Demand and rates for airfreight transportation continue to soar through the normally soft summer season, powered by the unrelenting strength of e-commerce fulfillment from China and shippers pulling forward orders for the winter holidays to protect against rising costs, capacity shortages and worsening ocean shipping delays.

Air cargo volumes remain elevated from major Asian and Middle Eastern origins, especially to Europe, amid cascading effects on port productivity resulting from the effective closure of container lines’ Red Sea shortcut because of the Middle East conflict.

At the same time, airlines are relying on business from China’s online retailers like never before. E-commerce has become the dominant force in air cargo shipping on the main trans-Pacific eastbound and China-Europe lanes as fast-fashion maker Shein, along with online markets Temu and Alibaba, push parcels directly to consumers without the typical seasonal ebbs and flows experienced by other retailers.

“Anecdotally, we’re looking at about 20% of global volumes today are e-commerce. In the trans-Pacific we’re in the 60%-to-70% range, and sometimes higher. And what’s astounding with this is we’re still only at the starting point,” said Glyn Hughes, director general of The International Air Cargo Association (TIACA), during a webinar in late May. “The e-commerce platforms are already foreseeing that they’re going to increase their needs for capacity in Q3 quite considerably from where they are today and they are opening up new markets.”

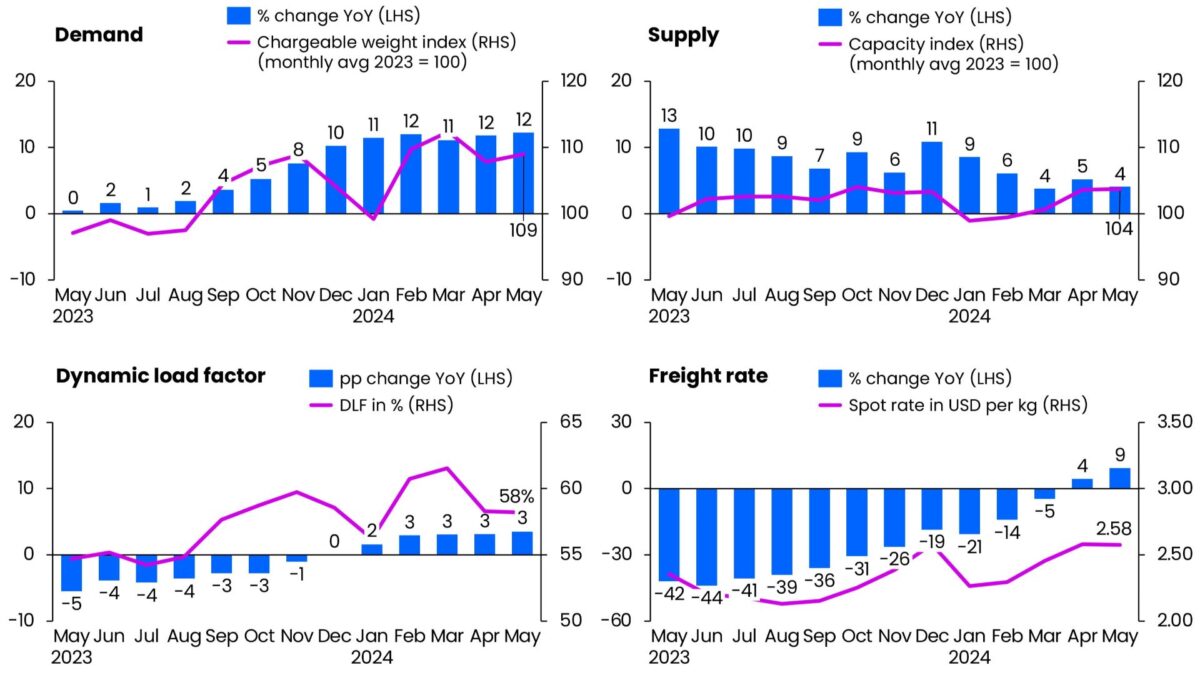

Whether the unexpected market growth is a harbinger for a massive peak shipping season starting in mid-September or is stealing from the future remains to be seen. Air logistics professionals at the start of the year projected volumes would grow 3.5% to 4.5% this year from the 2023 level. Instead, chargeable weight has increased by double digits for six consecutive months and shows few signs of letting up.

