Guidehouse Insights has published an extensive report on the global prospects for internal combustion engines powered by hydrogen. You can spend $3,950 to buy the full report and its 43 charts tracking markets for H2 ICE. Or, you can read one of the author’s perspectives below.

Hydrogen ICE study: Not that great a solution

Except for some vocational use cases in North America, a forgiving regulatory environment in Europe and a drive for energy independence in India, the idea of using gaseous or liquid hydrogen for commercial transportation doesn’t look so great.

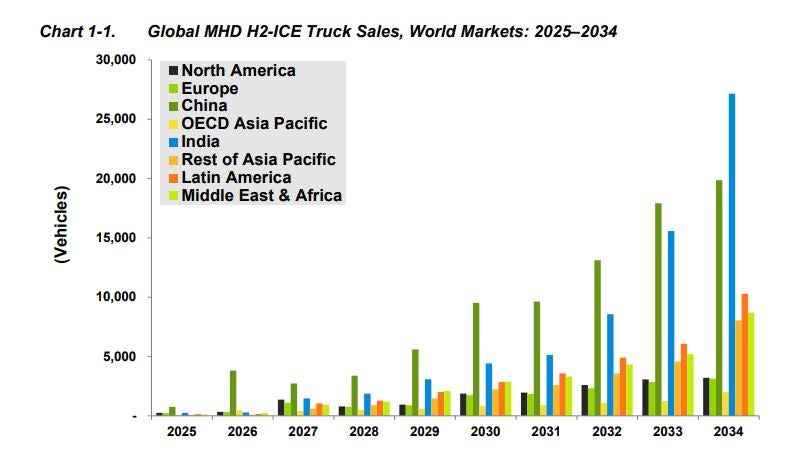

by hydrogen over the next decade. (Image: Guidehouse Insights)

“At best it’s a distraction,” Oliver Dixon, a co-author of the 43-page report, told me. He sees battery-electric trucks, despite concern about driving range limitations, as the leader in displacing diesel engines in the decades ahead.

“There’s still some room to go in terms of battery technology. And we’ve got a bit of a zero-sum game going on here. As battery trucks become more available in the near term, their acceptance within the market grows,” Dixon said.

A similar thing happened 15 years ago when selective catalyst reduction became the OEM standard approach to reducing carbon dioxide emissions. Navistar International paid a heavy price for sticking with exhaust gas recirculation in its MaxxForce trucks.

Buying in on a single answer – even if it’s not the best

“The transport industry will basically coalesce around a single technology type, not necessarily because it’s the most technologically superior, but primarily because it’s available, compliant and doesn’t break,” Dixon said.

States are pushing back against following California’s Advanced Clean Truck and Advanced Clean Fleet rules they once appeared to embrace. The state takes a battery-electric-or-bust approach to decarbonization. The backlash has more to do with the speed of implementation than the concept of electric trucks becoming the future of commercial vehicles.

Though new designs for electric trucks in Europe point to increased range – mostly by packaging more batteries – even at 310 to 370 miles on a single charge announced by Daimler Truck and Volvo Group, respectively, long-haul truckers would spend more time charging than they would filling with diesel.

Charging infrastructure still lags in Europe. And it is woefully inadequate in the United States to support an aggressive uptake of battery-electric trucks.

Hydrogen gets its moment

Over the past two years, hydrogen power – fuel cells and more recently H2 ICE – shook off their dismissal as an expensive alternative for transportation. Dixon found the talk compelling enough to begin a deep dive into its potential.

“As with a lot of research, it came about because if you hear something once, it’s an ad hoc remark,” Dixon said. “By the time you hear something 10 times, there seems to be some legitimacy to it.

“So whether or not we exist in an echo chamber right now in terms of decarbonization and transport, I’ve heard enough people talking about [hydrogen] in the abstract, that I [thought], ‘OK, yeah, let’s take a look.’”

Dixon found the evidence underwhelming. He concludes that hydrogen, especially green hydrogen made from renewables, is better suited to making cement and steel.

