FreightWaves had a chance to speak with Jason Schenker about what’s ahead for the freight and automotive industries, and what that means for our lives. Schenker is Chairman of The Futurist Institute and the President of Prestige Economics. He is also author of seven books, among them Jobs for Robots. He will be a keynote speaker at Transparency 18 in Atlanta this May.

“We can argue all day about the comparative differences between electric vehicles (EVs) versus hydrogen fuel cell vehicles (FCVs) and speculate about who the long-term winners will be, but for now the truth is, they both have costly parts,” Schenker says.

“For EVs it’s skyrocketing lithium, not to mention the humanitarian crisis of cobalt mining. For hydrogen fuel cells it’s the fuel block that has to be coated in platinum or something. The bottom line is currently there are no cheap solutions.”

While everyone wants to get crazy about the latest personal vehicles going all-electric, we have sobering news. Not only will commercial vehicles be way ahead of the curve for industry-wide adoption, according to Schenker, personal vehicles aren’t projected to make much of a dent in the market for decades.

“The biggest ROI is commercial vehicles. These alternatives are more conducive for EV than hydrogen at least for the longer term future. Why? The hydrogen process is more manual, just like the diesel process is right now. With EVs, it will be easier to automate entire fleets, and to even refuel a fleet all at once.”

Also autonomous commercial freight will be coming even before that, maybe not all at once, but the emphasis and the bigger ROI is going to come from this sector, especially as consumer demand only continues to grow.

Schenker says autonomous over electric in general for vehicles. Why will the utilization of commercial freight be much higher than for personal vehicles? “Because the geographic arbitrage of commercial goods is so much higher. It’s economic value added. The arbitrage value is also that it’s safer and cleaner.”

When will we see these changes really hit our highways and disrupt our industries? “We’re way beyond the ‘proof of concept’ stage,” he says. “We’re now more into the ‘how do we scale’ stage. It’s hard to see huge disruption in the 2018-2019 frame, but over the next 5-10 years expect massive disruption. It’s the Moore’s Law framework.”

Moore’s law is the observation that the number of transistors in a dense integrated circuit doubles approximately every two years. The observation is named after Gordon Moore, the co-founder of Fairchild Semiconductor and Intel, whose 1965 paper described a doubling every year in the number of components per integrated circuit. In layman’s terms, it means the rate of technology grows exponentially faster, at least when a technology is in earlier stages.

Schenker points out the example of the terabyte. Up until about 2007, a hard drive with a terabyte was unheard of until Hitachi built the world’s first. Now, only a decade later, they’re so commonplace you can purchase backup hard drives with 1-2 terabytes for $50-$60 anywhere.

The catch for EVs, however, is if a commodity that goes into the product like lithium goes up too much. “Lithium’s prices have gone up and up and up,” he says. “Also, consider that we currently burn through 97 billion barrels of oil a day right now. That’s a lot of petroleum you’re moving away from for personal vehicles.”

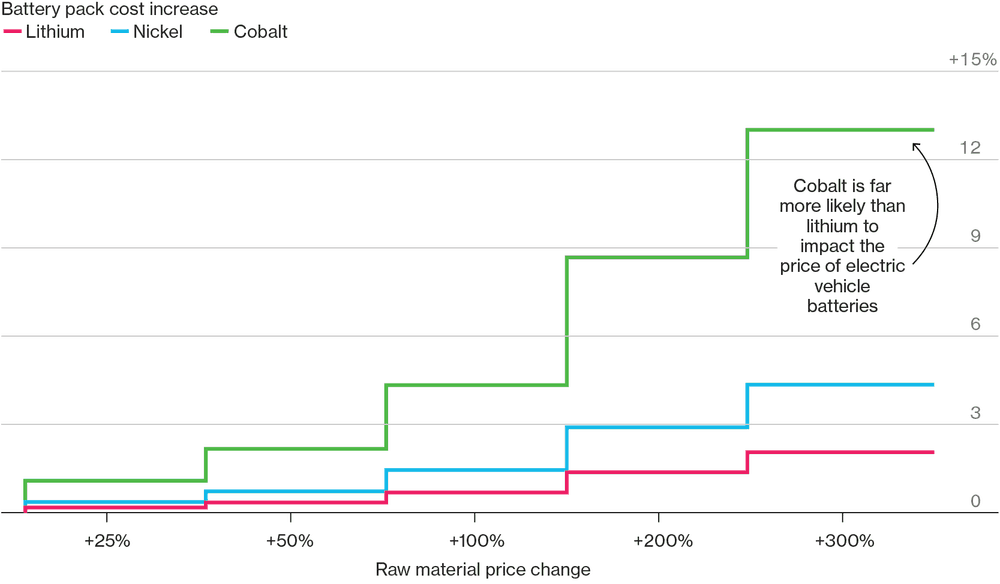

He’s right. Bloomberg just released an article on the reality check of the “metal crunch,” and it’s not just lithium. It’s nickel and cobalt too. Cobalt has nearly tripled in price in the past 16 months.