In May, global demand jumped 12% from the same month last year, and the spot rate — the current price for immediate delivery of goods — registered its second consecutive monthly growth, rising 9% to $2.58 a kilogram and up 5 points month over month, according to freight market tracker Xeneta. The positive momentum ebbed slightly during the first week of June, with volumes up 9% year over year, but was still relatively strong.

The International Air Transport Association, which uses a different methodology to generate data a month later, said demand climbed 11% in April — rubber stamping Xeneta’s prior estimate.

But in its latest outlook this month, IATA forecast demand to increase 5% for the full year from 2023, with industrywide cargo revenue falling $18 billion to $120 billion. The analysis suggests the trade group expects volume growth to slow in the second half of the year.

Meanwhile, global economic indicators appear increasingly favorable for air cargo. The Purchasing Managers’ Index (PMI) for new export orders in global manufacturing increased for the third consecutive month in April and industrial production remains in growth territory despite modest easing.

Ocean diversion

Deteriorating port conditions resulting from an unexpected surge in ocean volumes since the beginning of May are causing some businesses to shift loads to air cargo and pushing up airfreight rates, according to market watchers.

Cargo owners are front-loading holiday shipments typically booked in the second half of the year to avoid potential supply chain disruptions and make sure merchandise arrives in time for peak shopping season. Top of mind are rising freight rates, longer lead times and port congestion associated with vessel diversions to avoid Red Sea attacks, and a looming dockworker strike on the U.S. East Coast. When demand was stable early this year, carriers were able to shift excess capacity enough to keep containers on schedule.

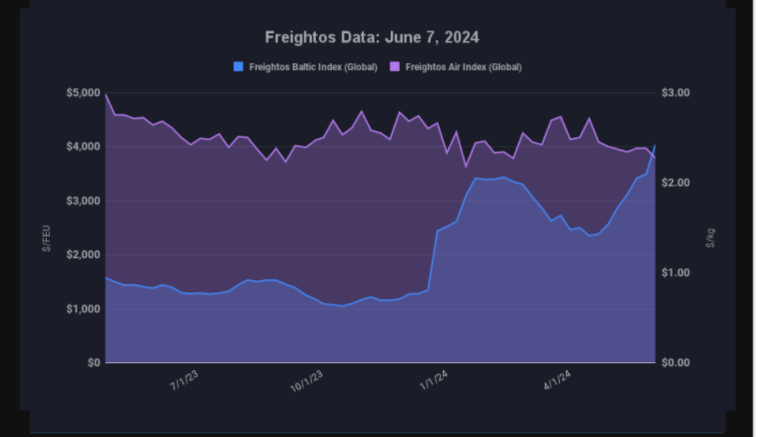

Now demand exceeds available equipment and vessels, as rerouting around Africa stretches carrier networks, resulting in vessel bunching and localized port congestion. The imbalance has caused container rates to jump far above seasonal norms. Daily trans-Pacific and Asia-Northern Europe rates are 50% higher than in April, nearly three times higher than a year ago and 3.5 times higher than in 2019, according to various benchmarking agencies.

Prices from Asia to the U.S. West Coast are approaching $6,000 per forty-foot equivalent unit and have surpassed $7,500 to the East Coast, with rates for each lane about $1,000 higher than their peaks early this year when the Lunar New Year coincided with the start of the Red Sea crisis, according to pricing platform Freightos. Shipping costs are expected to rise even more as carriers begin implementing peak season surcharges of as much as $2,000 per box.

