This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 40 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volumes continue to recover, but challenged year over year

The truckload market has recovered from the Thanksgiving holiday, but with less than two weeks until Christmas, the rebound is likely to be short-lived. Throughout December, tender volumes have actually held up better than previous years, but it appears it has to do with the timing between Thanksgiving and Christmas this year compared to previous years.

To learn more about SONAR, click here.

The Outbound Tender Volume Index (OTVI), a measure of national freight demand that tracks shippers’ requests for trucking capacity, has continued to rebound from the Thanksgiving holiday, increasing by 7.46% over the past week and is up over 2% in the past month. Compared to this time last year, the OTVI is still down 5.29%. Part of the reason for the limited growth in the OTVI has been the growth in loaded intermodal volumes, which are up 11% year over year.

Volumes across the mileage band are continuing to rebound from the Thanksgiving holiday, but only the local length of haul, or loads moving less than 100 miles, has seen volumes grow over the past year. Volumes for local length of haul are up 3.12% year over year, while long-haul volumes or loads moving 800 miles or more are down nearly 10% y/y.

To learn more about SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, the recovery is far less pronounced, rising 6.9% over the past week, driven by an upward movement in tender rejection rates. Compared to this time last year, CLAV is down 6%.

November’s retail sales data is set to be released later this week, but early reads on spending in November were strong. Bank of America’s card spending report showed that spending was up 0.6% year over year in November. Even with the late Thanksgiving holiday that pushed Cyber Monday into December, expectations are for sales to grow by 0.5% m/m.

To learn more about SONAR, click here.

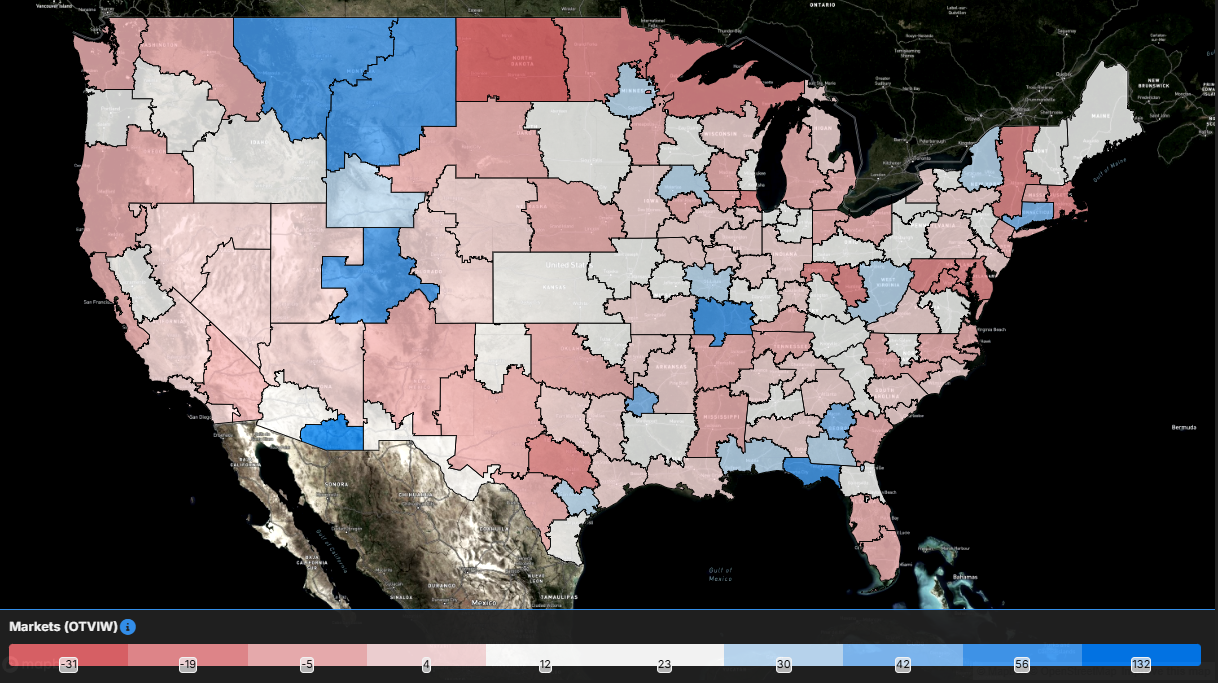

As volumes continue to rebound out of the Thanksgiving holiday, the vast majority of the markets in the country have higher volumes week over week. Of the 135 freight markets tracked within SONAR, 108 have seen tender volumes increase over the past week.

