Wise PanAmerican Solutions (WPS) has stayed busy since the start of 2024 helping international companies interested in doing business with Mexico.

The Austin, Texas-based company offers services aimed at assisting firms looking to expand or establish cross-border operations in the country.

“This year started with an increase in demand for our services as compared to the previous year. It may be related to the fact that nearshoring projections are expected to reach their peak in 2024-2025,” Tatiana Skumatenko, who oversees WPS’ business development between the U.S. and Mexico, told FreightWaves.

Mexican carriers importing goods to the U.S. are also seeing significant growth as nearshoring continues to ramp up, according to a recent report from Motive, an AI-powered integrated operations platform.

San Francisco-based Motive serves more than 120,000 businesses in industries such as trucking, logistics, construction and agriculture.

“Mexican carriers importing U.S. goods have been some of the biggest beneficiaries of [nearshoring], as the number of Mexico-based vehicles registered for cross-border shipping grew by 14.3% and the average fleet size grew by 11.3% in 2023. Mexico’s trucking market grew 2.3% last year, compared to a U.S. trucking market that saw a 6.6% contraction in 2023,” Motive said in its economic report for March.

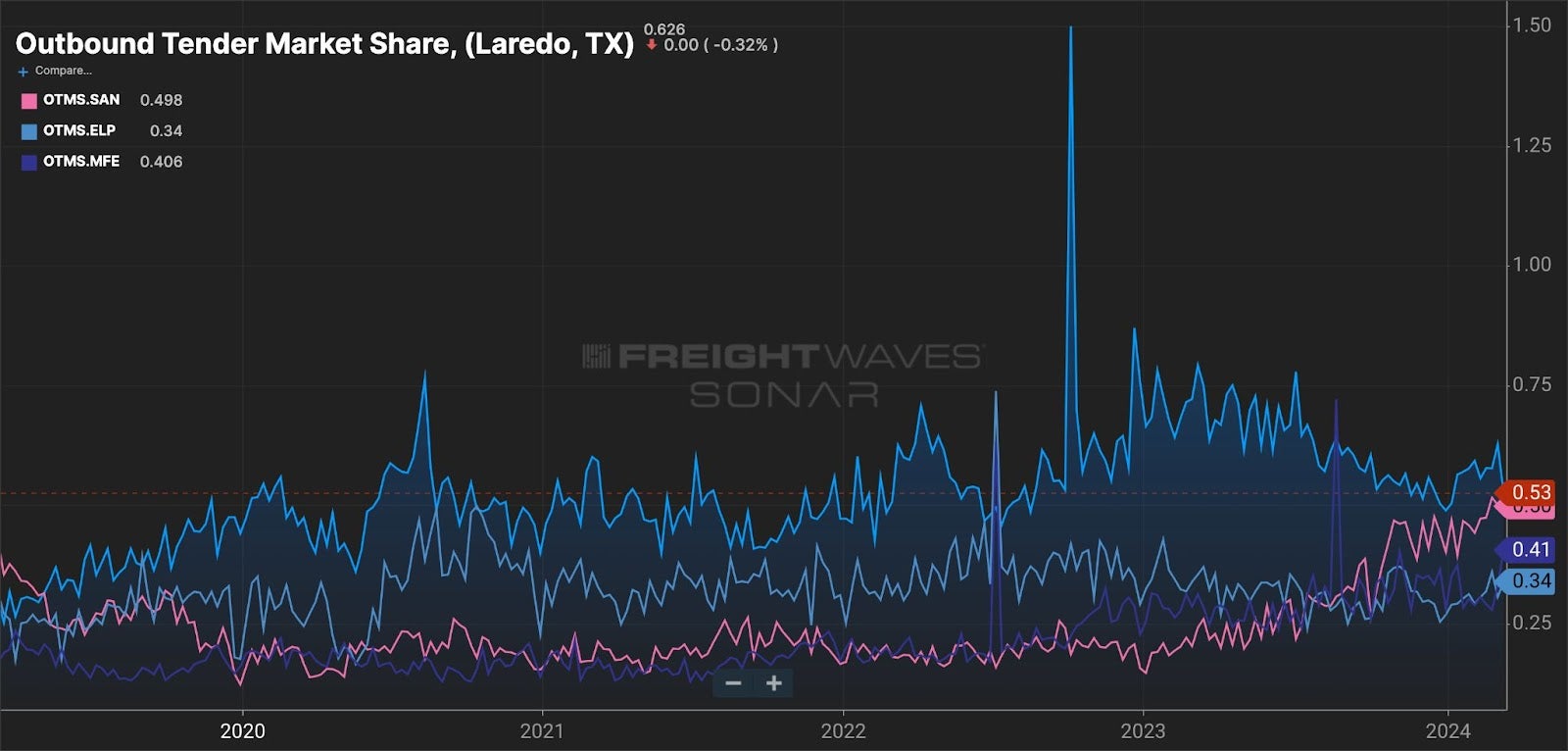

The movement of freight out of Mexico can be seen in FreightWaves SONAR data when comparing truckload demand out of markets in the Southwest. Cross-border markets in San Diego, as well as El Paso, Laredo and McAllen, Texas, have seen demand for capacity steadily increasing since 2019.

As more companies look at doing business in Mexico, Skumatenko said customers are particularly eager for information about the cost of operating in the country.

“The most common questions we are getting are about the costs of starting a business in Mexico, the time frame for each step of the process and the process itself: How we do what we do?” Skumatenko said. “In some cases, we’ve heard safety concerns, which we can manage with private and corporate security services.”

Skumatenko said WPS is hearing from companies of all sizes and from various industries about operating in Mexico. The types of operations reaching out in recent months include sectors such as semiconductors and industrial machinery manufacturers, electronic waste recyclers, food producers, and service companies.

“Larger companies, usually original equipment manufacturers with contract manufacturers in Mexico, need help to verify the performance and compliance of those maquiladoras, while others wish to relocate their production altogether,” Skumatenko said. “Not every company wants to relocate its factory from the get-go. Some start small, by opening a local office or hiring a salesperson or a representative, usually through an employer-of-record entity.”

Some companies are looking to outsource back-office or front-office services in Mexico, while others firms are seeking new distributors or sources of products and raw materials, according to Skumantenko.

“Some companies want to be present in Mexico but are not yet ready to make a bigger commitment, so they seek local distributors while importing and delivering their products through a vendor managed inventory program,” Skumantenko said. “To source ingredients or finished products, and verify the quality of those products, foreign companies don’t need to be physically present on the market — only to have a trusted ally to do that for them.”

Texas court sides with Union Pacific over 1872 jobs pact with town