The longer ocean transits combined with other delays led to a 12% year-over-year decline in schedule reliability in April, analysis by Sea-Intelligence shows. In the U.S., vessels arrive within their scheduled windows less than 50% on the West Coast and less than 40% on the East Coast.

Linerlytica noted that only six of 11 Asia-North Europe sailings departed on schedule last week because of port congestion in Singapore and Tanjung Pelepas, Malaysia. Delayed arrivals are also causing congestion at the ports of Shanghai and Qingdao in China. Drewry Shipping Consultants said 43 of 661 scheduled sailings, or 7%, on major East-West headhaul lanes have been canceled as carriers skip port calls due to congestion. Leasing rates are climbing as supply chain friction slows the circulation of containers. Average container leasing rates have doubled since November on the Shanghai-Los Angeles route to $1,100, says online marketplace Container xChange.

Maersk estimated that there has been a 15% to 20% reduction in available ocean capacity across the industry this quarter.

The spike in spot rates has motivated liner companies to roll containers under long-term contracts to prioritize more lucrative spot shipments. A recent survey of more than 50 logistics professionals by Freightos showed 70% of businesses had contracted volumes bumped from a scheduled vessel or contract prices adjusted up since early May.

As increases for ocean rates outpace those for air, the airfreight market becomes a more attractive alternative to some shippers. The average cost of shipping by air on the trans-Pacific trade lane is nine times greater than ocean shipping compared to 22 times higher at the start of December, before Houthi rebels escalated attacks on Red Sea shipping, Xeneta said in a May 10 blog post.

Separately, some businesses are also shipping early to avoid U.S. tariff increases on Chinese products and because they need imports to replenish stock and meet demand after a post-pandemic clearout of excess inventories, logistics providers and say. Flexport said that nearly half of respondents to a recent poll said that higher-than-expected sales increases are the reason for current booking levels. Walmart, Target and Amazon reported first-quarter inventory levels were down 3%, 7% and 9%, respectively, cementing the notion that the U.S. destocking cycle is over. U.S. inventory levels slightly contracted in May, according to the PMI, while European importers also appear to be aggressively restocking.

Dimerco Express, a large freight forwarder based in Taiwan, expects “more less-than-container-load shipments will switch to air freight starting in June, especially on the trans-Pacific eastbound route, resembling the situation in 2021. Furthermore, with the new tariff set to be implemented in August, it is expected that a surge in products related to this tariff will occupy both air and ocean capacity to meet the expected arrival dates before the tariff takes effect,” said Kathy Liu, vice president of sales and marketing, in the company’s monthly analysis of cross-border trade.

Monthly inbound cargo volume at U.S. container ports will reach its highest level in nearly two years this summer at 12.1 million twenty-foot equivalent units, up 15% from the same period last year, according to projections from the National Retail Federation and Hackett Associates. The previous two years also had elongated peak seasons as shippers reacted to supply chain disruptions.

The Red Sea situation is a key factor behind higher costs for air cargo. Global airfreight prices are 6% higher year over year. Rates in April and May were higher than in October and November — a remarkable fact considering now is usually a quiet period for shipping and the fourth quarter is the busiest. Passenger airlines also introduce more capacity for the summer travel season, which normally weighs on rates.

The ocean disruption has pushed up aircraft load factors by nearly 10 points on Asia-Europe lanes to more than 80%, creating a seller’s market, Xeneta said. Air cargo spot rates from Southeast Asia to Europe were up 34% in May year over year, and were up 43% to North America. Outbound rates from Shanghai are up 38% from the same week a year ago, according to the TAC Index. Shipping rates from the Middle East and Southeast Asia to Europe averaged $3.35/kg in May, more than twice their levels last year and significantly more than before Red Sea diversions started in December. India, Bangladesh and Dubai, where sea-air transfers have become popular as a way to minimize shipping delays around Africa to Europe, heavily contributed to the increase with tonnage and rates that are two and half times last year’s level.

