The container shipping market calls to mind a famous Mark Twain misquote: “Reports of my death have been greatly exaggerated.”

The historic rate boom appears alive and well — bad news for cargo shippers and good news for container shipping investors.

There was a dip in spot prices over recent months from stratospherically high levels, but downward momentum did not hold. Rates stabilized at extremely high levels, and in several trade lanes, including Asia-to-U.S., rates are now gravitating upward yet again.

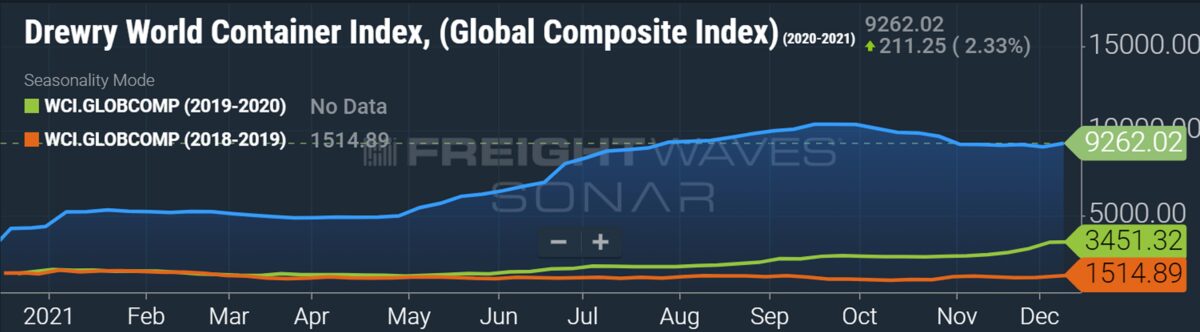

Global indexes rising

Different spot rate indexes give different numbers, but they all paint a similar picture of the container-shipping market, one featuring little relief from ultrahigh transport costs.

The Drewry World Container Index, a global composite of main routes, rose 2.3% last week, to $9,262 per forty-foot equivalent unit, up 170% year on year. The index hasn’t been this high since the last week of October.

A different measure, the Shanghai Container Freight Index (SCFI), shows an even more bullish pattern for ocean carriers. After pulling back minimally in October, the SCFI global composite continued its climb and has just reached a new all-time high, rising 1.8% last week and 2.7% the week before that.

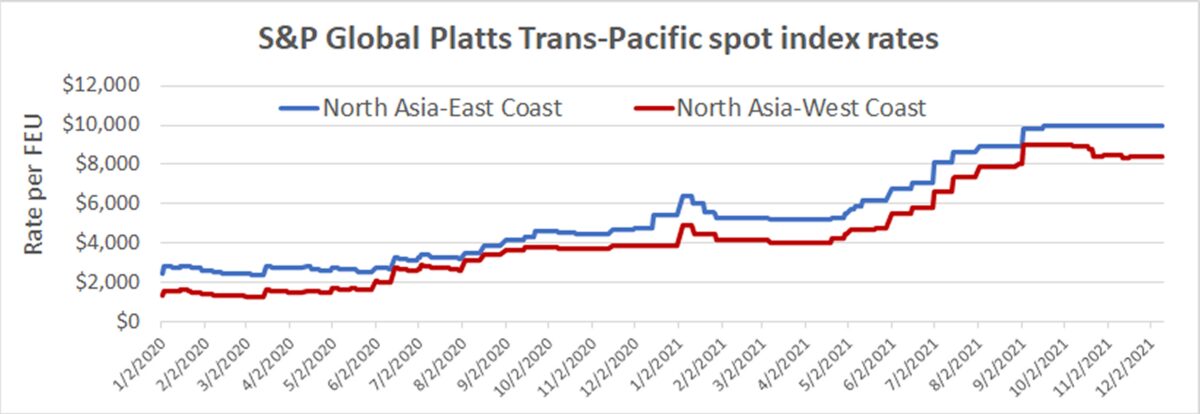

Asia-US indexes rising

Looking specifically at the Asia-U.S. trade, Drewry’s Shanghai-Los Angeles weekly assessment was $10,138 per FEU last week, up 5% week on week. Drewry’s Shanghai-New York assessment rose 4% from the prior week, to $13,118 per FEU.

Daily rate assessments are provided by S&P Global Platts, the Freightos Baltic Index (FBX) and Xeneta.

The Platts Freight All Kinds (FAK) daily rate assessment, which does not include premiums, was at $8,400 per FEU for the North Asia-West Coast route on Friday, unchanged since late October. The Platts North Asia-East Coast rate was at $10,000 per FEU on Friday, an all-time high and the same level it has generally been since mid-September.

The FBX daily index — which does include premiums for its two Asia-U.S. routes — was at $14,924 per FEU on Friday for Asia-West Coast, up 7% month on month and 3.8 times the spot rate at the same time last year.

FBX’s Asia-East Coast rate was at $17,195 per FEU on Friday, up 8% month on month and 3.5 times the spot rate at the same time last year.

Norway-based Xeneta has just teamed up with Compass Financial Technologies to launch the Xeneta Shipping Index by Compass, providing daily short-term FAK rates compliant with the EU Benchmark Regulation. The FBX is also EU-benchmark-compliant. Xeneta CEO Patrik Berglund said his company was motivated to provide its new product by “the unreliability of existing indexes and their lack of transparency.”

As of Friday, Xeneta put the daily Far East-West Coast FAK rate at $7,383 per FEU, excluding premiums. To put that in perspective, Xeneta assessed the most recent low at $6,913 last Tuesday. Pricing is up 7% since then. It put the all-time high for this route at $8,961 per FEU on Oct. 31, 21% above Friday’s rate.

Sentiment still bullish on rates

The consensus is that spot rates should remain strong in the near term, if not rise further. “The container sector continues to be well supported,” affirmed Clarksons Platou Securities on Monday.

According to S&P Global Platts, “All-inclusive trans-Pacific container shipping rates to North America held steady [last week] with the expectation that shipping lines would push for further increases [this week] as demand strengthens.

“Shippers are getting squeezed by a shortage of empty containers in Asia as port congestion and blank [canceled] sailings impede the return of equipment from Europe and North America.”

Consultant Jon Monroe wrote in his new weekly newsletter, “It does not look like the spot market will come down anytime soon.”

Vespucci Maritime CEO Lars Jensen said in an online post: “And up we go again. … Following a large hike in rates up to Chinese New Year 2021, rates did decline for a short while, only to then rocket further on upwards over summer 2021. Then there was a second break after Golden Week 2021, where rates once more declined. But now we are again setting new records. It appears this might continue until Chinese New Year 2022.”

Click for more articles by Greg Miller

Related articles:

- Biden-backed plan to clear California port congestion stalls

- It’s official: 96 container ships are waiting to dock at SoCal ports

- Ships in California logjam now stuck off Mexico, Taiwan and Japan

- California ship pileup still piling up — but out of sight, over horizon

- No relief from ‘ridiculously expensive’ container shipping rates