The 2017 Atlantic hurricane season started off slowly, but will ultimately go down as one of the most energetic, powerful seasons in modern history. In just a few short months at the end of the season, major ports were shut down, millions of people were left without power, and billions of dollars of value—from crops to buildings—was destroyed. Harvey, Irma, and Maria, the three major hurricanes of the season, caused an estimated $317B in damage.

As storm after storm strengthened in the Atlantic and moved west, Riskpulse, the leader in providing the supply chain industry with weather-related risk analytics, advised its clients on exactly where, when, and what kinds of threats from wind, storm surge, or flooding their supply chains would face. Riskpulse was founded in 2007 as Stormpulse and built one of the world’s most popular weather tracking sites before requests from their customers prompted them to shift toward deeper risk management solutions for the supply chain. Now they categorize and quantify risk for every node in their clients’ supply chains—stores, warehouses, production facilities, trucking routes—and, even more crucially, prescribe the specific actions that should be taken to avoid losses.

Riskpulse just issued a retrospective report of the 2017 hurricane season that lays out exactly how they helped protect their clients’ supply chains, and we break some of their results down here.

In August, as Harvey formed, dissipated, and then re-intensified into a hurricane-force storm, Riskpulse kept watch and notified their customers that there would likely be enormous impacts if it made landfall. “Prior to Harvey’s landfall, Riskpulse identified over 800 retail stores in the high-risk impact zone and briefed clients on the varying risks posed to assets along the Texas coastline,” the report’s authors wrote.

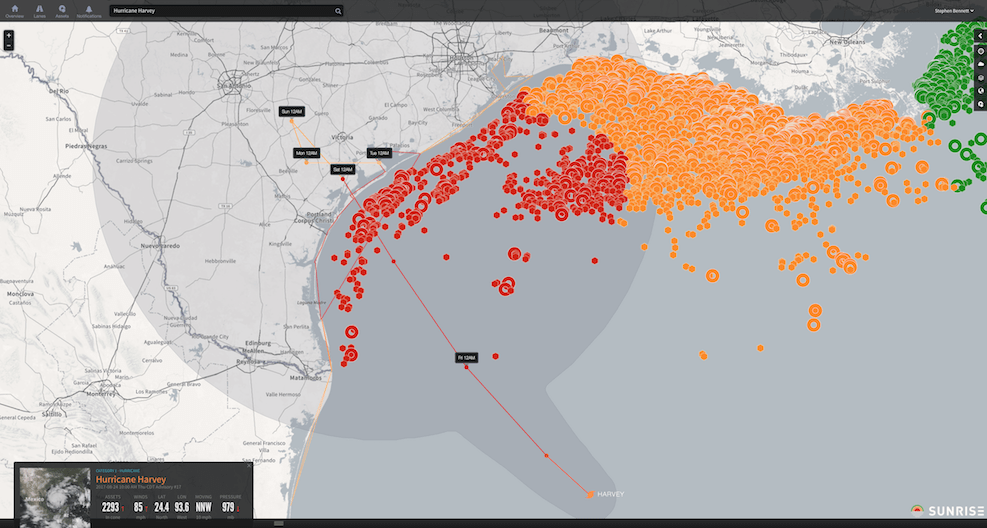

Because Harvey was headed for the petroleum-rich Houston and Galveston region, there was widespread concern about the hurricane’s impact on the country’s energy supply: the Gulf of Mexico hosts more than 45% of the U.S.’s oil refining capacity. So Riskpulse identified which oil platforms and refineries were in Harvey’s path and flagged them at one of three levels of risk (high, medium, low). A screenshot from their Sunrise product suite showing the at-risk oil platforms is pictured below.

While the 130-mph winds at Harvey’s eyewall damaged many structures, the catastrophic flooding that followed was worse. Anticipating the closure of hundreds of flooded roadways around Houston, the country’s 4th largest city, Riskpulse helped its customers avoid delayed shipments by advising them to use other distribution hubs in the Southeast to supply markets that would have otherwise been fed by hubs in Houston.

Irma was a different kind of hurricane than Harvey: Irma was a fast moving storm that dissipated quickly upon landfall, but it was also a larger system that brought hurricane and tropical storm force winds to a much wider radius as it moved north through Florida. “Prior to Irma’s landfall, Riskpulse monitored the increasing risk to 2,000 of one company’s retail locations–some 10% of their total stores–and helped that customer adjust inbound deliveries for those 2,000 stores in Florida,” the report’s authors wrote. “Riskpulse also helped a retailer identify likely shipment delays to stores well outside the path of Irma since the retailer relied on vendors with warehouses located directly in the path of the hurricane. Again, armed with this knowledge, the retailer took steps to preposition inventory from that vendor before operations went offline for five days during and immediately following the storm.”

Riskpulse’s record of success during the 2017 hurricane season proves how crucial data science and meteorological advisory are becoming for knowing when to move personnel out of harm’s way, shield harvests from damage, delay or accelerate production schedules, shift shipping routes, and coordinate with colleagues in your supply chain to take additional steps to avoid losses. Riskpulse is part of the growing trend recognized in recent studies by Stifel and Penn State of shippers and carriers establishing an ever-closer collaboration with 3PLs in analyzing and acting on realtime data to increase the productivity of their supply chains.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.