Maersk divests energy business, seeks growth onshore

“We’re building this company that is a global integrated container business, a company very similar to UPS and Fedex,” Maersk CEO Søren Skou told investors at a capital markets day in Copenhagen on February 20. “I hope they will be considered peers of ours, when we are done with this journey in 3-5 years,” Skou said. Maersk’s sudden pivot landed like a bombshell on investors and industry observers, who wondered why the storied Danish container line was looking to expand in areas so far afield from its core competencies.

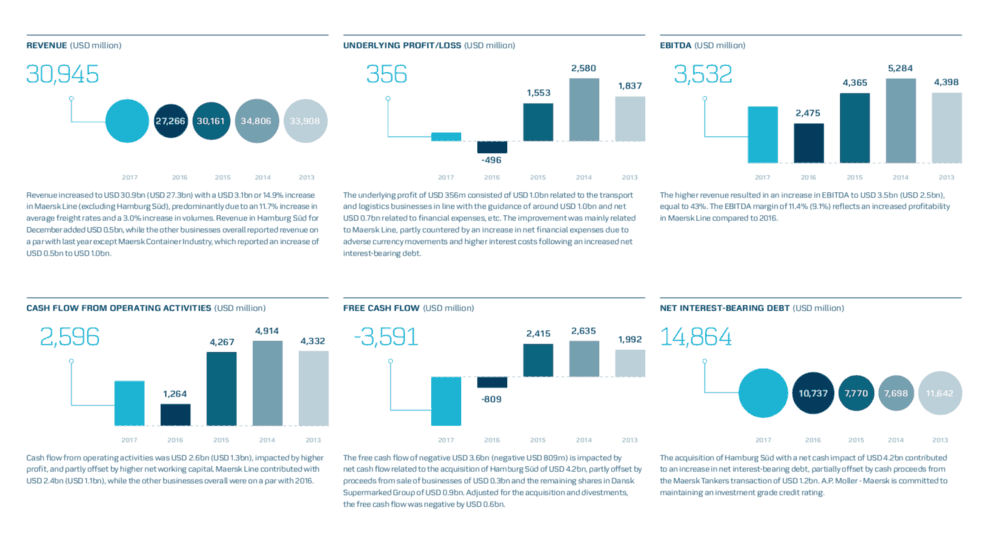

2017 was a year of recovery for Maersk, the world’s largest container shipping line. Maersk moves one in every five containers globally, and one in four refrigerated containers, but faced challenges in recent years related to the container industry’s volatile boom-bust cycle. Beginning in 2015, overcapacity and weak demand cratered shipping rates, cutting Maersk’s revenue from $34.8B in 2014 to $27.2B in 2016, a decrease amounting to 21.8%. In 2017, revenue grew to $30.9B, up 14.9% from Maersk’s bottom in 2016, but still below the figures from 2013-4. 2017 would have been even stronger if not for the exceptionally aggressive NotPetya worm cyber attack, which Skou said cost Maersk $250-300M in Q3.

Maersk now finds itself in a much healthier position than a year before (EBITDA grew 43% from 2016), but is shying away from container shipping as a source of future growth. Some analysts attributed at least part of the 2015-6 crash in container rates to Maersk’s unprecedented order of 20 18K TEU vessels in 2011. Maersk notably sat out the last round of mega-orders in November, when CMA CGM and MSC ordered a total of 20 22K TEU ships, each of which will be larger than the current record-holder, the 21,413 TEU OOCL Hong Kong.

In the 2017/8 edition of Maersk’s annual magazine, published February 5, Søren Skou wrote that “there is a low need for capital expenditure as future ordering is expected to stay low for the coming years.” Maersk has also divested itself of its energy businesses, creating liquidity to help fund its pivot to an integrated transport and logistics company.

Maersk has signed an agreement to sell Maersk Oil to oil and gas major Total S.A. for $7.45B in a combined share and debt transaction that is expected to close during the first quarter. It has also sold Maersk Tankers to APMH Invest, a subsidiary of A.P. Moller Holding, for $1.17B in an all-cash transaction. “We are proud and very satisfied with the speed in which we have found good and solid solutions, and where we safeguard that the capabilities and assets built in Maersk Oil and Maersk Tankers continue to be developed in the future,” said Claus V. Hemmingsen, Vice CEO of A.P. Moller – Maersk and CEO of the Energy division.