What can we anticipate for personal cars first? In a word, automation.

Here’s some mind-blowing data Schenker alludes to. According to the Energy Information Administration’s 2017 report, which projects ahead for the next 50 years, “battery electric vehicles (BEV) sales increase from less than 1% to 6% of total light-duty vehicles sold in the United States over 2016–40, and plug-in hybrid electric vehicle (PHEV) sales increase from less than 1% to 4% over the same period.”

They also write, “Hydrogen fuel cell vehicle (FCV) sales grow to approximately 0.6% of sales by 2040. In 2025, projected sales of light-duty battery electric, plug-in hybrid electric, and hydrogen fuel cell vehicles reach 1.5 million, about 9% of projected total sales of light-duty vehicles.”

Those are some rather sobering numbers for the prognosticators who think we’re about to be deluged with personal EVs. To complement this data, a majority of auto executives still think BEVs will fail, according to research firm KPMG. The reasons as to why they project failure vary, but what becomes increasingly clear is that the challenges are numerous enough that widespread adoption is highly unlikely any time soon.

On the other hand, 9% disruption of an industry so reliant on a single source of fuel might mean more than the single-digit number suggests. After all, e-commerce retail only accounts for 9.1% of all retail sales from last year.

That’s right, while it feels like e-commerce has already disrupted the retail industry, and while our experience seems like it must be dominating the market with such new realities as “Cyber Monday” surrounding Thanksgiving and “Black Friday,” e-commerce accounts for less than 10% of total retail sales. Amazon alone accounts for about 56% of all e-commerce traffic.

In other words, by the time EVs and FCVs have penetrated the market at even 9%, that could by correlation also mean that they have been accepted culturally, and therefore with an expanding national and international infrastructure.

Schenker sees the adoption of autonomous happening in earnest across all sectors sooner than the implementation and widespread adoption of EVs. There is other evidence supporting this, too. In terms of the “sharing economy,” there is breaking news that two million cars will soon be mapping roads for autonomous vehicles using a crowdsourcing app called Roadbook.

According to Pitchbook’s Dana Olsen, “The massive amount of funding that’s been funneled into autonomous vehicle tech over the last year is representative of innovation in the industry and points to the fact that companies are actively building self-driving cars and their accompanying features (LIDAR sensors, mapping tools, etc.).”

The problem remains—no surprise—infrastructure.

Schenker agrees that currently Europe is adopting sharing economy policies and infrastructure plans that are far outpacing the U.S., and really virtually all other parts of the world. “Yes, infrastructure has been a concern for awhile,” he says, citing data from the CIA World Factbook.

The U.S. gets held up with the adoption of new technologies with long-term nagging infrastructure problems. According to the CIA World Factbook, “The US has the most technologically powerful economy in the world, with a per capita GDP of $57,300. U.S. firms are at or near the forefront in technological advances, especially in computers, pharmaceuticals, and medical, aerospace, and military equipment; however, their advantage has narrowed since the end of World War II. Based on a comparison of GDP measured at purchasing power parity conversion rates, the U.S. economy in 2014, having stood as the largest in the world for more than a century, slipped into second place behind China, which has more than tripled the U.S. growth rate for each year of the past four decades.”

At the same time, “Long-term problems for the U.S. include stagnation of wages for lower-income families, inadequate investment in deteriorating infrastructure, rapidly rising medical and pension costs of an aging population, energy shortages, and sizable current account and budget deficits.”

First, Europe is like about 1/3 the size of the U.S.,” says Schenker. “So there’s the practical issue of geography. But here’s the deal,” he says. “Tax incentives are higher for Europe. Two things really need to happen and everything would change: the tax incentives and the financial benefits would have to be there and the adaptations would happen. The free market benefits will have to be there and the tax incentives.”

It would seem either of these factors could come first, but especially together we would see the infrastructure change in the U.S., much like we see the adoption of virtually anything whose time has come.

Meanwhile, it’s the consumer demand for e-commerce that projects a more autonomous world, Schenker observes. Humans cannot keep up with even the current pace of online orders; neither pickers, or handlers. This is supported from previous FreightWaves reporting about the adoption of tens of thousands of robots, somewhat quietly, into Amazon’s workforce. While Schenker doesn’t see drones descending from above with our packages in half an hour anytime soon—“there’s this little problem of gravity”—it’s fleet carrier’s autonomous vehicles he envisions dropping our packages off first.

“The funny thing about technology,” he says. “The first time a drone delivers our package to our doorstep, we’re going to be like mind blown. The second time we’re like where is that damn thing?”

That certainly is one thing you can’t take out of the human. We’ll always find more efficient ways keep us busy. Does that make us more or less human? We’ll keep you posted.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.