Following dismal first-quarter results, heads of two of the nation’s largest truckload fleets provided constructive market commentary at a Wednesday investor conference. That said, the long slog back to market equilibrium continues as the industry slowly purges the excess capacity added during the freight boom.

“By no means am I here saying I think we’re at a turning point or an inflection point, but I do believe, just like it took a long time to get this low and we stayed this low for this long, it’s taken us awhile to maybe pick up on some of the signals that are out there in front of us that seem to be more positive,” said Derek Leathers, chairman and CEO of Werner Enterprises (NASDAQ: WERN), at Wolfe Research’s annual transportation and industrials conference in New York.

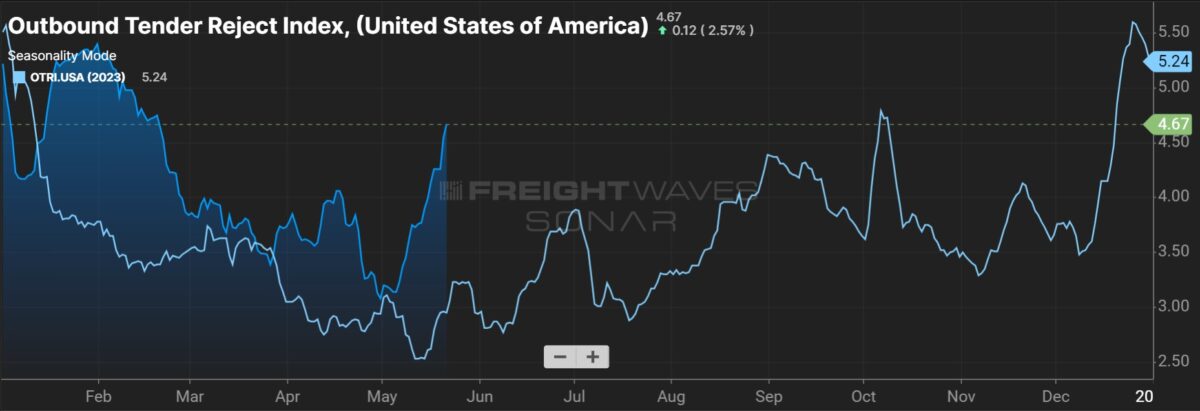

Leathers pointed to a notable decline in the number of trucks posted on load boards during the past two months and a more normal tightening in capacity during International Roadcheck, an annual 72-hour inspection blitz by law enforcement, held last week. He also said recent customer conversations have been positive and that all the discount retailers Werner serves under dedicated contracts have increased their truck counts this year.

Mark Rourke, Schneider National’s (NYSE: SNDR) president and CEO, said the company has been able to capture low-single-digit price increases on contractual renewals in its one-way TL business.

“We think that’s some place that we can build upon as we get through the rest of the allocation season,” Rourke said.

He noted that some of the price increases corresponded to lost share within certain customer accounts but that overall, the company has been able to positively navigate bid season thus far. Schneider has completed roughly 40% of its one-way contractual negotiations this year.

Werner has seen some price renewals move higher but “not across the board.” However, it is seeing less pressure from shippers to reduce rates, a decline in customer churn and improved bid compliance for previously awarded freight.

“This time around, we’re not seeing that same level of dislocation,” Leathers said. “We signal with pricing what we want to retain, and we’ve been able to do it.”

Werner’s bid season will be half-complete by the end of the second quarter.

The company reiterated rate guidance when it reported first-quarter results on April 30. It expects revenue per total mile in the one-way segment to be down 6% to down 3% year over year (y/y) in the first half of the year, with revenue per truck per week in the dedicated unit flat to up 3% y/y for the full year.

Leathers said most spot freight is on load boards and not reflective of the drop-trailer and other engineered solutions the big carriers offer. As such, he doesn’t think contract rates need to reset lower than spot rates for the cycle to turn.

“I don’t think that you’ll need to see spot supersede contract to see it become meaningfully obvious that this market has turned,” Leathers said.

Both carriers have more than 60% of their trucking assets placed under contractual dedicated agreements.

