After a year of recovery and stabilization, manufacturers of intermodal chassis, like the rest of the global supply chain, are maneuvering through market changes wrought by geopolitical, economic and business factors in 2025.

“2024 had its ups and downs,” said Val Noel, executive vice president and chief operations officer at Trac Intermodal, in an interview with FreightWaves. “First- and fourth-quarter demand was a little bit stronger while the second and third quarters were not as strong. We were pretty satisfied with how the year played out. We saw things settle down so the year saw more tailwinds than headwinds.”

The early summer peak season fueled momentum through the end of the year, driven by sustained frontloading by shippers looking to beat prospective tariffs and simmering labor issues at U.S. ports.

North American Chassis Pool Cooperative (NACPC) saw “soft business levels in 2024 across chassis manufacturing, chassis leasing and pool operations with the exception of Q4, which demonstrated a nice uptick in all segments compared to previous quarters,” said President and Chief Executive Officer Darren Hawkins, in response to questions from FreightWaves.

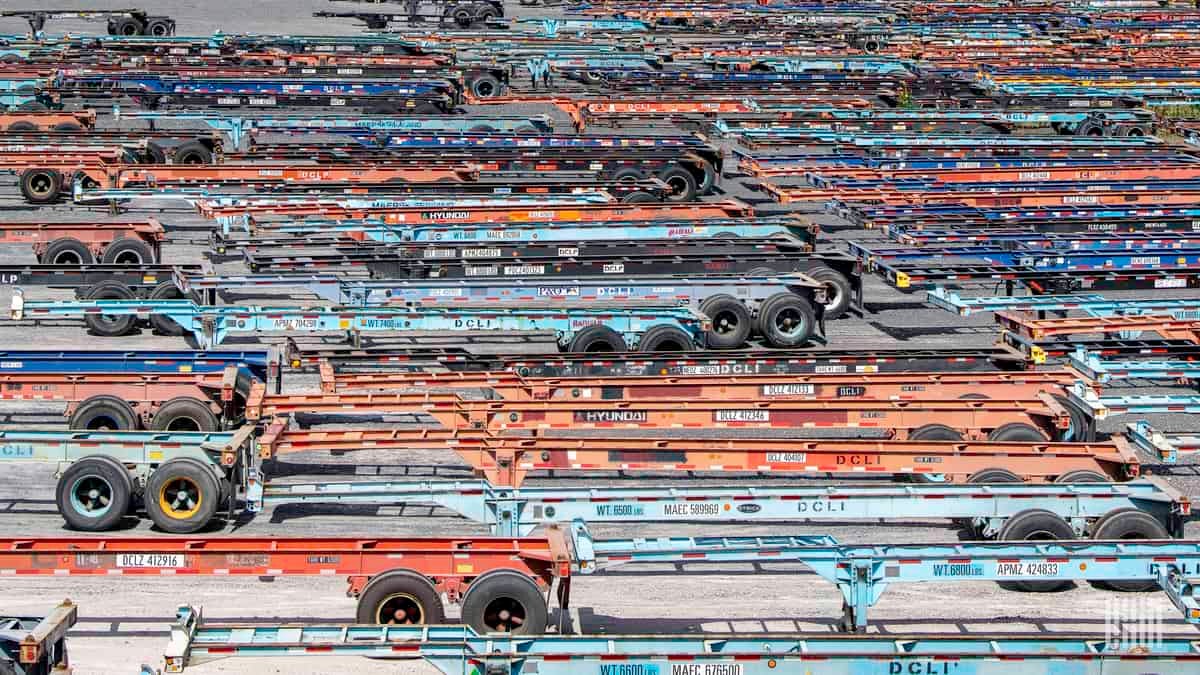

After a very strong 2021-2022, “the past two years were challenged by the post-COVID reduction in freight demand and an oversupply of chassis,” said Mike O’Malley, senior vice president, government and public relations, for Direct ChassisLink Inc. (DCLI), in response to questions from FreightWaves. “There were approximately 100,000 chassis added to the marine/international intermodal market during COVID in response to the congestion- and dwell-driven disruptions, so it will take time for demand to catch up with that capacity.

“We also saw growth in the number of trucker- or BCO-controlled chassis in the marine market so DCLI continues to enhance its portfolio of offerings across the country to serve these changing customer needs.”

The chassis market in 2024 “experienced a more balanced supply-demand dynamic compared to the volatility of prior years,” said Paul Nazzaro, chief executive of Consolidated Chassis Management (CCM), answering FreightWaves’ questions. “Early in the year, we saw some lingering inefficiencies in the form of oversupply as users in a post-pandemic freight environment continued to refine their needs to support their supply chain. The West Coast experienced increased fluidity while certain inland points have continued to experience occasional equipment shortages. The East and Gulf coasts have remained relatively balanced. We expect this trend to continue during 2025.”

While industry continues to look for less uncertainty in the Trump administration’s trade policy, chassis makers are focused on the economy and interest rates to help guide their businesses.

Said Noel, “The overall economy and consumer demand has been resilient, but if the cost of living continues to increase and not decrease, then they are going to be paying higher prices for products off the shelf because of tariffs. That is going to weigh on consumer confidence.

