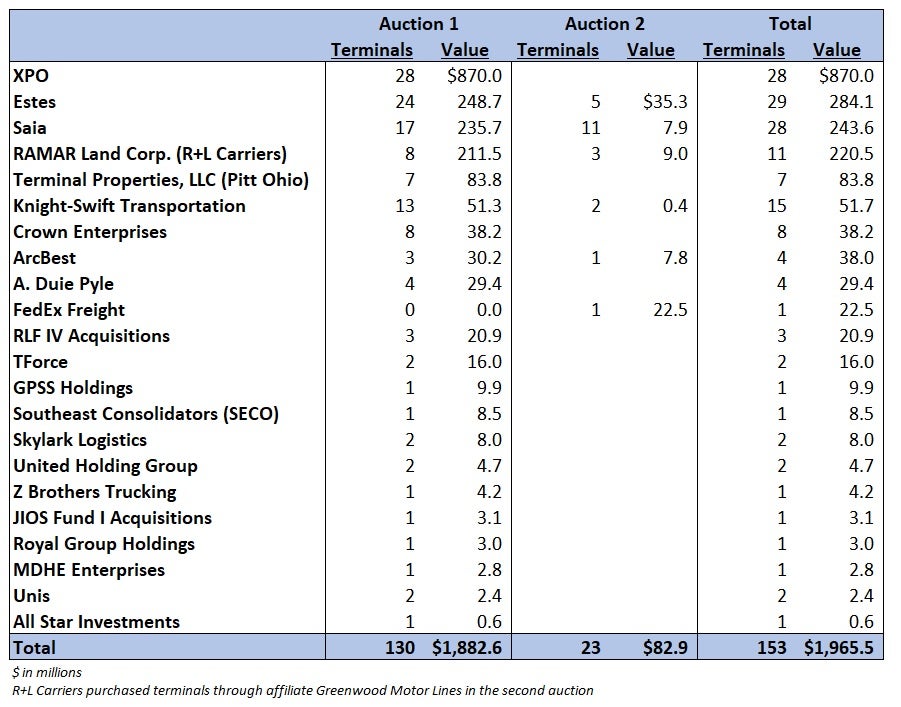

A Delaware bankruptcy court blessed the sale of 23 of bankrupt less-than-truckload carrier Yellow’s leased service centers on Friday. The second round of terminal sales will fetch $83 million, according to court filings.

A Dec. 20 filing with the court originally showed the results from the two-day auction that began on Dec. 18. The latest transactions were said to represent “the highest or otherwise best offer” for the assets.

A hearing scheduled for Friday was canceled as all objections to the sales had been resolved. In recent weeks, numerous landlords had filed objections with the court, claiming that cost-to-cure estimates provided by Yellow showed amounts much smaller than those actually due for repairs and back rent. Some of the property owners also wanted additional time to vet their new LTL tenants.

The first round of terminal sales included 130 terminals, most of which were owned, and raked in nearly $1.9 billion.

FedEx Freight (NYSE: FDX) was a newcomer to the proceedings with a winning bid for one terminal near Reno, Nevada, valued at $22.5 million. The nation’s largest LTL carrier undertook a plan last spring to unload 29 terminals, predominately in the Midwest, in efforts to right-size its national network.

The rest of the winning bids in the second auction were from five other carriers that were also active in the first round.

Estes had the largest bid at $35.3 million for five properties. It previously landed 24 terminals valued at $248.7 million.

Greenwood Motor Lines (R+L Carriers) won three terminals with a $9 million bid. It took home eight in the first round for $211.5 million through its real estate arm Ramar Land Corp.

The filing showed that Saia (NASDAQ: SAIA), ArcBest (NASDAQ: ARCB) and Knight-Swift (NYSE: KNX) will again add some of Yellow’s real estate to their networks.

