Editor’s note: This story was updated to reflect that the company’s CEO says he is working to bring drivers home.

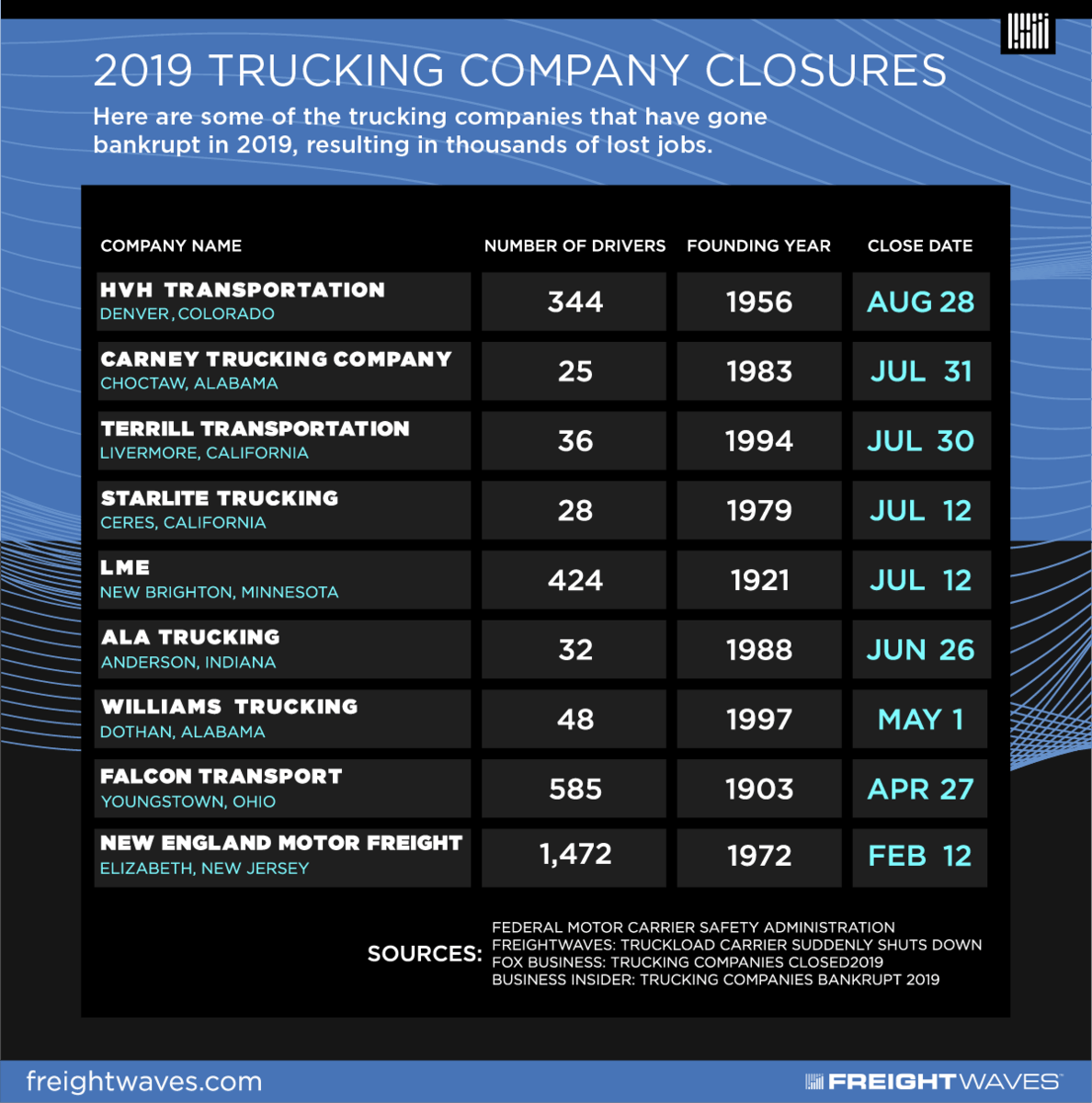

HVH transportation, a 344-unit trucking company, has abruptly shut down. It’s the latest in a string of trucking failures stemming from an economic environment that has put pressure on operating ratios.

The Denver, Colorado truckload carrier operated in all contiguous states west of the Appalachian mountains, with the exception of the deep South. According to Pitchbook, the trucking company had been operating since 1956 and was acquired by HCI Equity Partners, a private equity firm, in October 2012.

Initial reports in the wake of the abrupt shutdown indicated that the company left drivers stranded over the road, in a situation that was eerily similar to the sudden closure of Falcon Transport, another private equity backed trucking company that abruptly closed earlier this year.

Subsequent to the publication of this story, the company’s CEO, John Kenneally, said he is actively working to avoid stranding drivers and get them back home.