Maersk’s leadership team is united around the pivot toward integrating the company as an end-to-end transportation and logistics provider.

“We want our customers, the people who ship goods from one end of the earth to the other, to be able to do that while just dealing with Maersk,” said Skou at the capital markets conference. “We want to be able to carry the box from one port to the other, we want to be able to provide the inland service, customs house brokerage, finance the goods, insure the goods, and any other relevant services.”

“The future focus is to deliver best-in-class services within container shipping, ports and logistics, as an integrated company with expanded coverage of the whole value chain. By offering a wider range of logistics services, as well as products not related to sea transport, we will deliver more value to our customers, seek growth, increased earnings, and reduced volatility of our business,” wrote Maersk Chairman Jim Hagemann Snabe in the annual magazine.

Snabe’s phrase ‘reduced volatility’ is key here. While Maersk says they will still grow Maersk Line, their container shipping business, organically and through acquisitions, the company has made a strategic decision to seek sustainable growth in other key areas. Despite holding huge assets out to sea, Maersk has always been exposed to the boom-bust cycle of container shipping for one fundamental reason: supply (capacity) is inelastic for the largest, most efficient container ships. If the market experiences a glut of capacity or demand falls, Maersk cannot afford to lay up and mothball an ultra-large container ship—it’s more expensive to do that than to simply run the ship half empty. Conversely, if demand rises suddenly, and rates skyrocket, it’s impossible for Maersk to rapidly build capacity to take advantage of the environment, because designing, ordering, building, and delivering a large container vessel takes years.

In the magazine, CEO Søren Skou pointed out that while the container shipping business has estimated revenues of $150B and is growing in line with global GDP, the contract logistics business brings in $245B globally and is growing above GDP. Skou’s numbers are confirmed by the McKinsey report on the next 50 years of container shipping, which said that after decades of growth faster than GDP, container shipping growth is falling back in line with GDP. Skou specifically mentioned three components of Maersk’s shift to logistics: Twill, their Europe-based digital freight forwarder; inland services generally speaking; and Maersk’s custom house brokerage business.

Twill is a software solution designed to transform the recursive, repetitive work flow of the freight forwarding business—all those emails and phone calls—into a smoother linear process featuring instant quotation, milestone transparency, integrated document management, and proactive exception management. Twill’s CEO Troels Støvring realizes that Twill is far from being first-to-market in the digital freight forwarding space. “If it’s ‘eat or be eaten’ time in this industry, I think Twill’s advantage is that it isn’t just about the software,” said Støvring. “What we’re actually doing is combining the knowledge, expertise and scale of Damco as a major freight forwarder with the agile mindset of a start-up. We have to prove it, of course, but I think it puts us in a unique position to win in this market.”

Twill is part of Damco, Maersk’s logistics and supply chain management division. In 2017 Damco posted revenue of $2.7B, with profits of $36M that experienced downward pressure from the cyber attack, lower margins (in a rising transportation rate climate), and investments in products and digitization.

APM Terminals, Maersk’s container terminal operator, is another onshore division that experienced difficulties in 2017. Maersk poured billions of dollars into developing ports in African petro-economies that lacked infrastructure and strong states, and has had a hard time realizing strong returns on invested capital. APM Terminals lost $168M in 2017, sharply down from its $438M profit in 2016. APM Terminals cited impairments costing $621M in what it called “commercially challenged markets.” Earlier in the year, APM Terminals announced a major shift in commercial strategy—it now intends to focus on inland services like connecting to intermodal rail.

“Liner customers are rapidly becoming fewer but there are thousands of landside customers large and small for us to also focus on. We have always done business with these customers and it is important for us to serve them well and ensure a better flow through the whole supply chain,” said APM Terminals CCO Henrik Lundgaard Pedersen.

While to some, it seemed as if Maersk was rashly expanding into areas outside of its expertise, a closer look at its strategy reveals that the group is actually becoming more focused. Maersk strengthened its tanker and drilling segments before selling them off, is leveraging its vast storehouse of data to offer its customers boutique, high-revenue services and using its natural footholds in ports to turn inland and gain further control over the supply chain. The lengthy, convoluted global supply chain connects as many people as it does today in large part because of enterprises like Maersk: now the Danish group wants to deploy its formidable resources, including cash reserves exceeding $11B, to simplify, streamline, and monetize that supply chain.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.