In the past month one of the main stories in trucking has been the ELD implementation hard enforcement and the impact to the freight market. But according to the Tender Rejection Index (TRI), freight markets appear to be stabilizing after an unusually volatile winter.

The fourth quarter of 2017 was one of the most volatile in years, with holiday shipping surges hitting as hurricane-damaged areas were still in recovery. Then the ELD soft enforcement period hit and created another reason for opportunistic carriers to head to the spot market and seek to land bigger year-end gains.

The fallout continued into January as year-old contracts had yet to expire and drivers were coming back on the road after shutting down for the holidays. January is traditionally a dead period in terms of freight movements, and there usually is little opportunity for any real spot market gains.

That was not the case this year. According to DAT, lanes like Dallas to Atlanta saw a 7% increase in average rate per mile from December to January. In the Chicago to Philadelphia lane, the rate jumped 13% from $2.98 to $3.36 in the same time.

Moving into spring, the same volatility has not been seen. After the early winter spike, rates have generally stabilized since across the country. The Chicago to Philadelphia lane has since dropped back to $2.82 per mile. Dallas to Atlanta lane over the last seven days is only averaging one cent more per mile than it was in December. Note that the rates only dropped to the levels seen in December in those lanes, not to pre-holiday levels. Rates are settling back to an apparent new normal. They are not receding to pre-ELD soft mandate levels.

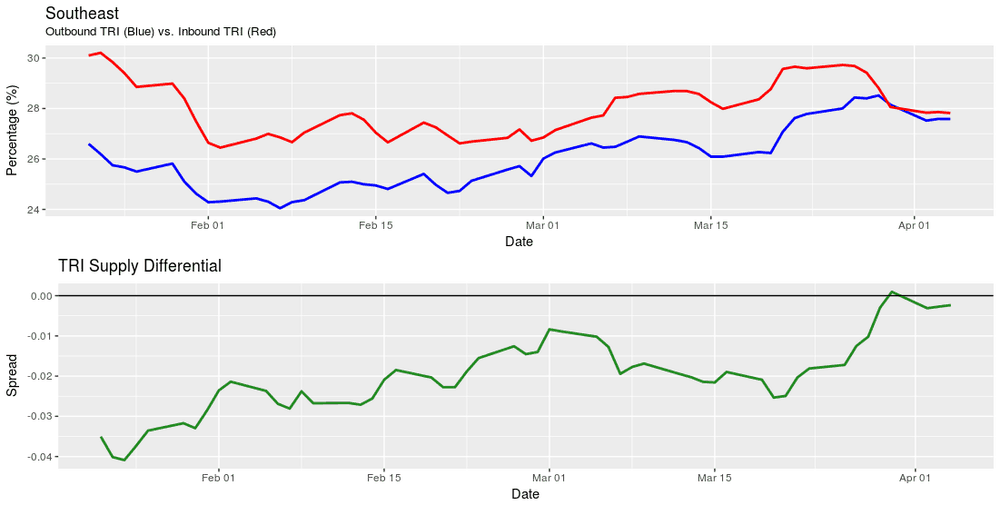

The Southeast region TRI supports this stabilization. The overriding trend over the past three months is toward equilibrium.

Outbound and Inbound tender rejections are occurring at similar rates, indicating carriers are realizing how to properly balance their networks. The region shows the market quickly correcting after a brief mid-March elevation in outbound tender rejections.

Notice that the inbound load offerings were rejected with less frequency heading into April. The lower rejection rates indicate carriers were willing to put more trucks into the area to compensate for the demand.

The Western region TRI also paints a picture of stability after an early winter surge in load rejections. Currently, 9.5% of the outbound loads offered to carriers are being rejected, compared to 13% in late January. Carriers appear to be less willing to head into the West, as inbound load rejections are creeping higher, from 14% in early March to 16% in early April.

This movement could be an early warning sign for potential exposure to tightened capacity. If freight suddenly starts coming off the West Coast, as it tends to do in early and late spring in the agricultural sectors, you could see some capacity issues driving spot rates higher rapidly. For now, it remains quiet on the western front.

Why are we seeing this flat-lining trend in the market when everyone is expecting disruption? The market had the information about ELDs in December and January. The spot market volatility of last year created by now has been fully integrated into freshly executed contracts. Carriers were able to go to shippers and renegotiate these new costs into the contract market. Therefore, carriers are turning down load tenders with less frequency, and the spot market is level-setting to a higher normal.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.