Neha Palmer helped Google build data centers that operate on 100% renewable energy. Don’t bet against TeraWatt Infrastructure, the startup Palmer co-founded, doing the same thing on a four-state electric truck charging corridor along Interstate 10 in the American Southwest.

The corridors are coming

Startup TeraWatt’s announcement Thursday of a Long Beach, California, to El Paso, Texas, corridor of high-speed charging stations for electric trucks will cost hundreds of millions. With $1 billion in capital to work with, TeraWatt CEO Neha Palmer sees similarities to building electricity-gobbling data centers for Google.

“It’s very, very relevant to what we’re doing here,” Palmer told me. “I spent almost a decade helping Google [create] a very large, energy-intensive infrastructure. I spent a lot of time working with utilities to get those large power interconnects required to power those server warehouses. It’s a very similar process to put together a charging center.”

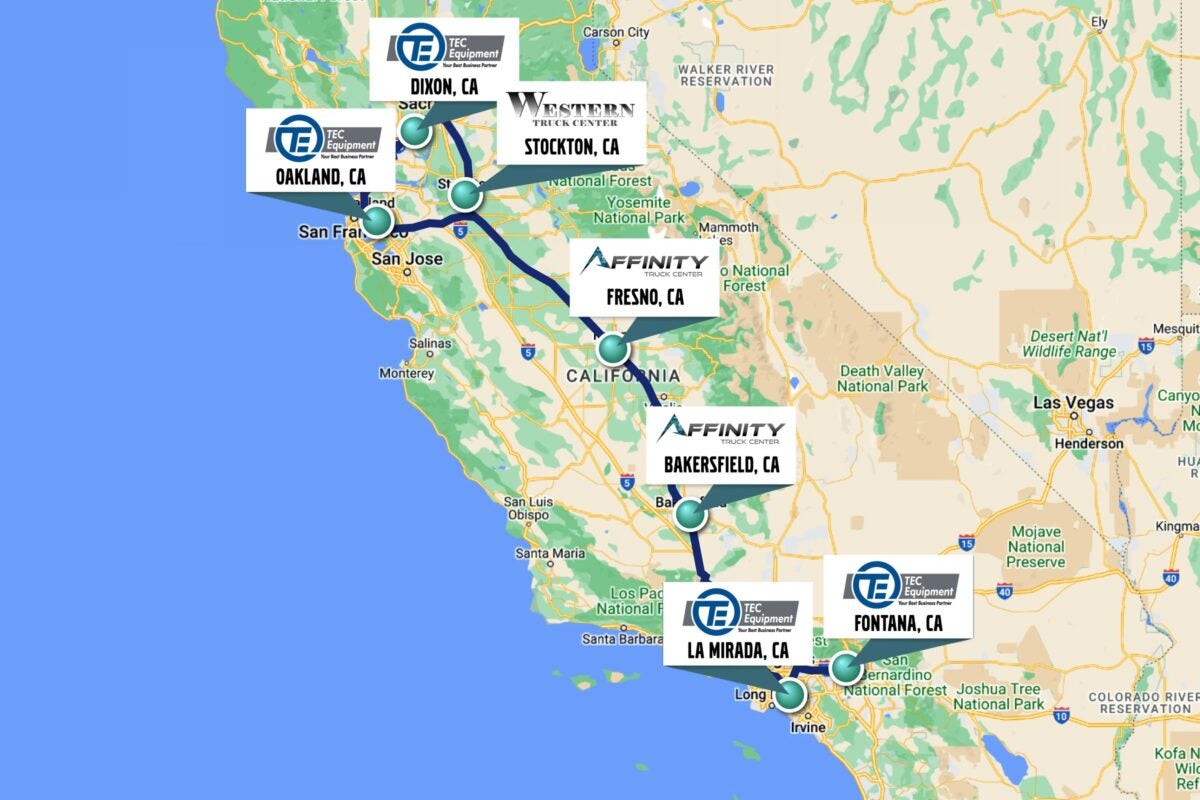

In an infrastructure challenge that will require many players and projects, Volvo Trucks North America is farthest along with details. It is working with three dealers on a Southern to Northern California Electrified Charging Corridor Project. Volvo plans seven charging sites for medium- and heavy-duty electric vehicles backed by a $2 million California Energy Commission grant.

Daimler Truck North America (DTNA), BlackRock Renewable Power and NextEra Energy Resources announced in February a $650 million joint venture to build truck-charging infrastructure. So far, no details are known.

