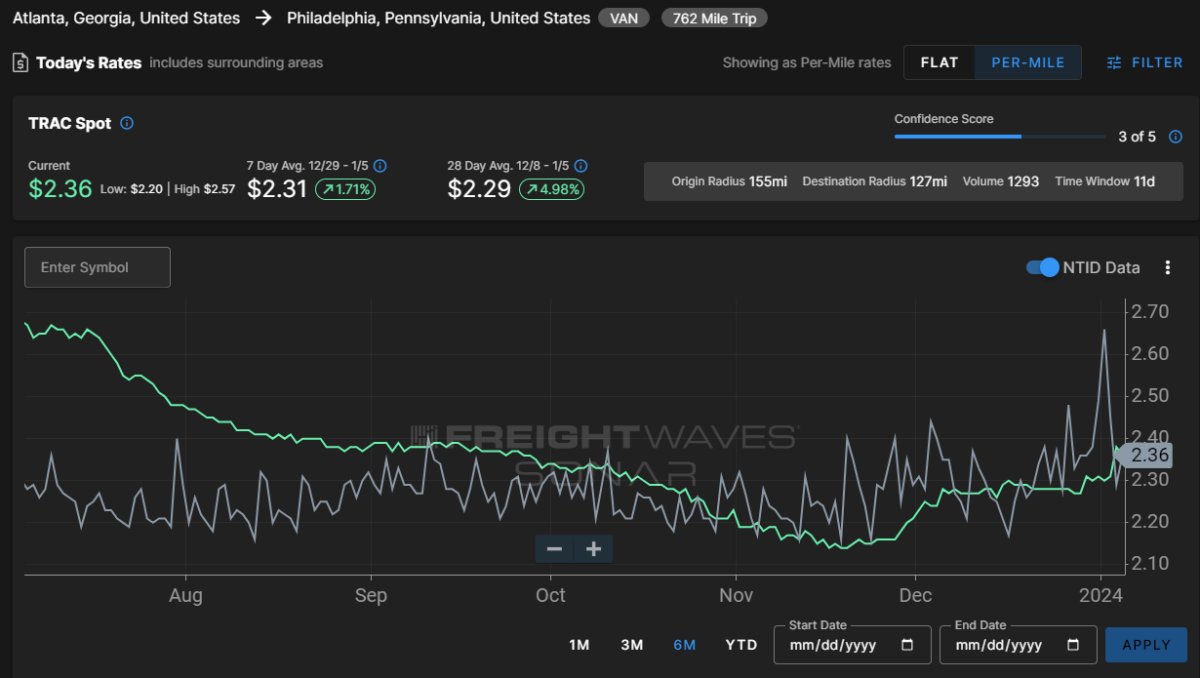

On the East Coast, especially out of Atlanta, rates are acting in line with the national average, benefiting from a delayed boost that has yet to find its ceiling. The FreightWaves TRAC rate from Atlanta to Philadelphia rose 9 cents per mile w/w to $2.36. After plateauing well above the national average during the summer, rates along this lane declined sharply at the end of July, lacking any positive momentum until recently.

For more information on FreightWaves’ research, please contact Michael Rudolph at mrudolph@freightwaves.com or Tony Mulvey at tmulvey@freightwaves.com.

Felton Brown

Still remaining optimistic.

Dennis mckaeras

It’s a race to the bottom at this point, December was the cheapest rates I’ve ever seen get booked entire year of 2023. People have no patience to wait for a hour or so to find a load that pays double or triple.