Many businesses in Europe are frantically searching for airliner space, said Xeneta Chief Airfreight Officer Niall van de Wuow during a Xeneta webinar last month. Widebody freighters are mostly booked, and logistics providers are paying premiums to get priority access, industry executives report.

The limited recovery of passenger flights between China and North America since the pandemic because of political tensions and the growing reluctance of U.S. business executives to travel to China is a major factor in the tight capacity, and elevated rates, on that trade lane. Before COVID, airlines from both countries operated about 350 widebody flights per week. Only a third of flight activity has returned as of May.

The pre-shipping activity is happening despite questions about how durable consumer demand and factory orders are, leaving the possibility that the peak season could be more muted, or end sooner, than normal. But with multiple economic cross currents, getting a true read on consumer and business spending is difficult.

The latest data paints a picture of a U.S. economy growing at a solid, but slower pace, with analysts estimating U.S. GDP to grow 1.6% in the second quarter.

U.S. consumer spending rose a modest 2% in the first quarter, below estimates. New orders for manufactured goods increased by 0.7%, while shipments increased by 1%. Government data shows U.S. nonauto inventories increased by only 0.3% month over month in April, indicating cautious restocking by retailers. On the positive side, consumer prices cooled in May to 3.3% above last year while the labor market remained robust, which could give shoppers more confidence.

E-commerce bumps out general cargo

When it comes to the B2C online markets in China, including the new TikTok Shop, there is no peak season. Their fulfillment firehose is on full blast, year-round.

The market position of large e-sellers is so strong that 70% of air exports from Hong Kong and half of volumes flown out of Shanghai are small parcels, Dimerco’s Liu said on a recent podcast.

Shippers of general cargo are already having trouble securing airfreight capacity out of China and other regional hubs because of the e-commerce platforms’ buying power and long-term space allocation, according to logistics providers.

E-commerce platforms are sucking up about 30% to 40% of block space capacity — sections of the cargo hold reserved under long-term contracts — on flights from China to the U.S., according to market researchers. Many businesses that rely on air transport are shipping earlier to make sure they can book dwindling space for their goods — not because of the Red Sea situation.

The e-commerce volumes are forcing lower-yield general cargo to be trucked to airports in Vietnam, Thailand and Malaysia. Freight data firm WorldACD reports that on-demand air cargo quotes for flights from Vietnam to Europe have been more than double last year’s level for seven consecutive weeks.

TIACA’s Hughes said he expects online marketplaces to soak up huge amounts of freighter capacity out of Hong Kong and south China this fall. All-cargo carriers are likely to redeploy aircraft from the less profitable trans-Atlantic market, where passenger airlines are flexing fleets for the summer travel season, to the Asia market, he added.

Last Monday, Canadian airline Cargojet announced it had signed a three-year contract to provide scheduled Boeing 767 charter service three times per week from Hangzhou, China, to Vancouver, British Columbia, for Great Vision HK Express, an e-commerce logistics provider.

Trade on the China-to-Latin America corridor is seeing dramatic increases in demand and putting pressure on available capacity thanks to the rise of e-commerce and high-tech manufactured goods, combined with the lack of direct passenger flights between China and Latin America, Xeneta reported. Air cargo spot rates in May were more than double rates in the same month in 2019. Rates from China to Brazil were $1.60 more per kilogram than the rates from China to the United States — three times the pre-pandemic gap.

Temu last month began operations in Brazil, joining Shein and Alibaba that already offered delivery to customers there. Alibaba’s logistics division, Cainiao, brings orders to Sao Paulo on more than 14 Boeing 747 charter flights per week operated by Atlas Air. Some Cainiao-controlled flights also stop in Santiago, Chile.

RECOMMENDED READING:

Dave Salter

This article by Eric Kulisch drove some great conversations at ProShip this week. I’m sure many businesses are now looking at whether they are really prepared for the upcoming peak season. You are definitely worth following and I look forward to your articles!