Susquehanna Financial Group cut estimates for trucking and logistics companies heading into the first-quarter earnings season. Uncertainty around tariffs and retailers building inventories in response has turned “macroenthusiasm into pessimism,” analyst Bascome Majors told clients in a Wednesday report.

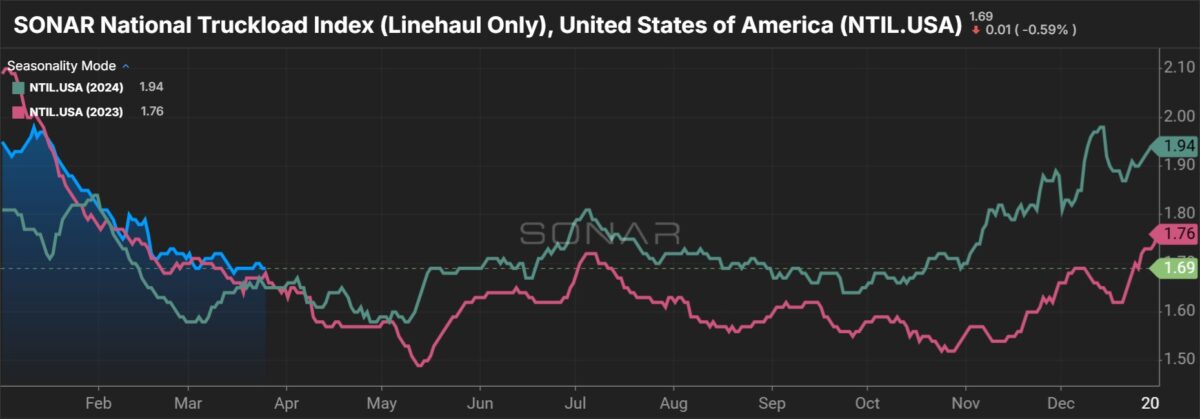

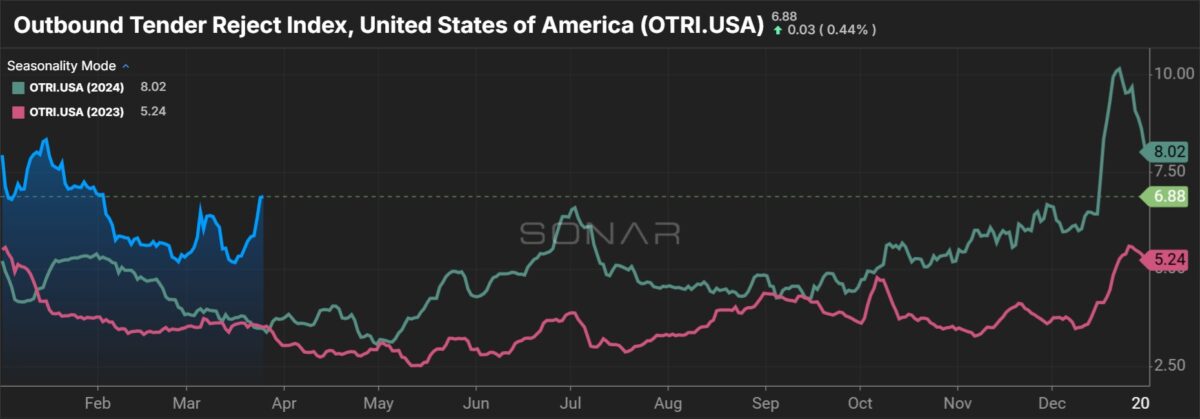

“We’re cautious into spring as the truckload cycle likely gets worse before it gets better,” Majors said, noting that “pending tariffs have caused a broad ‘wait & see’ approach for retail and industrial shippers alike.” He said key industry data points are closing the quarter “with a whimper into the critical spring bid season.”

Majors noted shippers have their own margin concerns as they navigate a changing trade landscape, which he believes will “weigh on carriers’ rate/margin gains in bid season.” Retailers are still working their pricing models to determine the right balance between shielding consumers from price hikes and protecting their own gross margins.

Majors selectively lowered first-quarter earnings numbers, primarily targeting TL carriers, as the seasonally strongest month of the period – March – will likely disappoint. Broader changes were made to the full year, which produced knock-on effects to 2026 estimates.

“1Q is seasonally weaker, but we fear the exit rate of spot rates into the most critical months of the annual contract bid season poses some risk to annual pricing that will drive margins in 2H25 and into 1H26,” Majors said.

Majors cut his Knight-Swift Transportation (NYSE: KNX) earnings-per-share estimate by 16% for the first quarter, with Schneider National (NYSE: SNDR) taking a 9% haircut.

Truckload carriers, including Werner Enterprises (NASDAQ: WERN), saw low-double-digit to midteen estimate cuts for full-year 2025 given the slow start to the year, with flow-through effects impacting the 2026 numbers by a similar amount.

“Reflecting a shakier cyclical backdrop for TL/intermodal/trade and contractual bid season, we’re exercising more caution in 2Q toward both demand and pricing, which flows through to 2H and 2026 estimate reductions.”

Across his trucking, intermodal and logistics coverage, which includes brokers, numbers sit 5% to 15% below consensus for 2025 and 5% to 25% below for 2026. (Majors has not issued quarterly previews for the less-than-truckload carriers and railroads that he follows.)

Truck broker Landstar System (NASDAQ: LSTR) is the only company for which Majors’ first-quarter number sits above other Wall Street estimates. He raised the estimate by 4% given recent outperformance in the flatbed market, which accounts for 30% of Landstar’s revenue. However, he quantified the near-term strength in that market as “transitory.”

He pointed to the potential for a supply shock next year as changes in trade policy will push new Class 8 tractor prices higher and as equipment prebuying is curbed as the new administration works to nix planned changes to nitrogen oxide emissions standards.

“In 2026, we could see truckload/intermodal demand grow while the class 8 fleet shrinks, fueling a stair-step lift in TL/IM price and margins after 2025’s emerging disappointment.”

His call for the 2025 bid season, which is based on channel checks and recent public carrier commentary signaling low-single-digit rate increases, is for contractual rate renewals to be positive.

Majors downgraded multimodal provider J.B. Hunt Transport Services (NASDAQ: JBHT) to “neutral” on Wednesday, cutting full-year 2025 and 2026 estimates by 5% and 7%, respectively.

He said recent tariff-driven import activity has been behind the 7% y/y increase in North American intermodal container volumes so far this year. He expects contractual bid season to be fruitful on major headhaul lanes off the West Coast, which could be mostly offset by softness on backhaul lanes. The call is for intermodal rates to “exit 2025 on a slight winning streak, with more meaningful opportunity for recovery in 2026.”

“We see a challenged 2025, with the largest earnings growth % at TL carriers vs. depressed 2024 troughs, but see strong growth for 2026 coming off the 2025 bridge year as our estimates reflect a more measured improvement to demand, pricing and margins across the industry.”

0 replies