It may be more than a week until the end of January, but various market signals are starting to shout that cold weather’s potential impact on lifting diesel prices has run its course.

Against that bearish backdrop, the benchmark price used for most fuel surcharges declined Monday for the 14th time in 18 weeks. The Department of Energy/Energy Information Administration’s average weekly retail diesel price declined 2.5 cents a gallon to $3.838 a gallon. The price posted late Monday claws back all but one cent of the 3.5 cents a gallon increase that was posted a week earlier.

The scorecard for this huge secular decline now reads as follows: since Sept. 18, when the DOE/EIA price was posted at $4.633 a gallon, the average price of diesel according to the agency has dropped 79.5 cents, and it was down an additional cent two weeks ago for the low point in this series. The price is down 76.6 cents a gallon in the last year. Since its all-time high of $5.341 a gallon on Oct. 24, the DOE/EIA diesel benchmark has declined $1.503 a gallon.

The latest decline comes as traders, who are betting for a price rise, realize that a cold winter is not going to ride to the rescue of traders who have bet on higher prices.

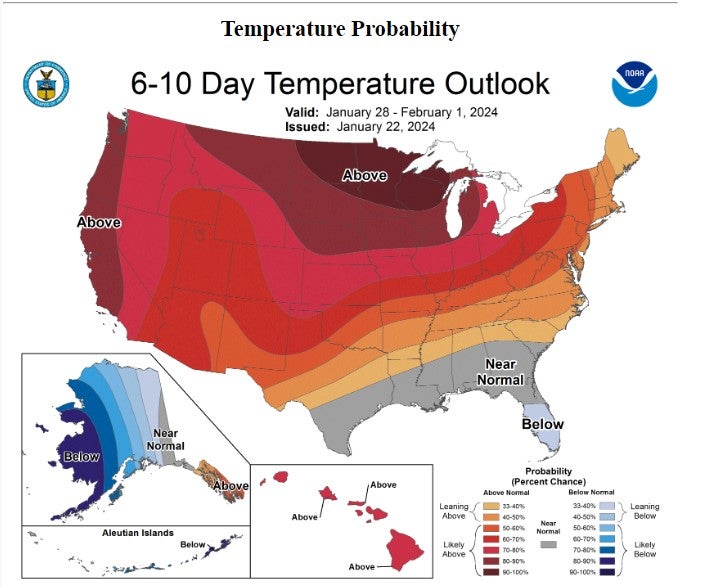

This chart released Monday by the National Oceanic and Atmospheric Administration shows that warmer-than-usual temperatures are in store for much of the country over the next 10 to 14 days. By the end of that period, the heating season, at least from the perspective of oil trading, is largely done. The front-month contract for ultra low sulfur diesel on the CME commodity exchange, which serves as a proxy for heating oil, is trading March barrels.

That does not mean that a sudden dip in temperatures might not make short-term heating oil — and by extension diesel — prices surge. It means that it won’t be the start of a long draw on inventories that could go on for weeks, because by the second week of February, at least in the heating oil market, spring is in sight.

The impact of that warmer weather is most visible in the price of natural gas delivered at the Henry Hub in Louisiana. Its recent peak was $3.313 per thousand cubic feet on Jan. 12. Monday, with the warmer weather forecast firmly in place, it settled at $2.419, down almost 90 cts in just five trading days.

At this point, there is one bullish factor in the market: the continued diversion of all sorts of shipping, including oil, away from the Red Sea/Suez Canal and instead around the Cape of Good Horn, whether it be eastbound or westbound. A recent chart from the energy consultancy of Energy Aspects showed how the diversion of tankers carrying middle distillates, which includes diesel, has risen.

That activity ties inventory up for longer, which is bullish for prices.

But physical diesel markets are showing signs of weakness or at least stability. Last week, when the price of ULSD was flat over the course of the four trading days, wholesale diesel prices declined, as evidenced in the ULSDR.USA data series in SONAR, a national average of wholesale diesel prices.

Wholesale prices are impacted by many factors, but the two biggest factors are the price of ULSD on CME and the differentials to that price posted in key trading areas for physical barrels, such as the U.S. Gulf Coast or the New York harbor.

Despite the relatively flat CME price for ULSD last week, the ULSDR.USA data series fell to $2.585 a gallon Monday from $2.654 on Jan. 12. That sort of decline would set the trend for changes at the retail level, which as the DOE/EIA price shows, is declining.

Diesel in several of those key physical markets is showing weakness. The differential between physical diesel in Chicago has weakened slightly. According to data from DTN, the differential fell Monday to minus 51 cents a gallon; it was minus 45 cents on Jan. 16. In Group 3, a Midwest region, the spread Monday was minus 44.5 cents a gallon. On Jan. 12, it was 10 cents a gallon stronger.

At minus 15 cents a gallon, prices in Los Angeles on Monday were at their widest differential since April, according to DTN data.

More articles by John Kingston

State of Freight takeaways: Impacts of the deep freeze; data looking up

Teamsters rack up late 2023 wins, stage significant strike in 2024

Supreme Court rejects review in broker liability case, leaving the issue unresolved