Europe is farther along than the U.S. in decarbonizing transportation because it assesses older vehicles more than newer ones for carbon emissions. It essentially exempts battery-electrics trucks from carbon fees. H2 ICE, despite emitting small amounts of smog-forming nitrogen oxide emissions by burning hydrogen, is poised to get zero-emission treatment like electric trucks do.

Regulatory uncertainty and inadequate infrastructure

The Environmental Protection Agency has not yet bought into that approach. That lack of certainty, and negligible hydrogen fuel infrastructure, has led engine maker Cummins to take a wait-and-see approach on the timing of a hydrogen ICE version of its next-generation X15 big bore engine.

Originally, the company talked about production beginning in 2027. Now it’s at least 2028. Meanwhile, the X15 diesel version that complies with EPA NOx regulations for 2027 has been pulled ahead by a year.

“There’s a lot of ways to reduce carbon,” Accerela by Cummins President Amy Davis told me at the IAA. “We’re also showcasing some hybrid concepts, which can start making headway without the infrastructure.”

Paccar Inc., which builds its own engines for Kenworth and Peterbilt trucks, also offers Cummins’ powertrains. Paccar’s DAF Trucks showed a version of a hydrogen ICE engine at the IAA in September. Cummins displayed its hydrogen ICE engine as well.

“We have a great relationship with Cummins,” Paccar Inc. CEO Preston Feight said Tuesday on the company’s third-quarter earnings call, responding to a question about a Cummins’ pull ahead of its next-generation diesel powertrain.

“We are well positioned for today’s emission standards, as well as the upcoming emission standards, and feel like we’ll be able to offer our customers the right products for the upcoming markets,” Feight said.

The Guidehouse report’s bottom line: H2 ICE has value but falls short of a breakthrough.

“Removing 50% of greenhouse gas emissions may not be as valuable as removing 90%. But making smaller reductions in the short term, with reduced complexity and cost, more than makes up for removing a higher percentage later,” the report said.

And what of Hyzon’s hydrogen fuel cell refuse trucks?

The nascent growth of hydrogen fuel cells got a boost this week when fuel cell system maker Hyzon reported a conditional order for a dozen fuel cell-powered refuse trucks from GreenWaste.

There is little history of fuel cells and refuse trucks. Republic Industries was going to buy 2,500 of them from Nikola back in 2020 before Nikola realized it couldn’t build to Republic’s specifications. The deal fell apart.

Several unknowns call into question whether the Hyzon announcement will result in production.

Whose truck will carry Hyzon’s new single-stack fuel cell system?

“The base chassis OEM has not been disclosed publicly at this time,” Hyzon said in an email.

Where will the hydrogen come from to fuel the trucks?

“[The] fuel supply source has not been disclosed at this time.”

Hyzon confirmed that privately held New Way Trucks is the contract manufacturer for the waste bodies.

Meanwhile, Hyzon’s future remains murky. After executing a 1:50 reverse stock split in September to fend off delisting from the Nasdaq, Hyzon shares continue to plummet, closing Thursday at $1.87. They are trading 93.82% lower over the past six months.

Briefly noted …

As Outrider CEO Andrew Smith explains in the Truck Tech short above, the autonomous distribution yard developer has plenty of projects for its $62 million D Series capital raise.

Freight mobility provider Einride is partnering with PepsiCo on a fleet of digitally optimized electric trucks in Memphis, Tennessee, to support Frito-Lay food distribution.

Netherlands-based logistics provider Simon Loos has ordered 75 eActros 600 electric trucks, It is among Mercedes-Benz Trucks‘ largest orders for electric trucks to date.

Truck Tech Episode No. 88: Life during wartime for Israel-based Ree Automotive

That’s it for this week. Thanks for reading and watching. Click here to subscribe and get Truck Tech delivered to your email on Fridays. And catch the latest episodes of the Truck Tech podcast and video shorts on the FreightWaves YouTube channel. Send your feedback on Truck Tech to Alan Adler at aadler@firecrown.com.

Hydrogen is the CLEAN energy that we need. Toyota, Bosch, Daimler, MAN, Volvo, Cummins are all testing prototypes now. as well as Kawasaki, Suzuki, HySe for small engines. so, its definitely not DOA!