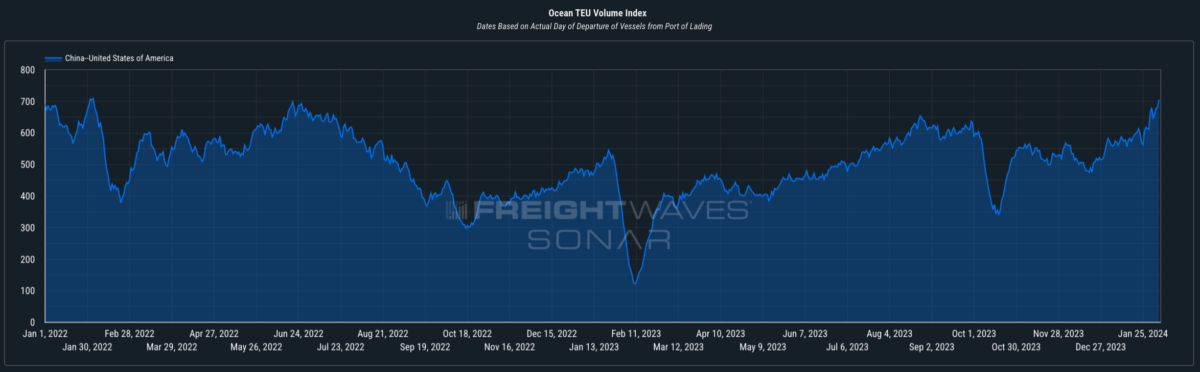

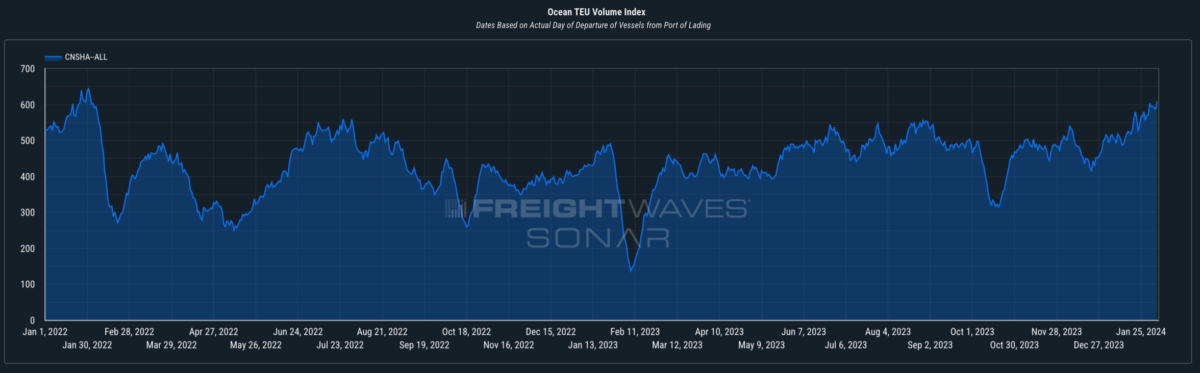

There’s a seeming contradiction in the macroeconomic and trade data coming out of China these days: Despite contracting industrial activity, low consumer confidence and a worsening stock market rout, China is currently sending the highest volume of ocean container freight to the United States since May 2022.

Part of the surge in shipments is due to the traditional pre-Chinese New Year surge, when factories on China’s coast move a flurry of goods to the port before their workers depart for a long holiday in their hometowns. But this year’s peak is well above 2023’s anemic Chinese New Year season, and volumes have been mounting all year.

Container volumes from China to the United States are steadily growing at a time when the macroeconomic picture in China couldn’t be more uncertain. China’s manufacturing Purchasing Managers’ Index contracted in January for the fourth consecutive month. China’s second-largest property developer, Evergrande, is being liquidated, with approximately $300 billion in debts against $245 billion in assets. Chinese stocks have been in a deepening rout: The CSI 300, an index of the 300 largest stocks on the Shanghai stock exchange, is down more than 19% over the past year. The Chinese government has taken steps to limit short selling by domestic institutional investors and is considering asset purchases exceeding $1 trillion in order to put a floor under the market.