Asked about margin improvement, Leathers said Werner likely won’t see a “pronounced step up” in margins from the first to the second quarter as previously renegotiated rates are still being implemented on some business. However, he expects margins to improve throughout the year, noting that recent utilization increases (one-way miles per truck up 11% y/y during the first quarter) have come on the downside of the rate cycle, implying favorable leverage when the market turns as the higher level of miles garners better rates.

He said the dedicated fleet also has leverage when demand improves as truck counts will increase on a per-account basis. Additions to existing fleets already operated by Werner won’t accompany incremental startup costs.

Rourke expects operating margin improvement throughout the year even if the market doesn’t improve. He said the company’s long-term TL margin target of 12% to 16% remains but noted it may take awhile to get there on a full-year basis. He said Schneider will be “much, much closer” to the target run rate next year.

Schneider posted a 97.2% adjusted operating ratio (inverse of operating margin) during the seasonally weakest first quarter. That will likely prove the trough for this cycle.

Werner’s 12% to 17% long-term adjusted operating margin guidance also remains intact, but Leathers sounded a little less optimistic about hitting that range by year-end as previously hoped. The company’s 95.3% adjusted TL OR in the first quarter was also a cycle worst.

Both companies see an opportunity for large, transformational acquisitions.

Rourke said the M&A market should improve into the back half of the year and that it could take on something on a “much broader basis than [the] $200 to $250 million acquisitions” it has executed in recent years.

Leathers said he expects to see more consolidation among freight brokers. He also said “larger is actually not harder” when it comes to acquisitions, and that Werner may pursue a larger deal with robust integration synergies.

Shares of WERN closed up 2.4% on Wednesday while shares of SNDR were up 3.4%. The S&P 500 was down 0.3% on the day.

Stephen Webster

In Canada we still have 7000 too many trucks with drivers last Dec we had over 20 000 too many trucks and drivers

. We both Canada the United States and Mexico need to improve traing for new truck drivers and Set a industry wide standard of providing both liability insurance and medical care ( insurance) for all truck drivers and set a min rate to be paid on payroll for all drivers both truck Bus and Uber type drivers. The United States can not allow lower wage drivers that are from countries with lower safety standards and new truck drivers from here with out enough traing to come in to cause these boom and bust cycles. I see the results in Ont Canada in the homeless shelters

Matthew wagoner

Let’s see data on the auto industry.

James Bauman dba Kirplopus MC 895097

It’s a little bit like The FED’s proxies trying to amp up the stock mkt; nice words yet not nice facts, IMO. The FED today also revised it’s mood about inflation; saying that inflation is more worrisome than it previously assessed. It (The FED) should know; as it just printed money to bail out another bank (NYCB) to the tune of $5B. Printing money is directly responsible for inflation; when we on on gold standard , there was zero inflation. Need to go back. BRICS might force this; as it is gold backed $ dollar is junk nowadays. Here it is “produce season.” I just bought a quart of blueberries; the price was $8 / qt ; almost double the price it was last few years. So I think this small example is very reflective of a larger reality. Inflation, higher costs of goods; less purchases therefore; slower sales; less freight.

Mark Stephens

The Supply Chain Pendulum Swing

An observation by Mark Stephens

Volume capacity. Outbound tender volumes. Spot market rates. These are but a few terms used in the trucking industry within the United States supply chain.

As with any cost to profit business supply and demand remains the critical constant by which one makes predictive analysis.

In a balanced market, freight movement compares nicely to trucking capacity. Trucking capacity is the measurable available units bidding for loads; these loads are often found on load boards such as DAT, CL Robinson, 123Loadboard to name a few.

In today’s current market we find ourselves in a conundrum as such. Where supply is abundant, but so too are empty trailers whose movement depends on quick timing and flexible negotiated compromising techniques by planners and dispatchers.

Pre-pandemic figures categorize nicely into the predictive ebb and flow of the pendulum swing supply chain. The pendulum swing you ask? Essentially it’s the range of profit margins targeted and often surpassed within the supply chain participant namely the shippers and receivers also known as customers and that of the carriers and brokers. Ironically, the margins have hovered in the 30% for either partner. That is before the 2020 covid era. The supply and demand formula was absolute during this time due to the unpredictable consumer buying phases. Production plants, distribution centers and off market third party logistic warehousing begin over ordering and quickly filling beyond maximum capacity. This exasperated increase to the normal pendulum swing was a primary effect of rate escalation.

