The continued grounding of the Boeing 737 MAX significantly impacted Southwest Airlines’ fourth-quarter and full-year profits and the airline said Thursday that 2020 earnings will also be compromised by the crisis.

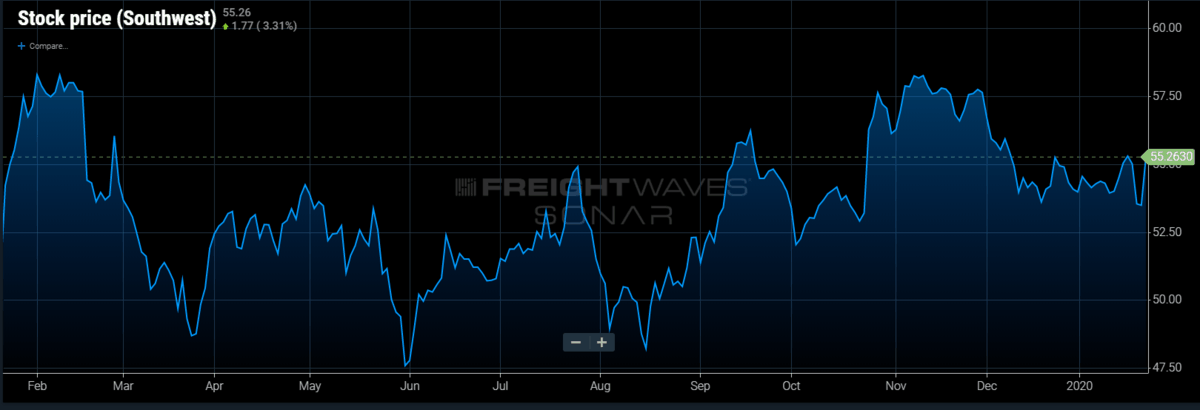

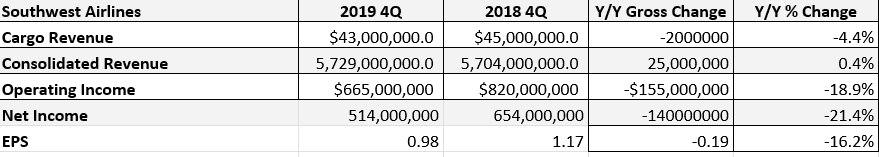

The Dallas-based carrier reported fourth-quarter net income fell 21.4% to $514 million, with earnings per diluted share of 98 cents, below the consensus estimate on Wall Street of $1.09. For the year, it achieved net profit of $2.3 billion on record operating revenues of $22.4 billion, with an operating margin of 13.2%. Southwest Airlines (NYSE: LUV) stock price closed with a 3.6% gain to $55.41 per share.

But officials said the MAX flight ban contributed to a 7.7% rise in annual unit operating costs, excluding fuel, for the fiscal year and impacted a planned network expansion. Lost MAX utilization cut seat capacity by 1%, which limited the airline’s flexibility to take advantage of greater demand during the peak holiday travel period.

Southwest’s fourth-quarter and full-year fuel efficiency decreased 0.8%, year-over-year, due primarily to the removal of the MAX, the company’s most fuel-efficient aircraft. It estimates first-quarter 2020 fuel efficiency will decrease in the range of 2-3% because of the ongoing MAX groundings.

United Airlines, by comparison, experienced a 1% increase in costs because of the MAX’s loss, but it only has 14 idle planes and 44 more scheduled for delivery through the end of this year.

Southwest has 34 MAX aircraft in its fleet and was scheduled to have 75 by the end of 2019, with an additional 38 deliveries in 2020.

It deferred the planned retirement of seven planes in 2019 to future years to cover a portion of the fleet deficit created by the MAX groundings. The company retired six Boeing 737-700 aircraft in 2019, compared with its most recent plan to retire 11 total, with five retirements shifted to 2020.

Southwest last week stripped the MAX from its flight schedule until June 6 after Boeing recommended pilots get retrained using flight simulators, a much more intensive pre-flight program than the computer-based training Boeing had previously encouraged. Boeing is making fixes to the software for its automated flight control system implicated in two crashes that killed 346 people. Investigations have determined that most pilots were unaware of the automated override capability during takeoff and didn’t know how to react to it.

Chairman and CEO Gary C. Kelly said Thursday that Southwest will probably push back the flight schedule for the MAX even further after Boeing this week said it doesn’t expect the Federal Aviation Administration to clear the aircraft for commercial operation until midyear.

“Our operational and financial performances in 2019 were truly remarkable considering an estimated $828 million reduction in operating income and the significant reduction in planned flights due to the MAX groundings,” he said in the financial statement.

During the fourth quarter, Southwest reached a confidential agreement with Boeing on compensation related to estimated 2019 financial damages associated with the FAA’s March no-fly order. The airline is sharing part of the compensation with employees through its profit-sharing program, but the $97 million contribution for 2019 reduced bottom line numbers, the airline said.

Southwest’s compensation will come in the form of reduced prices for payments owed on existing MAX aircraft and future purchases, which is expected to reduce future depreciation expense.

“We continue to incur financial damages in 2020, and we will continue discussions with Boeing regarding further compensation,” Kelly said.

It will take airlines several weeks, if not months, to train pilots, complete maintenance checks and book passengers after aviation authorities rescind the grounding. Kelly said Southwest will carefully control the pace of integrating 737 MAX aircraft, including the 27 produced and being held in storage by Boeing, back into operations.

“The FAA’s timetables and directives will determine the timing of MAX return to service, and we offer no assurances that current estimations and timelines are correct,” Kelly said.

Southwest, which exclusively operates 737s, experienced less of a decline in cargo revenue for the fourth quarter and year than most of its domestic competitors, in percentage terms.

Among Southwest’s 2019 highlights was the opening of service to Hawaii. The Wall Street Journal reported Wednesday that FAA managers allegedly gave Southwest preferential treatment in the approval process for the route between Hawaii and California.

The airline said it expects revenue per available seat mile to increase 3.5-5.5% this quarter, due to favorable year-ago comparisons when the federal government shutdown reduced travel, as well as the MAX capacity void.

Unit costs are expected to increase 6-8% due to headwinds from the MAX shortage and higher salaries, wages and benefits, maintenance expense, and operating expenses related to technology and facility investments.

“While our 2020 financial results and year-over-year trends will continue to be significantly impacted by the MAX groundings, demand for air travel remains healthy, and we are well-hedged against rising fuel prices,” Kelly said. “We remain focused on delivering long-term, customer-centric, revenue-generating initiatives and driving efficiencies throughout our company to maintain our low-cost structure.”