HVH, which has also gone by the name of Thacker Brothers Transportation, had 344 power units and employed 324 drivers. The company’s website and social media accounts were still operating as of Wednesday morning.

HCI Equity Partners has $957 million dollars in assets under management and has made investments in trucking and logistics buy-outs in the past, including investments in Road Runner (NYSE: RRTS) Naumann Hobbs Material Handling, GO2 Logistics, Milan Supply Chain, Southern Ag Carriers.

HCI exited its investment in Road Runner earlier this year, when the hybrid truckload/LTL carrier recapitalized the company with an investment from Elliott Management.

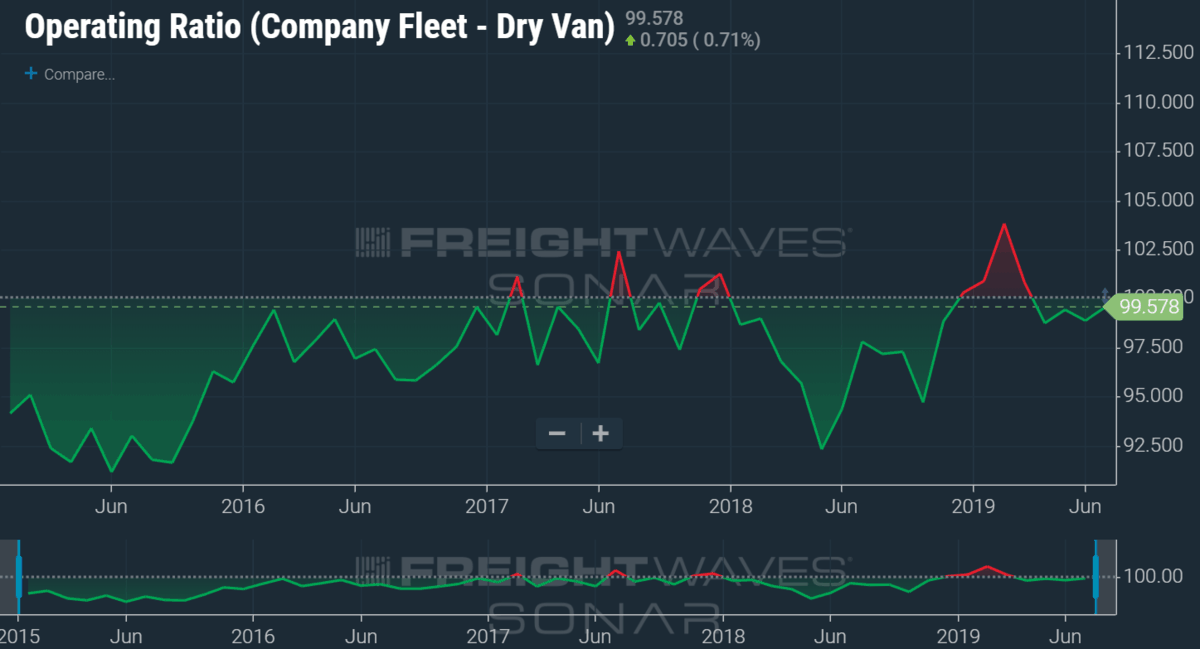

2019 has been the worst year of profitability in the trucking industry in over five years. Even the downturn of 2016 was not nearly as painful in terms of operating losses.

According to operating ratios across the industry, the average dry-van truckload carrier has teetered on losing money every month in 2019.

SONAR users can interact with this dashboard by clicking here.

Operating Ratios (OR) measure operating costs in relation to revenues. A high operating ratio is considered a bad thing (a 100 is an operating break-even, anything above one-hundred is a loss and anything below represents operating profit). OR will come before any debt servicing, distribution, or taxes.

This data is compiled based on financial reports from over 220 truckload fleet profiles, representing over 70,000 trucks, ranging from mid-sized (75 trucks to enterprise 7000 trucks). The operating KPI data is aggregated in partnership with the Truckload Carrier Association’s Truckload Indexes and available exclusively on SONAR.

Eight mid-size and large carriers have shut their doors in 2019 including NEMF, Falcon, and LME.

Mark

I am not a trucker, but always understood that they could bring the country to its knees if they stopped delivering for some reason. I always wondered why they didn’t band together and demand better conditions. Part of the problem is that of loyalty to one another. I understand that it’s hard to organize, but I can wish. I care a lot about the trucking industry because its kind of an institution. An American institution, so even though I am not a trucker, I really respect it.