Carriers, owner operators and brokers reacted in similar fashion akin to the California Gold Rush of the mid 1800s or the oil fracking business in recent years. Carriers and owner operators began purchasing additional equipment then was available such as semis and trailers, old and new. One couldn’t find a semi for sale at that time, but if a truck was located the sale price was at least 50% over the normal value just a mere a few months prior.

As far as the new trucks, orders are being taken a year in advance. Only problem was the computer chip issue which was currently being delayed during development in China perhaps politics played a role, nonetheless the entire concept could be called greed by those in the trucking industry. Actually the answer was well… it was greed.

As a retired history teacher, I do recall 19th century philosopher George Santayana’s century old adage, “by not knowing relative history, there’s an excellent chance of repeating similar failure.” Doomed or condemned I believe was the operative adjective used.

The trucking capacity grew at an alarming scale yet the demand to move product remained the carrot to the thoroughbred. Rates were at their highest ever measured and the pendulum needle could not have reached any further than it did before the adverse effect began.

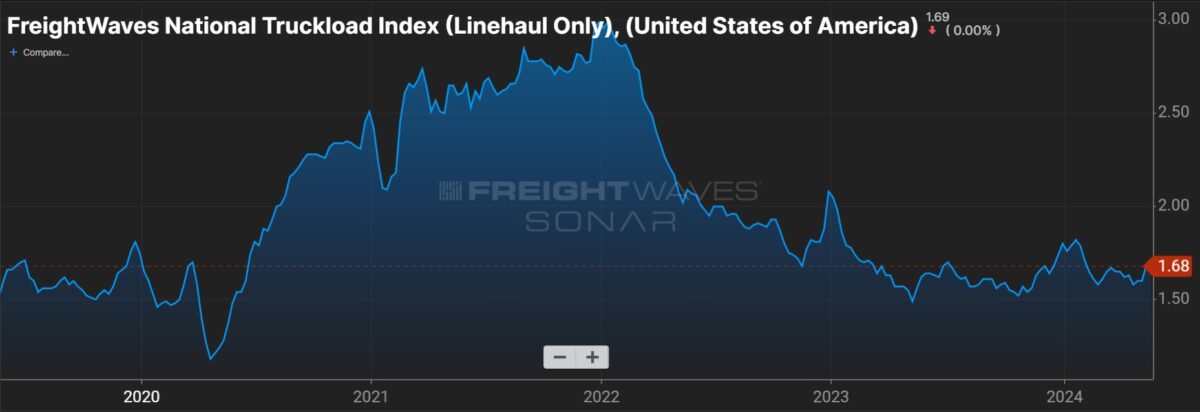

By the time carriers had received their pre-ordered trucks and trailers in 2023 the reflux of the pendulum began moving in favor of the shipper and receiver (customer) where it currently lies, albeit in a slow decline.

The anomaly is trucking capacity is still extremely high in spite of some of the lowest rates offered and agreed upon. Add that to the rise in fuel cost in 2023 the supply chain industry saw a devastating rise and carrier and broker bankruptcies with thousands either going out of business or parking their units.

Large carriers had a much better chance of surviving due to its potential cash flow and mixed with cost cutting actions compared to the SMB carrier.

Many analysts predict a settlement back to pre-pandemic normality this year. That’s wishful “hopeful” thinking. Bizlytics predicts spring of 2025 to measure closest to pre-pandemic volumes save fuel ventures.

The needed transparency within the supply chain would require one of the two partnerships to take it on the chin, so to speak, in order to balance this pendulum range and minimize it’s volatility. If an agreement was achieved to neutralize the influx of supply chain movement through supply and demand predictives and attainable profit margins would fall in a satisfactory target range the survival of all participants would become a reality; at least until the next pandemic.

Technology is moving along quite well. AI is becoming a more understood ally to the supply chain partnerships and those who exercise that technology will transcend to the top and to those who let’s say wing it, on their instincts, well let us not forget Dr. Santayana’s famous quote.

Mark Stephens

Bizlytics