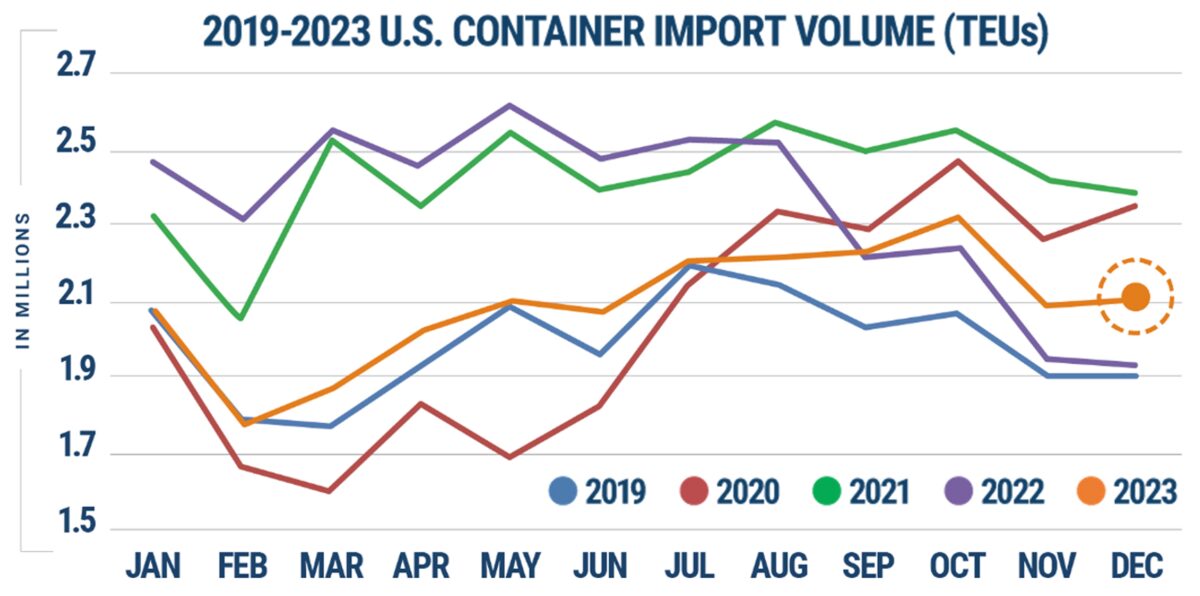

With all the headlines on trade disruptions, you might have expected U.S. imports to fall in December. They didn’t, according to new data from Descartes.

The U.S. imported 2,107,012 twenty-foot equivalent units of containerized goods in December, up 0.4% from November and up 9.2% year on year, said Descartes (NYSE: DSGX) on Monday.

December is traditionally slow from a seasonal perspective — and there was another headwind this year.

A drought in Panama significantly reduced transits of larger Neopanamax-class container ships in November and December, with transit constraints intensifying last month.

Container vessels that traditionally used the Panama Canal to bring Asian goods to East and Gulf Coast ports switched to the Suez Canal. Those ships then rerouted from the Suez Canal to longer voyages around the Cape of Good Hope, with diversions starting in late November and accelerating in recent weeks.

Intuitively, this should have led to some pressure on U.S. import volumes in December, with weakness centered on East and Gulf Coast ports, as had been the case in November.

Descartes’ data did not follow the script.

Counterintuitive West Coast weakness

Instead, it points to continued import strength in December versus November, driven by higher volumes to East and Gulf Coast ports, with these ports sequentially outperforming those on the West Coast.

According to Descartes data — which is derived from U.S. Customs filings and differs from official port data — imports to Houston, Texas, jumped 37,865 TEUs, or 29.5%, in December versus November.

East Coast ports also saw month-on-month gains: an increase of 16,612 TEUs (5.1%) in New York/New Jersey; 6,207 TEUs (6.3%) in Charleston, South Carolina; 5,451 TEUs (2.6%) in Savannah, Georgia; and 4,619 TEUs (11.3%) in Baltimore, Maryland.

In contrast, Descartes data shows December imports to Long Beach, California, down 29,635 TEUs or 8.5% in December versus November; imports to Los Angeles down 20,578 TEUs or 5.3%; and imports to Tacoma, Washington down 16,759 TEUs or 26%.

Top West Coast ports saw their share of total imports fall to 39.7% (versus 43.1% in November), while the top East/Gulf Coast ports’ share rose to 44.9% (versus 42% in November). The coastal balance swung eastward last month.

2023 handily tops pre-COVID imports

The full-year U.S. import tally ended strong, despite all the dire predictions in the first half of this year.

American consumers spent more in the post-COVID period on services, but they also kept spending on goods, supporting inbound containerized volumes.

Full-year imports came in at 24,959,664 TEUs, according to Descartes. Compared to pre-COVID years, 2023 topped 2019 by 4.6%, 2018 by 3.8% and 2017 by 11.5%.

Related articles:

- West Coast shipping rates surge as Red Sea fallout goes global

- Container shipping rates spike as Red Sea crisis draws first blood

- How safe is Red Sea? Different shipping lines have different answers

- Panama Canal transits plunge as larger ships are turned away

- Shipping braces for impact as Panama Canal slashes capacity

- Red Sea fallout much greater for containers than tankers, bulkers

- Red Sea chaos should boost tanker and container shipping rates

- Yet another shipping ‘chokepoint’ risk as Yemen rebels attack

- Zim container ships divert as threat to Israel-linked vessels mounts