Why, if China’s GDP growth fell to 5.3% in 2023, its slowest growth of the 21st century, is the port of Shanghai (for example) shipping more volume than at any time in the past two years?

It appears that volume isn’t so much being pushed out of China by a burgeoning manufacturing sector so much as it’s being pulled out of China by U.S. importers who have burned off inventory and are preparing to face higher-than-expected retail sales. In November 2023, the most recent date for which data is available, U.S. inventory-to-sales ratios fell to 1.37 months, well below pre-pandemic baselines. Meanwhile, in December 2023, U.S. retail sales grew 4.8% year over year to $709 billion, outpacing overall y/y GDP growth of 3.3% in the fourth quarter of 2023.

February and March should be relatively strong months for U.S. ports, particularly on the West Coast. In general, when inventories are low yet economic growth is strong, transportation providers find themselves in a more favorable business environment. Retailers and manufacturers need to move higher volumes of goods and accelerate the velocity of freight through their networks, which tightens transportation capacity and raises rates.

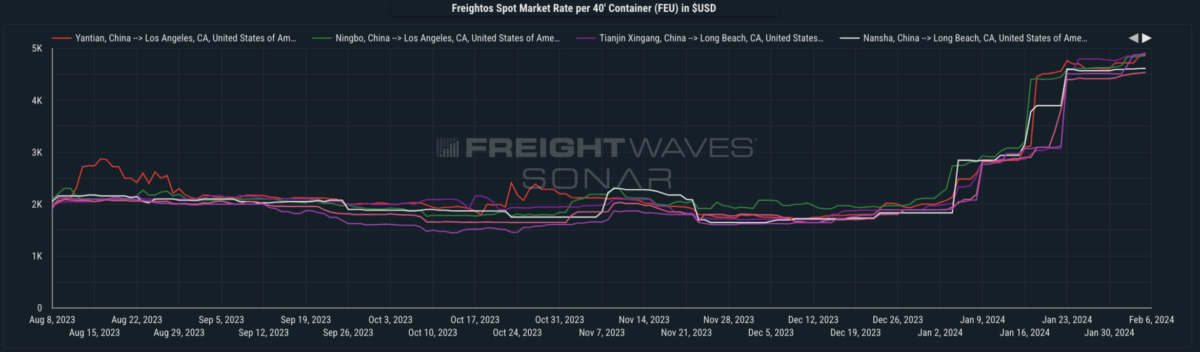

On the other side of the planet, Houthi terrorist attacks against international shipping in the Red Sea have necessitated diverting shipping from the Suez Canal around the Cape of Good Hope, extending transit times and effectively removing containership capacity from the market. Because those strains on steamship line networks are coinciding with higher volumes out of China, eastbound spot rates on the trans-Pacific have ripped upward to more than $4,500 per forty-foot equivalent unit on most lanes out of China to the West Coast.

In C.H. Robinson’s fourth-quarter earnings call on Jan. 31, CEO Dave Bozeman commented on the crisis’ impact on global supply chains and container rates.

“In the wake of the ongoing conflict in the Red Sea and low water levels in the Panama Canal, global supply chains are facing transit interruptions and vessel rerouting, which is causing extended transit times and putting a strain on global ocean capacity,” Bozeman said. “While the Asia-to-Europe trade lane has been most affected, the impact is extending to other lanes as carriers adjust routes based on shipping demand. As a result, ocean rates have increased sharply in Q1 on several trade lanes, including Asia to Europe and Asia to North America. While the Red Sea disruption continues without any clear timeline of when it will be resolved, the strain on capacity and the elevated spot rates are expected to continue through at least the Chinese New Year.”

According to the Port of Los Angeles’ PortOptimizer, Week 6 TEU volumes were up 38.6% compared to the same week in 2023 (105,076 TEUs vs. 75,801 TEUs). In other words, volumes are already elevated compared to last year, and there’s reason to believe that even more is on the way.