(PHOTO: SHUTTERSTOCK)

By Jack Porter, Managing Director, TCA Profitability Program

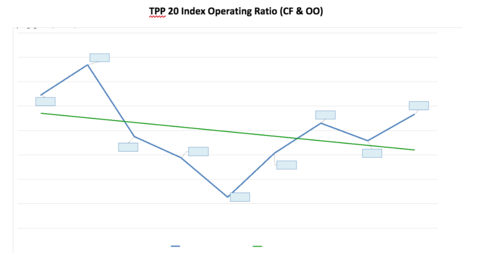

2018 was the best year for carrier profitability in the sixteen years of tracking the data for TCA. The market gave all Carriers an across-the-board increase in rates. Overall rate revenue grew 8-15%. Combined with the opportunity to grow their fleets (despite the tight labor and equipment markets) some Carriers were able to move their top line revenue dramatically. Most carriers took some of that revenue and passed in on with increased driver wages (well-deserved for a dedicated bunch of people), and a way to compete for people to man our trucks. However, almost all other costs increased slowly over the year. The 2018 Party will have a “hangover.”

Rates were hit with a perfect storm; 1) the rates never recovered from the 2016 Rate Recessions until 2018, 2) New ELD rules were delayed until the Spot Market caught fire, and any “on-the-Fence” small Carriers considering exit from the business, have stayed to reap the new rewards, 3) Core Carriers have continued to have a tough time finding Drivers, and the Cost of Growing “Qualified Drivers” has skyrocketed, 4) The Economy, Consumer Confidence and the Tax Cut heated up the Shippers volume for Transportation. In any Market these indicators would reflect an increase in Service Cost to the Customer.

2019 – Handling the Hangover

Rates will probably level off and remove some of the volatility. However, the rate pressures are still present in the Market. It appears that the the Economy is poised to cool off, but what happens if some of the uncertainties get some clarity? The driver shortage will remain, and the costs will need to be reflected in rates – permanently. The spot market carrier capacity will remain dynamic due to the make-up of these small family run carriers and their long-term plans for their future in this business.

Costs will drive the “Hangover”. All carriers will need to review their new expense levels, develop plans to leverage the best costs for their business, and reduce costs, including non-driver support people that we are not getting utilization from. Continually reviewing increased administration, maintenance and fuel costs is a must do to reduce the lingering effects of this hangover.

The Party for Revenue will reside, and the Hangover will need some positive medicine. Good Luck in 2019.