Volumes in the largest markets in the country have increased fairly significantly over the past week. In Atlanta, tender volumes have increased by over 10% w/w while farther up the East Coast, volumes out of Harrisburg, Pennsylvania, increased by 8.1%.

In the center of the country, it was more of a mixed bag as tender volumes out of Dallas increased by 9% but volumes out of Chicago fell by 12.6% week over week.

On the West Coast, tender volumes out of Los Angeles increased by 9.43% w/w, driven by significant increases in volumes ranging from 100 miles to 800 miles (short haul, midhaul and tweener lengths of haul). Long-haul volumes out of Los Angeles increased by 5.76% over the past week and are up 7.6% y/y.

To learn more about SONAR, click here.

By mode: The dry van market is leveling off at a higher level than it was in November. Over the past week, the Van Outbound Tender Reject Index increased by 7.3%. Some of that increase is a result of noise around the Thanksgiving holiday, but dry van volumes are up 1.7% over the past month, which shows there has been some growth since early November. Still, van volumes are down 5.8% year over year.

The reefer market continues to show it is holding up quite well as volumes are now near the highest level of the year. The Reefer Outbound Tender Volume Index has increased by 7.4% over the past week and is 5.8% higher than it was a month ago. Reefer volumes are up 7.5% year over year, suggesting that the reefer market is firmly out of its freight recession.

Rejection rates rebound, could reach double digits in coming weeks

After a brief decline following the Thanksgiving holiday, tender rejection rates are back on the rise. That is expected given the timing of the holidays and primes the next two weeks for a fairly significant increase, likely pushing double digits as tender rejection rates nearly doubled in the final two weeks in both 2019 and 2023.

To learn more about SONAR, click here.

Over the past week, the Outbound Tender Reject Index (OTRI), a measure of relative capacity, rose by 50 basis points to 6.48%. The OTRI is 253 basis points higher than it was this time last year, a sign that the market is tighter now than it was then. While tender rejection rates remain below 2019 levels, the increase in tender rejection rates has been steady as opposed to only around the holidays, which suggests that 2025 is likely to be a tighter environment than the past two years.

To learn more about SONAR, click here.

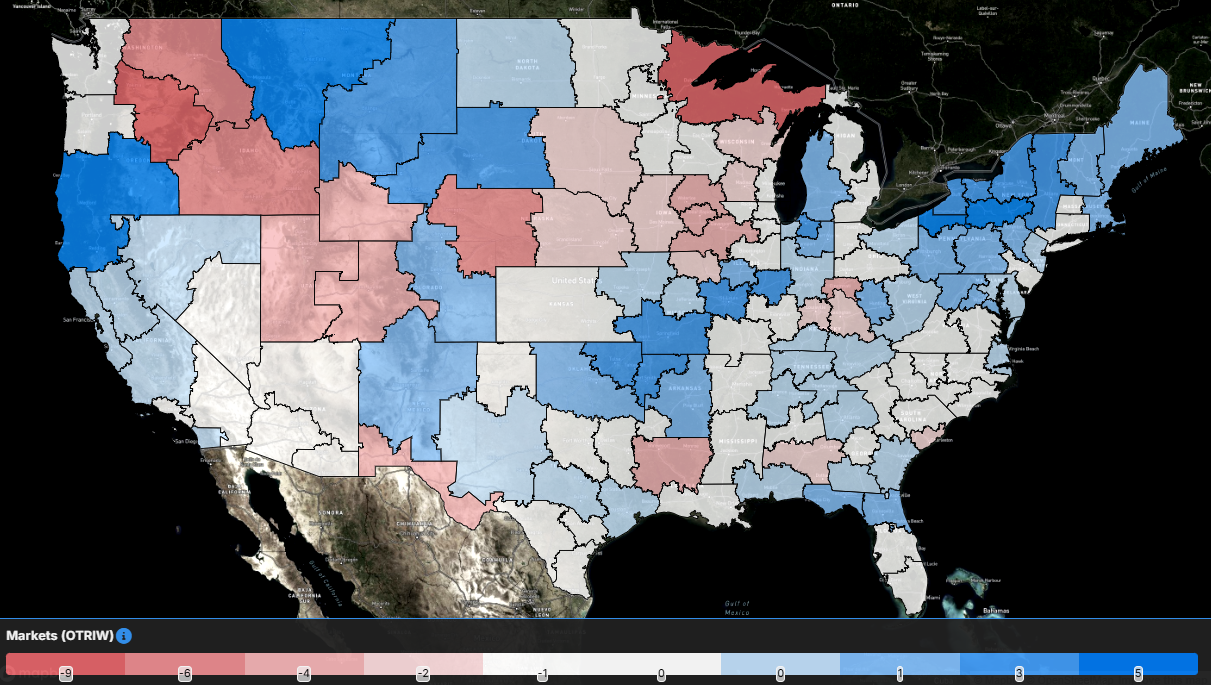

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue and white are those where tender rejection rates have increased over the past week, whereas those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 88 reported higher rejection rates over the past week, up from the 50 that saw tender rejection rates rise in last week’s report.

