All thawed out

The cold chain is headed to Washington, not quite in the same manner as Mr. Smith, but in the form of bipartisan legislation. The Fortifying Refrigeration Infrastructure and Developing Global Exports (Fridge) Act was introduced in the House of Representatives and the Senate. This act would add authority to the Trade Title of the Farm Bill to focus on strengthening the global food supply chain for frozen and refrigerated products. The act would add a section promoting infrastructure in the Foreign Market Development program.

Essentially the act would provide funding to help build more refrigerators and cold storage in other countries, so that U.S. farmers can safely sell their food to more people around the world without worrying it will go bad. Currently farmers have limited avenues for selling their products because certain areas of export don’t have the cold storage capacity to receive the shipments or prevent spoilage.

Sarah Stickler, Global Cold Chain Alliance president and CEO, said, “Given the current uncertainties with tariffs and trade agreements, developing new markets for U.S. products will be extremely important. One of the biggest barriers to increasing trade in emerging markets is the lack of cold chain capacity. The FRIDGE Act would strengthen the ability of these markets to safely and efficiently receive high-quality U.S. perishable commodities, creating new trade opportunities, improving food security and nutrition, and reducing food loss and waste.”

Temperature checks

Norwegian tech company Surfact is hitting the U.S. market with Emma, a cable-free Internet of Things tracker that ensures real-time data on location, temperature and shock. The goal of the expansion is to give cargo a voice and eliminate blind spots and hidden risks in the supply chain.

The new tracker is roughly the size of a hockey puck but is made of recycled ocean plastic, continuing the improvements in sustainability that we all love to see. The company notes that one-fifth of all food is lost before reaching consumers in the European Union. Some sources say a third of food and medicine is wasted globally. Literally anything to improve this is better than nothing.

Magne Helseth, CEO of Surfact, said in a news release: “Last year saw record-high cybersecurity attacks on the US supply chain. Meanwhile, the American truck fleet is getting older, and most tracking devices come from overseas manufacturers with questionable security standards. That’s not just a problem – it’s a crisis. At Surfact we don’t outsource security. We manufacture our products in Norway, ensuring that your data stays safe and your cargo stays protected.”

Food and drug

Peanut butter lovers have another thing to get excited about in the hand-held ice cream cone sector. Drumstick, known for its elite cones (the caramel ones are the best), has released a new peanut butter collection, including peanut butter and chocolate peanut butter sundae cones.

Classic elements of a Drumstick have remained as the cones have a center filling. This time it’s peanut butter, and the iconic chocolate shell coating with the crunchy pieces remains with a cone that somehow doesn’t seem to get soggy in the freezer.

In a news release, Elmer Gonzalez, brand manager, said: “We know there are so many peanut butter fans out there, but there aren’t too many peanut butter frozen novelties and even fewer cones.”

The cones are rolling out nationwide, and I for one will absolutely be hunting these down. I missed the Deadpool pizza; missing this is not happening.

Cold chain lanes

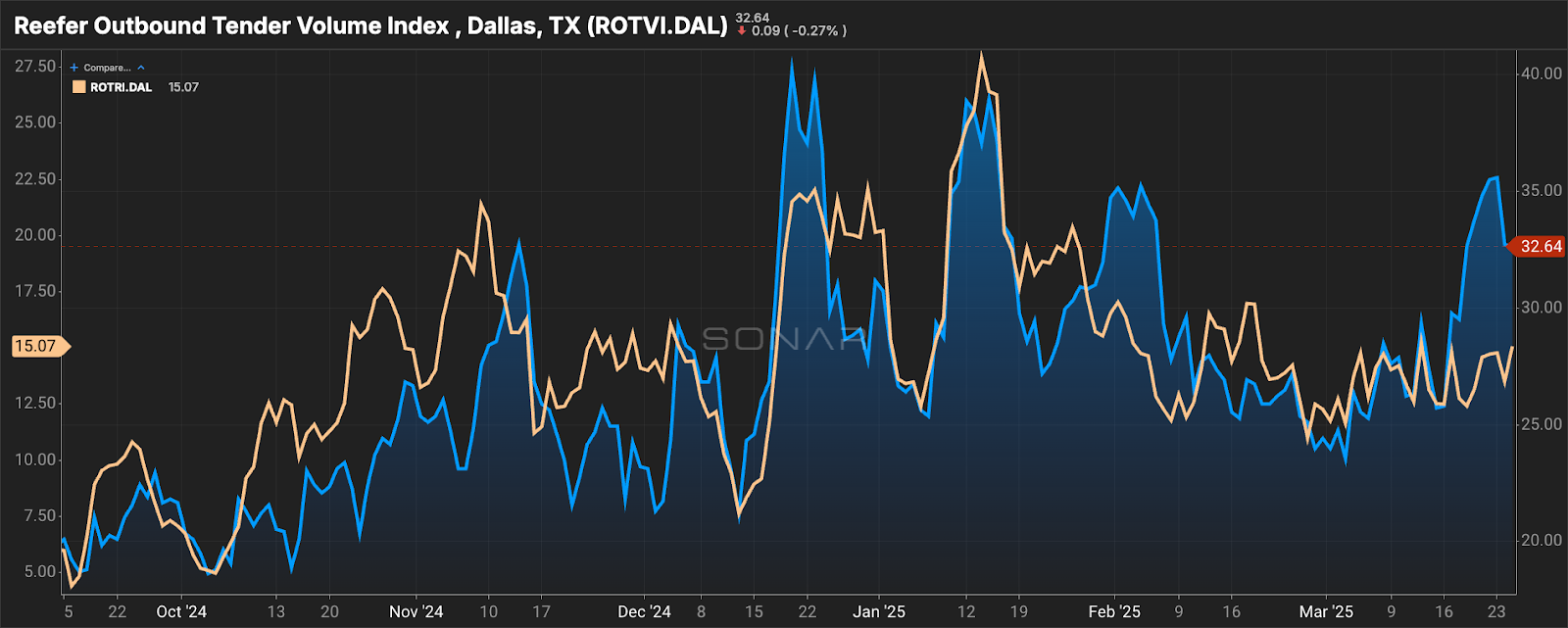

This week’s market under a microscope heads south to Dallas. In a land where bigger is always better, there is a growing sentiment that that principle can be applied to reefer spot rates. Reefer outbound tender volumes have dropped after hitting a peak in the middle of month but are still up 10.57% compared to week-over-week volumes. Reefer rejection rates are also up 232 basis points w/w for a ROTRI of 15.07%.

Reefer outbound tender volumes are higher than last year but significantly higher than volumes in 2023. That being said, the sharp mid-March peak has been a constant the past few years in regard to reefer outbound volumes. It’s a brief bit of demand before falling till mid-May, when volumes pick up for the 100 days of summer. Shippers can expect a reprieve on spot rates compared to the end of April and the beginning of March, but don’t expect that reprieve to last as summer volumes return.

Is SONAR for you? Check it out with a demo!

Shelf life

Americold Realty Trust Inc (COLD) announces $400 million public offering of notes

Tree of Life Canada expands warehouse operations in Mississauga

Cold Chain Technologies acquires Global Cold Chain Solutions

Port of Wilmington, NC closer to becoming major cold chain link

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.

0 replies