Hurricane Irma, wild fires expected to contribute to higher rates for months

An already robust spot truckload freight market is now reacting to the effects of Hurricane Harvey, and with Irma on the horizon and wild fires burning out west, is now showing few signs of slowing down.

“You have a strong economy and now the natural disasters, all of this is going to put pressure on capacity and rates,” Ken Harper, director of marketing for DAT, tells FreightWaves. “I hate to be cliché, but it’s almost as if the U.S. is experiencing the perfect storm.”

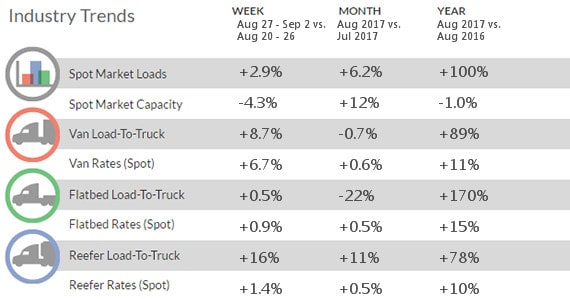

Following Hurricane Harvey, DAT analyzed data from previous storms and other supply chain disruptions and found that the changes to lanes in and out of Houston are among the most dramatic ever seen. As expected, outbound loads from Houston dropped, falling 72% compared to the previous week (Harvey came ashore on Friday, Aug. 25). Nationally, loads posted on DAT’s network increased 2.9% and rates rose 12% for the week ending Sept. 2.

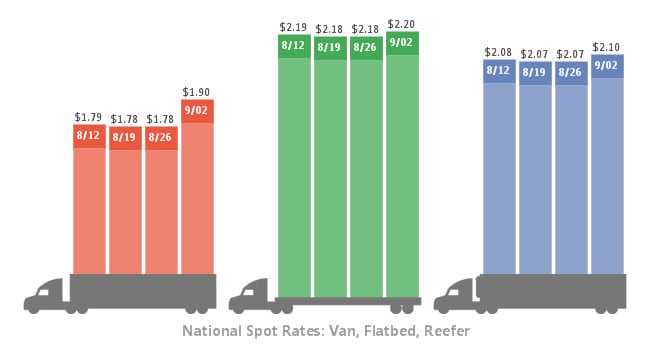

The effects of Harvey were particularly acute on van truckload rates, which climbed an average of 6.7% last week to $1.90 per mile, including fuel surcharge but not counting accessorial fees. DAT said that 78 of the top 100 van lanes in the country saw higher rates as the fallout from Harvey spread across the country due to rearrangement of supply chains and difficulty shipping into flooded regions.

Flatbed rates rose 2 cents to $2.20 per mile and refrigerated rates climbed 3 cents to $2.10 per mile. Mark Montague, senior industry analyst, says DAT expects flatbed rates to in the coming weeks.

“We didn’t see much movement in flatbeds and reefers, but I think flatbeds will come into play in reconstruction,” he says. Reefers, he notes, have already climbed 9 cents per mile to $2.19 per mile this week.

What few loads there were leaving Houston saw rates climb to $2.03 per mile, up 20% week over week. Among the most affected Houston outbound lanes were:

- Houston to New Orleans: $3.21/mile, up 89 cents, with volume down 80%.

- Houston to Dallas: $2.57/mile, up 46 cents, with volume down 65%.

- Houston to Laredo: $1.76/mile, up 26 cents.

- Houston to Oklahoma City: $2.19/mile, up 24 cents.

On inbound lanes to Houston, Dallas to Houston was up $1.60 per mile at $4 per mile, the first time this lane has reached $4 per mile, DAT said, and Denver to Houston was up 59 cents to $1.63 per mile.

DAT also found that on Aug. 30, there was a shortage of trucks in the Memphis and Greenville, SC, areas. “Some of the load posts were likely headed to FEMA staging areas, and others were the result of on-the-fly adjustments so shippers could re-supply distribution centers in Louisiana, Oklahoma, and other states that would normally be served out of Houston,” it said in the latest Trendlines.

Montague says that rates along Texas lanes have doubled and in some cases tripled since the storm. As an example, he cites a truckload from Dallas to Houston that cost $525 a year ago is now $990. Loads from Dallas to Sequin, where FEMA has a large staging area, have climbed from $523-$529 to $962 and Dallas to Baytown have increased from $535 a year ago to $1,210.

There has also been an increase in Chicago to Denver rates as Chicago has picked up some of the slack from Houston, which typically supplies the Denver area. Rates along that route have risen to $2.73 per mile, up from $2.41 the week before.

“As the recovery takes place, I think we will see Texas rates start to decline a bit, but it’s having an effect on national rates,” Montague says. “The impacts are being felt from Denver all the way to the East.

“The good news is we are seeing far more freight and volumes in Houston as of today,” he adds. “The volumes are near or above normal for this time of year.”

The impact Harvey is having on rates is also expected to multiple if Hurricane Irma makes landfall in Florida or the Southeast Coast.

“If Irma hits Florida, it could be a wild ride,” Montague notes.

Already, the potential impact of Irma has boosted rates for loads moving from Atlanta to Florida, and the storm isn’t forecast to hit until Sunday. Atlanta, Memphis and surrounding areas, which typically supply the East Coast, have been filling in for the disruption in the Texas area. The result is now Columbus is picking up some of that Northeast slack and outbound rates there are rising.

Complicating the national rate picture are the wild fires raging on the West Coast, particularly in Oregon, which has seen parts of I-84 closed.

“This is the perfect example of natural disasters affecting rates,” Montague notes.

The rising rates could benefit carriers, though, as Montague expects spot rates to remain elevated through the ELD implementation in December. Carriers who were already fighting for increased contract rates may get a boost from the elevated spot rates. Early indications are that contract rates were rising about 2-3%, but Montague thinks that may be conservative.

“Just based on these events, shippers are going to have a more [difficult] time” keeping rate down, he says. “They maybe should have hedged their bets.”