Susquehanna Financial Group cut earnings estimates for less-than-truckload carriers following weaker-than-expected volume updates for August. The investment firm pushed out its call for a “gradual recovery” in demand to 2025, with the expectation that 2026 will deliver “more meaningful performance.”

“As we exit 3Q, we’ve been right on pricing holding up so far, but wrong on demand as underlying LTL volumes trended sideways-to-softer instead of sequentially strengthening,” analyst Bascome Majors said in a Tuesday evening note to clients.

Majors cut third-quarter and fourth-quarter estimates on average by 10% and 14%, respectively, for the LTL carriers he follows: Old Dominion Freight Line (NASDAQ: ODFL), Saia (NASDAQ: SAIA) and XPO (NYSE: XPO). Canadian transportation conglomerate TFI International (NYSE: TFII), which has LTL exposure through its TForce Freight subsidiary, saw estimates revisions of down 4% and up 1%, respectively.

Full-year 2025 estimates for the three U.S. carriers were cut by an average of 18%, with TFI getting a 5% cut. Majors issued 2026 estimates, which assume a more than 30% average year-over-year growth rate for the LTL-only group and 25% growth for TFI.

The near-term estimates assume the industrial economy remains soft with “fairly seasonal performance off this lowered base that builds gradually” throughout 2025. A full-blown recovery is forecast for 2026.

“In short, 2026 looks like the new 2025 for a freight recovery,” Majors said.

The call is based on the expectation that carriers will remain rate-disciplined. Public carriers said on second-quarter conference calls that they expect to continue to get mid-to-high-single-digit y/y contractual rate increases in the back half of the year. Also, no company has signaled a need to cut rates to fill the terminals acquired from Yellow Corp. (OTC: YELLQ), many of which have been recently relaunched.

Majors added that cooling inflation, interest rate cuts and an eventual exit from “a deep 2.5-year freight recession already long by historical standards” support his outlook. He said he has also been encouraged by “very early signs of price stability in the much larger truckload market.”

Why Q3 intraquarter updates disappointed

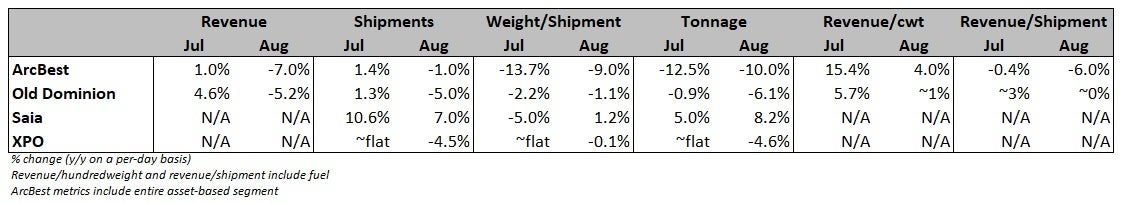

Midquarter updates issued earlier this month by public carriers showed y/y tonnage declines were worse on average in August (down 3%) than in July (down 2%). Saia was the lone outlier as its tonnage grew 8% y/y in August after a 5% increase in July.

The carrier was very active following Yellow Corp.’s demise last summer, aggressively taking on its abandoned shipments and later acquiring 28 of its terminals. However, its recent growth has favored lighter, retail shipments and more business from large, national accounts, which tend to have a weaker margin profile.

Excluding Saia’s third-quarter trends, tonnage among the other public LTL carriers providing updates was off 7% y/y in August, following a 4% decline in July. August faced tougher prior-year comparisons as August 2023 was the first month to fully benefit from Yellow’s exit.

Weight per shipment was largely negative again in the first two months of the third quarter. Lower shipment weights are usually a headwind to margins. Yields remained positive, but only two carriers disclose this metric intraquarter.

“While we expect carriers to continue pricing rationally, we model moderating yield growth for all LTLs with the onset of more difficult Y/Y comps (as carriers begin to cycle YELL’s demise in mid-2023) and ongoing softness in industrial demand with no foreseeable short-term catalysts,” Majors said.

Shares of ODFL (up 1.8%), SAIA (up 2.5%) and XPO (up 0.6%) were higher at 2:14 p.m. EDT on Wednesday compared to the S&P 500, which was up 0.3%. Shares of TFII were flat on the day.

LTLer

Freight Zippy:

Do try to keep up.

ABF is a subsidiary of ArcBest.

Currently it seems they are choosing yield over volume unlike some of their ltl competitors. I would hardly call that pitiful, just another way of surviving the current economy.

They will not be the last NMFA teamster ltl standing as they have had their own ABF agreement for the last 11+ years.

That will not change anytime soon.

Freight Zippy

Dan:

They are listed first in the grid.

Do try to keep up, besides they are a pitiful carrier can fortunate to be the last NMFA teamster LTL standing.

That all may change soon

Dan Lund

I did not see anything about the best LTL Freight Company ABF.