Prior court filings showed the estate still needs to unwind 118 leased properties and 46 owned terminals. No update was provided on that auction process. In total, the estate has moved close to half of the company’s nonrolling stock at a price tag of nearly $2 billion.

A separate liquidation of Yellow’s 12,000 tractors and 35,000 trailers remains ongoing.

The court is expected to soon hear arguments regarding Yellow’s potential withdrawal liability claims from multiemployer pension funds that filings have shown could exceed $7 billion. However, bankruptcy experts have communicated to FreightWaves that the claims are likely to settle for just a fraction of that amount.

Other outstanding claims to the estate include more than 200 personal injury claims and payouts due, if any, for failure to timely comply with Worker Adjustment and Retraining Notification Act guidelines.

More FreightWaves articles by Todd Maiden

- PS Logistics acquires flatbed, dedicated hauler Buddy Moore Trucking

- Morgan Stanley sees inventory restock producing freight upcycle soon

- Transportation capacity up again in December, prices fall faster

Old man Henry

The teamsters threw 22 thousand families plus 8 thousand nonunion families under the bus just to prove to UPS they were dead serious about shutting down companies that won’t give what the union wants; funny now 12 thousand families at UPS will be looking for jobs because of the great contract Sean O’Brien negotiated for the UPS workers ! I hope Yellow prevails in their lawsuit against him and the teamsters !

Shane

Upper management got a bonus in July, non-union employees were given a severance package, union employees got nothing. We are owed money from work done, vacation days, settled grievances, non-settled grievances that kept getting put off, sick days, etc.

There’s people commenting about how the union should have gone with the proposed change of operations, but they have no clue what was actually proposed. Yellow wanted to change the contract without negotiations. It was bad enough Yellow didn’t honor their part of the contract. Yellow refused to listen to the employees on how to make day-to-day operations better on a local level, they refused to provide help for the end-of-line terminals (who were either too short on their trailer pool, or understaffed, or both), they refused to implement agreed upon practices from grievances won, payroll would constantly forget to add vacation pay or sick pay to employees checks, the list goes on and on.

Yellow freight, in my opinion, was just outright union busting, and the sad part is, they are getting away with it.

Freight Zippy

Proof that Yellow worth much more dead than operating as a carrier.

The Teamsters did nothing to protect these employees and few have gotten jobs in the industry.

My guess is there will never be another LTL carrier organized by the Teamsters Union after this abortion.

Michael Middleton

It is unfortunate that the teamster’s union did not support the Companys plan to restructure assets to improve operating efficiency. It should be clear to everyone that Yellow had the assets to keep the company going. The losers here are the union drivers.

Ed

Clint Elliott you can get hired check out r&l Carriers website… Tell him Ed sent you from Norwalk

Curley sockwell

Hello I was one of the driver for yellow freight are they going to pay us for our pension and vacation time we earned can you leave me a email

Dennis Stout

What about the employees is owed money write about that

Who cares about who bought what they screwed the employee’s

Fight for that or write about that

Clint Elliott

It’s like Yellow Corp is bragging about how much $ is being generated with the sales of It’s assets yet they owe me over 3k. I personally know a former employee they owe over 25k in vacation pay. He was going to use his vacation pay in 2024 when he retired after 20+ years of working there. Their should be some stories about how crooked uper management is. Giving themselves millions in bonuses a month before closing the doors. Not giving the employees notice of closure. They didn’t pay anyone’s vacation owed, and getting around the waren act…. working there was a mistake. I now can not get hired in the LTL industry because i was former union. Don’t get me started on the union- they ghosted every one i knew that worked there when they closed. The only time i needed help from the union was to find employment after the closing of Yellow, and to get paid the 3k they owe me. The union wouldn’t even return a call. The Teamsters are a joke. The real story should be where is all this $ going. Why are the management not getting investigated for the misuses of all the $ that lead up to the closure. Im sure you know of the 700 million $ bailout a few years back. The upper management should be behind bars. At the very least their assets taken away.