Length of shutdown unclear, as is impact on fuel prices

With the aftermath of Hurricane Harvey still keeping a large portion of southeast Texas basically closed for business, that means that the nation’s oil supplies are being disrupted. Gas prices have already started to spike around the country as refineries and oil rigs are struggling to get back online

The Gulf Coast provides about 20% of the nation’s oil and holds nearly one-quarter of the nations’ oil capacity. While gas is up 4 cents today nationally and 10 cents since last week, according to AAA, diesel prices have not spiked yet. Brett Wetzel explained to FreightWaves last week before Harvey hit that diesel prices don’t tend to spike as gasoline does due to the more consistent nature of buying patterns by commercial users.

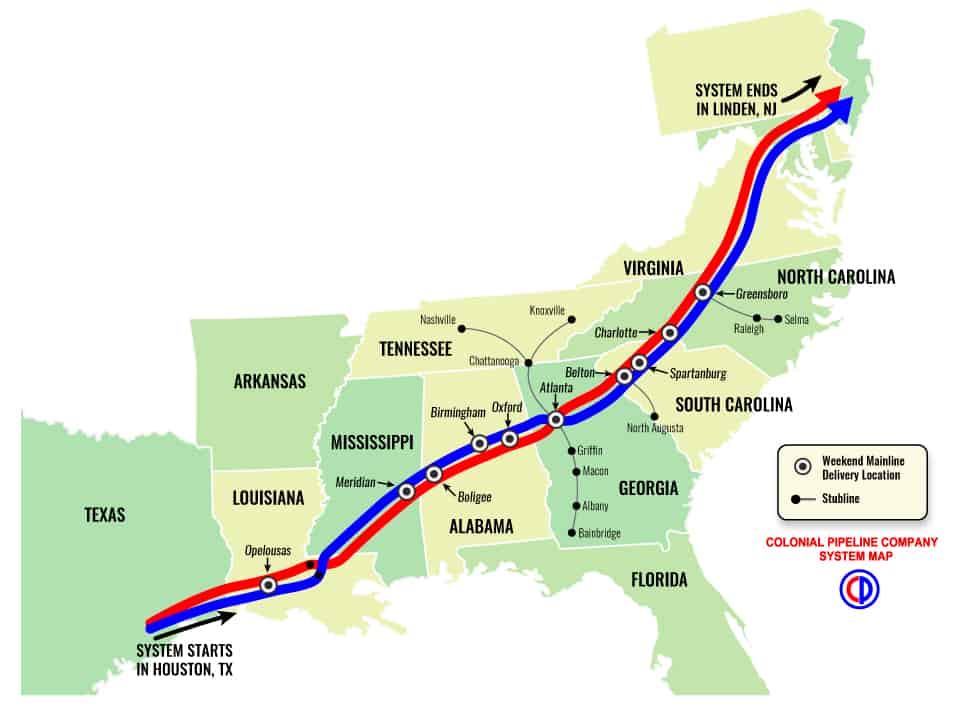

That may be changing though, as a news this morning that a major pipeline supplying diesel fuel from Texas to the East Coast has had to be shut down. Colonial Pipeline Co. said that it had to shut down the pipeline due to “storm-related refinery shut downs and the impact to Colonial’s facilities.”

It also shut down a gas pipeline today. The pipeline transports more than 3 million barrels of diesel, gas and jet fuel from Houston to New York Harbor each day, according to NBC News. It is the main provider for major East Coast cities such as New York, Atlanta and Washington, DC.

The company noted that half of the refineries in the Houston area connect to its system.

“Once Colonial is able to ensure that its facilities are safe to operate and [its] refiners in Lake Charles and points east have the ability to move product to Colonial, our system will resume operations,” it said in a statement.

While diesel prices have not risen dramatically yet, any long-term disruption could change the equation.

“As of this morning, we have continued to see diesel prices go up nationally by a few cents per gallon each day,” Daniel Cullen, vice president-advisory services for Breakthrough Fuel, told FreightWaves. “The gasoline market is feeling much more pain from this than diesel, but the longer these disruptions remain in place, the greater risk is posed to the diesel market as well.

“As of today, we have refinery suspensions that limit production, port closures that limit imports, and now a major pipeline closure that limits product flow,” he adds. “If these can all return to more normal operation soon, there should be enough supply, but the longer these outages remain, the greater price and supply risk there will be.”