Separately, DTNA earlier this month unveiled the Megawatt Charging System direct-current (DC) fast-charging connector for heavy-duty vehicles under the auspices of the Charging Interface Initiative (CharIN). Daimler plans to offer megawatt charging at the Electric Island it operates with Portland General Electric near its Oregon headquarters.

Enter TeraWatt

TeraWatt burst onto the scene with its September billion-dollar funding announcement with funds managed by Vision Ridge Partners, Keyframe Capital and Cyrus Capital. San Francisco-based TeraWatt has been plenty busy in the background.

“We’ve been at this for almost four years now in terms of assembling pieces of properties along corridors,” Palmer said. “The amount of demand that you’d see if you have all of the vehicles start to electrify, it will be a hockey stick of demand for charging capacity. We’re going to need a lot of solutions.”

No more chicken and egg

The cliche description of electric vehicles and charging infrastructure no longer applies. The ramp-up of electric trucks, especially medium-duty trucks, is advancing much faster than expected. Matching charging capacity — in this case publicly available charging versus “behind-the-fence” depot charging — is the challenge.

Vehicle architecture must change to accommodate higher-power charging. Navistar CEO Mathias Carlbaum suggests that it can happen around 2026. TeraWatt is starting with 350-kilowatt chargers, too powerful for most trucks to fully utilize today.

“I won’t say it’s chicken and egg. I think everyone realizes we have to move to those higher [charging] powers,” Palmer said. “But it will take a few clicks to get there for the vehicles and the technology from the charging hardware to meet up at that level.”

NFI Industries plans to install high-speed 350kW chargers next year at a depot in Ontario, California, but it will recharge trucks at 175kW in the early days.

Turnkey approach

An efficient way to help fleets substitute batteries for diesel requires offering a turnkey approach. Call it charging as a service, even though Palmer agrees “as a service” is fast becoming an overused term for any number of functions.

“We see this as a full-stack solution,” Palmer said. “We have the location. We have brought in the large amount of power that you need for large scale EV recharging, especially for those large-battery formats. We have all of the onsite infrastructure, and then we operate it reliably.

“A lot of early adopters are finding that they have to work through some of these elements themselves, and they realize it’s complicated. Getting tens of megawatts of power from a utility is certainly not something most fleet operators are familiar with.”

So, charging as a service is an apt description for TeraWatt.

The company wants long-term commitments from customers when it starts building out the corridor, ultimately placing a charging location every 150 miles. The first locations open in 2023. The corridor should be complete by 2024 with fill-in locations added as electric truck adoption grows.

About the route

The sunny climes of the American Southwest host testing of numerous battery-electric and autonomous trucks. It doesn’t snow. It’s rarely cold. So batteries perform better. But the density of freight coming out of Long Beach and north from Mexico drove TeraWatt’s decision to begin buying up properties in 2018.

“This one seemed like a great place to start just given the combination of the demand from customers where the early adoption from the vehicles was happening and the wide open spaces and the opportunity you have on I-10,” Palmer said.

About the cost

One estimate puts the cost of electric vehicle infrastructure for cars and trucks globally at $1 trillion by 2040.

That won’t be enough, Palmer said.

“I think this is a once-in-a-generation shift. Two centuries ago, you had the railroads come in, and think about the investment that was required for that.

“Last century was the national highway network, which really changed how goods and people moved. Electrification of these routes is kind of the next layer for this century. There is a lot of cognizance among investors that this is going to be a really big opportunity. And there is a lot of money chasing it.”

Best of the rest …

DTNA has begun series production of the Freightliner eCascadia Class 8 heavy-duty daycab. Everyone involved, including CEO John O’Leary, signed off on Job 1.

Separately, DTNA announced plans to offer a complete factory-installed dual camera module from video telematics provider Lytx. The system is capable of both road- and driver-facing digital video recording in Freightliner and Western Star trucks.

Registrations of electric-powered commercial trucks in China rose 89% in August compared to a year earlier, according to Interact Analysis.

Waymo, Aurora Innovation and TuSimple lead the way to developing autonomous driving systems, a new study from Guidehouse Insights says.

Kodiak Robotics added Ikea as a customer for autonomous test runs in Texas.

That’s it for this week. Thanks for reading. Click here to get Truck Tech in your email on Fridays.

Alan

Hannah Zamora

I’ve made 💰$64,000💰 so far this year working online and I’m a full time student. Im using an online business opportunity I heard about and I’ve made such great money. It’s really user friendly and I’m just so happy that I found out about it. Heres what I do.

🙂 AND GOOD LUCK.:)

HERE====)> 𝐰𝐰𝐰.𝐖𝐨𝐫𝐤𝐬𝐟𝐮𝐥.𝐜𝐨𝐦