“It’s no secret in intermodal that we look to see how big and bulky items move, such as refrigerators, dishwashers, washers, dryers, which would indicate a solid housing market. The question with the new administration is, will interest rates create an uptick or headwinds for us?”

Positive trends continued through the first half of Q1 2025, said Hawkins of NACPC, but he added that standard 40-foot chassis are still in oversupply throughout the United States. Demand is expanding in lightweight and other specialty chassis classes, he added.

DCLI’s O’Malley agreed, and said domestic chassis demand has been “somewhat muted” post-COVID. “But many of our customers have new container capacity that they hope to deploy as demand returns,” he said, “so we have been investing to ensure we are ready with chassis capacity to serve them when that happens.”

To that end, DCLI has expanded its domestic chassis service capabilities, increasing its total fleet by more than 60% since 2020 to ensure long-term operational fluidity.

Similarly, Nazzaro said CCM has continued to modernize its South Atlantic Chassis Pool fleet, recently adding its 12,000th new or refurbished piece of equipment, to improve reliability, resiliency and availability. The single-provider SACP offers a total 45,000 chassis at eights ports and/or terminals in five states.

While ocean container lines wrestle with thorny geopolitical issues that are stressing supply chains from Asia to the Middle East and North America, chassis makers are focusing on the things they can control.

“Port diversion, global challenges and rerouted cargo are dynamics that our industry encounters on occasion,” said Noel. “At Trac Intermodal we have built resilience into our network to ensure we have available equipment in road ready status to meet these market dynamics head on and supply our customer with a high-quality piece of equipment.

“We would like to see global issues resolved in a way that’s better for our industry. We are hoping that the administration is going to be able to spark the economy and drive down interest rates. What happens on the trans-Pacific, trans-Atlantic trades, that is what will have a profound impact on our business.”

To that point, the focus for many remains on the domestic market.

“I believe motor carrier C-suites are considering releasing pent-up capex dollars from 2024 in Q2 and Q3 of 2025 for chassis refurbishment, purchases and leasing,” said Hawkins. The company’s PIC Trailers chassis manufacturing unit “is seeing steady quotes and wins in the nonstandard 40-foot chassis areas, along with good net-lease wins from NACPC, our chassis leasing/pool operation.”

Hawkins said that while tariff implications are changing weekly, “that uncertainty is being managed effectively by suppliers, manufacturers and end users. All are communicating daily to make sure risk mitigation is being balanced with the new business opportunities coming from what appears to be a slow but steady recovery from the past two-year freight recession.”

At DCLI, supply chain disruptions, tariffs and trade, stricter emission regulations, fluctuating freight demand, and rising material costs are factoring into planning.

“We do anticipate that there could be fluctuations in freight demand driven by tariffs or other economic policies such as taxes and regulatory change,” said O’Malley. “Rising material costs do affect our maintenance and repair program, which is our

largest expense, so DCLI is constantly working with our vendors to identify ways we can be more efficient.”

For other providers, changes in the supply chain are closely watched for follow-on effects.

“Global trade route shifts such as ocean carriers routing cargo around the Cape of Good Hope as opposed to the Suez Canal can create longer transit times to the East Coast,” said Nazzaro. “This can cause port omissions or delays, which can increase chassis dwells on-street, leading to chassis deficits in key markets. Cost and inflationary pressures on key items like steel, aluminum, rubber and labor to maintain chassis equipment will likely continue in 2025.”

Noel said Trac in 2025 will continue to invest capital, to provide different offerings to the marketplace.

“We want to be super-responsive to what the market is looking for, and aggressive in diverse product offerings. We want to provide the safest, most reliable equipment out on the street at a price point that is advantageous for the end user.”

As far as domestic network demand, Hawkins believes 2025 “will be more of a second-half story if [truck] spot and rejection rates continue to tighten that traditionally push more moves to intermodal.”

Nazzaro said demand across the domestic chassis network is evolving due to shifting freight patterns and supply chain adjustments.

“Container ports and inland intermodal hubs are creating challenges and opportunities for chassis pools,” he said. “Strong demand at inland intermodal hubs due to e-commerce warehouse growth in markets such as Atlanta, Charlotte and Memphis continue to expand, increasing demand for chassis to support rail delivery or rail-to-truck transloads. While congestion has eased as most major port gateways, dwell times have seen some variability during peak season and other weather-related disruptions.”

CCM is developing what Nazzaro terms “the most efficient repositioning strategies” to balance inland growth and coastal demand to ensure chassis availability at all locations.

Technology, said O’Malley, continues to be an important component of chassis provisioning in both the marine and domestic markets. DCLI in December announced a plan to equip the more than 140,000 chassis in its domestic fleet with GPS, which is expected to improve customer service while improving the company’s maintenance programs.

Smart chassis integration, lightweight materials, sustainable designs, port expansion and increased intermodal transport adoption are also important trends, he added.

Find more articles by Stuart Chirls here.

Related coverage:

Canada ports facing container delays due to weather, rail issues

Wan Hai Lines sees record revenue, profit

Longer voyages, higher container rates power Evergreen Marine earnings

Yang Ming profit soars on Red Sea diversions, emerging Asia markets

0 replies