Freight market conditions are improving.

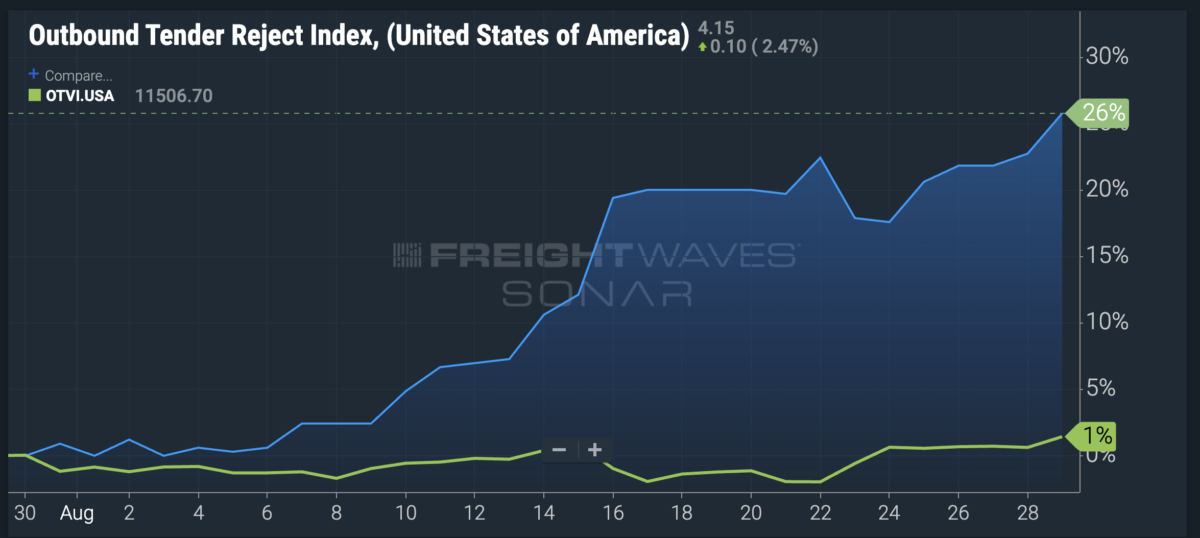

Let’s start with the FreightWaves SONAR Outbound Tender Rejection Index (OTRI). This measures the percentage of truckloads that are turned down by trucking firms in the market. It’s an anonymized measurement of midsize to large truckload carriers’ willingness to accept the loads that are offered. OTRI is the best way to measure supply and demand.

Tender rejections are at 4%, which is the highest level in six months.