My opinion is just that scavengers come in and rape big companies, but its by design. Look at all the other industries. Notice that they all consolidate into just a few big ones? That is what is happening here. Just wait. As soon as a few big companies swallow up everything, there will be harmony again – to a limited degree. Smaller numbers of giant companies make it easier to for government to nationalize. Friends, the real issue here is consolidation of political power. The State, FED, Big Brother (Orwellian term) is the problem with over burdensome regulations, and over taxation. The Income tax is being used to enslave America, and it is easy to demonstrate. Property, Gas, tires, road taxes are more than enough to cover operating Federal expenses and this has been demonstrated time and again… The income tax is no more than an entitlement tax. It already gets spread world wide. So people, your labor supports programs that Government uses to establish its agenda – things like the International Monetary Fund (IMF) for example.

I think sometimes it would have been better had I never known. It has brought me a lot of pain in life. Taking the red pill hurts a lot.

Stacie

Yes this troy and Curtis refused to pay me the 2100 dollars back pay owed to me before they closed door .literally telling me they will not pay it .along with Fominec in the office .They stole my money along with a lot of drivers .And Sheri you are the best and awesome driver manager thank you .stacie

john

sorry for you guys and your misfortune . Having been in this industry many years , its easy to see an overall decline across the board .States are writting anti truck laws faster than ever , before they get one passed they are already writing another . Billboards from lawyers anxious to sue Drivers and trucking companies are as widespread as orange cones these days .Tollways only targeting trucks are now on the rise along with the many emission laws being enacted . This is our reward for many years of accident free service .Where is the incentive to leave home , live out on the road ,endure one truckstop after another , battle your way through DOT inspections for little respect and lower pay ? long haul trucking is especially being hit hard and the storm is just beginning in my opinion .Following this upcoming election you will see things you havent seen before . Being stranded out in Tim-Buck-Two with a busted out fuel card is not a good place to be. I would counsel you to search out runs that just go out and back or just run local .There are options . Your Trials can be your blessings .In the end , the only thing that will turn the tide of Gross discrimination against the trucking industry is failure of goods being delivered .

David Giacomino

HVH is just another example of BIG BUISNESS in this country SCREWING the middle class.I was hired the Wed before they shut down .They had to know they were going to shut down.Theyre was no communication and they left my stranded 1200 miles from home.My guess id Management took the money and ran .CROOKED RICH PEOPLE are RUINING this country

Stacie

That is what they did David .I tried to let you guys in orientation know when I passed you by not to work for them they owed us drivers lots of monies

Brian howard

My name is Brian Howard and im a lease driver for roadrunner. Our company extends this initial invitation to all you effected to help expedite the hiring process to get you rolling again. Email bsowa@rrts.com and say I sent you to him and he will fast trac you. Thanks everyone sbd again sorry for HVH closing on you.

Joe Repetur

Not sure how many drivers will be stranded, when they can all take their trucks home.

John Wassanstein

I guess they can fill their tanks with unicorn tesrs? The first thing these defunct companies do, is drain the cash. That includes fuel money. That’s how many of the drivers find out, the company has shuttered.

Ronnie Partin

It’s pretty much the same with all the big guys now. They dont care about their drivers anymore. Mercer, England, Schneider, Swift and the rest of them. They’ve all gotten to big for their britches. Owner ops are always looking just for that SPECIAL company that will care. Not many to be found anymore. Sad days in trucking!!!

Clifton Carnes jr.

Typical CORPORATE THINKING F I SAY F the working man its ok for big boys to steal and hurt others in our country but the working man AINT ALLOWED TO STEAL!!!!!!!!!

Krista Laspada

ITS THE FOREIGNERS

Judith Ochs

Exactly right

a friend

Look at your forefathers they were foreigners too. Dont blame others for your screw ups.

Reality sucks when you live in denial

They were foreigners but they learned the ways of the land & adapted & also did what they needed to become citizens not sit & demand everything change to their ways & cause a bunch of chaos for no reason other than too lazy to work for it.

Terry Sanders

You are crazy. They are here to get all the cash they can then just leave. You must be one of them….. Not all Foreigners are bad but alot are…It is just another way to hurt America and the great citizens of this great country…Fact if a trucking company is owned by a foreigner then stay away from it….. who you think ruined the mileage pay?….Does not take much to figure that one out!

Terry Sanders

We are not talking 1800’s here we are talking now and what is really happening…every Hotel, Fuel Station and Now Many Trucking Companies are owned by these modern day terrorist. I can not go to the country of my wife and own anything but here they can just help themselves. As I said I am married to a woman that is a foreigner. Even she can see whats going on…Not all foreigners are bad and some are great people but the ones ruining our businesses are only here to scam and steal…wake up Drivers.

Terry Sanders

Yes it is the foreigners. It is about time someone notice this……

William C Frederick

Hello mrs Sherri you and tonya and luanne thank you all for being my fleet Managers thank you for help when I needed it and yes mrs Sherri you are spot on every trailer i got since the end of june when i would say something one ear out the other when a roadside service refuses to come out because the company accounts are on hold yep big red flag