The largest increases in rejection rates are stemming from fairly small markets in the Northeast, so not areas of the country that tend to impact the overall freight market. The Harrisburg, Pennsylvania, market, the largest freight market in the Northeast, did see tender rejection rates increase by 195 basis points over the past week.

Tender rejection rates in the Southern California markets of Los Angeles and Ontario increased by 68 basis points over the past week, rising back above 5%, which is an important level for the heartbeat of the U.S. freight economy.

To learn more about SONAR, click here.

By mode: The dry van market is waking up as tender rejection rates have now surpassed Thanksgiving holiday levels, though they are still below the Fourth of July holiday peak. The Van Outbound Tender Reject Index increased by 63 basis points over the past week to 5.87%, less than 100 basis points from the YTD high set July 2. Dry van tender rejection rates are 213 basis points higher than they were this time last year.

The reefer market is still tighter than it was this time last year, but reefer tender rejection rates have retreated over the past week. The Reefer Outbound Tender Reject Index has fallen by 69 basis points over the past week to 14.2%. Compared to this time last year, reefer tender rejection rates are more than double, up 751 bps.

The Federal Open Market Committee meets this week for the final time in 2024, and expectations are for the third consecutive cut to the federal funds rate. The first two interest rate cuts haven’t had a significant impact on the housing market, but flatbed tender rejection rates have moved higher since the first cut. The Flatbed Outbound Tender Reject Index fell by 69 bps over the past week to 12.96%, but even so flatbed rejection rates are 313 bps higher than they were this time last year.

Spot rates rebound to highest level of the year

As the end of the year approaches and capacity is coming off the road, spot rates are continuing to move higher, setting new year-to-date highs seemingly daily. Much of the movement in recent weeks can be attributed to seasonal pressures, but spot rates have largely been moving higher since the beginning of October. There will likely be downward pressure on spot rates at the beginning of 2025, again driven by seasonal pressures, but the higher spot rates move in the next two weeks, the higher the baseline likely to be set to start 2025.

To learn more about SONAR, click here.

The National Truckload Index – which includes fuel surcharge and various accessorials – rebounded over the past week, rising 14 cents per mile to $2.52, the highest level of the year. The NTI is now 24 cents per mile higher than it was this time last year. The linehaul variant of the NTI (NTIL) – which excludes fuel surcharges and other accessorials – matched the overall increase in the NTI, rising 14 cents per mile to $1.97. The NTIL is 32 cents per mile higher than it was this time last year, a sign that diesel fuel has put deflationary pressure on all-in spot rates as there is a gap between the y/y increase in the NTI and the NTIL.

Initially reported dry van contract rates, which exclude fuel, have broken out of the high side of the range that they have been in throughout much of 2024. This breakout is likely a result of seasonal pressures, though contract rates have actually been moving higher since the end of the second quarter. The initially reported dry van contract rate comes in at $2.37 per mile, an increase of 3 cents per mile from the previous week and 5 cents per mile y/y.

To learn more about SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread remains wide, but with the recent stronger positive momentum in spot rates compared to contract rates, the spread has continued to narrow. Over the past week, the spread between contract and spot rates narrowed by 3 cents per mile. It is 22 cents narrower than it was this time last year.

To learn more about SONAR, click here.

The SONAR Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas was back on the rise over the past week. The TRAC rate from Los Angeles to Dallas increased by 4 cents per mile to $2.75, erasing some of last week’s decline. Spot rates along this lane are 28 cents per mile above the contract at present, which is why rejection rates out of Los Angeles are on the rise, now above 5%.

To learn more about SONAR, click here.

From Chicago to Atlanta, spot rates have been volatile, but they really haven’t moved significantly since the beginning of November. The TRAC rate for this lane decreased over the past week, falling by 1 cent per mile to $2.69. Spot rates are 9 cents per mile below the contract rate, but that spread is at a level where spot rates offer optionality for carriers and can make the market feel tighter for shippers than it was just a few months ago when the spread was in the 40-cent range.