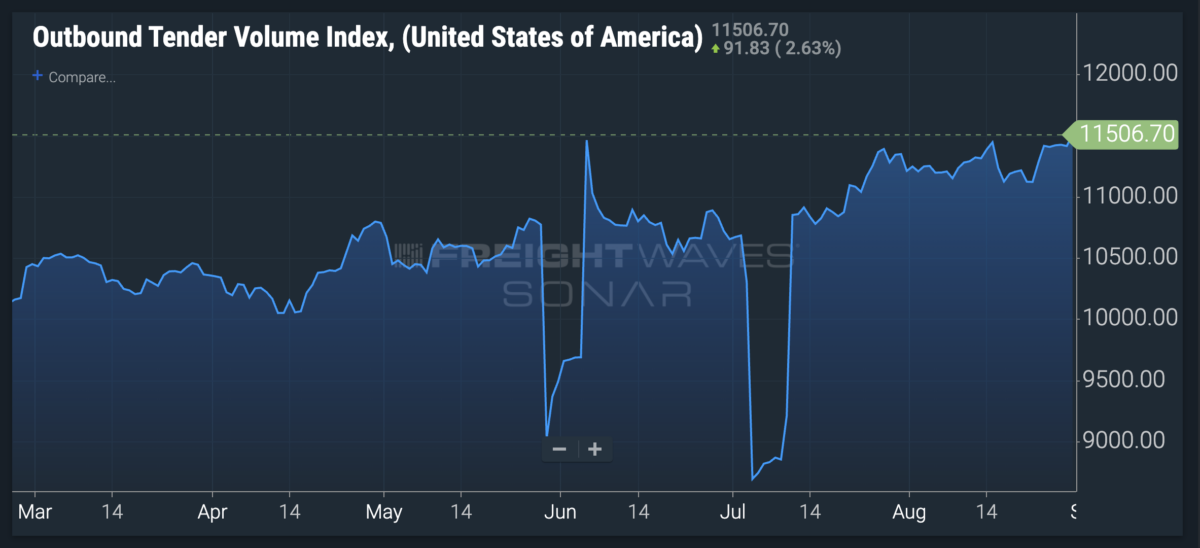

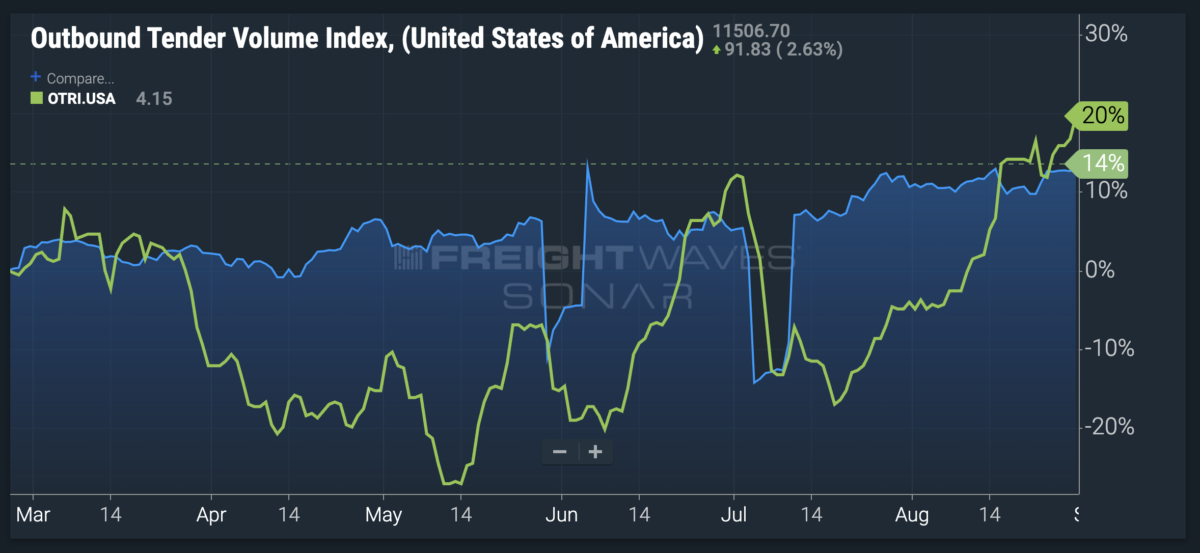

The FreightWaves SONAR Outbound Tender Volume Index (OTVI) measures electronic offers from shippers to truckload carriers for the transport of goods.

OTVI has been increasing throughout the year; the big dips in the chart below are when holidays occurred. Over the past six months, volumes are up 12%.

For most of the year, tender rejections didn’t reflect these higher volumes. This indicated that there was too much capacity in the market — too many trucks chasing the available freight loads.

However, that has changed in the past month. In the past 30 days, tender rejections are up 26%, while volumes are only up 1%.

Capacity has been bleeding out of the market. Carriers large and small have been leaving the industry, meaning there are fewer trucks available to haul freight.

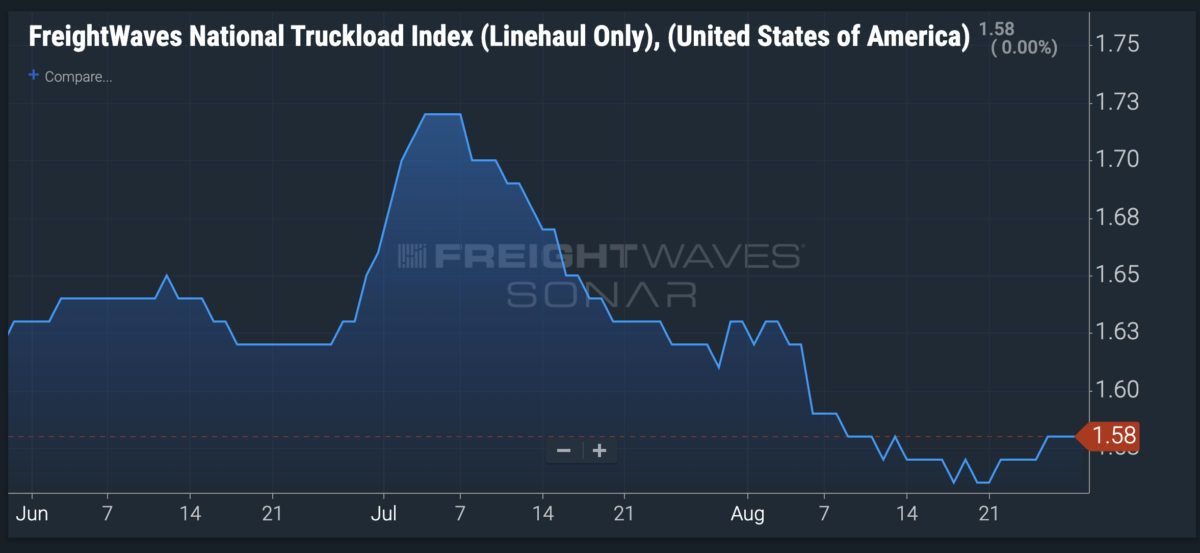

Trucking companies have different operating costs, but none of them can survive long on low rates. Throughout this year, truckload spot rates have hovered between $1.50 and as high as $2.10 a mile. Meanwhile, the average breakeven cost per mile for truckload ranges from $1.56 to $1.90 per mile, according to a recent J.P. Morgan study.

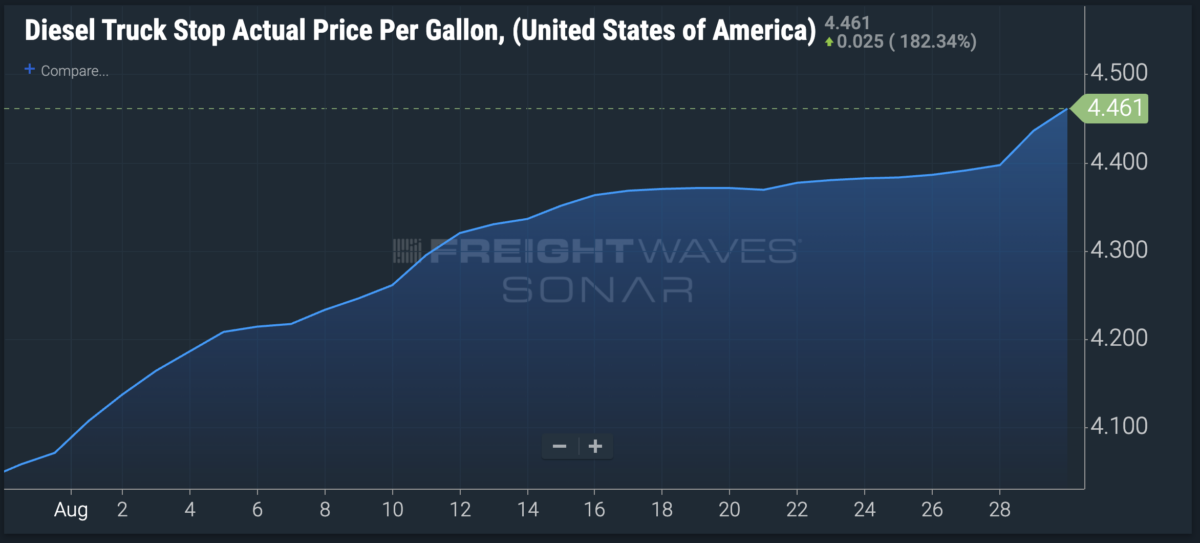

Combined with the low freight rates, trucking companies have been hurt by higher diesel prices.

What’s next?

Assuming that higher volumes remain persistent and capacity continues to leave the market, higher freight rates are on the way.

Shippers have enjoyed lower freight rates since the spring of 2022. However, rates are cyclical and shippers should play defense now by locking in contract rates or moving to index-linked freight contracts.

All charts in the article are available on the FreightWaves SONAR high-frequency data platform. To set up a demo, check out SONAR.FreightWaves.com

Ava Schockly

The sources are bogus for JP Morgan. The link that cites the info. takes you to a different freightwaves article where Craig mentions the JP Morgan study about cost per mile breakdown. However, that article does not cite the source of the study at all. Then when you search out the study, nothing pulls up. Not in AI, not in Google, not even on JP Morgans own website. We don’t appreciate misinformation being placed out into the public. Especially when it concerns a breakeven cost per mile for trucks that is entirely too low.

Barry Boland

Can someone answer this question? My freight rates have dropped about 20-24% for hauling cold, and frozen foods from manufacturers to grocery store warehouses. Most people have stated that food prices have risen 3-7% due to inflation. That spread is upwards of 30%. Who is getting this profit, at my expense ? Either brokers, manufacturers, or grocers, or all three are making some huge profits! Generally speaking, grocers, and manufacturers have to report their profits quarterly to their share holders. Brokers provide no such transparency, so I would lean towards the brokers making huge profits.

I am disheartened, and am contemplating parking my truck and waiting for rates to rise.

Bradley

Glad to see something almost positive!

Yes, shippers should lock in rates now, but as a carrier no way would I do that unless it was beneficial. Or at least maybe “lock in” a rate at $1.75, then leave them hanging with it as soon as rates climb, the same as shippers done to us a year ago…

Jason Ellingson

It’s good to be positive, but in a society that wants everything now…I think we should hang on before you get to excited. Interest rates take time to work it’s not a quarter or two it’s a few years